Degroof Petercam: Frühe Anzeichen einer Bodenbildung

Die Weltwirtschaft wächst. Wobei Vertrauensindikatoren auf eine schwache Konjunktur hinweisen, das Wachstum des Welthandels ins Stocken geraten ist und sich die Aussichten für Investitionen verschlechtert haben. Doch es gibt Hoffnung.

09.04.2019 | 10:21 Uhr

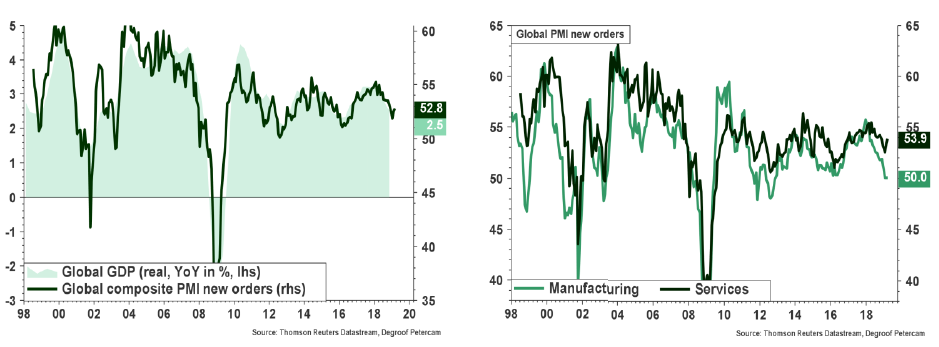

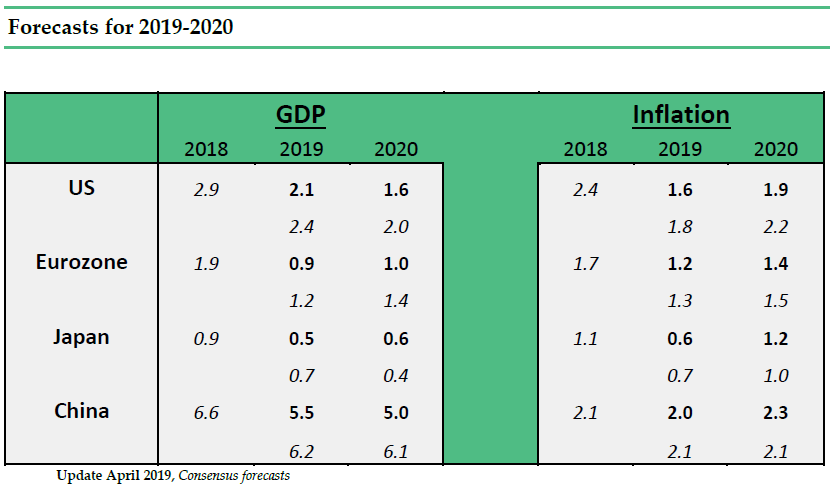

Global growth currently hovers around 2.5% with confidence indicators still mostly pointing to soft economic activity ahead, particularly in the manufacturing sector. Meanwhile, growth in world trade volume has stalled and the outlook for investment has deteriorated significantly.

But there are also some hopeful elements. These include (1) more positive signals surrounding the trade discussions between the US and China, (2) central banks’ willingness to keep their policy stance loose and/or flexible, (3) modest energy prices in combination with a rise in household disposable income, and (4) the implementation of Chinese stimulus which are starting to bear fruit.

Headline inflation is still under pressure as a result of base effects linked to the evolution of energy prices. Core inflationary pressures, meanwhile, remain very tame in general despite recent acceleration in wage growth.

The upshot is that central banks are absolutely in no hurry to tighten monetary conditions. On the contrary, both their tone of voice and policy has turned more dovish.

US yield curve signals softer growth ahead

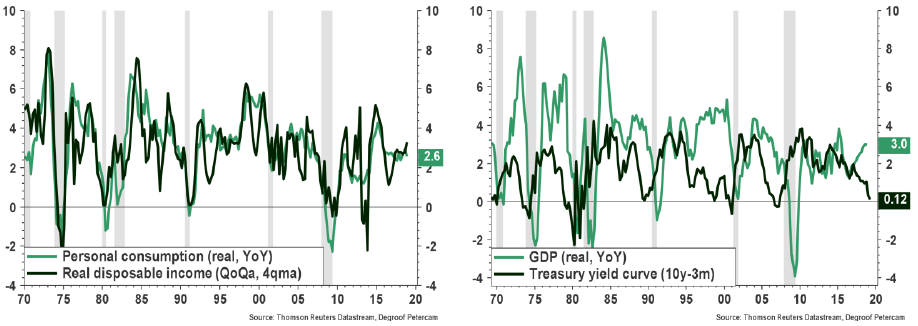

The expansion following the 2008-09 has entered its 119th month. This puts the US at the point of breaking the record of the longest expansion phase ever (120 months). That is more than twice as long as the average duration of post-war expansions. Of course this must be put in perspective. The crisis of 2008 was very deep and the recovery that followed was difficult compared to previous episodes.

Last year the US economy grew by almost 3%. 2019 won’t see a repeat of this performance. Sluggish global industrial activity in combination with the strong dollar is eroding confidence in the manufacturing industry. Prospects for corporate profits and investments are weakening. What’s more, the positive impact of the Trump tax cuts is fading away.

Household consumption, on the other hand, should still see decent growth for now as consumer confidence and real disposable income growth hold up well. That said, the rise in household borrowing costs witnessed in recent years looks set to weigh on consumer lending. Indeed, rates on credit cards and auto loans have increased significantly.

The combination of lower anticipated future activity, modest inflation and volatility in financial markets has caused the Fed to become more cautious. In fact, over the last few months the Fed has taken a remarkable U-turn towards more ‘patience’. The Fed also provided more guidance on the rundown of its balance sheet which looks set to stop later this year.

Yield curve flattening has received a lot of attention lately. At the end of last month the difference between the 10y government bond rate and 3m treasury yield was even negative. This signal should not be taken lightly (despite the real possibility that it’s distorted by unconventional central bank policy and banking regulation). Even if we’re not forecasting an imminent recession, historically it has been of the best and most forward looking warning signs.

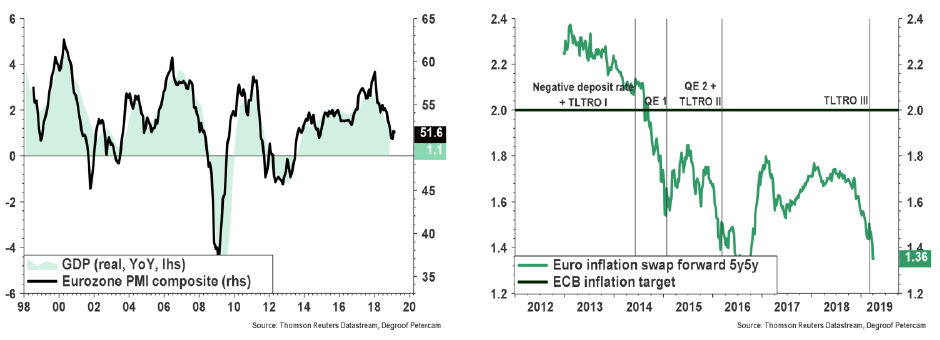

Industrial recession and very weak inflation keep ECB in ultra-loose policy mode

Eurozone economic activity has weakened significantly over the course of 2018 and prospects still look rather bleak according to the latest confidence indicators.

Both external and domestic factors lie behind the Eurozone slowdown. Industrial production growth has dropped into negative territory on the back of a slump in car manufacturing, weaker external demand and ongoing political uncertainty. Meanwhile, the outlook for both investment and exports has quickly deteriorated. Consumer confidence has come down too, albeit from elevated levels. All in all, household consumption should hold up as the increase in real wage growth should help to support spending.

The recent pick-up in wage growth should (in theory) lead to an acceleration in core inflation. That said, the 2% inflation target still looks very much out of reach. And inflation expectations have come down aggressively more recently (partially on the back of base effects linked to the evolution of energy prices).

Logically, the combination of downbeat growth prospects and undershooting inflation figures has led the ECB to become much more cautious in recent months. As anticipated, in its latest policy meeting the ECB brought down its growth projections, postponed the timing of the first rate hike into 2020 (at the earliest) and announced more targeted long-term refinancing operations (TLTRO) for commercial banks.

Italy remains a source of concern. Confidence in Italy has dropped significantly following the elections earlier this year and the budget dispute with the European Commission. Economic growth remains hugely disappointing. As such, without further structural and institutional progress both in Italy and the Eurozone, the country remains vulnerable to periods of self-fulfilling panic reactions in markets.

Meanwhile, the Brexit saga drags on with no real definitive solution in sight for now as discussions between the UK and the EU have gone in overtime once again. All in all, our base case scenario that a no-deal Brexit will be avoided has become increasingly uncomfortable since the start of the year. On the other hand, negotiators now seem to be close to strike an agreement on a longer term extension. In any case, uncertainty is sky high.

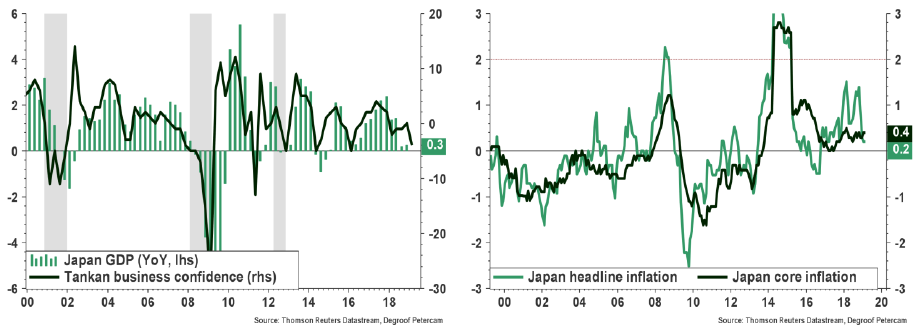

Bank of Japan stands put as growth remains downbeat

GDP growth came to a halt in the first quarter and qhe outlook for economic activity remains downbeat. Although policymakers intend to press ahead with the sales tax in October, they acknowledged that demand could be hurt and look set to offer some budgetary loosening in return.

Despite tight labour market conditions, wage growth and inflation remain tepid. As a result, although the BoJ has been emphasizing the risk of unwelcome side effects of its policy, monetary policy remains firmly in easing mode.

Chinese stimulus measures start to bear fruit but a strong and sustainable upturn looks unlikely

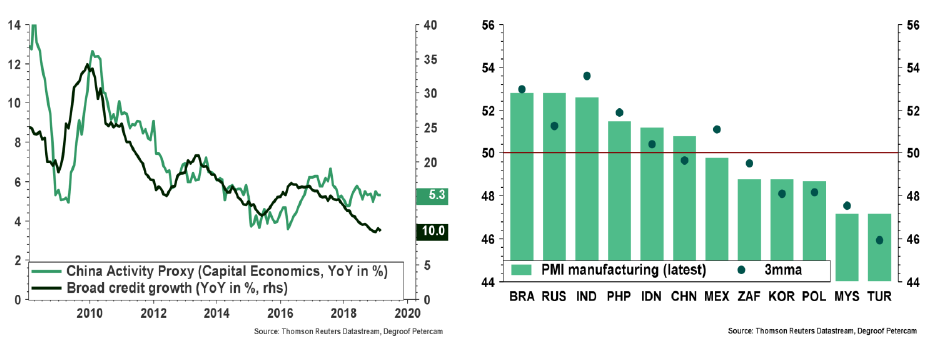

The situation in the emerging world is very different from region to region and from country to country. While the Brazilian, Indian and Russian manufacturing sector are recording fairly positive figures, countries such as Turkey, Poland, S. Korea, Malaysia and S. Africa are facing (strong) headwinds. On aggregate, though, EM manufacturing confidence in March picked up to the highest level since last Summer, suggesting the worst may be over.

Of course China attracts the most attention as it represents no less than 40% of all economic activity in the developing and emerging world. Budgetary and monetary policymakers in China have been stepping up efforts to arrest the slowdown. And there is growing hope that China and the US will soon reach an agreement (even though the underlying nature of the bilateral relationship has changed forever).

Lower interbank interest rates, tax cuts (mostly directed towards families and SME’s) and some extra investment spending should produce stabilizing results. Broad credit growth, while still suggesting that economic activity remains under pressure, is showing early signs of stabilization. All in all, while Chinese policymakers look set to succeed in arresting the growth slowdown, the relatively modest stimulus measures taken so far (i.e. compared to the 2015/16 slowdown) are unlikely to lead to a significant and sustainable demand boost. Moreover, longer term concerns remain present. Slowing productivity growth, a rapidly ageing society and the unsustainable trajectory of credit growth still call for caution.

Diesen Beitrag teilen: