Degroof Petercam: Technologieaktien - eine weitere Blase?

Sorgen über eine weitere Tech-Blase tauchten nach einem Goldman Sachs-Bericht auf. Dies führte zu einem Ausverkauf in der Technologie-Branche weltweit. Haben wir wirklich eine Blase?

26.07.2017 | 16:49 Uhr

Almost two decades. That is how long it has been since the bursting of the now infamous tech bubble at the beginning of this millennium. The impact and consequences were so severe that the tech sector will always be scarred by this event. So every once in a while, typically when there is a highly publicized IPO or when an emerging tech company closed its latest private funding round, the same question comes popping back up: is this another tech bubble? Last week was no different, but this time after a Goldman Sachs report claimed volatility for FAAMG (Facebook, Amazon, Apple, Microsoft and Google – now Alphabet) stocks is very low, ignoring potential cyclical, regulatory and tech disruption risk. Moreover, Goldman showed these stocks were very well owned. This led to strong selling of not just the FAAMG stocks, but all of tech across the world.Is this 2000 all over again?

Let this be very clear, the technology sector is fundamentally a totally different space now compared the year 2000. Valuations then were sometimes based on air, in Belgium even on fraud in one high profile case (i.e. Lernaut & Hauspie). Average valuations in the tech sector were roughly three times higher than today. More importantly, many tech companies were not making, but losing money. Today, we would argue the technology sector is probably the most cash generative sector around. Importantly, in the end it all boils down to the numbers. For each of the FAAMFG stocks, we argue their performance can at least partly be attributed to the numbers they posted this year or to fundamental reasons, justifying the move. There is only a bubble when one can speak of irrational behavior or expectations.

Nothing is expensive?

An important distinction is that between “old tech” and “new tech”. The former contains companies like Apple, Microsoft and many software companies. These generally are more mature and tend to be real cash cows with relatively lower valuations. The latter companies are typically younger, have very high growth rates and burn cash at a high pace (think Uber). These companies tend to trade at high multiples. We do believe that some parts of the tech sector might have bubble characteristics. For example, the IPO of SNAP was ridiculously expensive and moreover, the shares issued carried no voting rights. Typically, hard-to-justify valuations are seen in subsectors of tech where there are hardly any listed alternatives and where there are massive growth opportunities ahead. Nobody wants to miss the next Amazon or Netflix… But, this sometimes leads to irrational valuations.

Carry high valuations?

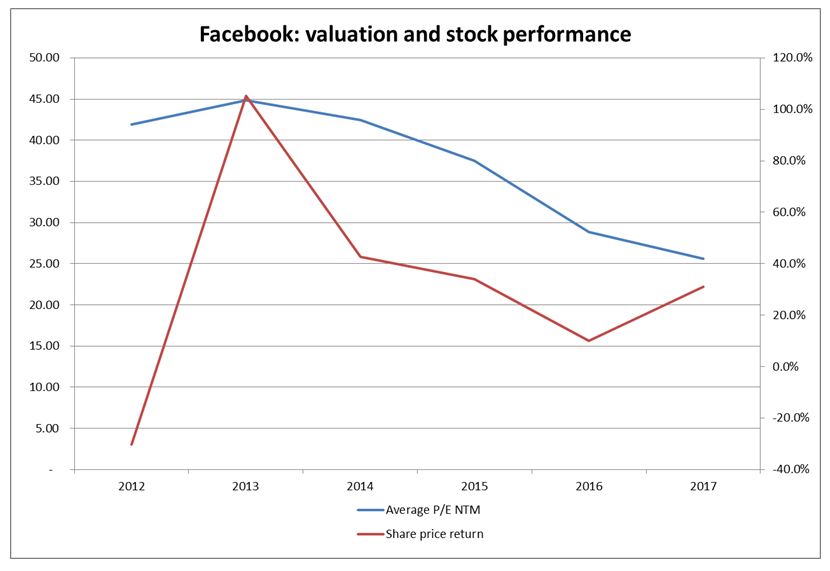

One should always remember that stock prices incorporate expectations. All else equal, high valuations mean high expectations. Theoretically, a stock delivering 50% growth might double or halve on result announcement depending on the expectations the market has at that time. So, as long as these companies deliver on the expectations (which they themselves can manage to some extent), the stock price might continue to perform very well. In the graph below, if we exclude the IPO year 2012, we see that stock performance of Facebook seems positively related to valuation levels, i.e. the higher the valuation, the higher the stock return in a particular year. Remember the IPO itself was fraught with technology problems at Nasdaq and was right at the time when we saw an accelerated shift towards mobile. We will not claim there is or should be a positive relationship between stock performance and valuations, we simply want to demonstrate high valuations are not necessarily an issue. Facebook has performed very well, handily beating expectations along the way and masterfully navigating the company towards mobile monetization of its users.

Source: Factset.

Structural rerating?

Nothing in the Goldman Sachs report is wrong, it is based on facts. So yes, technology stocks carry risks that might have been neglected to some extent. This leads to this very low volatility and high ownership. But maybe what we are experiencing is the market starting to be more comfortable with technology stocks. And maybe the market is willing to put a higher multiple to the risk they are taking as they are more comfortable with that risk. For instance, in the coming days or weeks, Alphabet will probably receive a record breaking fine from European Commissioner Vestager for abusing its market dominance. Barring any changes in regulation itself, we would be surprised if the stock would be hurt by this. What is certain, is that tech has outperformed the general market, whether one looks on 1,2,3,4,5,10 or 20 years. Valuation premium well deserved we would argue.

Diesen Beitrag teilen: