Robeco: Catalans tighten their grip on taxes

While in Spain the government rides towards a tax reform, there are new developments in Italian politics as well as Angela Merkel goes for new plans considering a European Monetary Fund - the Robeco Europe Update.

04.09.2017 | 08:13 Uhr

Catalans tighten their grip on taxes. Berlusconi joins right-wing parties

Main market events

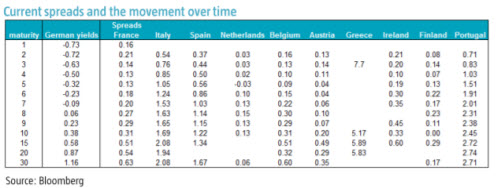

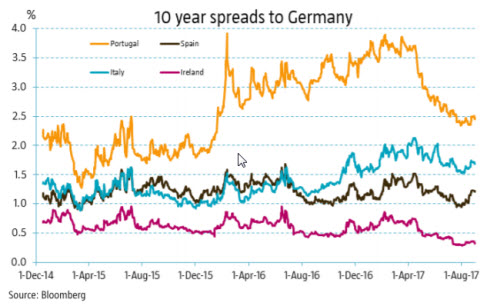

Market sentiment turned more positive this week and as a result peripheral spreads declined somewhat. Next week’s ECB meeting is relevant for markets, as the first signals are expected regarding the continuation of the QE program in 2018. Anonymous sources suggested the ECB is increasingly worried about the sharp appreciation of the euro. This should make the ECB cautious in reducing its bond purchases. Italian bonds have returned 0.02% this year, Spanish bonds 0.91%, Portuguese bonds 8.25% and Irish bonds 0.48%.

Italy

Forza Italia will support the candidate from right-wing parties Lega Nord and Fratelli d’Italia in the Sicily governor elections. Berlusconi had suggested a different candidate, but he chose to avoid splitting the right-wing vote. This is another indication that Berlusconi will not form a centrist, pro-euro bloc with the currently governing PD but rather join the right-wing, euro-skeptical parties in the national elections that have to be held no later than May 2018.

Spain

The Catalan government has set up systems to collect taxes from public companies. For now, the Catalan government will simply pass on the tax income to the central government. However, this is obviously a useful step to prepare for independence, in case the Catalans would vote that way on October 1st. The central government is still determined to prevent this referendum. Spanish Deputy PM Saenz de Santamaria stated the government has prepared measures to prevent the Catalan administration from breaking the Spanish law. Budget Minister Montoro has strengthened controls to prevent public money from being used to fund the referendum.

EU

Merkel embraced plans from her Finance Minister to develop the ESM into a European Monetary Fund. The FDP, a potential coalition partner after the September 24 elections, was very critical on “promising new pots of money to Macron”. A renewal of the current Grand Coalition would likely be more supportive for further EMU integration.

Robeco Euro Government Bonds

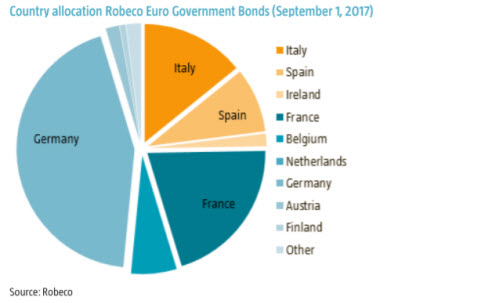

We have maintained the underweight position in Italian and Spanish government bonds. Spreads are close to the post-crisis lows, especially for Spain, while the market has to adjust to the gradual phasing out of the ECB’s bond buying program. Italian spreads are somewhat higher, but here fundamentals remain weaker and political risk is rising. Currently the fund is 25% invested in peripheral bonds compared to 40% in the index. Year-to-date the fund’s absolute return is 0.06%*.

* Robeco Euro Government Bonds, gross of fees, based on Net Asset Value, YTD September 1, 2017. The value of your investments may fluctuate. Past results are no guarantee of future performance.

Diesen Beitrag teilen: