Capital Group: U.S. Outlook - Aging economic expansion still flexing its muscles

The U.S. economy remains strong in the face of late-cycle concerns. Expect heightened volatility and slower growth ahead. U.S. equities aren’t likely to match stellar returns of past 9 years.

12.12.2018 | 09:32 Uhr

The U.S. economy remains strong in the face of late-cycle concerns. Expect heightened volatility and slower growth ahead. U.S. equities aren’t likely to match stellar returns of past 9 years. Look for companies with solid dividends and long runways of growth.

Age is just a number. But at 114 months and counting, it’s fair to say that the U.S. economic expansion is getting old. Consider that the average expansion since 1950 has lasted 67 months. Does that mean the U.S. is long overdue for a recession?

“We are presumably late in the game, but there is always the possibility of extra innings,” says portfolio manager Don O’Neal. “These cycles can go on for a long time. It all depends on the fundamentals.”

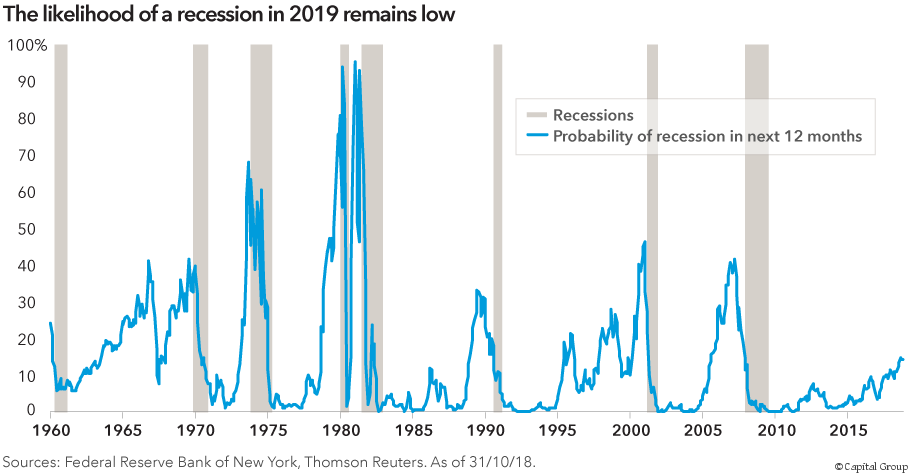

Economic cycles tend to continue indefinitely until some type of catalyst brings them to an end. The catalyst is usually a clear imbalance that arises over time in the economy, such as the housing bubble of the mid-2000s or the dot-com bubble of the late 1990s. The strength of the current expansion has been modest by historical standards and although government and corporate debt levels are elevated, a clear catalyst for derailing the expansion has not yet surfaced. Indeed, the likelihood of a recession in the next 12 months recently stood at just 14.9%, according to the Federal Reserve Bank of New York. The same model had exceeded 30% before each of the last seven recessions.

"We have not yet seen the excesses that would signal an imminent recession," says Capital Group economist Jared Franz. "I expect to see an economy that is still positive in 2019 but growing a bit slower, and the risk of recession will rise throughout the year."

Momentum is strong, but inflation is rising

Rather than slowing down, the U.S. economy continues to demonstrate its resilience.

With unemployment at its lowest level in 49 years, wage growth has ramped up. In October, average hourly earnings rose 3.1% from a year earlier, the biggest gain since 2009. What’s more, consumer spending and industrial production are strong.

The Purchasing Managers’ Index (PMI), a measure of manufacturing activity, recently stood at 57.7, indicating expansionary conditions. Any number above 50 indicates expanding manufacturing activity. Rising manufacturing activity has been an indicator of rising inflation.

“These conditions suggest continued growth in 2019,” says Capital Group economist Darrell Spence. “But the strong employment and wage growth, the manufacturing activity and the resource utilitisation rate — a measure of spare capacity in the economy — give you a sense of the direction of inflation. The signal is pointing clearly upward.”

Core inflation — the measure that strips out volatile energy and food prices — stood at 2.2% in September. Including food and energy, inflation hit 2.83% in September.

Three T’s spell more volatility in 2019

After years of calm, volatility returned to the U.S. stock market in 2018. Investors can expect more volatility in 2019, driven largely by three key factors: tightening by the Fed, trade tensions and too much debt.

Reacting to a strong U.S. economy, a tight labour market and moderately rising inflation, the Fed is expected to continue raising short-term interest rates in 2019.

“If the Fed sees inflation pick up, it will take more aggressive action,” Spence says. “And investors will have to reset their expectations, which could induce further volatility.”

This is happening at a time when government, corporate and consumer debt are all dramatically on the rise. Rising debt costs could have a significant impact on the bottom line for companies.

At the same time, global trade has taken centre stage as the U.S., China, Europe and others seek to rewrite the rules of world commerce in their favour. With these trade battles still evolving, it’s difficult to calculate a precise impact on the economy, but tariffs will be a drag on growth.

“Our base case assumes 10% tariffs on $200 billion of Chinese imports, plus some retaliatory tariffs from China,” Franz says. “That would likely reduce U.S. GDP growth by about 50 basis points, or half a percentage point.”

Of course, if the tariffs are expanded the impact would be greater. “This is a very fluid situation that we will monitor closely throughout the year,” Franz says.

The U.S. economy grew at an annualised rate of 3.5% in the third quarter of 2018. That’s significantly higher than the roughly 2% average rate of growth experienced during the post-financial crisis period through 2017.

With stiffer headwinds, expect more modest equity returns

Looking out at the coming year, rising inflation likely will put increasing pressure on corporate profit growth, which soared 26% in the third quarter of 2018. Also, the impact of the tax cuts enacted at the end of 2017, which propelled profit growth in 2018, will fade as the year progresses.

Spence believes profit growth will remain positive in 2019 but should slow down. “I expect earnings growth in the single digits, which would be consistent with an economy that is still growing but at a slower rate,” he says.

What’s more, after a 10-year bull market, U.S. stocks are expensive. The S&P 500 Index has advanced nearly 400% over that timeframe, and market valuations have expanded. As of October 31, the forward price-to-earnings (P/E) ratio for the S&P stood at 15.3 — not exceptional, but elevated by historical standards and at a level that suggests market returns will be more modest over the next five years.

“I don’t see how the overall market can generate better than single-digit returns over the next few years,” says portfolio manager Greg Johnson. “There will still be opportunities to pursue superior returns, but at this stage selectivity is critical.”

Value-oriented companies have lagged the market

A look beyond broader market results reveals that not all areas have advanced at the same pace. A small handful of leading-edge, fast-growing companies have driven much of the market return in recent years, many of them innovative companies in the technology and consumer discretionary sectors. Amazon, for example, has soared about 2,500% since the end of the last bear market. Many so-called value-oriented companies have trailed the broader market and carry more modest valuations.

Some companies have lower valuations for a reason, including lackluster growth prospects, says portfolio manager Alan Berro.

“I have avoided some companies in the consumer staples area over the last several years, including many of the food stocks and household products stocks, because I did not see the growth potential,” Berro says. “So even with lower valuations, I viewed them as expensive.”

How does Berro think about investing this late into a bull market? “I look for companies whose prospects are misperceived by the market,” he says. “It is a little harder today, but there are always opportunities.”

For example, shares of pharmaceutical and biotechnology companies have come under pressure in recent years due to patent expirations and headlines focused on lowering drug prices, leaving select companies with relatively attractive valuations.

Some of these drugmakers have invested heavily in the development of cancer therapies that may present powerful new growth opportunities. “When you look at a company like Merck, they have developed a cancer drug called Keytruda, which many expect will be a first-line cancer therapy,” Berro notes.

Berro also focuses on companies that can maintain their dividends in the event of an economic downturn. “That often means looking for conservatively run companies with strong balance sheets and good cash flows,” he says.

Look for long runways, deep moats

For growth-oriented investors, not all companies with higher P/E ratios are expensive. Some technology companies whose shares led the bull market have businesses with long runways of potential growth. Consider cloud computing — software and services that run on the internet. By 2021, cloud spending is expected to rise to $302.5 billion, nearly double the $153 billion spent in 2017, according to industry researcher Gartner. The movement of IT workloads to the cloud is boosting demand for the services of Amazon’s cloud computing unit, Amazon Web Services, for example.

Investors in high-flying innovative companies, however, should expect volatility going forward. Since the financial crisis of 2008, Amazon shares have declined at least 15% on 10 occasions, and more than 30% in three different periods. But following each of the previous corrections, its shares hit new highs.

“In the early days of a market correction, stocks that have done the best in the recent period often come down the most,” O’Neal says. “But over a long-term horizon, the outlook for these companies can continue to be strong.”

Alan Berro, Equity Portfolio Manager: Alan has 31 years of investment experience, 26 with Capital. He has covered U.S. utilities, capital goods and machinery companies. He has an MBA from Harvard Business School and a bachelor’s from UCLA.

Don O'Neal, Equity Portfolio Manager: Don has 31 years of investment experience, all with Capital Group. As an investment analyst he covered chemical, aerospace and defense, and environmental companies. Don holds an MBA from Stanford.

Darrell Spence, Economist: Darrell has 25 years of investment industry experience, all with Capital Group. He is a CFA and holds a bachelor’s degree in economics from Occidental College, where he graduated cum laude.

Diesen Beitrag teilen: