Degroof Petercam AM: Macro Economic Update

Useful sources to keep track of the latest health toll? There are several interesting and useful sources to stay informed about the latest developments.

01.04.2020 | 11:04 Uhr

Most international top newspapers such as the Financial Times provide excellent information in this respect. Many of these sources are relying on the figures from John Hopkins University. Our World in Data is also offering easy access to the underlying data, in turn stemming from the European Centre for Disease Prevention and Control.

What kind of economic crisis ?

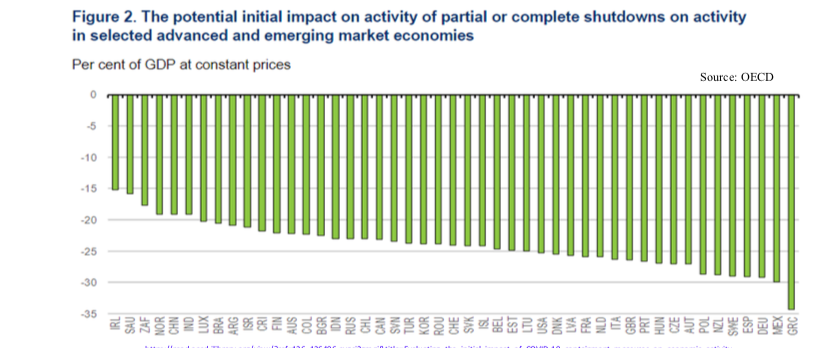

The coronavirus pandemic, a true exogenous shock, is triggering a global crisis of epic proportions. A global recession is now all but inevitable. Economies around the globe are entering a downward economic spiral and confidence among firms and households is taking a big hit. From an economic point of view, we are dealing with both a negative supply and demand shock. It’s a negative supply shock because global supply chains are severely impacted or even completely interrupted. It’s also an extremely severe demand shock. Several sectors including tourism, logistics, real estate and leisure for example see demand for their services almost grinding to a complete halt. And because citizens’ revenues ultimately derive from production, household income is falling quickly. Meanwhile, companies refrain from investing, international trade is collapsing and unemployment is soaring. In any case, the initial economic impact will be absolutely brutal as also shown in the graph below.

Unfortunately, the size and persistence of the economic impact are unknowable because the duration of the

economic shock depends on how the virus will behave and which public health policy reactions are being put in

place (and for how long). Uncertainty looms large. A ‘V-shaped’ hit seemed likely when COVID-19 was

essentially a Chinese problem and China was dealing with it forcefully. However, while a short-and-sharp crisis

is still possible, it’s looking increasingly less like the most likely outcome. Full recovery may take years,

implying that it doesn’t make much sense to talk about a ‘temporary hit’. That said, economic activity is still likely to pick up again from the third quarter onwards. Logically, the extent of any subsequent recovery will

depend on the effectiveness of the policy actions taken to support workers and companies through the

downturn and the extent to which confidence returns. Also, keep in mind that top epidemiologists think that the virus can/will do its ‘tour du monde’ until there’s a

readily available vaccine, implying that there could be several waves of lockdowns. In that case there’s a real

risk that the downturn becomes a self-fulfilling and ever-deepening depression. Many companies could face

bankruptcy in this scenario, in turn triggering defaults and more trouble for the economic and financial system

including a deflationary spiral. This scenario should be prevented at all costs but this is easier said than done.

What kind of financial shock ?

The crisis is creating huge havoc in financial markets too. They have been under great stress and volatility has reached historically high levels. S&P 500 stock prices dropped more than 30% between February 19 and March 23. In comparison, the stock market fell 57% peak to trough (October 2007 to March 2009) during the Financial Crisis of 2007-09 when investors were uncertain about the value of structured products related to subprime mortgages and the exposure of financial institutions to subprime risk.

Diesen Beitrag teilen: