Carmignac Portfolio Credit and Carmignac Portfolio Patrimoine Europe awarded best Funds in Europe

The Refinitiv Lipper Fund Awards, granted annually, highlight funds and investment managers that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. We are proud to see our two key strategies on the top of their respective categories for the second year in a row:

26.05.2023 | 08:00 Uhr

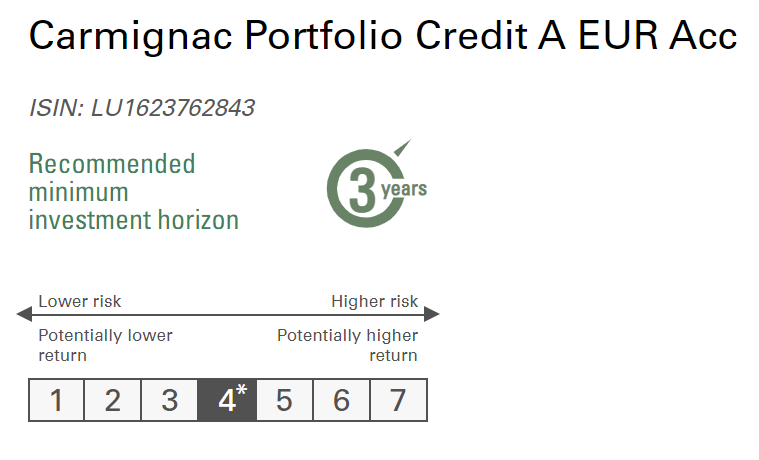

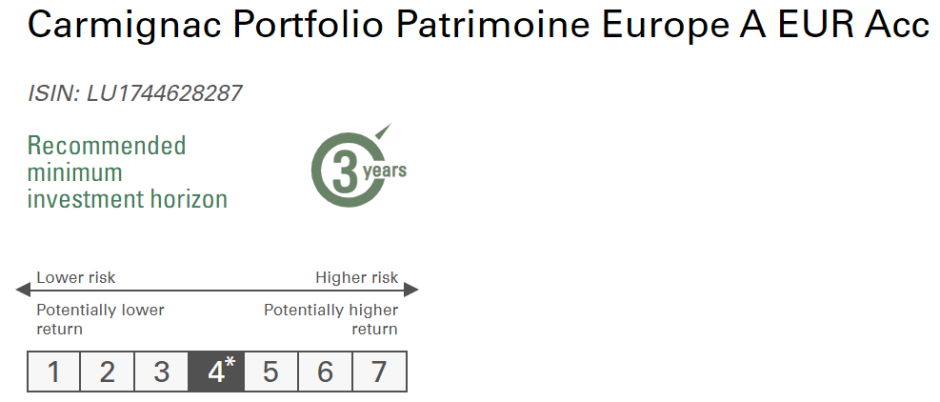

Carmignac Portfolio Credit is best Global Corporate Bond Fund over 3 and 5 years and Carmignac Portfolio Patrimoine Europe is best Mixed Asset EUR Bal - Europe Fund over 3 years.

Convictions and flexibility bear fruit

Being on the top of peers on European level for the second year in a row testifies to the quality and ability of our investment managers to fully exploit our dynamic and conviction-driven approach, always in the quest of the optimal risk-adjusted returns, in all market conditions.

Main risks of the Fund

CREDIT: Credit risk is the risk that the issuer may default.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

RISK OF CAPITAL LOSS: The portfolio does not guarantee or protect the capital invested. Capital loss occurs when a unit is sold at a lower price than that paid at the time of purchase.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.

Main risks of the Fund

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.

Diesen Beitrag teilen: