DPAM: Asset Allocation Flash

The world economy reveals more evidence of cooling with leading indicators mostly pointing to slower activity ahead. Growth in world trade volume has decelerated significantly and risks are still skewed to the downside.

15.03.2019 | 15:48 Uhr

Global

At the same time, some arguments caution against too much pessimism. These include more positive signals surrounding the trade talks between the US and China, central banks willingness to remain flexible, lower energy prices and the implementation of Chinese stimulus measures.

Headline inflation will continue to fall as a result of base effects linked to the evolution of energy prices. Core inflationary pressures, meanwhile, remain tame in general despite recent acceleration in wage growth.

The upshot is that central banks are absolutely in no hurry to tighten monetary conditions. If anything, their tone of voice has turned even more cautious.

United States

The US economy has fired on all cylinders over the past two years. Incoming economic and survey data remain pretty solid. Moreover, the labour market continues to post an impressive job gains.

That said, the fading of the fiscal stimulus, the lagged effects of earlier rate hikes and a weaker external environment in combination with the strong USD suggest that growth will weaken from here.

Headline inflation will decrease substantially in the first half of 2019 while core inflationary pressures continue to hover around the Feds 2% target.

The combination of lower anticipated future activity, modest inflation and volatility in financial markets has caused the Fed to become more cautious. In fact, over the last few months the Fed has taken a remarkable U-turn towards more patience.

Mr. Powell pointed to several factors including the recent volatility in financial markets, the uncertain impact of the government shutdown, trade negotiations and the continued weakening of global economic activity.

The Fed also provided more guidance on its balance sheet. While the Fed has reiterated that it doesnt see the balance sheet as an active policy tool, Mr. Powell stressed that the Fed wouldnt hesitate to adjust the run-down process if needed. In any case, its balance sheet looks set to remain very large in historical perspective.

Meanwhile, a couple of issues remain unresolved. Trade negotiations start up again after the Chinese New Year Holiday and attention has shifted back to the possibility of a renewed government shutdown. From March on, the debt ceiling looks set to become the next political hurdle.

Eurozone

The Eurozone economy has seen solid improvement in recent years. But activity has weakened and prospects look rather bleak. Economic activity finished on a weak note in 2018 and most business surveys suggest that things continued to worsen at the start of the year prompting many observers to revise their forecasts lower.

Both external and domestic factors lie behind the Eurozone slowdown. Industrial production growth has dropped into negative territory on the back of a slump in car manufacturing (linked to new emission standards) and weaker demand from China. And despite fairly solid growth for the quarter as whole, retail sales actually decreased in December. Consumer confidence has come down too, albeit from elevated levels.

Labour market conditions remain quite solid for now. The unemployment rate has dropped back to just below 8% and wage growth has finally picked up, implying that underlying price pressures should move somewhat higher from here (but not nearly enough to reach the 2% inflation target anytime soon). Meanwhile, headline inflation (now at 1.4%) is impacted negatively by base effects related to the evolution of energy prices.

All this has led the ECB to admit that risks to the outlook have shifted to the downside while stressing that the market understands our reaction function. This probably means that the first rate hike will not come in 2019. The ECB looks set to lower its economic forecasts in March and may be offering a new round of loans to secure funding in the banking sector.

Italy remains a source of concern. Confidence in Italy has dropped significantly following the elections earlier this year and the budget dispute with the European Commission. Economic growth remains hugely disappointing. As such, without further structural and institutional progress both in Italy and the Eurozone, the country remains vulnerable to periods of self-fulfilling panic reactions in markets.

Meanwhile, the Brexit saga drags on with no real solution in sight for now as discussions between the UK and the EU go in overtime. Nor the UK nor the EU will benefit from a no deal but the risk that it still happens remains significant (cfr. backstop issue).

Emerging Markets

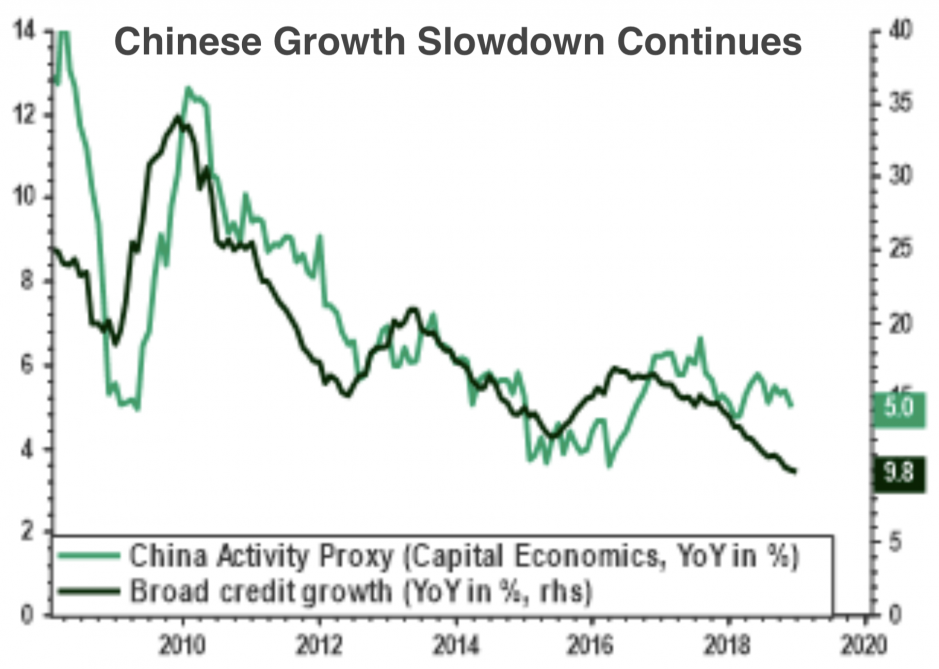

Budgetary and monetary policymakers in China are stepping up efforts to arrest the ongoing slowdown spurred by a decline in credit growth and international trade tensions. Official GDP growth, now at 6.5%, overestimates actual economic activity growth (a more realistic estimate hovers around 5%).

Lower interbank interest rates, tax cuts (mostly directed towards families and SMEs) and some extra investment spending should at some point produce stabilizing results. We expect this to happen about halfway through the year. But for now at least the risks are still tilted to the downside and the relatively modest stimulus measures taken so far (i.e. compared to the 2015/16 slowdown) are unlikely to lead to a significant demand boost. Meanwhile, trade tensions with the US remain fundamentally unresolved.

More broadly, the situation in the emerging world is very different from region to region and from country to country. That said, the overall picture portrays economic softening. With regard to monetary policy, the fall in headline inflation prices in combination with a downward shift in interest rate expectations in the US and Europe implies that most central banks are putting their tightening efforts on hold. The Indian central bank actually lowered interest rates in February. Indeed, from a EM wide perspective, the balance of risks with regard to monetary policy is now tilted towards more easing.

Currencies

The USD still looks expensive in a long term theoretical perspective. That said, more evidence of the Fed turning more hawkish could still lead to a somewhat stronger USD. Meanwhile, a stronger EUR has another dampening effect on Eurozone inflation numbers that are already considered too low. All in all, downward risks for the USD remain present in a medium to longer term perspective, provided that European political cohesion proves stable.

The GBP has already depreciated significantly as a result of the Brexit referendum. This has led to higher inflation and hence negative real household disposable income growth for UK households, challenging the growth outlook. The BoE dovishly hiked interest rates in August for the first time since July 2007 but this was largely anticipated by markets. Meanwhile, Brexit negotiations seem to be going nowhere at this point. This could change of course but for now risks remain primarily on the downside from current levels.

The JPY has been depreciating against the euro in recent quarters. Downward pressure remains as the BoJ sticks to its ultra-loose monetary policy in the foreseeable future. The fact that the JPY is now at its long-term PPP equilibrium level against the EUR, however, makes another significant depreciation less likely.

The RMB has appreciated significantly against the USD since the summer of 2016. But this has been mostly offset by depreciation against other currencies. In trade-weighted terms the RMB has remained broadly stable recently, in line with policy goals.

Asset Classes

Cash is neutral, Overweigh government bonds.

In spite of the return of risk appetite (equity markets have regained most of fourth quarter 2018 losses), safe haven assets like US treasuries and Bunds did not sell off. US 10 year yields continued to hover around the 2,70% level, while German 10 year yields actually reached a 27-month low of 0,08% in early February. Continued disappointments in macro-economic data incited central banks worldwide to strike a more cautious tone regarding future monetary policy.

Central banks have turned more dovish. The Federal Reserve already adjusted its rate forecasts downwards in December, but in recent communications, there was no longer any reference to further gradual interest rate increases. There is also the possibility that the Fed will delay or halt the reduction of its balance sheet. For the ECB, the prospect of a first interest rate hike is pushed further into the future, implying that there may not be a higher rate set in 2019. Emerging Markets central banks pause as well or start cutting rates i.e. India.

A Bund yield below 0% would imply a high probability of recession, no rate hike cycle, Italy below Investment Grade or a geopolitical event. This is not our base case scenario. It continues to be our view that yields still have some upward potential. On the other hand, lower growth expectations and inflation below 2% will prevent yields from rising significantly.

Our position in EUR government bonds remains unchanged. Periphery bonds continued to perform well, with the exception of Italian bonds which were lagging because of poor economic figures (the Italian economy tumbled into a recession over the two final quarters of 2018) and (internal) political tensions. The low for longer policy rate condition is supportive for non-core government spreads, but specifically for Italian bonds we do not expect a significant narrowing of spread from current levels (between 250 and 300 basis points).

Underweigh Euro IG Corporate Bonds

Spreads for Investment Grade bonds significantly fell back from the end of year highs that were comparable to peak levels in 2015-2016. The move down has almost been as sharp and aggressive as the move up during the final quarter of last year.

Market sentiment remains supportive, as supply during January and February was absorbed well. The amount of supply hitting markets remains high.

We have remained underweight EUR Investment Grade, as valuations are not attractive given the index composition that is heavily tilted towards BBB paper.

Underweigh Euro High Yield Bonds

Also for the corporate High Yield segment, spreads have retreated sharply.

We remain underweight on European HY. The underweight was reduced somewhat however because the Federal Reserve officially calling for a pause in the interest

rate cycle at the end of January will likely continue to lower market volatility, supporting higher risk market segments.

We believe that we are still rewarded a little bit better with

spreads above 400 basis points for a cumulative realized default cycle of 32.9% assuming a 40% average default recovery. No large volume of maturing bonds to be renewed in the near future (maturity wall). However, risks remain slowing growth (China, Europe), and/or a disappointing future earnings season.

The outlook for EM government debt in local currency remains positive:

Central banks (Fed, PBoC) turning more dovish, attractive valuations, political more stable situation in EM countries (Brazil, Mexico...). Risk: a stronger dollar could halt the current inflows in the region. We confirm our Overweight position.

Following the worst month in nearly a decade, equity markets have rebounded. Markets were buoyed by a not as bad as feared earnings season, progress in the trade talks between China and the United States and by the more cautious messages being sent by central banks. Defensive sectors (staples, health care, telcos) strongly underperformed the cyclical sectors (semis, retail, autos).

EPS growth expectations look unrealistic, especially in Europe, and should end-up closer to zero. In general, forward guidance for the second half of 2019 looks too optimistic in most sectors, in our view.

Equity markets have rebounded on a more dovish central bank outlook and trade deal optimism, while earnings expectations have come down and will most likely continue to be revised downward. We believe this environment warrants a further reduction of the equity weight and prefer to reinvest in yielding assets, i.c. Eur High yield. As such the exposure to risky assets remains unchanged but shifts towards a more defensive risk/reward profile. However, we continue to be invested in equity because valuation levels remain attractive. Risk premiums have retreated only modestly despite the equity rebound, because bond rates have fallen as well.

On a geographical level, we changed our recommendations:

we have an Underweight stance on European equity. We see the highest probability for further downward earnings revisions for this market and political issues continue to weigh on sentiment. We consequently see no trigger to close that valuation gap.

Valuations remain mixed because cheaper sectors are cheap for a reason.

US equity continues to be neutral. Valuations are less supportive compared to other regions, but the market has a more defensive profile. Growth and earnings growth will decelerate to be more in line with other regions, as the effects of tax reform will disappear in the course of 2019. On the positive side, the risk of an overshoot in central bank action appears to have disappeared.

The emerging region underperformed slightly during the rebound, but outperformed significantly during the 2018 end of year correction. The improving sentiment on the trade conflict between the United States and China is most likely priced in by the market. The economic slowdown in China shows no signs of stabilizing and we await the effects of the stimulus programs. In September we raised the weight of emerging markets but position remains underweight.

We are underweight Japanese equity because of their link to slowing global growth. Earnings figures are disappointing and later in the year, another tax hike is in the cards. Structural problems remain intact, such as the demographic trend that encumbers potential growth, and the high government debt. However, valuation stay attractive and monetary policy remains extremely accommodative.

Diesen Beitrag teilen: