Degroof Petercam: China - one of the major risks to the global economy

China’s economy has settled down from earlier hard landing fears. Economic policy uncertainty has declined. But China continues to be one of the major risks to the global economy. More on that and a look at the European and US economy.

13.02.2018 | 09:35 Uhr

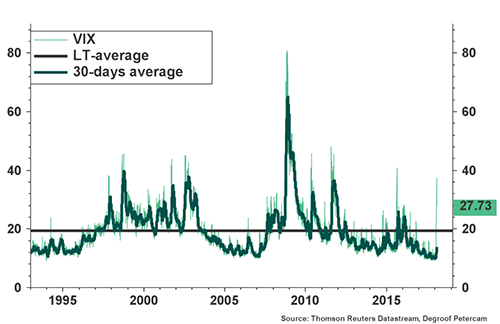

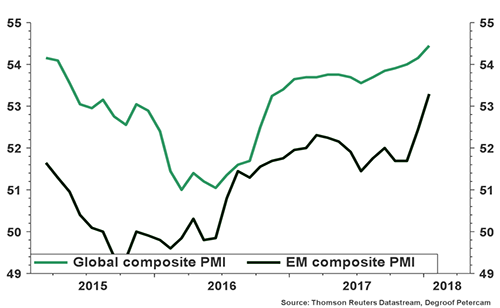

The recent rise in volatility demonstrates that the key challenge for the coming years will be the removal of monetary life support without hampering economic growth and upsetting market psychology too much. The global sell-off confirms the importance of market psychology after a long period of calm. However, the stock market is not the economy. Economic indicators remain solid for now. Ten years after the onset of the financial crisis, the global economy is showing signs of a synchronized recovery. Economic activity performs solidly, trade volumes are growing, corporate profits are on the rise and unemployment is falling. The combination of extremely loose monetary policy, relatively low commodity prices (though industrial metal and energy prices have rallied more recently) and neutral fiscal policy has come to fruition. So far, however, this is only modestly translating into rising wage and inflation readings. There has been a lot of talk about the death of the Phillips curve but it might be premature to confirm that message. Indeed, the absence of evidence is not the evidence of absence. Inflationary pressures are firming and we expect this to continue. At the same time, other factors including globalization, technological change and digitization, the ageing of the population, insufficient labour union power, lower anchored inflation expectations and sluggish productivity growth suggest that the negative relationship is weaker than before. Financial conditions look set to become tighter from here eventually biting into economic activity, perhaps already later this year. Future equilibrium interest rates (and therefore real policy rates) are expected to remain lower compared to pre-crisis standards.

Spike in volatility after long period of calm

(Source: Thomson ReutersDatastream, Degroof Petercam)

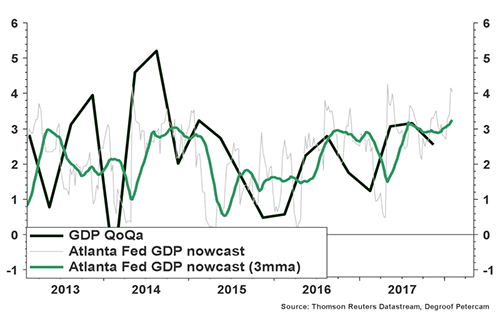

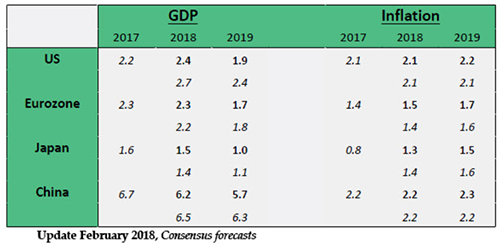

The United States are currently seeing the third-longest economic expansion in history, with the yield curve continuing its flattening trend. This is something to monitor closely. That said, we believe recession odds are low for now. Consumer confidence is still strong and the outlook for investment has been improving according to several leading indicators. Importantly, the low household savings rate in combination with expensive equity market and rising real estate prices bear watching. President Trump’s tax looks set to give economic growth a small boost, but will primarily result in deteriorating public finances and growing inequality over time. We do expect core inflation to rear its head again as the labour market is nearing full employment. The latest rise in average hourly earnings seems to hint in this direction. Therefore, more tightening of monetary policy is in the cards, and as things currently stand it is plausible that the Fed will hike interest rates three to four times by the end of 2018, more than markets currently price in. In case the increased volatility in financial markets continues, it may convince the Fed to be more cautious. A higher Fed funds rate and an increased risk-off sentiment may result in a slight appreciation of the USD, but a significant boost should not be expected, given its current valuation.

Atlanta Fed points to strong start of 2018

(Source: Thomson ReutersDatastream, Degroof Petercam)

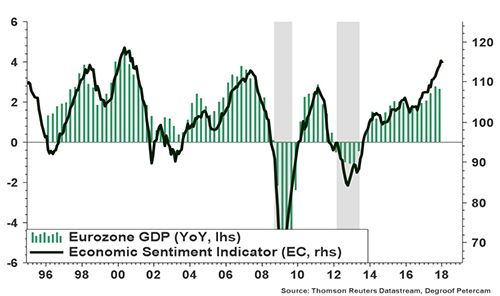

Europe: cyclical recovery on track

In the past two years, the European economic cycle has caught up significantly, and is doing very well today from a cyclical point of view. All sectors are recovering, and the labour market is thriving again. However, unemployment remains above pre-crisis levels, and there are major divergences between countries. Moreover, there are many discouraged workers who have dropped out of the labour force in the past few years, as well as part-time workers who would rather work full time. Hence, it does not come as a surprise that wage pressures will remain modest for some time to come, and that inflation will remain below the 2% target. As such, tighter monetary policy should not be expected any time soon. Here, the ECB will want to avoid the mistake it made in the past, namely to tighten monetary policy too soon. In addition, a further euro appreciation on the back of higher rates would make it harder for the ECB to reach its inflation target. It is too soon for an actual rate hike, and this will only come after the ECB has put an end to its asset purchase program later this year. The first rate hike will probably come in the spring of 2019. Meanwhile, tough Brexit negotiations and the potential political deadlock that may arise after the Italian elections are the main short-term risks.

Cyclical recovery on track

(Source: Thomson ReutersDatastream, Degroof Petercam)

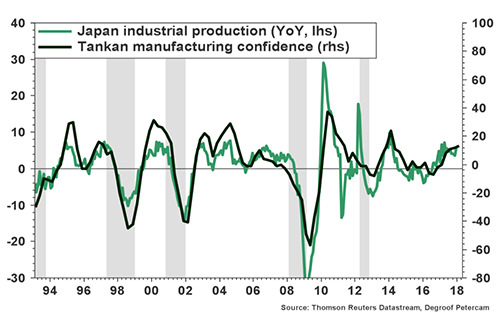

Japan: Boj remains put for now as lowflation persists

The Japanese economy continues to perform solidly and confidence indicators are holding up well, both at the consumer and business level, indicating that GDP is expanding at a solid pace. Meanwhile, incoming inflation prints remain soft, the same goes for household inflation expectations. That said, the labour market is becoming increasingly tight as the unemployment rate stands at a 25-year low. Survey evidence also reveals a lack of skilled labour and a high ratio of job-openings to applicants. Core inflation has increased a bit but the BoJ is searching for more evidence of rising price pressures before altering its policy of yield curve control and inflation overshooting.

(Source: Thomson ReutersDatastream, Degroof Petercam)

Chinese economy set to slow down again

China’s economy has settled down from earlier hard landing fears. Economic policy uncertainty has declined but we expect growth to decelerate in 2018 as the economy’s credit-driven recovery is over and monetary policy remains rather tight. China continues to be one of the major risks to the global economy. A slowing Chinese economy will have some fallout in the rest of the world, resulting in lower trade volumes and commodity prices.

However, concerns about a severely negative impact on the rest of the world remain subdued for the time being. The rule of thumb is that a 1% decrease in Chinese growth results in a 0.25% drop in global economic growth. In the rest of the emerging world, economic activity is holding up well. EM Inflation hit an eight year low in the middle of 2017 but this trend is unlikely to continue this year. Therefore, the monetary policy easing cycles witnessed throughout much of the EM world have come to an end. There is a slew of elections coming up: in March and May respectively Russia and Colombia will be holding presidential elections, and Indonesia has planned local elections in June. Furthermore, there will be general parliamentary elections in Mexico (July), Malaysia (August), Brazil (October) and Thailand (November). The elections in Mexico and Brazil in particular will attract a great deal of attention. Meanwhile, South Africa is preparing for general elections in 2019.

(Source: Thomson ReutersDatastream, Degroof Petercam)

Forecasts for 2018-2019

Diesen Beitrag teilen: