Pictet: Emerging markets - Where to find growth in 2019?

Latin America is the only EM region set to do better than last year. We look at the countries with the strongest prospects.

17.01.2019 | 13:48 Uhr

LOOK TO LATIN AMERICA FOR ECONOMIC GROWTH

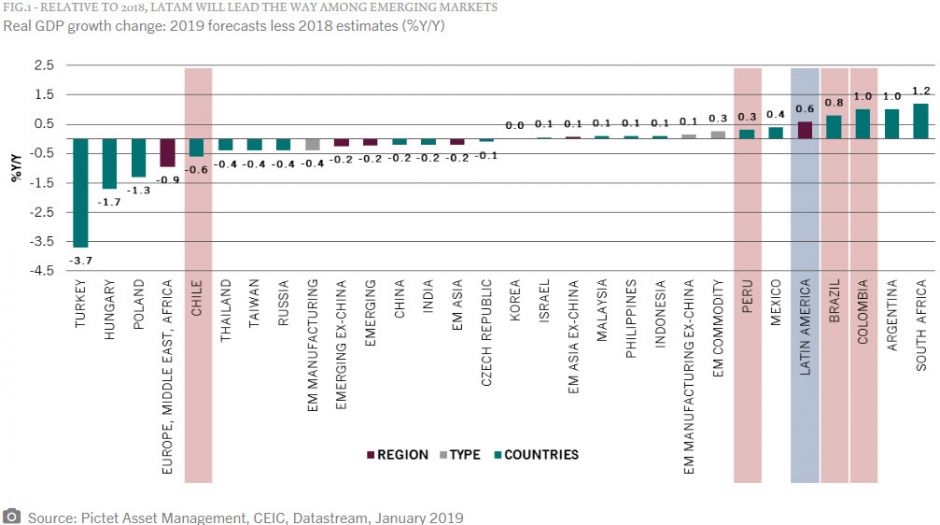

Against a challenging backdrop for emerging markets, Latin America is the only region which should do better than in 2018. Brazil, Colombia and Peru in particular are the most promising markets in terms of growth acceleration (Fig.1).

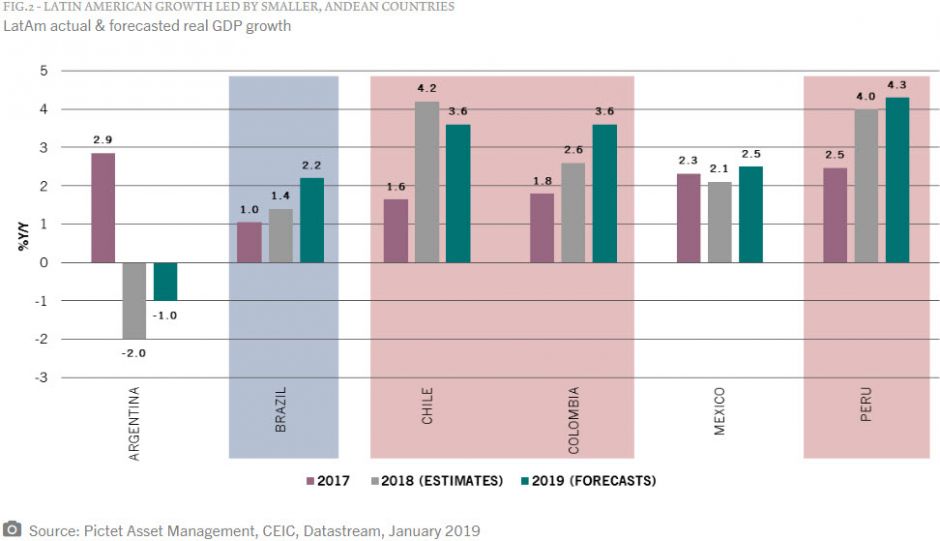

Chile won't repeat the performance of 2018 but growth is still projected to remain strong in 2019, as illustrated by the absolute numbers in Fig.2 below.

In absolute terms, Latin America’s GDP growth rate in 2019 (2.6%) should outperform that of the EMEA region (2.0%), the first time since 2013.1

Inflation in the region should remain within targets, in spite of risks such as falling commodity prices, enabling policymakers to continue accommodative monetary policies.

A new period of political stability

Elections took place in all four countries between 2016 and 2018, meaning that this year should be clear of any major political instability.

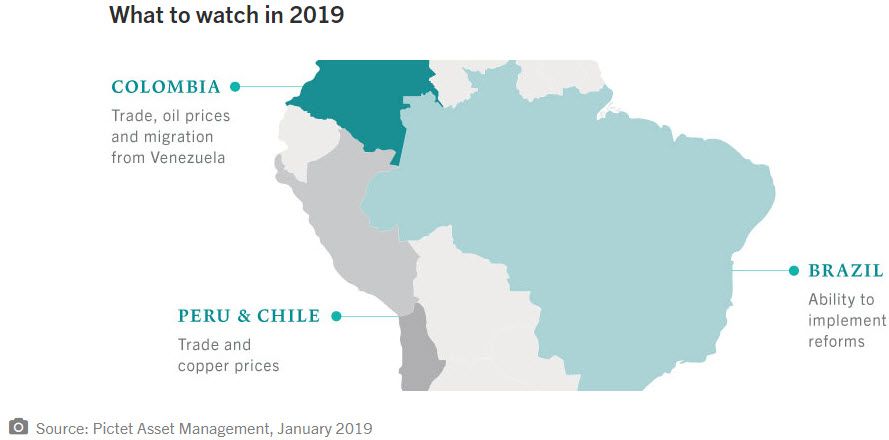

The elections have led to the establishment of more conservative governments willing to reform the public sector and to stimulate the economy through long-term policies. Colombia, for instance, has reduced corporate tax. In Chile, new laws are being introduced to speed up the process of setting up new businesses. In Brazil, one of President Jair Bolsonaro’s top priorities is to cut down public spending.

CHINA'S RISING PREDOMINANCE

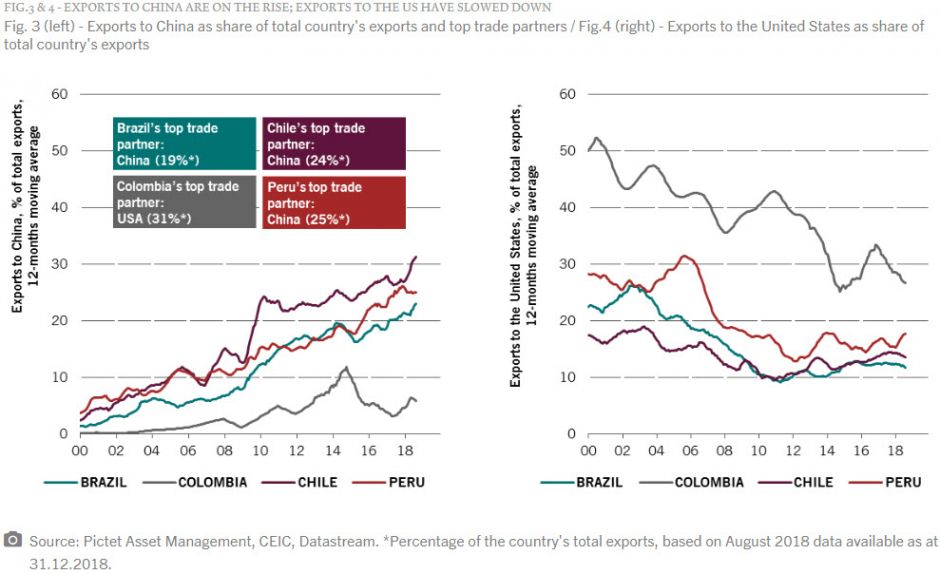

But one risk is looming for these countries: their increasing dependency on China for exports, especially in the current context of global trade tensions. As illustrated in Fig. 3 below, China is the main trade partner for Brazil, Chile and Peru.

For all four countries, albeit to a lesser extent for Colombia, exports to China have been on the rise since 2000 (Fig.3.). Over the same time period, exports to the US have slowed down, especially for Colombia (Fig.4.).

China has extended its influence globally and increased imports of commodities such as metals, or cereals in the case of Brazil to satisfy domestic demand. This has allowed Latin American countries to diversify trade partners away from neighbour countries. Meanwhile the US has imported less oil as it has ramped up domestic production, impacting Colombian exports.

In conclusion, Latin America’s economic growth should be stronger this year than in 2018, mainly driven by smaller countries such as Chile, Colombia and Peru. Brazil, the region’s largest country, will also grow, although at a more moderate pace. All of these countries have new governments in place with credible plans from an economic standpoint. Despite risks such as growing reliance on exports to China and inherent dependence on commodity prices, we believe these countries will provide opportunities for long-term investors.

CHART FROM OUR EMERGING CORPORATE BOND TEAM

By Karen Lam, Senior Client Portfolio Manager

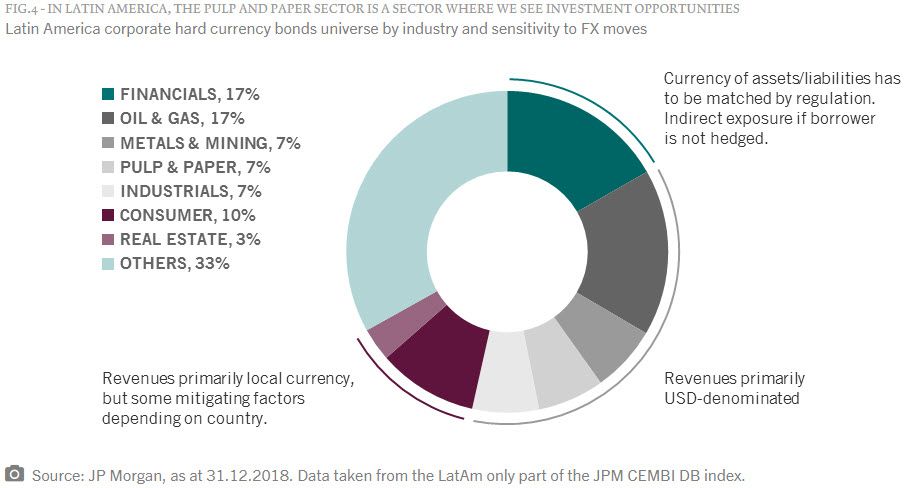

From a bottom-up perspective, we see attractive opportunities in commodity-related names. Given these are exporters, they tend to benefit from local currency depreciation. This is one of the reasons why we have given commodities a 7% overweight in our EM corporate bonds portfolio.2

Another sector that has appeal in Latin America is the pulp and paper sector, particularly in Chile and Brazil, based on relatively strong price fundamentals.

[1] Source: Pictet Asset Management, CEIC, Datastream; estimates for 2018 as at 03.01.2019

[2] Source: Pictet Asset Management, 31.12.2018

Diesen Beitrag teilen: