Degroof Petercam: Active Management and the War on Tech

Technology companies are under an unprecedented attack coming from multiple battlefronts: the political front, investors and the global trade war. How should we deal with these challenges in our daily active management.

27.07.2018 | 12:07 Uhr

This front is mostly against the big tech groups, the FANGS in the Western

world and increasingly the BATs (Baidu, Alibaba,

Tencent) in Asia. First, Facebook lost almost 20% in value in less than two weeks after the Cambridge Analytica scandal. The FTC confirmed

a probe into Facebook’s privacy practices and Mark Zuckerberg even had to testify

before Congress and in the European Parliament. However, what really matters for Facebook investors is users’ trust.

No trust, no users, no Facebook. Facebook responded

by making its privacy settings

clearer by creating

a central hub where users

can examine the data they

are sharing.

I t doesn’t seem like a massive wave of people deleted their Facebook profile since, and the stock subsequently recovered to new all-time highs. But Facebook allegedly influenced the outcome of the US presidential elections so one shouldn’t be surprised that Facebook will see further regulatory scrutiny. Facebook just received its first financial penalty over the massive data leak to Cambridge Analytica after a UK watchdog accused the social network of breaking the law. The broader question for internet platforms is how much data are users willing to give up and how private do we really want our data to be? Well, since May most EU websites have new cookie disclaimers and privacy policy notices now that the GDPR is in effect. How many of you are just clicking “OK” or “I accept”? We think most people…

Secondly, it seems Mr. Trump doesn’t reallycare about Facebookbut is reportedly “obsessed” with Amazon, and made his intentions clear with the following tweet:

Source: Twitter

Thi

s seems like a very one-sided debate and doesn’t take into account the massive benefits Amazon has brought to consumers. Trump issued an executive order that creates a task force “to evaluate the operations and finances of the USPS, which is responsible for a large part of the last mile deliveries for Amazon. Meanwhile, the internet behemoth recently announced a plan to roll out its own fleet of Amazon vans in the US, increasing its capacity and control over last mile deliveries, and decreasing its reliance on the US Postal System. Behind the scenes it is an escalating feud between Trump and Jeff Bezos, owner of Amazon but also of The “fake news” Washington Post. Trump has argued without evidence that The Washington Post is engaged in attacks on him on behalf of Bezos, who once offered to launch Trump into space on a rocket (without return flight). The fact that the rise of e-commerce doesn’t help real estate owners in the US might have something to do with this as well. That being said, there is some truth to what Trump is saying, and we don’t think this particular fight will be over any time soon, either. A very important development in our opinion is that Lina Khan, a prominent critic of Amazon.com Inc.’s business practices, is joining the office of Federal Trade Commissioner Rohit Chopra as the agency prepares to increase antitrust scrutiny of technology firms. Khan is working on a sequel to her Amazon article (entitled “The Separation of Platforms and Commerce”) that will urge Washington to break up internet companies into platforms and apps/verticals. She argues that there’s an inherent conflict between owning a platform and competing on the platform against third parties. Is this a harbinger of things to come?

Thirdly, it is common knowledge that tech giants are also facing growing scrutiny from a number of regulatory bodies in Europe, reflecting a general anxiety in Europe about the market clout of the leading US technology and internet groups. After giving Alphabet a record-breaking fine for anti-competitive practices, the European Union is contemplating breaking up Alphabet and imposing incremental taxes on digital companies like Facebook, Google and others. Momentarily, the European Commission is expected to find Google to have illegally abused the dominance of its Android operating system for mobile phones, and issue a new record-breaking multibillion-euro fine. It is also expected to order changes to the company’s Android-related business practices, something which might hurt even more. Google is also facing a legal dispute with Germany’s Federal Network Agency, claiming that providers of messaging and email services should be regulated just like ordinary telecom companies. Finally, the overall tax strategies of technology companies operating in Europe, if they pay tax at all, are also being scrutinised.

To conclude, this war won’t end any time soon and will be waged over the coming years, with many lawsuits, fines, new regulations and Trump tweets to come. We believe Silicon Valley needs to change its blasé attitude and be more humble. It might be a good idea to stop casting aside concerns regarding privacy issues and have a friendlier approach towards European regulators. Don’t be mistaken, we believe tech groups might come out of this stronger than before. Don’t forget, more regulation often creates higher barriers to entry. Finally, increased regulatory scrutiny is not just a FANG story, but increasingly a BAT story as well, as the Chinese government is well aware of the increasing dominance of BAT in more and more areas of society.

The valuation front

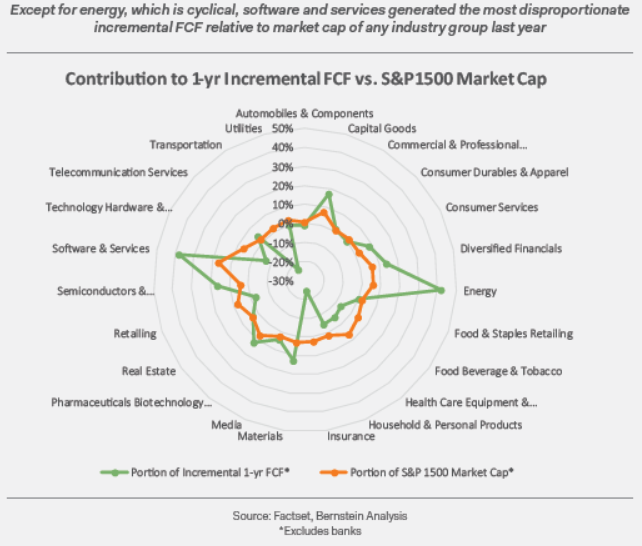

The NASDAQ composite index is hitting all-time highs again this year. Valuations are creeping up yet again. We’ve seen over 30 tech IPOs just this year with most of them performing extremely well. So yet again the argument that tech is very expensive comes back on a daily basis. We have written about this before, but will repeat the main arguments against tech being expensive. First of all, what is technology? It is one of the most diversified sectors around with enterprise software, IT services, payments, social media, IT hardware, semiconductors and semi equipment. One cannot just generalise and speak about valuation in technology (we can to the extent that a large part of technology indices have concentrated holdings). Let’s be clear, there are very expensive subsectors, cheap subsectors and everything in between withintechnology. Stock picking is increasingly important as valuations rise. Moreover, technology in general and certain of these subsectorsin particular, are part of the highest free cash flow generating sectors around. A recent Bernsteinanalysis showed that Technologycompanies comprise 25% of the S&P 1500’smarket cap, but generated 57% of incremental FCF over the last fiveyears.

Secondly, compared to the market, valuations look more reasonable as everything is expensive, but tech is showing a growing premium nonetheless. Is this because there is an insatiable demand for growth assets or is this a sign of technology becoming overheated? Maybe, but maybe part of the answer also lies in the fact that technology has become such a big part of our lives that we have become more accustomed with technology and are more comfortable investing in technology. Hence, a larger premium than before would be justified. We are no longer in the dotcom era when we had so many untested business models and where few companies made profits.

The trade war front

We have not yet reached a full-blown

trade war, but tensions are rising and the situation seems to be escalating. The Trump administration just announced it was moving forward with potential

new

tariffs on $200bn worth of Chinese imports, part of a broader battle against what the White House has labelled China’s “economic aggression”. The FT recently wrote:

Technology is one of the most important

reasons this is happening. When the US commerce department earlier this year banned ZTE, the telecom network equipment-maker, from buying US chips and other components, it in effect put the company out of business. This surely demonstrates China’s dependence on high-end US semi chips. But China also flexed their muscles with a preliminary injunction from a Chinese court banning

some sales in China by Micron, whose memory chips are used in many smartphones, computers and other devices. The timing suggests China is demonstrating its importance to US companies

as it accounts for half of Micron’s sales. President Xi Jinping’s Made in China 2025 industrial strategy is a state-led effort to establish Chinese leadership in technology which

also shows the relentless expansion

of China’s own semiconductor industry, a product it will no doubt be prepared to sell below cost in the coming years.

You can download the full Summer 2018 editionof Ascent, DPAM’s quarterly magazine here.

Diesen Beitrag teilen: