Pictet: Capitalising on currencies to boost EM return

Each currency has its unique drivers and the foreign exchange market overall is known for bouts for volatility. But there is the potential for broad-based appreciation of EM currency versus the US dollar, providing a lift to total returns from local currency debt, Patrick Zweifel, Chief Economist at Pictet means.

14.03.2018 | 13:12 Uhr

Fixed income investors ignore exchange rates at their peril. They have the power to either erode or enhance the returnson an overseas bond portfolio. Which is why, in our emerging market debt strategies, we embrace them as separatesources of both risk and return.

Each currency, of course, has its unique drivers and the foreign exchange market overall is known for bouts for volatility. However, taking a medium-term view, we see the potential for broad-based appreciation of EM currencies versus the US-dollar, providing a lift to total returns from local currency debt.

Going for growth

Emerging markets are traditionally associated with faster economic growth than their developed peers – after all, theyusually have some catching up to do in terms of wealth.

Recently, that growth premium has widened to 270 basis points from a low of 170 basis points in 2015.

The gap is likely to increase further in coming months for two key reasons. First, emerging markets are particularly wellplaced to benefit as a ramp-up in the investment cycle boosts global trade. According to our models, a 1 per centincrease in cross-border flows lifts EM economic output by 0.26 percentage points. The impact on developed worldactivity is about half as much.

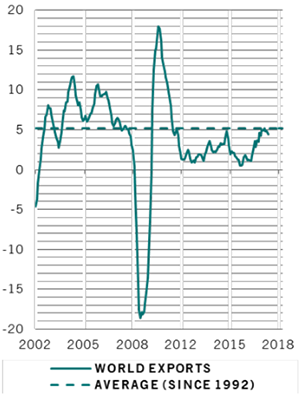

POWERED BY EXPORTS

World export growth (% Y/Y, 3-month moving average)

(Source: Pictet Asset Management, BIS, CEIC,Thomson Reuters Datastream. Data covering period01.01.2002 - 31.12.2017.)

Global exports rose by 4.4 per cent in 2017 (see chart). That’s the fastest pace since 2011, but still below their multidecadetrend, potentially leaving scope for further acceleration. In fact, we expect that export growth will overshoot thelong-term average of 5.1 per cent before peaking, as it has done in previous cycles.

Moreover, commodity and energy prices look well supported as global economic growth remains strong. This shouldboost those commodity-producing emerging markets.

Over the next five years, we forecast that annual EM growth will average 4.6 per cent – 300 basis points higher than thatof the developed world.

This could prove to be good news for emerging currencies. Historically, the differential between EM and DM real GDPgrowth has displayed a strong correlation with the exchange rate, with a six-month lag. The wider the growth gap, theweaker the US dollar against a basket of EM currencies.

The value view

This time round, the case for currency appreciation is strengthened by very attractive valuations.

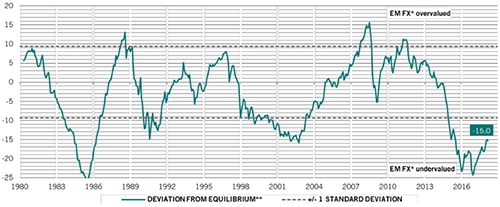

According to our models, EM currencies are currently 15 per cent undervalued against the US dollar. They are alsotrading at some of the cheapest levels seen over the past two decades (see chart).

UNDERVALUEDEM

currencies: over (+) and under (-) valuation vs USD (%)

*Unweighted 31 EM exchange rates vs USD **based on relative prices, relative productivity and net foreign assetsSource: Pictet Asset Management, CEIC, Thomson Reuters Datastream. Data covering period 01.01.1980 - 01.03.2018.

We also have inflation on our side. The inflation differential between emerging and developed nations is at its lowest levelin recent history (at 140 basis points), offering further support to the exchange rate.

Of course, emerging markets span a very diverse universe of countries, which in turn have many different individualcircumstances and drivers for their economies, exchange rates and bonds. So any general potential appreciation of EMcurrencies will likely have some specific exceptions. And even for those currencies which do appreciate, short term boutsof volatility and corrections cannot be ruled out, given the nature of the asset class.

The broad trend of appreciation, however, should remain intact. For EM debt investors, that creates an opportunity tofurther maximise returns by taking active positions in the currencies against their benchmark.

Diesen Beitrag teilen: