Degroof Petercam: Global Economic Outlook

Economic confidence indicators continue to point to a solid cyclical growth momentum across sectors and regions. The global economy is not firing on all cylinders but following numerous false starts in recent years, the current recovery looks somewhat stronger, more broad-based and more sustainable.

03.05.2017 | 07:11 Uhr

(Foto: Hans Bevers, chief economist Degroof Petercam)

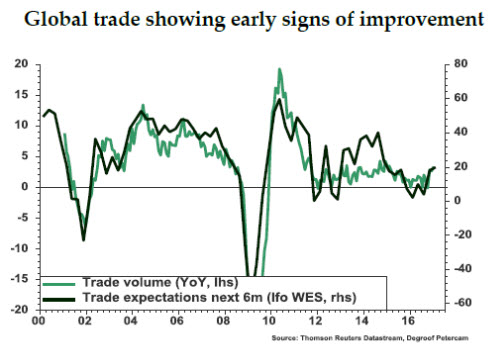

That said, the significant difference between (soft) confidence indicators and (hard) measures of economic activity are questioning this to some extent. Besides, global trade is showing early signs of improvement.

Base effects linked to commodity prices continue to support inflation but have now started to fade. This means headline inflation is heading somewhat lower again as expected. Underlying inflation remains modest and below target in most developed markets for the time being. This implies that monetary conditions will stay loose for now even though the Fed has resumed its hiking path.

While financial market volatility is very low, economic policy uncertainty remains at high levels. Risks to the current more positive growth momentum are significant in all too many ways including Trump not being able to live up to his promises, China’s unsustainable credit boom or more Eurozone political instability. What’s more, recent political outcomes suggest the world economy could see an unwelcome shift towards more protectionism. Encouragingly, however, Trump has stopped labelling China as a currency manipulator (for now at least) and there is much less talk about overhauling the NAFTA- agreement. Heightened political tensions in the Middle East and in the Korean peninsula, on the other hand, warrant caution.

The structural economic outlook is still clouded against the back of demographic headwinds, slower productivity growth, the debt overhang, geopolitical concerns and the difficult economic rebalancing process in China.

United States

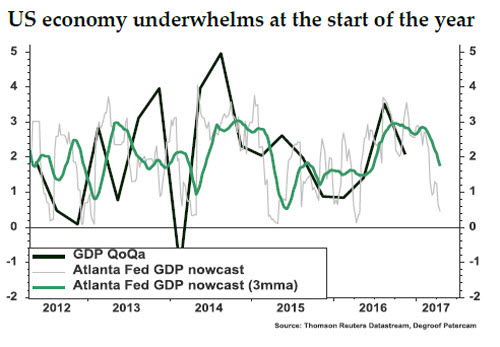

US economic activity rebounded nicely towards the end of last year following a very disappointing start. That said, GDP figures at the start of 2017 are likely to be lacklustre. Indeed, the Atlanta Fed GDP tracker is hovering at just 0.5% at the time of writing even though confidence among households and firms suggestthis is not truly representative for the underlying strength of the economy. There have been several weather related seasonal distortions in recent years. ‘Trumponomics’, meanwhile, remains subject to a lot of uncertainty (~trade policy, ~investment policy, ~tax policy) at this point in time.

Disposable income growth, consumer sentiment and the favourable housing and labour market backdrop still point to solid household consumption growth. Job growth in March disappointed (98K) but considering the two strong preceding months, the unemployment rate dropping further to 4.5% and survey evidence, this doesn’t look too worrying yet. Private investment remains weak. The combination of higher energy prices and more upbeat confidence indicators suggest investment growth should accelerate. Policy uncertainty, however, could create headwinds in this respect.

Headline inflation still surpasses the Fed’s target of 2% but base effects will push it lower again. Underlying inflation has been climbing in recent months but most recent survey evidence is not pointing to a swift acceleration in the months to come. Market-based measures of inflation have been picking up since last summer but remain low in historical perspective. Survey-based measures of inflation, meanwhile, are broadly stable in recent months. Wage growth is still modest at around 2.5% YoY.

Monetary policy remains accommodative for now even though the Fed remains on its hiking path with the implementation of a rate hike in March. Fed minutes indicate that Fed members will continue a cautious wait-, see- and react-stance depending on incoming economic data. The minutes of the monetary policy meeting indicated an increased discussion on balance sheet normalisation. The Fed intends to reduce the balance sheet in a predictable manner and questions are being raised about conditions and timing of this process. This discussion is likely to become even more prominent during the next meetings.

Europe

While the upcoming French presidential elections are capturing all attention, economic confidence indicators throughout the whole of Europe and across sectors are on the rise and the European labor market continues to improve. Industrial production disappointed in February but survey evidence is more upbeat. Household consumption growth remains firm, illustrated by a further rise in passenger car registrations.

Whereas the Eurozone is experiencing a cyclical recovery, structural headwinds in the form of ageing and insufficient progress towards a budgetary, political and banking union remain present.

Moreover, the easiest part of the economic recovery may be behind us. The benefits stemming from economic tailwinds including falling interest rates, lower euro exchange rate, lower commodity prices and the lifting of earlier austerity measures are weakening.

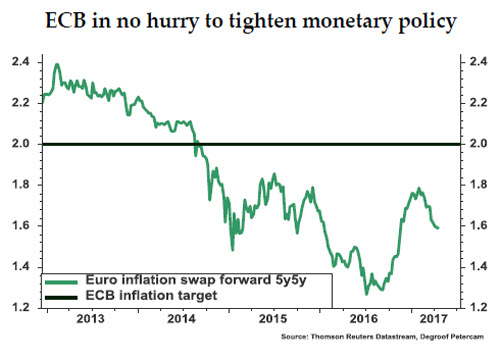

As expected, headline inflation has been rising quickly (~base effects linked to energy prices) and has fallen back in March to 1.5% on a yearly basis as reverse base effects kick in. Underlying inflation remains very low and longer term financial market expectations of inflation have fallen back again. All in all, even though core price pressures should rise somewhat against the back of a more positive growth momentum, the ECB still looks to experience difficulties in getting inflation up to its target of 2% in a sustainable way. Therefore, the ECB is in no hurry to leave its zero interest rate policy or dismantle its asset purchase program (60bn EUR each month until the end of 2017) program for now. That said, ‘ECB tapering talk’ will become more pronounced as the year proceeds and economic activity confirms.

Japan

Household consumption and industrial production growth remain subdued though confidence indicators are showing clear signs of improvement more lately. Although the deflationary spiral has ended since late2013, wages and inflation fail to take off meaningfully despite the tightening labour market. In its September meeting, the BoJ presented its new QQE program adding yield curve control (by targeting 10y yields around 0%) and inflation overshooting. This could be interpreted as Kuroda providing more fiscal space to Abe’s administration to increase fiscal spending. The idea is to stimulate inflation and lower real yields while going hand in hand with JPY depreciation. The move also gives the BoJ more flexibility to taper its asset purchase program further down the road.

Emerging Markets

Sentiment towards EM has improved since early 2016 against the back of a more cautious Fed, stabilization in commodity prices and reduced concerns about China’s near term prospects. The ‘reflationary trade’ currently supports commodity-dependent countries including Russia and S. Africa.

China’s challenging rebalancing exercise and uncertainties linked to monetary policy tightening in the US could still expose more EM weakness. Moreover, Trump’s presidency bodes risks for EM (~trade policy, ~protectionism).

Although very difficult to time, concerns about China look set for a comeback. Indeed, the background of soaring house prices and continued rapid credit growth is far from comfortable. In the March National People’s Congress, Chinese policymakers have changed the growth target to ‘around 6.5%, or higher if possible’, down from ‘6.5% to 7%’ last year while highlighting the need to cut excess supply and monitor financial risks.

From an EM wide perspective, inflation remains under control though base effects linked to commodity prices are also at play in most countries, including China. Significant differences between countries exist but in most EM remains within target corridor. All in all, the combination of subdued economic activity, stabilization in EM currencies and commodity prices should make sure EM headline inflation remains in check.

CURRENCY OUTLOOK

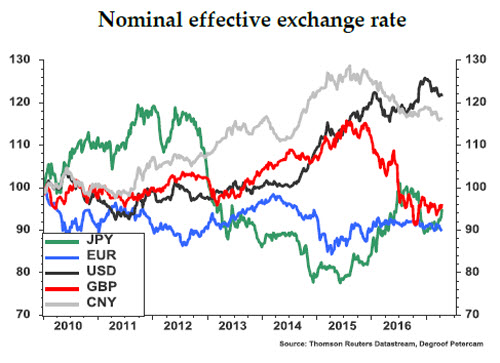

The USD is still expensive in a long term theoretical perspective. That said, more evidence of the Fed turning more hawkish could still lead to a somewhat stronger USD. The EUR, on the other hand, could suffer from political uncertainty. All in all, downward risks for the USD remain present in a medium to longer term perspective.

The GBP has already depreciated significantly as a result of the Brexit referendum. Risks remain on the downside from current levels.

The JPY has been firming again since a couple of weeks but remains below the levels of last summer. This earlier depreciation was mainly due to the BoJ’s monetary policy measures (of yield curve targeting and inflation overshooting) announced in September. While the JPY looks rather cheap against the USD in a long-term perspective, the opposite seems true for its valuation against the EUR. A big depreciation versus the EUR, however, seems unlikely.

EM currencies experienced downward pressure again since Trump got elected but most recovered since then. In general, China’s challenges, the unimpressive growth outlook and political risks warrant caution.

Although, the RMB did not see a large one-off depreciation so far, it has faced structural downward pressure against the USD since 2014. A managed depreciation remains our base case scenario but we would not completely rule out the possibility of a big depreciation. The reason is that we remain concerned about the sustainability of China’s economy in a medium to long term perspective.

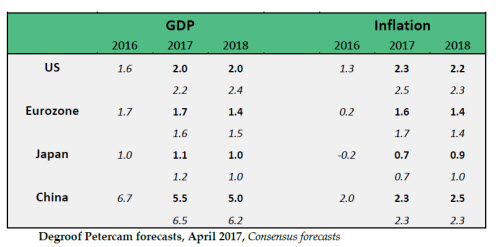

GDP and CPI OUTLOOK

Diesen Beitrag teilen: