Pictet: A Correction looms for Equities

With developed economies under pressure and corporate profit growth slowing, prospects for most stock markets look uninspiring.

04.04.2019 | 10:28 Uhr

Equities are a turn off

A powerful rally across global stock markets since the start of the year has lifted equity valuations to levels that are at odds with our downbeat expectations for corporate profit growth. This has prompted us to cut equities to underweight and upgrade cash to overweight.

Stocks have almost fully recovered the losses sustained during last year’s fourth quarter panic thanks to policy U-turns in both the US and China.

The US Federal Reserve put the brakes on its aggressive liquidity squeeze, by halting its rate hike cycle and flagging a potential end to its balance sheet reduction. Slowing economic growth forced the Chinese to turn their attention from campaigning against the country’s shadow banking sector, to re-starting credit growth and injecting fresh fiscal stimulus. And meanwhile, the trade war between the two countries was nudged off the front burner.

While it’s true that a softening of attitudes could pave the way for a healthier economic environment later this year, we remain cautious. Corporate profit margins are under increasing pressure from higher wages in an environment where firms are reluctant to raise prices. And with profits looking more vulnerable than analysts are willing to acknowledge, there’s scope for some negative surprises in the coming quarters.

Our business cycle indicators highlight a

deterioration in developed economies’ prospects. Gloomy sentiment

surveys could well be overstating the case, but it’s clear growth is

slowing.

Our leading indicators suggest that developed economies will grow by

just 1.8 per cent this year from 2.2 per cent in 2018. Emerging market

economies are doing considerably better. Growth should come in at 4.6

per cent for the full year – and would be stronger if the two big

problem countries, Turkey and Argentina, were stripped out.

For all this, the slump in global trade appears to have bottomed out and there are some signs of modest recovery. As ever, the Chinese government is determined to support the country’s economy. It plans to inject stimulus equivalent to 3.8 per cent of GDP in the form of infrastructure, public spending and trade measures in 2019. That might be relatively modest compared to past measures, but it’s also likely to be increased should the need arise. Something to watch out for is the degree to which the Chinese authorities favour tax cuts over infrastructure spending.

Our liquidity scores suggest a stabilisation in credit conditions after last year’s sharp tightening of the monetary reins. Investors should expect a mildly negative follow-through from previous policy moves, though. For instance, the Fed will be shrinking its balance sheet by another USD200 billion before calling a halt to its quantitative tightening programme. But an end to a squeeze is in itself stimulatory – there’s evidence that changes matter more than trend. Meanwhile, China, which now represents more than half of the liquidity flowing through the global financial system, is loosening policy again. And the European Central Bank appears to be on the cusp of launching another infusion of long-term bank credit.

Our valuation analysis suggest that global equities are broadly fairly priced – conditional on earnings growth evolving as the market expects. True, analysts are more cautious than they were, with Japanese companies in particular subject to sharp earnings downgrades. Even so, we’re less optimistic than the market generally about the prospects for corporate profits. At the same time, markets seem to be under-pricing the risk of a recession. That’s particularly true for cyclical equity sectors and assets like US high yield credit. Indeed, bonds overall are looking expensive.

Technicals paint a broadly positive picture for fixed income, though they’re supportive of most asset classes. The exceptions are some emerging market currencies.

Equity sectors and regions: emerging markets better value than US, euro zone

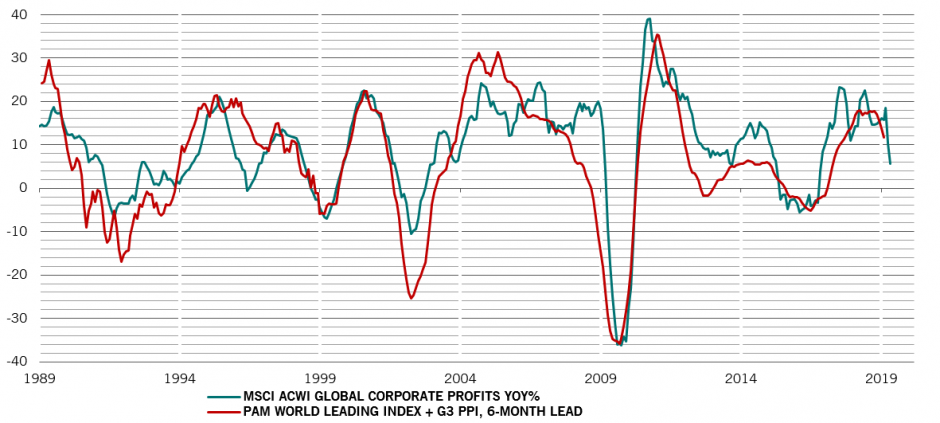

Equities have recouped almost all the losses they suffered during the late 2018 sell-off, with the MSCI All-Country World Index rising more than 10 per cent since January. But a repeat of this stellar performance looks unlikely in the coming months as deteriorating economic growth – particularly in the developed world - threatens to weigh on corporate earnings.

Worldwide, company profits are expected to rise by just 6 per cent this year, down from a robust 15 per cent in 2018, according to consensus analyst forecasts.

Our models suggest the picture could be worse than that. We expect earnings to grow by only 1 - 2 per cent this year.

The US stock market looks the most vulnerable to a correction; not only is it the most expensive in our scorecard, but profit margins among US companies look set to contract from record highs of 11 per cent. Already, almost two thirds of US companies reported higher wage costs, according to the National Association for Business Economics Survey.

Emerging market stocks remain our preferred equity investment, due to the developing world’s more resilient economic growth, low inflation and the prospect of a weaker US dollar. China is a particularly bright spot as its sizeable fiscal and monetary stimulus has helped the country transform from a major threat to a stabilising force in the global economy.

UK equities are also cheap, given the market is well stocked with defensive companies that are trading at what we consider to be unjustifiably cheap levels, unfairly tainted by concerns over Brexit. We are less convinced about euro zone and Japanese stocks mainly as economic growth in these markets remain sluggish – we therefore keep a neutral stance there.

In terms of sectors, we prefer to hold companies in defensive industries such as health care and utilities, which tend to outperform in periods of slowing economic growth.

We keep our underweight stance on economically-sensitive cyclical stocks, such as consumer discretionary and technology – the two most expensive industries on our scorecard.

These stocks are hardly a bargain on a relative basis either: after a

brief correction in late 2018, cyclical stocks are once again outpacing

their defensive counterparts, by some 4 percentage points so far this

year (see chart) – gains which we expect to be unwound if the economy

continues to slow.

Diesen Beitrag teilen: