Degroof Petercam: Global economy set to reveal more evidence of cooling in 2019

Recent developments in financial markets suggest investors are coming to terms with our long-held scenario that economic growth would slow down in the second half of this year.

14.12.2018 | 13:15 Uhr

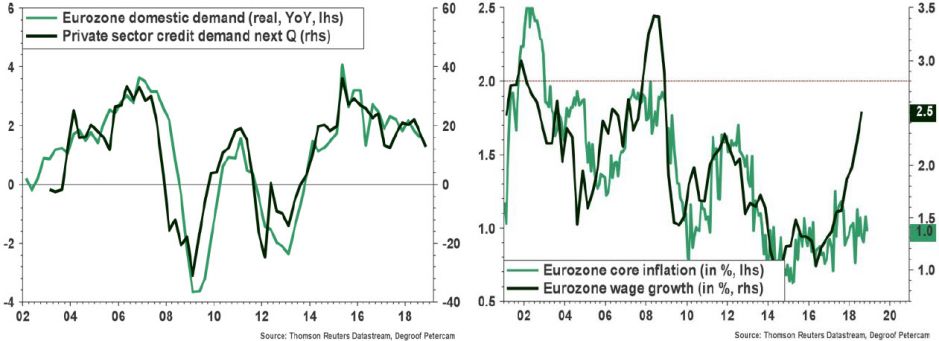

Recent developments in financial markets suggest investors are coming to terms with our long-held scenario that economic growth would slow down in the second half of this year. Although talk of an imminent recession seems overdone, the world economy looks set to reveal more evidence of cooling next year. While current tariffs are still modest and the tone of debate between the US and China has softened a touch, the risk of escalation remains significant. Indeed, tensions go beyond the issue of the bilateral trade balance. China’s economic, cultural and technological rise over the last three decades have also undermined the US superpower status. But even apart from that, expectations for global trade already point to further deceleration in the months to come. This is consistent with reduced prospects for global growth. Since the US economy is still growing firmly and core inflation hovers around the 2% target, this will not deter the Fed from raising interest rates next week. That said, the strong dollar, global trade tensions and fading effects of US stimulus look set to translate into slower growth in 2019. At some point, this is likely to convince US monetary policymakers to move to the side lines. Meanwhile, despite policy easing, Chinese credit growth continues to decelerate. Therefore, risks to economic activity are still skewed downwards. On the inflation front, despite the strong cyclical global recovery over the last two years, wages and prices have reacted only modestly. True, headline inflation accelerated significantly over the last two years. But this was mostly due to the sharp increase in energy prices. Base effects and the recent fall in oil prices will now cause headline inflation to fall pretty sharply in 2019. There has been a lot of talk about the death of the Phillips curve but it might be premature to confirm that message. All in all, underlying inflationary pressures have been gaining strength. At the same time, other factors including globalization, technological change and digitization, the ageing of the population, insufficient labour union power, lower anchored inflation expectations and sluggish productivity growth suggest that inflation is unlikely to break out any time soon. Indeed, in recent years wage growth has become less sensitive to changes in labour market conditions.

Boj remains put and looks at financial vulnerabilities

Economic activity in Japan has clearly softened since the start of the year. And the outlook for economic activity remains downbeat as the government has pledged to press ahead with the sales tax hike scheduled for October. Meanwhile, incoming inflation prints remain modest. Headline inflation will decrease significantly on the back of base effects linked to energy prices while underlying price pressures may strengthen a bit further on the back labour market tightening and accelerating wage growth. An increase in the regular earnings number encouraging in this regard. Survey evidence still points to a lack of skilled labour and a high ratio of job-openings to applicants. But so far core inflation has increased only a bit. The BoJ remains firmly in easing mode, allowing only technical adjustments to its policy of yield curve control for now until more evidence of price pressures appear. In addition, the Boj issued a stronger warning for side-effects of its policies on financial intermediaries over the long run.

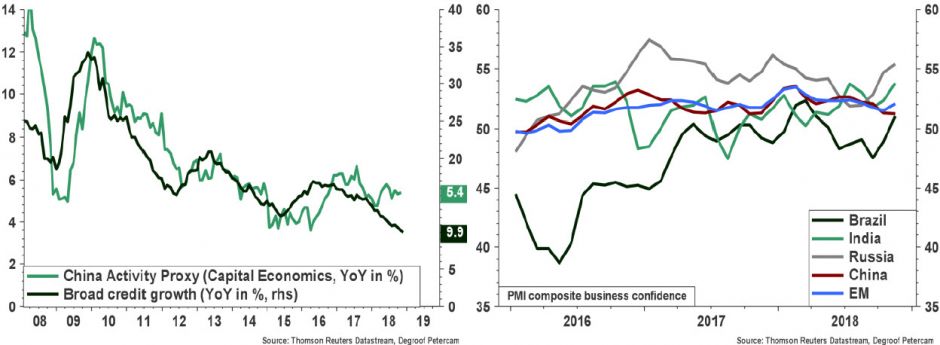

Chinese credit slowdown takes its toll on growth

Budgetary and monetary policymakers in China are stepping up efforts to arrest the ongoing slowdown spurred by a decline in credit growth and international trade tensions. Renminbi depreciation, lower interbank interest rates, tax cuts and extra investment spending should at some point produce stabilizing results. But for now at least the risks are still tilted to the downside. More broadly, the situation in the emerging world is very different from region to region and from country to country. Recent upheaval in EM financial markets has sparked comparisons to the debt crises of the 1980s and 1990s. True, tightening financial conditions usually herald a more difficult environment for emerging markets. That said, the analogy looks of the mark. Apart from Turkey and Argentina the risks facing most EMs today are significantly smaller. Indeed, the vulnerability of EM in general is lower compared to past decades. Many EM have improved their macroeconomic frameworks, including the use of flexible exchange rates, ample reserve buffers and multiple financial safety nets. For more info, please see this blogpost. In Brazil, the extreme-right Jair Bolsonaro emerged as the winner from the elections. He will be confronted with a challenge. The sustainability of Brazil’s public finances will depend on the continuation of the ongoing public spending reforms. In India, the spat between the Modi government and the central bank has raised questions on the independence of the central bank in the wake of a default of a major infrastructure funding company (~shadow bank).

Den vollständigen Beitrag können Sie hier als PDF herunterladen.

Diesen Beitrag teilen: