Pictet: Should we worry about emerging market debt levels?

Compared to developed countries, emerging markets continue to have a lower debt-to-GDP ratio. But their debt is rising. Should we be worried?

27.06.2018 | 12:30 Uhr

Emerging markets continue to have lower levels of debt than developed markets as a percentage of GDP. But as the chart below shows, from 2009 emerging markets have increased their levels of indebtedness to reach 183% of GDP according to latest available figures. What has driven this increase?

FIG.1 - TOTAL DEBT BY MAIN REGION (% GDP)

1990-2018

Source: Pictet Asset Management, BIS, CEIC, Datastream, Q3 2017

As is often the case, the answer is China. Strip it out and the level of indebtedness of emerging markets has barely budged for 20 years. This is a positive fundamental consideration for investors.

China's corporate debt is the main factor

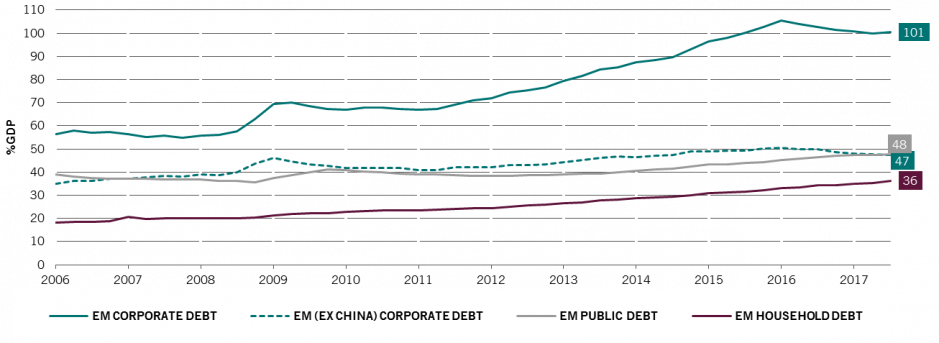

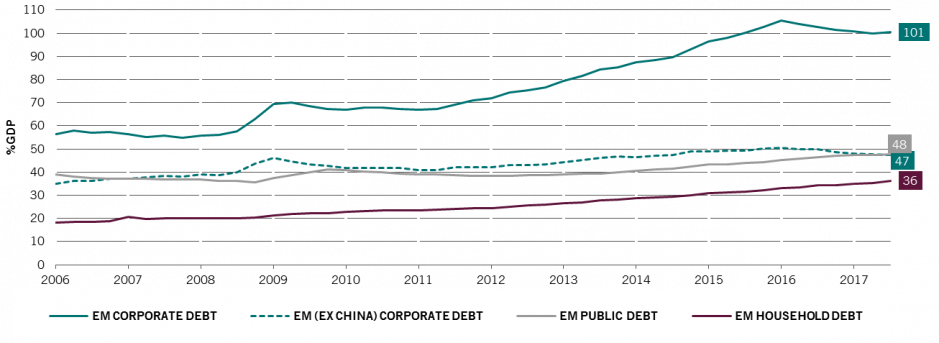

Digging into the composition of emerging market debt unveils a similar insight: most of the increase has come from corporate debt in China. By contrast, public (sovereign) debt or household debt has remained fairly flat.

FIG. 2 - TOTAL EMERGING DEBT BY SECTOR (% GDP)

2006-2018

Source: Pictet Asset Management, BIS, CEIC, Datastream

Should we be concerned?

The wave of Chinese corporate debt issuance over the past decade is observable in the chart below. The only market that has come close over this period is Turkey.

FIG. 3 - EM CORPORATE DEBT CHANGE BY MARKET

Q2 2009-Q3 2017

Source: Pictet Asset Management, BIS, CEIC, Datastream

Is this a problem? Although the size of China's corporate debt sector has been noted as a source of systemic global risk by policymakers, we do not feel the bubble is likely to burst. Firstly, excess corporate debt aside, China's macroeconomic fundamentals are broadly in good health. We expect an orderly, managed corporate deleveraging over a period of years, which will admittedly weigh on overall growth. Second, much of the debt is issued by state-owned enterprises (SOEs), which are quasi-sovereign and can be considered as being bank-rolled by the Chinese goverment.

The View from our emerging corporate bonds team

Karen Lam, Senior Client Portfolio Manager

In the Chinese corporate market, we feel our investment opportunities are mainly in the external (US dollar denominated) space. That's not to say we don't occasionally look at renminbi debt, but we do not currently have any RMB corporate bond exposure in our portfolios.

As shown below, China is expected to remain a significant contributor to gross issuance in external debt in 2018.

FIG. 4 - EM CORPORATE EXTERNAL BONDS

2018 supply forecast by region

Source: JP Morgan 09.05.2018

China now accounts for 42% of short-dated EM credit issuance compared to 18% five years ago. Most of this is focused on two sectors: real estate and financial services.

In our view, short-dated credits issued in the former are not attractive. This is because China real estate developers have been willing to pay up to get their debt issued, given their refinancing needs and time limits on regulatory approval, which in turn has put pressure on the secondary market. In relative terms, we therefore prefer select short-dated Chinese credits in financial services when the bottom-up fundamentals stack up.

Diesen Beitrag teilen: