Degroof Petercam: Global economic update

Economic activity is cruising. Confidence indicators continue to surprise positively, pointing to a solid cyclical growth momentum in the months ahead. Unemployment is coming down, yet stronger labour market conditions have failed to generate meaningful upward price pressures so far.

27.10.2017 | 12:20 Uhr

Economic confidence indicators continue to surprise on the positive side pointing to a solid cyclical growth momentum across sectors and regions. Global trade is showing clear signs of improvement on the back of these improved conditions. Unemployment is coming down, yet stronger labour market conditions have failed to generate meaningful upward price pressure so far.

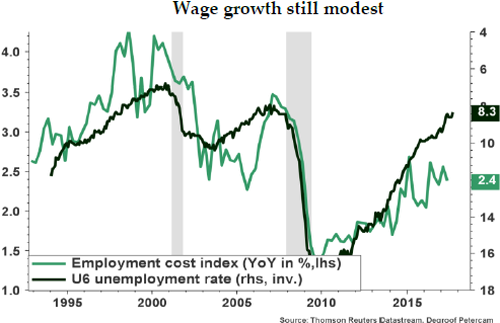

Judging from core employment and broader measures of unemployment, it can be argued that there’s still a fair amount of hidden labour market slack in place. Therefore, we think it’s premature to state that the Phillips curve is dead. At the same time, other factors including globalization, technological change and digitization, the ageing of the population, insufficient labour union power, lower anchored inflation expectations and sluggish productivity growth are playing a role as well.

From this point of view, central banks around the world are in no hurry to tighten monetary policy. On the other hand, policymakers are cautiously looking to gradually move away from the zero interest rate environment in order to create space for manoeuvre further down the road and to prevent stretched valuations in certain asset classes from turning into bubble-like valuations.

Unsurprisingly, how fast central banks will act is largely dependent on economic activity, inflation and market volatility. Financial market volatility has been very low over the past few years but looks set to go up from time to time, perhaps significantly. Indeed, scaling down the amount of central bank asset purchases is a relatively easy process from a technical point of view but it is clearly more difficult to factor in market psychology.

The structural economic outlook is still clouded against the back of demographic headwinds, slower productivity growth, the debt overhang, the difficult economic rebalancing process in China and geopolitical concerns.

Political risks such as North Korea are clearly adding to geopolitical uncertainty and as things stand a swift cooling of tensions seems unlikely. A full-blown war between North Korea and the US is not our base case scenario as diplomatic options are still available. Moreover, both human losses and economic costs would prove gigantic. Unfortunately, however, history is full of similar examples that have played out otherwise.

United States

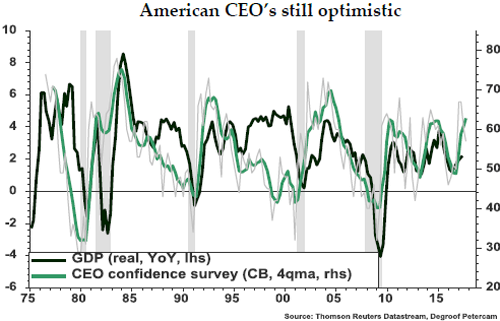

US economic activity is holding up firmly, despite the effects of hurricane Harvey and Irma. While the estimated costs are mounting for the damage caused by the hurricanes, the temporary disruptions to activity data such initial jobless claims and car sales remain modest for now and are likely to be reversed over the course of the following quarters.

For now, easy financial conditions, disposable income growth, upbeat consumer sentiment and the favourable housing and labour market backdrop still suggest household consumption to hold up. It’s also encouraging to witness early signs of an upturn in private investment.

The need for disaster relief has postponed the spectre of a debt ceiling debacle and government shutdown until mid-December. The deal between Trump and Democratic congressional leaders averts a near-term fiscal showdown but without addressing the fundamental underlying issues, it could set up the prospect for an even bigger clash at the end of the year.

Thus far, the Trump administration has not been able to deliver on anything serious. Trumponomics remains subject to a lot of uncertainty (~trade policy, ~investment policy, ~tax policy) at this point in time. The White House announced a framework for tax reform in September, but details remain missing and it is estimated to decrease tax revenues for the coming decade. Meanwhile, Trump is struggling on healthcare reform. For now, we still hold rather soft expectations with regards to tax reform or infrastructure investment. We could still see some budgetary initiatives but they are unlikely to boost GDP growth by much.

At 1.3%, core inflation remains firmly below the Fed’s target of 2%. That said, there were some temporary factors at play. Survey evidence suggests underlying inflation pressures will pick up again from the current low level. Recent USD depreciation should help lifting although pass-through effects are likely to be limited at this stage.

Market-based measures of inflation remain low in historical perspective whereas survey-based consumer measures of inflation were broadly stable in recent months. Wage growth, meanwhile, is still modest at around 2.5% in YoY-terms even though several leading indicators are pointing to an acceleration.

Given the recent batch of decent economic data the Fed is still on track to tighten monetary policy further. As things currently stand, we expect the Fed to hike interest rates again in December. The Fed announced that it will begin its balance sheet rundown this month (currently close to USD 4.5 trillion), not by actively selling but by reinvesting increasingly less as assets mature over time.

Europe

Economic activity in the Eurozone continues to come in strongly from a cyclical point of view, Confidence among firms and consumers remains high which points to more positive economic news in the months ahead. Meanwhile, company profits and credit growth are picking up.

Judging from the most recent evolution of confidence indicators, economic activity looks set to surpass the 2%-level (on an annualized basis), more or less double the estimates of Eurozone potential growth (around 1%). This implies that the large negative output gap is gradually closing and that unemployment (currently at 9.1%) is coming down significantly from high levels. Differences between countries, however, remain substantial.

Political risks have eased in recent months but have not disappeared. The German elections have resulted in another mandate for Chancellor Merkel to form a coalition but the formation of a coalition will take time. The Catalonian referendum has put the Catalan issue again to the forefront of the European political agenda. As things currently stand, a deal with the Spanish government looks the base case scenario. But risk remain present and a worst case scenario of further conflict cannot be excluded. Next year’s Italian election could prove another difficult hurdle to pass as the Democrat Party and the Five Star Movement are neck and neck in the polls.

While this recovery is more solid and more broad-based than anything we have witnessed over the last couple of years, in a way it is also the easiest part. The tailwinds stemming from low interest rates, low commodity prices, low exchange rate, the end of austerity and a more synchronized global recovery are very helpful but also likely to fade over time.

Meanwhile, underlying inflation remains subdued at 1.1%. Looking forward, core inflation will rise only very gradually. The four criteria linked to the ECB’s inflation objective (close but below 2% in the medium term, durable, self-sustained and broad-based) have not yet been met.

Wage growth is crucial in this respect but upward pressure is still very modest. Moreover, the recent appreciation of the euro exchange rate clearly won’t help. Draghi clearly stated that the stronger euro is a source of uncertainty which requires monitoring.

Against this background, the ECB is shifting its tone away from stimulus but only so in a very gradual and cautious way. The ECB is in no hurry to leave its zero interest rate policy or dismantle its asset purchase program (60bn EUR each month until the end of 2017) program for now. That said, ECB tapering talk or QE recalibration has become more pronounced. The ECB has moved closer to providing the market with more details about how it will scale down its asset purchases later this year, probably at its policy meeting later this month. With premature policy tightening in 2008, 2011 and 2013-2014 fresh in the memory, the ECB will want to avoid moving too fast.

At this stage, starting in January next year, we expect the ECB to reduce its asset purchases from eur 60bn to zero over a period of 6-12 months and to raise interest rates for the first time somewhere around the summer of 2019. That said, all this is subject to revision, also given the uncertainty surrounding the volatility of the exchange rate and financial conditions in general.

Japan

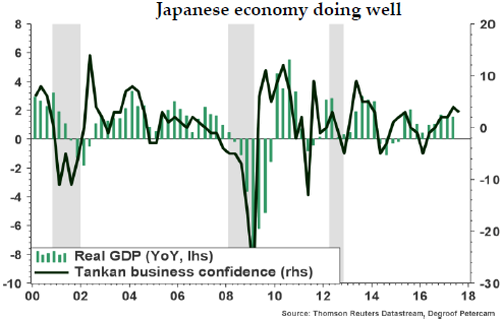

The Japanese economy has been performing strongly recently and confidence indicators are holding up. Consumer sentiment remains at elevated levels and firms’ expectations both in the manufacturing and service sector are upbeat by past standards, indicating that GDP is expanding at a solid pace. Throughout 2017 the outlook for investment has been improving.

Meanwhile, incoming inflation prints remain soft, the same goes for household inflation expectations. That said, the labour market is becoming increasingly tight as the unemployment rate stands at a 25-year low. Survey evidence also reveals a lack of skilled labour and a high ratio of job-openings to applicants. There are some signs of stronger wage pressures amid part-time workers but all in all the BoJ is unlikely to hit its 2% inflation target anytime soon.

Prime Minister Abe formally announced a general election to be held on October 22th, taking advantage of a favourable opinion poll. Abe’s party is expected to win, but the election has added a risk for the future of abenomics in case the vote results in a different outcome than anticipated.

In its September 2016 meeting, the BoJ presented its new QQE program adding yield curve control (by targeting 10y yields around 0%) and inflation overshooting. This could be interpreted as Kuroda providing more fiscal space to Abe’s administration to increase fiscal spending. The idea is to stimulate inflation and lower real yields while going hand in hand with JPY depreciation. The move also gives the BoJ more flexibility to taper its asset purchase program further down the road.

But monetary policy tightening is not on the cards for now. The BoJ’s pledge to continue its QE efforts until inflation has settled comfortably above the 2% target remains intact. As this is still a distant prospect, we expect the BoJ to leave both the policy rate of -0.1% and the 10-year yield target of 0% unchanged until at least mid-2019.

Emerging Markets

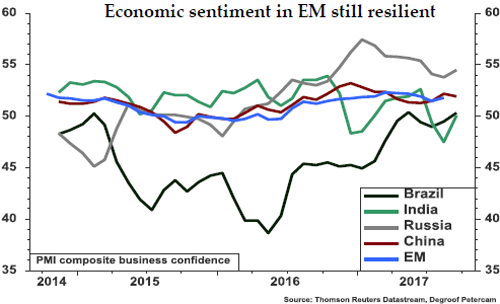

Sentiment towards EM has improved materially since early 2016 against the back of a more cautious Fed, stabilization in commodity prices and reduced concerns about China’s near term prospects. The latest confidence indicators suggest that economic conditions remain resilient throughout the entire emerging world.

The Chinese economy has been in recovery mode since late 2015 following a year in which hard landing fears were omnipresent. Confidence indicators and commodity prices suggest that economic activity is holding up well at this stage even though broad credit growth has started to cool on the back of a modest tightening of monetary conditions since last fall. China’s labour market continues to perform well. Survey evidence shows concerns about unemployment remain low and the ratio between job vacancies and job seekers remains high.

The Chinese Party Congress will be held later this month. While statements are likely to remain vague, the symbolic value of the meeting carries great weight. The meeting will reveal both more information about Presidents Xi’s own priorities and a better gauge of where Chinese economic policy is heading. Attention will be given to policies affecting the Chinese debt risk and consumption growth over the medium term. China is on a slippery slope to keep economic growth high while keeping financial risks in check. In the short-term, should economic activity slow down too much there is still sufficient room to ease monetary policy, to cushion FX depreciation and tighten capital controls. That said, concerns about China look set for a comeback at one point in time given the longer-term challenges for the economy.

From an EM wide perspective, inflation remains under control. Significant differences between countries exist but in most EM remains within target corridor. All in all, the combination of modest economic activity, stabilization in EM currencies and commodity prices should make sure EM headline inflation remains in check.

CURRENCY OUTLOOK

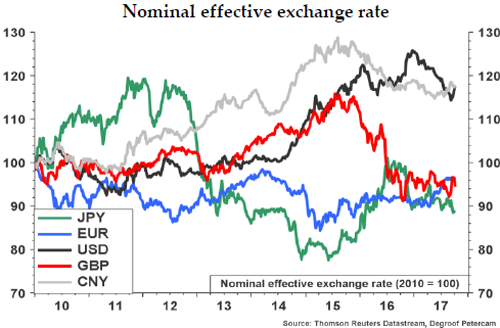

The USD has lost some ground in recent months against the back of easing political risks in Europe and further confirmation of the Eurozone economic recovery. The USD still looks expensive in a long term theoretical perspective. That said, more evidence of the Fed turning more hawkish could still lead to a somewhat stronger USD. Meanwhile, a stronger EUR has another dampening effect on Eurozone inflation numbers that are already considered too low. All in all, downward risks for the USD remain present in a medium to longer term perspective.

The GBP has already depreciated significantly as a result of the Brexit referendum. This has led to higher inflation and hence negative real consumption growth for UK households, challenging the growth outlook. Meanwhile, Brexit negotiations seem to be going nowhere at this point. This could change of course but for now risks remain primarily on the downside from current levels.

The JPY has been depreciating against the euro in recent quarters. Downward pressure remains as the BoJ sticks to its ultra-loose monetary policy in the foreseeable future. The fact that the JPY is now at its long-term PPP equilibrium level against the eur, however, makes another significant depreciation unlikely.

The RMB has seen a significant appreciation against the USD in recent months. In nominal effective exchange rate terms, the currency is still significantly down from its 2015 levels but managed to stabilize over the past year. We expect the RMB to remain broadly stable against this broader basket of currencies but we think downward risks prevail as we remain concerned about the sustainability of China’s economy in a medium to long term perspective.

For other DM and EM currencies, we refer to our quarterly currency update.

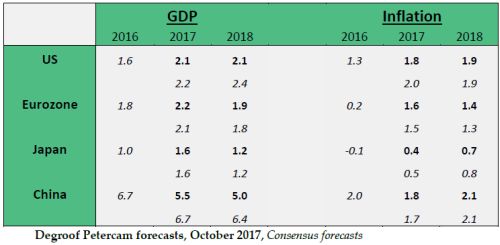

GDP and CPI OUTLOOK#

Diesen Beitrag teilen: