Pictet: Why a US recession is not on the cards

Chef-Ökonom Patrick Zweifel untersucht die Gefahren einer möglichen Rezession in den USA und kommt zu dem Ergebnis, dass keiner der verlässlichen Wirtschafts- und Finanz-Indikatoren derzeit auf rot stehe.

18.02.2016 | 14:16 Uhr

Financial markets have had a torrid time through early 2016 as fears mount that the US may be due a recession. Our analysis suggests markets are getting ahead of the economic reality.

Many investors are starting to fret that the US could be due an economic upset. Recent falls in the S&P 500 – down around 13 per cent since peaking in July – suggest equity markets are pricing in, by our calculations, a 40 per cent likelihood of recession in the US, up from 3 per cent a year ago.

The widening spread on high yield bonds, meanwhile, shows bond investors anticipate recession-like default rates nearing 20 per cent – indicating a one in three chance of an economic contraction. So has the US Federal Reserve made a fatal error in hiking interest rates for the first time in more than a decade? After all, some economic data are headed in the wrong direction – particularly in the mining and energy sectors where profits are being decimated by the commodities rout. Could the Fed have misread this data? Our analysis suggests not.

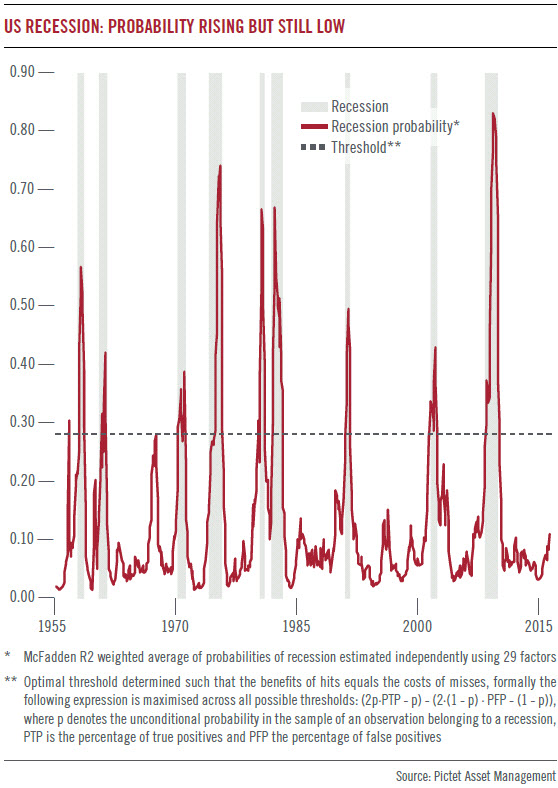

None of the 29 economic and financial indicators we have found to be reliable predictors of recession since 1955 are flashing red. Some show the probability of contraction has risen though none are yet anywhere near levels where we would consider it a likely outcome.

In fact, our model puts the probability of recession at just 11 per cent (see chart).

This calculation excludes unforeseen influences that cannot be quantified and could, therefore, underestimate the real probability of recession. However, we believe the chances of an economic contraction are not higher than one-in-five.

To see why, one need only look at the financial condition of US households, where recessions usually take root. Overall, the household data we monitor indicate in aggregate that US consumers are in pretty good shape, suggesting a 3.7 per cent probability of recession which is little changed over the last year. This figure incorporates eight closely watched economic variables such as consumer sentiment gauges, retail sales, non-farm payrolls, housing starts and residential investment, all of which are in robust form, according to our analysis. This is also the view expressed by Federal Reserve Chair Janet Yellen who in her most recent testimony to Congress said the US economy was being supported by jobs and wage growth.

This is important because past US recessions have tended to be precipitated by weak households. Since 1950, the US economy experienced 10 downturns, eight of which triggered by a downward lurch in the household/consumer cycle. Take, for example, the 1973-74 oil shock which put an end to years of growth when sharply higher fuel prices severely dented the disposable income of US households.

Now, of course, oil prices are sharply lower than they were a year ago, giving lift to household budgets in the US which bodes well for consumer spending. The most recent downturn in 2008 came after a deep financial crisis hammered jobs, which had in turn been caused by a burst housing bubble in the US, piercing household financial health to the core.

That slump also coincided with extremely high oil prices, hurting US households further at a time when they were heavily indebted. The exceptions occurred in 1953, a recession that could be attributed to a big cut in public spending after the end of the Korean war, and 2000, which resulted from the bursting of the dot.com bubble that led to a collapse in business investment.

Trade and corporate data such as exports and industrial production indicate a higher probability of recession than the data on households, though our analysis shows they remain well short of the danger zone. So if history is anything to go by, a US recession remains off the cards as long as the country’s households are in good shape. There is little to suggest that this may change.

Low fuel prices are boosting household finances while unemployment is low. And though the Fed recently made a small increase to interest rates, monetary policy is by no means tight. This suggests, therefore, that if market valuations are underestimating the longevity of the US economy’s growth spurt, this may be a good time to increase exposure to certain risk assets like equities.

Author: Patrick Zweifel, Chief Economist at Pictet Asset Management

Der komplette Marktkommentar als PDF-Dokument.

Diesen Beitrag teilen: