Pictet: Dry summer for stocks

Bonds are likely to take the upper hand over equities this summer, as liquidity dries up and economic growth slows.

11.07.2018 | 15:32 Uhr

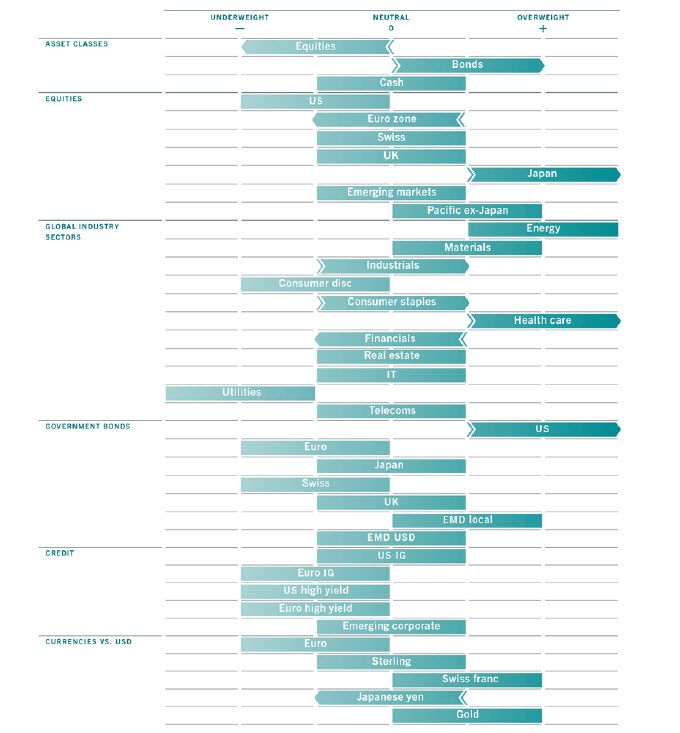

Asset allocation: no easy living for equities

The summer months might be a time for relaxation, but not for investors. To the investment community, it’s a season characterised by volatile markets and lacklustre equity returns. This year, that trend could be even stronger than normal thanks to a loss of momentum in the global economy, a draining of monetary stimulus and overly optimistic corporate earnings expectations.

Some caution seems warranted, at least in the near term. We therefore downgrade equities to negative, and raise our allocation to fixed income to overweight.

Source: Pictet Asset Management

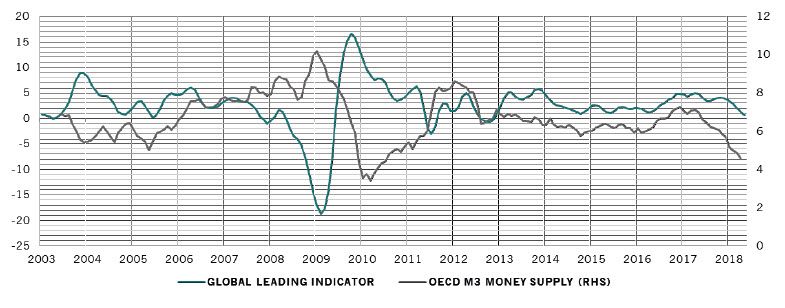

Our business cycle indicators suggest that global economic growth is going to continue its gradual deceleration in the coming months, particularly in developed countries (see chart).

Of all the geographic regions, only Latin America still has an above-trend leading indicator reading. Most of the negativity elsewhere is a reflection of deteriorating consumer and business sentiment, so it could prove relatively short lived, particularly as interest rates around the world still remain supportive of economic activity. But for now, certainly, the macroeconomic backdrop is relatively less favourable for equities and other risky assets, such as high yield debt, on which we are also underweight.

Source: Datastream, OECD, Pictet Asset Management. Data covering period 01.02.2003 - 15.04.2018

Influenced by a tightening of the monetary reins in the US, our world liquidity gauge remains in negative territory. Indeed, the US Federal Reserve has already administered the equivalent of 440 basis points of interest rate hikes, if you include the removal of its quantitative easing policy. That equates to the average cumulative tightening of the past 16 cycles, stretching back to 1919. We believe this draining of monetary stimulus is already affecting financial markets, and that impact is likely to be magnified through the widening of risk premia.

Valuations don’t paint a positive picture either. Within equities, there are several areas that look too expensive. Cyclical stocks are among those, trading at a near-record 26 per cent premium relative to their defensive counterparts on cyclically-adjusted price-earnings basis, compared to a long-term average of 10 per cent. What is more, our negative excess liquidity readings1 are consistent with a further 5-10 per cent decline in price to earnings ratios by the end of the year.

Technical gauges that capture seasonal factors support our asset allocation stance, with strongly positive readings for bonds and strongly negative ones for equities. Given the potential for a pick-up in volatility over the summer months, it is also worth noting the build-up of short positions on the VIX. If this risk appetite gauge were to fall – which seems quite likely at some point during skittish summer trading – that could send significant waves through financial markets.

Den vollständigen Marktausblick von Pictet können Sie hier herunter laden.

Diesen Beitrag teilen: