Pictet: From rout to recovery

Almost all assets were battered by October storms as investors worried about rising rates and trade wars. But that has opened up some tactical opportunities.

12.11.2018 | 14:15 Uhr

Asset allocation: equities to recover after October rout

October proved a cruel month for equities, with virtually all sectors and regions mired in red. Yet we believe there is plenty of scope for stocks to stage a recovery, which is why we have raised our allocation to equities to overweight from neutral and downgraded bonds to underweight.

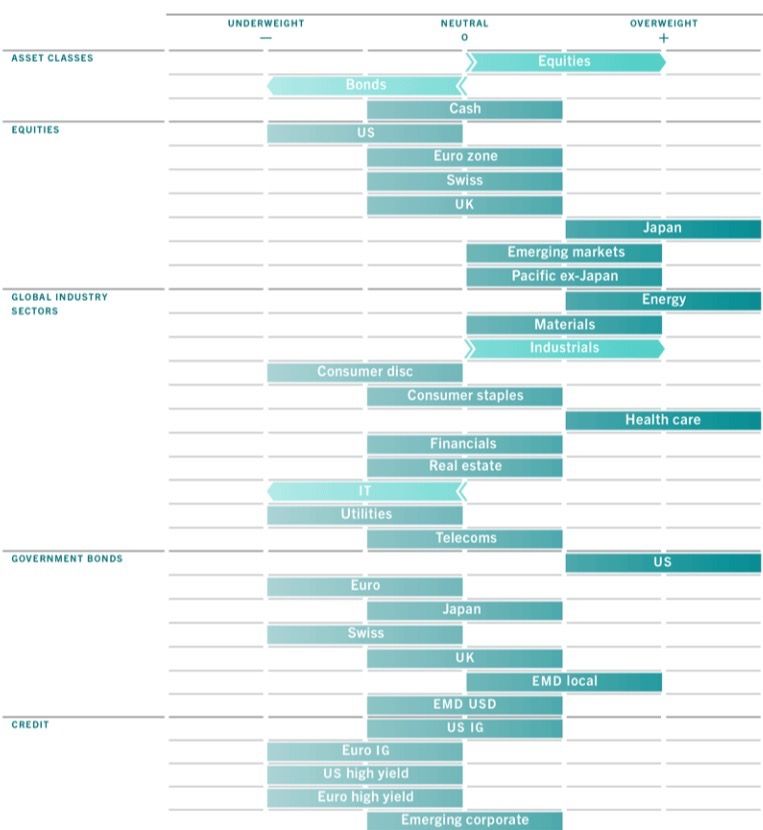

Monthly Allocation Grid November 2018

It is true that the bull market which stocks have experienced for much of the last decade had gone too far, but so too has October’s sharp correction.

Aftersinkingbysome10percentinfourweeks,globalequitiesarenowinexpensive:accordingtoourmodels, valuations for world stocks are below their 20-year historical average for the first time in two years. The price-to-earnings ratio for the MSCI ACWI dropped to just 13.3 times by the end of October from 15.0 times a month earlier and 16.9 times in January. Regionally, Asia looks particularly cheap, as do most emerging markets (excluding Latin America).

Notably, the massive reversal in prices and valuations has not been accompanied by any major changes in either economic or corporate fundamentals. In fact, our business cycle indicators suggest both that the global economy remains on a firm footing. Globally, while corporate earnings growth peaked in the first half of 2018, it remains solid at an annual pace of some 15-20 per cent (see chart).

Unearned Correction

There are, of course, a number of risks on the horizon, including the US/China trade disputes and uncertainty over the outcome of US mid-term elections.

As far as tensions between the US and China are concerned, we think much of the negativity has already been discounted by markets, leaving the opportunity for surprise developments that would be taken positively by global equities. Such a surprise could take the form of new US-China trade deal potentially around the G-20 meeting in Buenos Aires at the end of November.

The US mid-term elections, in which the ruling Republicans lost control of the House to the Democrats but retained the Senate, present a different set of risks. The consensus view is that a split Congress will result in legislative gridlock that would likely slow fiscal expansion. Trump's protectionist approach to trade policies, however, is likely to remain unchanged, not least because a large number of Democrats agree with his views.

Our liquidity conditions remain negative, and there are signs that the Fed's twin-pronged tightening policy – through interest rate hikes and the withdrawal of quantitative easing – is starting to bite. In contrast, China stands out as the only major central bank actively loosening policy, which supports our positive stance in emerging markets.

On a global basis, technical indicators support our tactical preference for equities over bonds this month. Short-term sentiment signals for equities are very positive as a result of heavily oversold conditions across almost all the regions. Seasonality – the tendency for equities to rally at the end of the calendar year – is another factor to consider. In the longer term, economic growth will eventually slow, inflationary pressures will bite, and earnings will turn lower. But for now we believe that the equities sell-off has prepared the ground for one more burst higher.

Diesen Beitrag teilen: