Pictet: Emerging Market - Inflation in Central & Eastern Europe

Inflation across emerging markets is at multi-decade lows. But one region is bucking the overall trend: Central & Eastern Europe. What does it mean for investors?

27.03.2018 | 08:55 Uhr

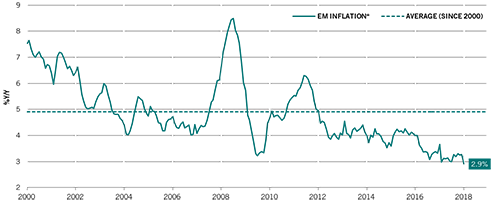

First, some global observations about inflation. Average inflation across emerging markets has fallen to 2.9%, a level not seen since the 1970s, and this is good news for holders of hard currency debt.

FIG. 1 INFLATION IN EMERGING MARKETS

(Source: Pictet Asset Management, CEIC, Datastream, February 2018. *Based on 30 EM consumer prices indices, GDP weighted.)

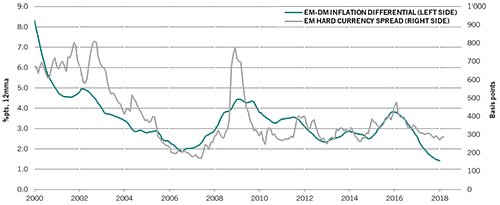

As Fig. 2 below shows, the inflation differential between developed and emerging markets and EM hard currency yield spreads appear closely linked. Even if inflation is expected to pick up modestly in emerging markets, we believe it will rise less than in developed markets, and this supports a further narrowing in emerging hard currency debt spreads.

FIG. 2 - INFLATION DIFFERENTIAL

(Source: Pictet Asset Management, CEIC, Datastream, January 2018)

The exception to the rule...

As mentioned, one cluster of countries bucking the falling inflation trend is the Central and Eastern Europe (CEE) markets of the Czech Republic, Hungary, Poland and Romania. This is mainly because of wage growth, which has ticked up in all four countries.

FIG. 3 - NOMINAL WAGE GROWTH IN THE CEE REGION

(Source: Pictet Asset Management, CEIC, Datastream, February 2018)

The four markets in the CEE region account for over a trillion dollars of GDP and around 80 million people. Poland is the region’s powerhouse accounting for half of GDP and half of the population. The richest market in terms of GDP per capita is the Czech Republic.

Download the full article here.

Diesen Beitrag teilen: