Degroof Petercam: Holprige Wachstumsaussichten

Das globale Wirtschaftswachstum verlangsamt sich. Sowohl in den USA als auch in Europa und Japan wird der Einfluss der Notenbanken spürbar bleiben. Auch die Emerging Markets werden betroffen sein.

16.08.2018 | 09:12 Uhr

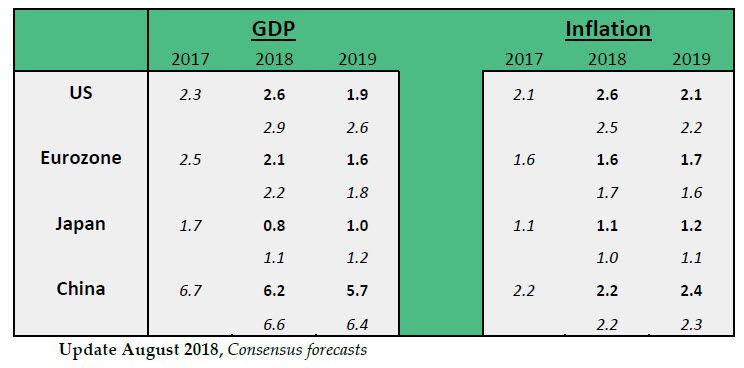

The picture is one of moderating and increasingly unbalanced growth, after the strong synchronised upturn in 2017. Reduced global trade volumes point to a slower economic expansion. What’s more, rising protectionism remains a key risk for the world economy. While current tariffs remain modest, the risk for subsequent tit-for-tat increases is high. Even though some leading indicators suggest that the pace of the recovery is slowing, the world economy remains robust for the time being. The negative output gaps witnessed over the past decade in most parts of the world have all but closed so that the momentum for catch-up growth is quickly fading. Tighter monetary conditions, a gradually diminishing effect of US fiscal stimulus measures, capping commodity prices, a more difficult international trade environment and less Chinese capital investment signal a growth slowdown in the quarters ahead. Indeed, we seem to be in the late-cycle phase of the expansion. The only thing missing is a general pick-up in inflation. So far, firming economic activity has only modestly translated into rising wage and inflation readings. Headline inflation has been creeping higher but this is mainly the result of the year-on-year evolution in energy prices. Core inflation, meanwhile, remains quite modest. There has been a lot of talk about the death of the Phillips curve but it might be premature to confirm that message. All in all, inflationary pressures are slowly but gradually building. At the same time, other factors including globalization, technological change and digitization, the ageing of the population, insufficient labour union power, lower anchored inflation expectations and sluggish productivity growth suggest that inflation is unlikely to break out. Financial conditions look set to become tighter from here eventually biting into economic activity, perhaps already later this year. Central banks are focusing on gradually removing monetary accommodation, following the tightening cycle of the Fed.

US: sustained growth reassuring Fed

The United States are currently seeing the second-longest economic expansion in history with second quarter growth coming in at over 4% annualized. Meanwhile, the yield curve continues its flattening trend. This is something to monitor closely as it tends to go hand in hand with slower economic growth further down the road. That said, recession odds are still low for now. Consumer confidence is still strong and the outlook for investment has been improving according to several leading indicators. Importantly, the low household savings rate in combination with an expensive equity market and rising real estate prices bear watching. President Trump’s tax reforms are temporarily boosting economic growth but will primarily result in deteriorating public finances (towards a deficit of around 4 to 5% of GDP) and growing inequality over time. Inflation is rearing its head again, albeit still modestly, as the labour market is nearing full employment. During its latest meeting the FOMC left the funds rate unchanged. But the strong momentum in the economy means that more tightening of monetary policy is in the cards. As things currently stand it can be expected that the Fed is looking to hike rates again next month. If no negative economic surprises emerge, another rate hike is expected in December. In case significant volatility in financial markets resurfaces, it may convince the Fed to be more cautious. Further significant flattening of the yield curve over the coming months could well prompt the Fed to pause its monetary tightening efforts at some point in 2019 when the pace of economic growth is likely to slow down materially. The economic impact from tariffs on Chinese imports remain negligible for now but a global trade war and equity slump would be costly.

Europe: slowdown warrants cautious approach

While the latest leading indicators suggest that economic growth has clearly moderated in the first half the year, the overall picture still remains one of continued expansion. Since the second half of 2016, the European economic cycle has seen solid improvement. All sectors are recovering, and the labour market is thriving again. However, unemployment remains above pre-crisis levels, and there are major divergences between countries. Moreover, there are many discouraged workers who have dropped out of the labour force in the past few years, as well as part-time workers who would rather work full time. Hence, it should not come as a surprise that wage pressures will remain modest for some time to come, and that inflation will stay below the 2% target. As a result, tighter monetary policy should not be expected any time soon. Of course, the ECB is looking to end its asset purchases by the end of this year. But it is too soon for an actual rate hike. As things stand, the first rate hike will probably not come before the summer of 2019. Italy’s new populist Eurosceptic coalition government will remain a source of uncertainty for both Italy and the Eurozone. In absence of a real economic improvement over the coming years, there is a real risk that the meagre Italian support for Europe and its single currency deteriorates further, a backdrop which populist political parties will try to exploit even further. Meanwhile, the trade relationship between the EU and the US has warmed again after Trump and president Juncker agreed to de-escalate the ongoing trade dispute between the trading blocks. Brexit-negotiations are going nowhere. Prime minister May’s efforts to reconcile conflicting internal views from the UK have been met with resignations from leading cabinet ministers. The disagreement on Ireland remains the most problematic unresolved element in the discussions. Despite the uncertainty surrounding Brexit and the moderate economic recovery, the BoE hiked interest rates last month to the highest level since the financial crisis.

Japan: Boj remains put as lowflation persists and economic activity cools

Japan’s economy reported negative growth figures in the first months of the year before turning to positive territory. In the second half growth should remain positive but modest. Meanwhile, incoming inflation prints remain soft and the same goes for household expectations with regards the future path of inflation. True, the labour market is becoming increasingly tight as the unemployment rate stands at a 25-year low. Survey evidence also reveals a lack of skilled labour and a high ratio of job-openings to applicants. But so far core inflation has increased only a bit. Because of the lacklustre economic performance, hopes of the BoJ moving towards a tighter monetary stance were premature. The BoJ remains firmly in easing mode, allowing only technical adjustments to its policy of yield curve control for now until more evidence of price pressures appear.

Emerging markets: receding tide but risks mostly idiosyncratic

The situation in the emerging world is, as usual, very different from region to region and from country to country. Asia and Eastern Europe are performing more or less as expected while Latin America disappoints. The recent upheaval in EM financial markets has sparked comparisons to the debt crises of the 1980s and 1990s. True, tightening financial conditions usually herald a more difficult environment for emerging markets. That said, the analogy looks of the mark. Apart from Turkey and Argentina the risks facing most EMs today are significantly smaller. Indeed, the vulnerability of EM in general is lower compared to past decades. Many EM have improved their macroeconomic frameworks, including the use of flexible exchange rates, ample reserve buffers and multiple financial safety nets. Still, pre-emptive tightening efforts of EM central banks may hurt economic activity in the months ahead. What’s more, domestic risks in some important countries like Brazil (public debt trajectory) and China (private debt trajectory) remain present. The Chinese economy, as the second biggest in the world, remains an important point of attention. The latest figures confirm that Chinese leaders are serious about reducing credit growth. For the time being, there is insufficient evidence that this results in a marked slowdown in growth. But that could change sooner than many suspect. The rapid aging of the population, the rebalancing of the economy towards more domestic consumption away from unsustainable investment on top of increasing global trade tensions mean that risks for the Chinese economy are skewed to the downside.

Forecast for 2018-2019

Diesen Beitrag teilen: