Pictet AM: Barometer: Going viral

With the global economy at the mercy of the coronavirus outbreak, investors should consider shoring up their defences in the near term.

12.02.2020 | 10:16 Uhr

Asset allocation: shoring up defences

Investors are trying to get a handle on the likely impact of the coronavirus sweeping through China.

The virus’s ultimate impact is still unclear to epidemiologists: they don’t yet have a proper understanding of how infectious and deadly the virus really is and to what degree it can be spread before the victim shows symptoms. It could prove to be little more than another variation on the seasonal flu bug. Or something altogether more malign – the World Health Organisation has designated it as a global emergency.

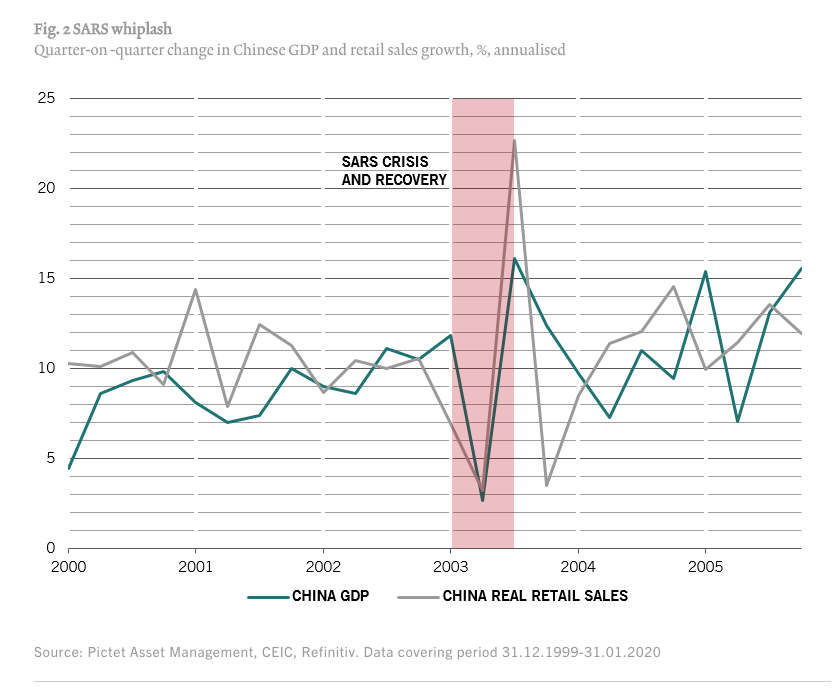

For now, investors are drawing parallels with the previous big coronavirus epidemic to spread from China, SARS in 2003 (see Fig. 2). Then, the initial market reaction was severe, reflecting SARS’ high mortality rates, and its immediate negative effects on the Chinese economy. But because the epidemic was quickly contained, the rebound was just as sharp, leaving little net economic effect for the year. A repeat of this outcome would reinforce a positive case for emerging markets. Still, there are differences between what is unfolding now and what occurred in 2003. The coronavirus seems less deadly, but is also less easy to contain. And, critically, China’s share of the global economy is four times larger than it was in 2003.

The US Federal Reserve chairman Jerome Powell has already said he’s watching developments closely – as are his peers around the world. China's central bank added an emergency dose of liquidity to soften the blow to its markets when trade resumed after the New Year holiday. But fiscal measures are likely to have a more immediate impact on the wider economy. The Chinese government slashed tax rates during the SARS crisis and is likely to do something similar again to mitigate the hit to domestic demand and to production if quarantines continue significantly beyond the Lunar new year holidays. And there’s likely to be an acceleration of infrastructure spending later in the year. Taking all this into account, we retain our neutral stance on equities but increase weightings in more defensive assets, changing our stance on bonds to neutral from underweight.

Setting aside the risks posed by the coronavirus, particularly to Asian economies, our business cycle model registers a broadly balanced outlook across much of the world, though the US is looking more buoyant. Business sentiment has broadly rebounded from last year’s lows.

Our valuation model is running up red flags over the US equities market. By contrast the British and Japanese equity markets continue to trade at attractive levels relative to their fundamentals.

After a massive rally, gold is starting to look expensive – though in a world of paltry yields and a surfeit of risks, it remains an attractively-priced hedge.

Our liquidity readings are broadly stable, with USD1.2 trillion of central bank monetary injections – equivalent to some 2 per cent of global GDP – forecast for this year. The market, however, is pricing in even bigger volumes of stimulus, which is potentially a recipe for disappointment, though China's response to the coronavirus could yet make up some of that shortfall.

Our technical indicators continue to flash green, particularly now that positive seasonal factors come into play. However, there are warning signs for a handful of assets: high yield bonds, technology stocks and the Mexican peso all look fully overbought according to our models.

Diesen Beitrag teilen: