Capital Group: Japan outlook - The refurbishment of Japan Inc. continues

Following a turbulent year in Japanese equity markets, what might be on the horizon over the next 12 months?

19.12.2018 | 09:35 Uhr

Continuity creates a relatively stable political backdrop

As Prime Minister Shinzo Abe continues his third term of service into 2021, so will his policies. Ensuring that Japan keeps up with its nominal gross domestic product growth, which has been favourable over the past few years, will be one of the prime minister’s main objectives in order to lift the country out of its fiscal deficit and improve its standard of living.

Improved governance will support the refurbishment of Japan Inc.

On the governance front, much is still needed to be done to refurbish Japan Inc. However, notable progress has been made. In March 2018, the Tokyo Stock Exchange revised Japan’s Corporate Governance Code and later in the year, the Financial Services Agency enhanced the stewardship code for institutional investors. These guidelines are now more prescriptive and there are signs that improvements can be self-sustained.

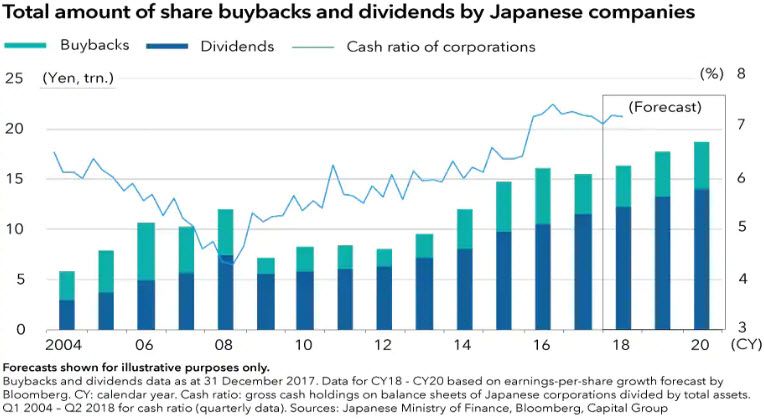

Public pension funds are also demanding more accountability from asset managers, pushing some firms to improve dialogue with investors and focus on returns. Japan’s Government Pension Investment Fund, the largest pension fund in the world, is using its influence to drive stronger corporate governance practices. Furthermore, there is added pressure to increase dividend payouts and share buybacks, which should help enhance shareholder returns. The chart below shows a marked increase in the total amount of dividends distributed in recent years, but Japanese firms took a back seat on share buybacks, which dropped sharply in 2017 after a record run.

Regular communication is key to pushing for good governance. Capital Group’s investment associates have had longstanding conversations with companies, including those in Japan, on improving governance. “Japan has made a lot of progress and is moving significantly away from the Kansayaku system, where statutory auditors are paid by the company, so they are effectively employees of the firm,” says portfolio manager Steven Watson. “The improvements to Japanese boards is a nice transition to watch.”

Capital efficiencies can potentially improve shareholder returns

The return on equity, despite rising to a 30-year high in fiscal year 2017, has yet to reach a similar level of gains achieved by profit margins. Our analysis suggests that the return on equity has been largely weighed down by a decline in capital efficiency (total asset turnover). And the key to improving return on equity boils down to efforts by firms, such as the efficient use of surplus cash for capital expenditure and mergers & acquisitions, execution of operational restructuring by removing unprofitable businesses, reallocation of resources into growth areas as well as shareholder payouts.

Portfolio manager Seung Kwak is positive on the prospects for Japanese corporates, stating “Uncovering hidden corporate value by improving shareholder returns and through efficient use of capital can potentially create a virtuous cycle in the Japanese stock markets and economy.”

Diesen Beitrag teilen: