Degroof Petercam: European Real Estate equities - Where the greatest opportunities lie

In addition to direct investment in residential and commercial property, indirect forms of real estate investment are playing an increasingly important role. This includes companies whose real estate portfolios are listed on the stock exchange. REITs from Europe have been delivering attractive risk- adjusted returns for years.

14.03.2018 | 13:40 Uhr

Direct real estate markets in Europe are booming. This is due in part to the increasing populations of many European countries, resulting in a rise in demand for housing, especially in metropolitan areas. Another factor is that Europe’s solid economic growth is leading to a further increase in demand for commercial real estate in the healthcare, office, industrial and logistics segments. The real estate cycle continues to progress in Europe. In some markets it is moving faster than others. Every real estate sector and every region or city follows its own rhythm. Most of the European real estate metropolises are mature markets that have been growing steadily in value for many years. Investors are therefore well advised to be very selective when choosing their investments. The good state of the economy and the resulting unmet demand for residential and commercial properties means that a further rise in rents can be expected. This is mainly due to increasing demand for quality premises.

REITs provide urgently needed income

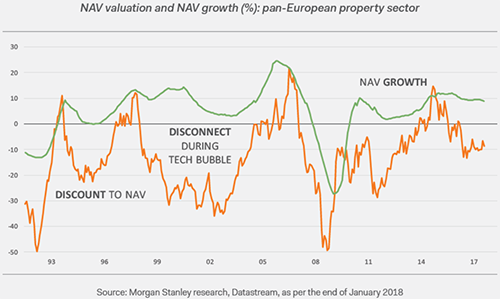

Real estate companies whose portfolios are listed as listed REITs benefit from the positive environment on the real estate markets and investors’ search for returns in an environment of low, albeit rising, interest rates. This is because REITs offer attractive risk-adjusted returns. There are many reasons for this. One reason is the solid growth in dividend yields, which are currently around 4.3 percent per year. In addition, real estate stocks are cheaper and more liquid than direct investments in real estate. Indeed, they are currently trading at a discount versus net asset value.

Furthermore, the healthy balance sheets of European REITs help minimise the risk of a real estate investment. The loan-to-value ratio, i.e. the ratio of loans to the market price of a property, is at its lowest point in the last several years.

For European REITs, it can be assumed that the total return for investors, which consists of dividend yield and the growth of net asset values, will be 8 percent total return in 2018. Meanwhile, the interest-rate side is providing a tailwind. Financing costs for real estate companies should remain low in the coming years. As a result, the gap between real estate returns and financing costs will remain substantial.

No significant risks from ECB policy in 2018

With the first steps towards higher interest rates having already been taken in the United States, we have recently seen markets anticipating to higher growth and inflation, pushing bond yield higher. However, this should be of no concern to real estate investors across Europe. Interest rate hikes usually only have a short-term impact on real estate stocks, while the long-term effects generally remain manageable. Rising bond yields often result in short-term price drops in real estate stocks, as seen early February. However, the longer the observed period of time, the more these effects disappear. Studies in the US REIT market show that even with a medium-term horizon, the correlation between bond yields and the development of REITs is very close to zero. The correlation behaviour of real estate stocks in the short, medium and long term therefore makes it possible to use temporary market downturns to open and expand positions.

It does not currently appear that the ECB will rapidly increase interest rates; instead it will gradually reduce quantitative measures. This should have only a very limited impact on the cash flows of listed real estate companies. Financing costs are set to remain low. Borrowing costs have been steadily reduced by the low interest rates of recent years. Many companies have taken advantage of the situation to restructure expensive long- term financing. In general, Europe’s real estate companies have significantly optimised their financing structures in recent years, thus greatly reducing their sensitivity to an increase in interest rates by significantly hedging this risk. This can also be seen in leverage, i.e. the net debt on the real estate portfolio. In 2017, it was approximately 40 percent on average for European real estate companies. In addition, risk premiums for European REITs remain high. The dividend yield minus the risk-free interest rate is close to a 4-year high of around 3 percentage points.

Europe is full of opportunities

Managers of actively managed real estate equity funds should concentrate more on distinguishing the actually good listed real estate companies from the mediocre, because far from everything that glitters is concrete gold in the European REIT universe. Above all, it is important to look at the management of the individual companies, because it is the people who make the difference in most cases. In addition to this investment criterion, other qualitative criteria such as the quality and diversification of the real estate portfolio as well as the financing structures are also important when selecting real estate equities. In addition, quantitative indicators such as cash flow and dividend yields and the interest coverage ratio have to be right.

Although real estate stocks are not yet as popular in Europe as in the United States, the “old” continent offers active stock-pickers a wide range of opportunities in various real estate sectors. Logistics properties are currently particularly attractive as long as they are located in the European logistics centres. The strong boom in online trading is the main driver of demand in this segment. Initial returns on acquisition costs of between 5 and 7 percent are realistic for good logistics properties. The German company VIB Vermögen and French Argan are currently among the most interesting of a total of eight listed logistics real estate companies in Europe. Residential properties are also attractive in Germany. Social housing construction and nursing homes are particularly promising. Demand is likely to exceed supply in the long term due to the significant needs resulting from the increase in population and the ageing of societies. In addition, the cash flow visibility of these properties is particularly strong.

For real estate stocks from the retail segment, one thing is particularly important: Top quality. Due to the growth in e-commerce, B-quality properties are already having problems. Investors should concentrate on the absolute top players. These include the French shopping centre giant Klépierre. The company operates globally with the aim of providing consumers with true shopping experiences. Pearls amongst real estate stocks can also be found in Spain. The country is currently emerging from its economic crisis. Office properties in the Madrid metropolitan region are particular beneficiaries of this situation. The economic situation in Italy is less positive. Nevertheless, the active selection of individual securities offers good investment opportunities there, too. Take Coima, for example. The company manages and develops real estate projects in the economic centres of Italy and could provide positive surprises in 2018 with impressive management and a restructured portfolio.

An excellent example: Aroundtown

Aroundtown has strong financial figures, a diversified debt structure and the ability to carry out transactions quickly. The company, which is listed on Germany’s SDAX, focuses on quality residential, hotel and office properties in densely populated regions in Germany and the Netherlands. Significant potential for rent increases at existing properties in both the residential and commercial sectors as well as strong operational performance by reducing vacancy rates mean that the company can expect further earnings growth in the coming years. The firm’s high cash ratio and quickly liquidatable assets give it a competitive edge in attractive acquisitions. The financing structure is very balanced with equity issues, traditional, convertible as well as hybrid bonds.

Eyes open in the United Kingdom

Many property market players currently take a critical view of the British market. And this is perfectly justified given the upcoming Brexit. However, investors need to keep an open mind when it comes to real estate in the United Kingdom. Sweeping assessments are not very useful in evaluating opportunities and risks; instead, real estate sectors and locations should be examined in detail. The UK’s exit from the EU is certainly a negative factor for the country’s growth outlook. The London office market is already feeling the effects of this across the board due to declining rental prices; the impact can also be felt nationwide. Real estate with very long-term leases has so far proved to be unexpectedly stable – demand from Asian investors is high for these properties. Logistics real estate is also largely unaffected, and the impact of Brexit on this segment seems to be small in any case. On the other hand, one should take a very close look at the subject of residential properties in the UK. High-end properties are not very promising, while well-located residential properties which are rented at affordable prices are very attractive for the portfolios of listed real estate companies. We may increase our exposure to the UK as soon as visibility post Brexit increases.

Outlook

Generally, valuations are not stretched and the visibility on future cash flows is very high. Investors are willing to pay higher multiples for this predictability. The major risk to our base case scenario is sharply increasing volatility for macro and political reasons. This may also affect investors on direct real estate markets, dampening valuations for listed real estate companies.

The full newsletter you can download here.

Diesen Beitrag teilen: