Die besten Mischfonds mit moderater Volatilität

Mischfonds zu kategorisieren ist oftmals schwierig. Zu unterschiedlich sind ihre Strategien. Daher haben wir uns über die Volatilität den Fonds genähert. Untersucht hat TiAM Fundresearch Mischfonds mit moderaten Volatilitäten zwischen sieben und zehn Prozent.

27.11.2024 | 07:15 Uhr von «Jörn Kränicke»

Es geht wieder ein bisschen erratischer an den Börsen zu. Selbst einstige Lieblinge der Börsen tendieren in letzter Zeit zu höherer Volatilität, die sich meist aufgrund von stärkeren Abwärtstrends erhöht. Auch einstige Aktienlieblinge wie Nestlè oder Novo Nordisk befinden sich im Abwärtstrend und schwanken daher stärker. Und mit der Übernahme der US-Präsidentschaft von Donald Trump könnten die Börsen noch empfindlicher auf Entscheidungen oder auch nur Ankündigungen aus dem Weißen Haus reagieren.

Mischfonds-Blockbuster haben eine moderate Volatilität

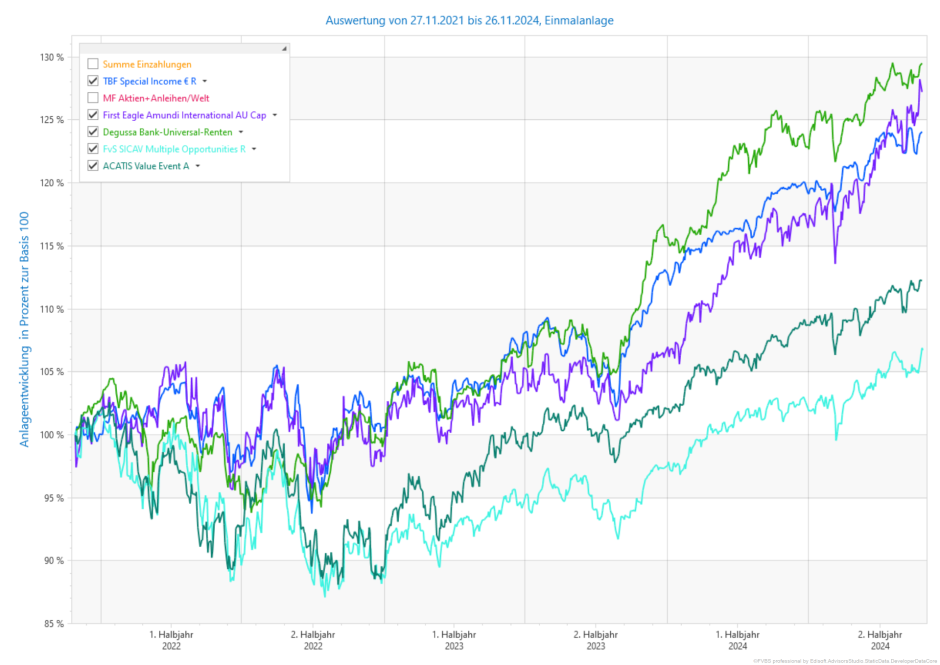

Das wird auch die Mischfondsmanager vor neue Herausforderungen stellen. Einfach nur auf die (US)-Highflyer zu setzen, dürfte kaum mehr funktionieren. Daher könnten Mischfonds, die einen eher „heißen Reifen“ in den vergangenen Jahren gefahren haben und daher auch eine stärkere Volatilität aufwiesen, eher Probleme bekommen als Fonds moderaten Volatilitätszahlen. TiAM Fundresearch hat mit Hilfe der Analysesoftware FVBS Professional alle Fonds untersucht, die sich im 3-Jahres-Volatilitätsbereich von sieben bis zehn Prozent bewegt haben. In dieser Range findet man die meisten der bekannten Mischfonds wie dem Acatis Value Event, FvS Multiple Opportunities, Phaidros Balanced oder auch den Kapital Plus. Fonds, die sich innerhalb dieser Schwankungsbreite bewegen, halten wir daher für ein ideales Basisinvestment für die meisten Anleger.

Degussa Bank Fonds hat die Nase vorne

Die beste 3-Jahresperformance mit knapp 28 Prozent einer Volatilität von etwas mehr als acht Prozent wies der Degussa Bank-Universal-Rentenfonds auf. Der 1991 aufgelegte Fonds hat dies geschafft, obwohl seine Aktienquote maximal 35 Prozent betragen darf. Der Großteil des Portfolios wird von Rentenpapieren bestritten. Aktuell beträgt die Aktienquote nur 24 Prozent. Manager Svilen Katzarski erzielt die dauerhaft gute Rendite des Fonds stets mit geschickten Renteninvestments, die in geringen Gewichtungen in eher unüblichen Märkten wie Montenegro oder Nordmazedonien erfolgen. Auf der Aktienseite investiert er in europäische Standardwerte wie Münchener Rück, SAP, Sanofi, UniCredit oder die Deutsche Bank.

First Eagle glänzt seit Jahren

Nur marginal schlechter als der Degussa Bank Fonds, der vermutlich nach der Übernahme der Bank durch die OLB bald umbenannt wird, war der First Eagle Amundi International - AU (C). Er gehört wie der Degussa Bank-Universal-Rentenfonds zu den Fondsklassikern. Dabei ist der Weg zu Performance des über sechs Milliarden Euro großen Fonds ein völlig andere. Seine Aktienquote liegt meist bei etwa 75 Prozent. Die Bandbreite liegt zwischen 60 und 90 Prozent. Trotzdem ist die Volatilität kaum höher als bei rentenlastigen Primus. Gemanagt wird der Amundi Fonds von Matthew McLennan und Kimball Brooker. Unterstützt werden sie von Manish Gupta und Julien Albertini. McLennan und Brooker investieren langfristig. Der Schutz vor Verlusten ist ihnen wichtiger, als einen Vergleichsindex zu schlagen. Zudem wollen sie mit dem Fondskonzept die Kaufkraft des Kapitals langfristig schützen. Diese Ziele sind dabei nicht nur Marketing-Geschwätz. Selbst 2022, als auch viele Mischfonds deutlich unter Wasser waren, lag der First Eagle Amundi International Fund nur gut zwei Prozent im Minus. Eine Besonderheit des Fonds ist die Tatsache, dass er immer in goldbezogenen Investments investiert ist. Die Goldposition bewegt sich zwischen fünf und 15 Prozent.

TBF meldet sich zurück

Interessant an der Auswertung ist, dass sich TBF mit seinen Mischfonds wieder auf dem aufsteigenden Ast ist. Das Manager-Quartett bestehend aus Guido Barthels, Daniel Dreher, Peter Dreide, und Patrick Vogel haben den TBF Special Income EUR R Fonds nach einer Schwächephase (20/21) wieder flott bekommen. Das äußert sich auch wieder in steigenden Mittezuflüssen. Knapp 24 Prozent Rendite schaffte sie in den vergangenen drei Jahren. Die Volatilität lag laut FVBS professional bei knapp 9,6 Prozent. Die höhere Volatilität liegt an der höheren Aktienquote von der derzeit rund 75 Prozent und der offensiveren Ausrichtung des Portfolios. Es finden sich dort Namen wie Microsoft, Nvidia, Meta oder auch Alphabet. Dies Ausrichtung will TBF auch erst einmal beibehalten, da sie recht optimistisch auf die Aktienmärkte blicken. Insbesondere von der US-Börse erwarten sie eine bessere Entwicklung als in Europa. Daher betragen die US-Dollarinvestments auch rund 60 Prozent.

Flossbach gehört nicht zu den besten

Blickt man auf den Mischfondsprimus, den FvS Multiple Opportunities fällt im Vergleich zu den besten Fonds mit moderater Volatilität eine Performanceschwäche aus. Der Fonds schaffte kumuliert knapp fünf Prozent Performance. Die Volatilität betrug dabei 8,15 Prozent. Er bewegt damit in ähnlichen Gefilden wie der Amundi oder Degussa Fonds. Nur der TBF-Fonds war etwas volatiler. Wer sein (Mischfonds)-Depot etwas aufpeppen möchte, sollte sich also nicht nur die drei angesprochenen Fonds anschauen, sondern es gibt einige gute Alternative zu den bekannten Platzhirschen. Diversifikation macht auch bei Mischfonds sehr viel Sinn, da die Korrelationen oftmals gering sind.

Mischfonds-Übersicht

| Name | ISIN | Perf. 3 Jahre | Perf. 1 Jahr | Perf. seit 1.1. | Perf. 5 Jahre | Perf. 10 Jahre kum. | Volatilität 3 Jahre |

|---|---|---|---|---|---|---|---|

| Degussa Bank-Universal-Rentenfonds | DE0008490673 | 27,44% | 17,83% | 11,92% | 30,29% | 54,99% | 8,32% |

| First Eagle Amundi International - AU (C) | LU0068578508 | 24,83% | 22,60% | 19,78% | 44,70% | 96,89% | 9,21% |

| Macro + Strategy (T) | AT0000A0H858 | 24,64% | 31,50% | 27,21% | 49,10% | 65,34% | 8,52% |

| Amundi Funds Income Opportunities A2 USD (C) | LU1883839398 | 23,75% | 14,61% | 12,90% | 39,48% | 7,82% | |

| AI US Dynamic USD | DE000A2JJ206 | 23,65% | 22,86% | 19,98% | 32,01% | 7,93% | |

| TBF Special Income EUR R | DE000A1JRQD1 | 23,55% | 13,77% | 9,66% | 24,60% | 42,39% | 9,58% |

| Weltportfolio Dynamik | DE000DWS0PD9 | 22,63% | 19,70% | 16,24% | 35,38% | 82,90% | 7,18% |

| Janus Capital Funds Plc - Janus Global Adaptive Multi-Asset A2 USD | IE00BZ775C54 | 22,61% | 21,01% | 14,41% | 57,36% | 8,06% | |

| Global Economic Performance Fonds | DE000A0NAU03 | 22,60% | 23,30% | 19,51% | 52,10% | 86,74% | 7,92% |

| HanseMerkur Strategie chancenreich AK P | DE000A1JGB05 | 20,06% | 22,17% | 18,02% | 56,65% | 98,71% | 9,16% |

| Capital Group American Balanced Fund (LUX) B USD | LU2343843681 | 19,93% | 24,24% | 20,03% | 8,83% | ||

| Franklin Income Fund A (Mdis) USD | LU0098860793 | 19,79% | 19,73% | 15,20% | 34,28% | 61,75% | 8,17% |

| Pimas No. 1 Global Equities indexed | LU0391980702 | 19,63% | 18,20% | 15,20% | 47,73% | 67,03% | 9,86% |

| Pollux I-UI | DE000A0RKXH8 | 19,50% | 21,99% | 18,42% | 36,38% | 59,07% | 7,69% |

| HSBC Trinkaus AlphaScreen | DE000A0JDCJ0 | 19,22% | 18,59% | 15,41% | 36,58% | 51,52% | 8,48% |

| Vermögenswerte Global VV R | DE000A2P5B72 | 19,03% | 19,61% | 18,34% | 7,82% | ||

| Capital Group Capital Income Builder (LUX) B USD | LU1820809694 | 18,93% | 21,05% | 16,50% | 34,09% | 8,24% | |

| 3 Banken Sachwerte-Fonds R | AT0000A0ENV1 | 17,44% | 22,33% | 18,33% | 44,73% | 79,45% | 9,28% |

| OPAL FONDS II L | LU0237783195 | 17,18% | 22,62% | 17,62% | 50,63% | 103,11% | 8,18% |

| Ampega ETFs-Portfolio Select Dynamisch P (a) | DE000A0NBPM2 | 17,16% | 21,60% | 17,74% | 26,87% | 50,91% | 8,67% |

| BNY Mellon Multi-Asset Balanced Fund Sterling Income Shares | GB0006778574 | 17,15% | 19,02% | 15,88% | 44,65% | 77,13% | 9,12% |

| GAM Institutional BVG/LPP - BVG/LPP 60 Plus B CHF | CH0036750815 | 16,94% | 19,54% | 13,19% | 53,37% | 93,00% | 9,36% |

| Janus Henderson Balanced Fund A2 USD | IE0004445015 | 16,76% | 24,59% | 21,02% | 50,59% | 125,63% | 9,90% |

| HMT Euro Seasonal LongShort R | DE000A2P9QX4 | 16,74% | 11,20% | 9,67% | 9,76% | ||

| Oberbanscheidt Global Flexibel UI - Anteilklasse R | DE000A1T75R4 | 16,58% | 14,14% | 10,13% | 23,49% | 37,86% | 8,88% |

| Goldman Sachs Global Multi-Asset Income Portfolio Base (Acc.) | LU1032466523 | 16,53% | 19,02% | 14,85% | 32,77% | 79,38% | 8,03% |

| MLB-Wachstumsmandat | DE000A2JF8M5 | 16,03% | 20,65% | 16,53% | 36,57% | 9,24% | |

| DB ESG Growth SAA (USD) USD LC | LU2132881132 | 15,88% | 20,70% | 17,27% | 8,70% | ||

| DB ESG Balanced SAA (USD) Plus USD DPMC | LU2132881488 | 15,87% | 20,17% | 16,98% | 7,20% | ||

| Garant Dynamic - IT - EUR | LU0253954332 | 15,66% | 24,14% | 20,73% | 22,36% | 31,99% | 7,91% |

| Münsterländische Bank Strategieportfolio II VV | DE000A2PYP32 | 15,66% | 20,28% | 16,16% | 8,98% | ||

| BKP Classic Fonds UI | DE000A0NEBB9 | 15,54% | 11,08% | 7,89% | 35,82% | 74,58% | 9,37% |

| Franklin Global Income Fund A (acc) USD | LU2129689431 | 15,53% | 17,40% | 12,77% | 8,09% | ||

| Deka-BR 75 | DE0005424543 | 15,23% | 20,16% | 16,11% | 38,68% | 91,77% | 9,42% |

| Trend Kairos Global A | DE0009767392 | 15,18% | 16,22% | 11,59% | 48,66% | 45,87% | 9,04% |

| MPF Protection | DE000A1CXU16 | 15,15% | 11,48% | 7,85% | 20,48% | 37,11% | 7,06% |

| MPF Odin | DE000A2DJU20 | 14,87% | 8,07% | 7,06% | 24,49% | 7,12% | |

| CTV-Strategiefonds Ausgewogen B | LU0247024648 | 14,85% | 14,85% | 11,56% | 26,49% | 48,76% | 7,94% |

| ALTIS Fund Value B | LU0142612901 | 14,48% | 17,06% | 16,30% | 44,07% | 60,57% | 8,05% |

| Dimensional Funds Plc World Allocation 60/40 Fund EUR | IE00B9L4YR86 | 14,48% | 18,99% | 14,63% | 36,89% | 8,74% | |

| Capital Growth Fund SD | DE000DWS0UY5 | 14,39% | 3,50% | 2,31% | 35,36% | 115,56% | 9,34% |

| RIM Global Opportunities B | LU0120650949 | 14,34% | 12,08% | 8,32% | 35,90% | 77,63% | 9,85% |

| FIRST EAGLE AMUNDI INCOME BUILDER FUND - AE-QD (D) | LU1095739733 | 14,33% | 16,19% | 12,95% | 21,24% | 51,88% | 7,92% |

| Multi-Axxion BELOS-COM Fonds - MA | LU0290570109 | 14,25% | 15,57% | 11,24% | 36,26% | 65,40% | 7,49% |

| AB SICAV I-All Market Income Portfolio AX USD | LU0203201768 | 14,17% | 21,03% | 16,69% | 17,33% | 43,91% | 7,73% |

| Invesco Sustainable Allocation Fund A-Acc | LU1701702372 | 14,11% | 19,24% | 13,29% | 36,74% | 9,00% | |

| Schelhammer Capital - Aktien Aktiv T EUR | AT0000A2SQG1 | 13,92% | 20,43% | 18,13% | 9,30% | ||

| HVB Select Alpha P | DE000A2DKRF0 | 13,63% | 14,00% | 10,39% | 26,56% | 8,78% | |

| Manganina Multi Asset | DE000A2AQZ11 | 13,57% | 15,98% | 13,23% | 21,82% | 7,75% | |

| Canada Life Perspektive GB | IE0007799681 | 13,37% | 17,83% | 14,29% | 35,73% | 69,88% | 9,54% |

| Value Intelligence Fonds AMI I (a) | DE000A0YAX80 | 13,32% | 11,74% | 7,39% | 35,76% | 81,76% | 7,17% |

| T. Rowe Price Funds SICAV - Global Allocation Fund A | LU1417861728 | 13,30% | 20,40% | 17,00% | 37,21% | 7,62% | |

| Mix-Fonds: Aktiv Chance | LU0571517498 | 13,23% | 18,23% | 14,96% | 35,03% | 63,19% | 8,56% |

| ACATIS CHAMPIONS SELECT - ACATIS VALUE PERFORMER | LU0334293981 | 13,20% | 21,87% | 18,72% | 30,04% | 53,36% | 8,72% |

| HB Fonds - Rendite Global Plus P | LU0378037310 | 13,13% | 18,92% | 14,26% | 37,76% | 56,14% | 9,19% |

| FTGS Franklin Multi-Asset Growth Fund E USD ACC | IE00BQQPSX92 | 13,07% | 23,34% | 18,39% | 37,81% | 9,78% | |

| Wachstum Global I A | DE000A0NJGU7 | 12,96% | 12,87% | 9,65% | 30,49% | 62,66% | 8,02% |

| Barbarossa: Chance | LU0332978823 | 12,86% | 24,05% | 19,98% | 59,10% | 93,99% | 9,87% |

| Allianz Strategiefonds Balance - A - EUR | DE0009797258 | 12,84% | 19,72% | 15,72% | 28,93% | 60,21% | 8,28% |

| LGT GIM Growth (USD) B | LI0108469250 | 12,84% | 18,93% | 15,37% | 36,53% | 81,54% | 8,56% |

| AIRC BEST OF U.S. - USD | DE000A1W2BT1 | 12,68% | 25,82% | 19,46% | 60,28% | 141,72% | 9,93% |

| E.I. Sturdza Family Fund B USD | IE00BF559G39 | 12,65% | 17,05% | 16,42% | 36,41% | 7,91% | |

| Warburg Classic Vermögensmanagement Fonds | DE0009765370 | 12,65% | 23,12% | 19,40% | 40,65% | 61,64% | 9,86% |

| WWK Select Balance dynamisch B | LU1479925486 | 12,64% | 24,59% | 20,16% | 38,66% | 9,74% | |

| SARA global balanced R | DE000A1XDYN5 | 12,51% | 18,18% | 15,75% | 27,04% | 8,98% | |

| Deka-PortfolioSelect dynamisch | DE000A2N44D1 | 12,50% | 19,59% | 16,04% | 34,63% | 9,39% | |

| Münsterländische Bank Strategieportfolio II P | DE000A0M2JT7 | 12,44% | 19,47% | 15,48% | 34,82% | 69,26% | 9,02% |

| Stadtsparkasse Düsseldorf Top-Chance | DE000A0NBG34 | 12,40% | 19,78% | 15,37% | 22,15% | 40,46% | 9,08% |

| Rosenheim TopSelect | DE000DK2J9A7 | 12,34% | 24,05% | 21,39% | 50,90% | 9,64% | |

| Vermögensmanagement Chance | DE000A0MUWU3 | 12,34% | 23,02% | 18,70% | 13,54% | 6,61% | 9,76% |

| Clartan Flexible C | LU1100077103 | 12,24% | 11,98% | 8,55% | 11,37% | 31,03% | 8,99% |

| RW Portfolio Strategie UI | DE000A0M7WP7 | 12,19% | 11,15% | 7,48% | 35,94% | 69,92% | 8,39% |

| Flexible Portfolio | LU0316909273 | 12,13% | 15,19% | 11,80% | 33,83% | 63,52% | 7,95% |

| UC Multimanager Global - INVEST | DE0009799155 | 12,13% | 23,63% | 19,70% | 48,82% | 89,09% | 9,93% |

| MPF Athene | DE000A0M6MX4 | 12,07% | 14,88% | 11,66% | 33,74% | 47,49% | 8,63% |

| Kapital Privat Portfolio | DE000A0MYEF4 | 11,94% | 9,30% | 6,70% | 29,13% | 60,57% | 7,05% |

| MPF SMPT 17 | DE000A1W2BU9 | 11,76% | 15,03% | 13,84% | 8,86% | ||

| Absolutissimo Fund - Xanti P | LU0384820337 | 11,73% | 13,48% | 10,73% | 34,48% | 56,00% | 7,94% |

| Schroder ISF Multi-Asset Growth and Income A Thesaurierend USD | LU1195516338 | 11,72% | 20,67% | 15,91% | 34,39% | 8,37% | |

| Phaidros Funds - Balanced B | LU0295585821 | 11,69% | 16,38% | 12,38% | 42,18% | 99,57% | 9,71% |

| Monega BestInvest Europa -A- | DE0007560781 | 11,68% | 7,38% | 4,06% | 20,39% | 32,63% | 9,22% |

| Global Multi Invest | DE000A1CUGL4 | 11,60% | 19,92% | 14,99% | 39,86% | 9,84% | |

| Luxembourg Placement Fund - Top Invest B | LU0327204631 | 11,55% | 16,09% | 12,32% | 29,55% | 55,11% | 7,21% |

| BlackRock Global Funds - Global Allocation Fund A2 USD | LU0072462426 | 11,51% | 20,61% | 16,36% | 42,11% | 81,79% | 8,46% |

| Vanguard LifeStrategy® 60% Equity UCITS ETF EUR Dist | IE00BMVB5Q68 | 11,49% | 20,32% | 15,45% | 9,75% | ||

| UBS (Lux) Strategy SICAV - Dynamic Income (USD) P-acc | LU1917362490 | 11,44% | 17,99% | 15,12% | 24,74% | 7,32% | |

| Fundsolution alphatrend - R | LU1687250271 | 11,44% | 9,22% | 2,96% | 34,89% | 9,19% | |

| Flossbach von Storch - Foundation Growth R | LU2243567570 | 11,41% | 17,47% | 13,58% | 7,89% | ||

| SparTrust XVII (T) | AT0000685615 | 11,33% | 18,37% | 14,16% | 45,70% | 7,15% | |

| VF (Lux) - Valiant Classique Dynamic ID | LU2601237774 | 11,33% | 17,78% | 12,05% | 37,44% | 8,25% | |

| UBS (Lux) Strategy Fund - Growth Sustainable (USD) P-acc | LU0033040865 | 11,31% | 21,68% | 17,50% | 35,08% | 86,40% | 9,26% |

| DC Value Global Dynamic | LU0370310038 | 11,20% | 10,23% | 8,69% | 53,21% | 131,42% | 9,61% |

| TBF Global Income EUR I | DE0009781997 | 11,19% | 11,62% | 6,83% | 13,83% | 43,63% | 7,83% |

| MPF Allegro | DE000A0M8HA8 | 11,17% | 12,75% | 11,54% | 22,66% | 41,88% | 7,06% |

| sentix Risk Return -A- Anteilsklasse R | DE000A2AMPE9 | 11,16% | 9,31% | 7,20% | 25,37% | 7,44% | |

| Dynamik Invest | AT0000A0PDE4 | 11,16% | 21,91% | 17,49% | 14,81% | 31,93% | 9,08% |

| Werte & Sicherheit - Nachhaltiger Stiftungsfonds (P) | DE000A2PE1C4 | 11,15% | 11,57% | 8,11% | 7,41% | 7,42% | |

| Goldman Sachs ESG-Enhanced Global Multi-Asset Balanced PF Base Dist | LU1057461649 | 11,09% | 20,09% | 16,20% | 33,63% | 69,61% | 8,62% |

| Baloise Fund Invest (Lux) - BFI Dynamic (EUR) R EUR | LU0127032794 | 11,04% | 16,93% | 11,94% | 26,97% | 66,23% | 9,33% |

| CONREN Fortune SF | LU0122183469 | 11,03% | 20,51% | 16,36% | 26,23% | 50,00% | 8,53% |

| Pictet - Global Dynamic Allocation - P USD | LU1437675405 | 11,01% | 17,66% | 14,84% | 32,56% | 7,32% | |

| MFS Meridian Funds - Global Total Return Fund A1 EUR | LU0219418836 | 10,89% | 17,94% | 12,04% | 27,50% | 69,00% | 8,50% |

| Swisscanto (LU) Portfolio Fund Responsible Focus (CHF) AA | LU0161534861 | 10,87% | 19,98% | 14,34% | 34,05% | 79,14% | 9,93% |

| Albatros Fonds | DE0008486465 | 10,86% | 9,12% | 6,31% | 22,19% | 45,13% | 9,15% |

| M&G (Lux) Dynamic Allocation Fund Euro A Dist | LU1582988132 | 10,84% | 8,47% | 4,36% | 16,20% | 37,67% | 7,79% |

| Credit Suisse (CH) Privilege 75 CHF B | CH0552940857 | 10,84% | 16,23% | 9,42% | 9,74% | ||

| Reimann Investors Vermögensmandat II | LU0560009929 | 10,77% | 21,82% | 18,90% | 41,01% | 53,01% | 8,50% |

| ACATIS Value Event Fonds A | DE000A0X7541 | 10,77% | 11,03% | 9,87% | 37,21% | 88,81% | 9,46% |

| Swisscanto (CH) Portfolio Fund I - Ambition AA CHF | CH0005040784 | 10,76% | 19,15% | 13,00% | 33,74% | 64,44% | 8,67% |

| BlackRock Global Funds - Dynamic High Income Fund A2 USD acc | LU1564329032 | 10,68% | 21,19% | 17,10% | 25,48% | 9,46% | |

| BlackRock Global Funds - Global Multi-Asset Income Fund A2 USD | LU0784385840 | 10,58% | 17,29% | 13,29% | 21,96% | 58,39% | 7,09% |

| Luxembourg Placement Fund - Solitär | LU0159025070 | 10,43% | 18,87% | 14,24% | 28,96% | 45,43% | 8,50% |

| Wagner & Florack Unternehmerfonds flex I (a) | DE000A2P23K5 | 10,41% | 9,05% | 8,42% | 9,13% | ||

| MPF Orthos | DE000A0M8G91 | 10,39% | 13,34% | 11,78% | 18,78% | 40,99% | 8,66% |

| SK Invest - Dynamisch | LU0367203444 | 10,36% | 15,07% | 11,16% | 35,52% | 68,39% | 9,86% |

| VermögensManagement Chance - A - EUR | LU0321021585 | 10,27% | 25,09% | 20,34% | 34,04% | 68,38% | 9,87% |

| DC Value Global Balanced (PT) | DE000A0YAX72 | 10,26% | 8,31% | 6,85% | 44,16% | 109,27% | 7,90% |

| BCV Portfolio Pension Fund - BCV Pension 25 A Fonds | CH0118631214 | 10,23% | 13,93% | 7,32% | 22,86% | 7,14% | |

| UNIKAT Premium Select Fonds D | DE000A0M6DP9 | 10,23% | 19,88% | 16,06% | 30,65% | 54,96% | 7,98% |

| MPF Herkules | DE000A0RKY29 | 10,22% | 10,44% | 9,22% | 28,82% | 51,40% | 9,17% |

| SparTrust Variabel (AA) | AT0000A07HH0 | 10,20% | 19,74% | 15,91% | 25,82% | 51,40% | 8,66% |

| LGT GIM Balanced (USD) B | LI0108468880 | 10,18% | 15,60% | 12,85% | 28,15% | 65,48% | 7,30% |

| DWS Vorsorge AS (Flex) | DE0009769893 | 10,16% | 14,77% | 10,74% | 33,03% | 72,07% | 9,40% |

| Bankhaus Seeliger VV Dynamisch | DE000A141WU4 | 10,12% | 15,45% | 11,54% | 18,43% | 8,78% | |

| Capital Group Global Allocation Fund (LUX) B USD | LU1006075227 | 10,08% | 19,33% | 14,99% | 31,39% | 81,83% | 8,58% |

| VV-Strategie - Potenzial T1 | LU0354722158 | 10,07% | 13,50% | 10,87% | 27,93% | 39,96% | 8,21% |

| Swisscanto BVG 3 Responsible Life Cycle 2020 VT CHF | CH0022412750 | 10,04% | 10,43% | 3,40% | 14,42% | 42,44% | 7,18% |

| DWS Vorsorge AS (Dynamik) | DE0009769885 | 10,02% | 14,65% | 10,64% | 32,72% | 70,17% | 9,48% |

| MPF Donar | DE000A12BPU4 | 9,90% | 12,42% | 9,48% | 21,52% | 7,40% | |

| Mediolanum Best Brands - US Coupon Strategy Collection L Class A Units | IE00BYVXSB26 | 9,90% | 21,21% | 17,89% | 27,84% | 9,02% | |

| DJE Lux - DJE Multi Flex | LU0346993305 | 9,87% | 23,32% | 20,40% | 36,99% | 82,57% | 9,28% |

| Canada Life Perspektive Fernost | IE0007799244 | 9,86% | 18,28% | 14,83% | 34,23% | 74,67% | 9,01% |

| Decus Invest - Balanced - P | LU1277512692 | 9,83% | 13,09% | 9,16% | 25,48% | 8,06% | |

| Multi Manager Access II - Sustainable Investing Balanced P-acc | LU1852198289 | 9,81% | 18,06% | 14,01% | 32,33% | 7,94% | |

| Vermögensverwaltung Systematic Return | DE000A0M6MW6 | 9,73% | 15,39% | 11,96% | 23,61% | 32,09% | 7,27% |

| Credit Suisse (CH) Privilege 45 CHF A | CH0010211107 | 9,68% | 13,41% | 7,19% | 25,75% | 53,60% | 7,54% |

| Global Masters Multi Asset Strategy I-CHF | LU1728550838 | 9,61% | 8,34% | 1,56% | 23,72% | 8,47% | |

| Haspa PB Strategie Chance | LU0324036036 | 9,61% | 15,92% | 11,43% | 36,69% | 56,11% | 9,23% |

| Mainfranken Strategiekonzept | DE000DK2CE40 | 9,53% | 17,60% | 14,23% | 22,01% | 52,23% | 9,91% |

| Tailormade Sustainable fund dynamic (VT) EUR | AT0000A2D952 | 9,51% | 18,88% | 14,35% | 9,38% | ||

| DB ESG Growth SAA (EUR) SC | LU2132882965 | 9,51% | 16,25% | 12,59% | 9,41% | ||

| Baloise Fund Invest (Lux) - BFI Dynamic (CHF) R CHF | LU0127029147 | 9,41% | 16,81% | 10,47% | 31,82% | 76,61% | 9,25% |

| Mediolanum Best Brands - Financial Income Strategy L - A | IE00BVL88501 | 9,28% | 13,76% | 8,90% | 24,29% | 9,45% | |

| DWS ESG Dynamic Opportunities FC | DE0009848077 | 9,24% | 14,66% | 11,53% | 37,76% | 104,54% | 9,28% |

| FundPro - Achilles | LU0355162982 | 9,13% | 15,16% | 11,07% | 28,53% | 54,98% | 8,31% |

| Baloise Fund Invest (Lux) - BFI Progress (CHF) R CHF | LU0127027950 | 9,10% | 13,85% | 7,74% | 22,61% | 55,23% | 7,14% |

| DJE Multi Asset & Trends PA (EUR) | LU0159549145 | 9,06% | 15,87% | 13,46% | 40,32% | 83,40% | 8,24% |

| GWP-Fonds | DE0008478199 | 9,05% | 20,48% | 17,64% | 18,23% | 13,15% | 7,66% |

| Sydbank Vermögensverwaltung Dynamisch A | DE0002605326 | 9,03% | 18,96% | 14,94% | 32,01% | 56,30% | 9,08% |

| Uni-Global Equities Emerging Markets Fund RA-USD | LU0929191293 | 9,00% | 20,79% | 17,50% | 14,95% | 31,84% | 9,62% |

| Citus - Performance Inside - P accumulating | LU1277395445 | 8,99% | 11,75% | 7,98% | 29,05% | 7,70% | |

| Swisscanto (CH) Portfolio Fund I - Balance AA CHF | CH0002379276 | 8,95% | 16,45% | 10,04% | 27,18% | 52,32% | 7,76% |

| UBS (CH) Strategy Fund - Balanced (USD) P | CH0002792189 | 8,87% | 18,55% | 14,89% | 25,43% | 68,53% | 7,49% |

| Ninety One Global Strategy Fund - Global Macro Allocation Fund IX Acc USD | LU1745457827 | 8,83% | 15,69% | 8,18% | 34,53% | 9,63% | |

| Serafin Multi-Asset Risk Focus EUR | DE000A1WZ1C1 | 8,81% | 17,93% | 14,05% | 12,70% | 28,31% | 7,66% |

| Aegon Global Diversified Income Fund B EUR Acc | IE00BYYPFG98 | 8,81% | 12,86% | 8,33% | 18,04% | 9,49% | |

| UBS (Lux) Strategy Fund - Balanced Sustainable (USD) P-dist | LU0049785529 | 8,76% | 18,55% | 14,84% | 25,74% | 66,95% | 7,65% |

| FTGS Franklin Multi-Asset Balanced Fund A USD ACC | IE00BQQPSN94 | 8,74% | 19,70% | 15,05% | 27,38% | 7,96% | |

| LF - AI Balanced Multi Asset S | DE000A2P0T51 | 8,68% | 16,50% | 12,76% | 7,36% | ||

| Adelca Invest - GVI Multi Asset Fund | LU0328115661 | 8,68% | 17,15% | 13,45% | 28,34% | 159,93% | 8,74% |

| Templeton Global Income Fund A (Qdis) USD | LU0211326839 | 8,67% | 15,64% | 10,63% | 8,25% | 22,15% | 9,19% |

| CLE SELECT | IE00B0YVM801 | 8,65% | 10,64% | 7,30% | 15,96% | 47,16% | 7,58% |

| Adelca Invest - GI Multi Asset Fund | LU0328114938 | 8,63% | 17,81% | 14,08% | 30,46% | 170,26% | 8,63% |

| DWS ESG Multi Asset Dynamic FD | LU0198959040 | 8,62% | 15,20% | 10,78% | 29,82% | 84,41% | 8,39% |

| Swisscanto (LU) Portfolio Fund Responsible Ambition (CHF) AA | LU0161537534 | 8,52% | 17,15% | 11,51% | 28,41% | 61,30% | 8,89% |

| VR Vip - Wachstum | LU0344350060 | 8,50% | 18,39% | 13,25% | 28,02% | 49,85% | 7,63% |

| JPMorgan Funds - Asia Pacific Income Fund A (acc) USD | LU0210527791 | 8,50% | 16,74% | 13,88% | 20,56% | 58,32% | 7,71% |

| Flossbach von Storch - Multi Asset - Growth R | LU0323578491 | 8,44% | 17,33% | 13,47% | 23,48% | 67,84% | 8,19% |

| JPM Total Emerging Markets Income A (acc) - USD | LU0972618572 | 8,44% | 15,34% | 11,63% | 24,64% | 47,79% | 8,41% |

| KEPLER Vorsorge Mixfonds (A) | AT0000969787 | 8,40% | 18,91% | 12,84% | 18,65% | 50,67% | 8,70% |

| DWS Fixed Maturity Multi Asset 2027 II | LU2242306996 | 8,39% | 10,04% | 6,42% | 9,51% | ||

| Carmignac Portfolio Long-Short European Equities F EUR acc | LU0992627298 | 8,37% | 17,46% | 16,08% | 45,80% | 74,35% | 7,17% |

| Swiss Life Funds (CH) Portfolio Global Balanced (CHF) A1 | CH0007294918 | 8,35% | 14,84% | 7,59% | 26,81% | 52,17% | 8,22% |

| Ellwanger.Geiger Vermögensstrategie - Ellwanger.Geiger Aktien - A | LU0334446308 | 8,35% | 19,38% | 15,18% | 33,25% | 58,95% | 9,02% |

| Stiftungsfonds Westfalen A | DE000A0RA4R0 | 8,30% | 15,54% | 12,66% | 17,54% | 29,97% | 8,09% |

| Finiens Long Term Investment Program UI | LU0632028865 | 8,29% | 15,88% | 11,79% | 26,67% | 36,19% | 7,95% |

| MPF Waterville | DE000A0M8HC4 | 8,26% | 12,15% | 10,13% | 19,47% | 40,08% | 7,03% |

| UniAusschüttung A | LU1390462189 | 8,26% | 13,84% | 9,21% | 20,66% | 8,62% | |

| Taunus Trust - TT Multi Assets Balanced I | LU0908857666 | 8,25% | 15,32% | 12,56% | 25,42% | 44,78% | 7,69% |

| Migros Bank (Lux) Fonds 50 A | LU0261663065 | 8,23% | 11,90% | 6,64% | 23,98% | 56,86% | 7,14% |

| Multi - Axxion RDB Universal | LU0266656635 | 8,21% | 13,23% | 9,68% | 21,33% | 46,62% | 7,53% |

| Siemens Diversified Growth | DE000A14XPF5 | 8,15% | 15,15% | 10,92% | 21,95% | 8,71% | |

| Multi Structure Fund - Contiomagus P | LU0404918483 | 8,13% | 15,75% | 11,63% | 19,12% | 37,25% | 7,59% |

| EICHLER & MEHLERT Balanced Strategie | DE000A0M8HJ9 | 8,12% | 14,16% | 12,04% | 12,98% | 21,29% | 7,91% |

| H&S Global Allocation | DE0002605359 | 8,11% | 14,77% | 11,02% | 21,15% | 36,41% | 7,32% |

| Fidelity Funds - Global Multi Asset Dynamic Fund A-USD | LU0080751232 | 8,11% | 24,27% | 20,24% | 13,47% | 42,34% | 9,51% |

| Pictet CH - LPP 40 - P dy CHF | CH0016431709 | 8,08% | 14,15% | 7,88% | 24,13% | 58,05% | 8,13% |

| Deka-BR 55 | DE0005424550 | 7,91% | 15,21% | 11,47% | 22,61% | 55,31% | 7,35% |

| VM BC BasisStrategie Global A | LU1815126443 | 7,91% | 15,83% | 11,76% | 15,79% | 7,53% | |

| LF - AI Dynamic Multi Asset S | DE000A2P0T10 | 7,91% | 19,44% | 14,92% | 9,94% | ||

| Deka-ESG Sigma Plus Dynamisch CF (A) | LU0236907720 | 7,88% | 20,54% | 14,33% | 33,54% | 37,08% | 9,13% |

| apo TopSelect Wachstum A | DE000A1W9AE0 | 7,85% | 18,32% | 13,56% | 23,31% | 9,75% | |

| KEPLER Mix Ausgewogen (A) | AT0000825476 | 7,83% | 17,91% | 13,29% | 19,88% | 47,86% | 8,99% |

| AF Value Invest UI | DE000A0MKQ32 | 7,77% | 6,23% | 3,20% | 32,51% | 53,88% | 8,47% |

| DWS Sachwerte LD | DE000DWS0W32 | 7,73% | 13,79% | 9,21% | 24,23% | 44,21% | 8,13% |

| Active World Portfolio (A) | AT0000A0PDC8 | 7,71% | 19,22% | 14,54% | 13,30% | 34,75% | 9,11% |

| FOCUS Globale Aktien RA2 | AT0000617667 | 7,70% | 19,52% | 15,53% | 19,35% | 41,92% | 9,60% |

| Amundi Funds Real Assets Target Income - A2 EUR (C) | LU1883866011 | 7,69% | 12,85% | 8,98% | 27,05% | 50,60% | 9,16% |

| TARENO FUNDS Diversified Index Investing Equities/Bonds/Real Assets A | LU0988536776 | 7,68% | 15,09% | 10,23% | 28,16% | 53,45% | 8,41% |

| SALytic Strategy | DE000A2DL4D1 | 7,64% | 13,51% | 10,18% | 26,81% | 8,08% | |

| DWS Funds Invest ZukunftsStrategie | LU0313399957 | 7,60% | 20,52% | 16,63% | 24,92% | 48,44% | 7,27% |

| Davy ESG Multi-Asset Fund A EUR Acc | IE00BJ9K2N00 | 7,60% | 16,29% | 12,36% | 9,32% | ||

| Franklin ESG-Focused Balanced Fund A acc EUR | LU2319533704 | 7,59% | 19,12% | 13,63% | 9,88% | ||

| MFS Meridian Funds - Diversified Income Fund A1USD | LU1099986488 | 7,58% | 17,17% | 12,02% | 16,24% | 57,03% | 7,53% |

| ODDO BHF Polaris Balanced DRW-EUR | LU0319574272 | 7,55% | 13,20% | 9,55% | 23,77% | 60,49% | 8,13% |

| DWS ESG Balance | DE0008474198 | 7,51% | 15,75% | 11,33% | 23,15% | 40,83% | 8,19% |

| Zürich Kosmos Invest | AT0000856919 | 7,50% | 10,30% | 6,93% | 17,14% | 43,22% | 7,00% |

| HannoverscheMediumInvest | DE0005317325 | 7,50% | 9,78% | 6,52% | 21,40% | 42,76% | 9,97% |

| Multi Manager Access II - Emerging Markets Debt BI | LU0985399996 | 7,47% | 18,09% | 13,48% | 11,26% | 52,99% | 7,34% |

| Wertewerk | DE000A2QJKZ7 | 7,46% | 17,82% | 15,18% | 8,29% | ||

| Nordea 1 - GBP Diversified Return Fund BD-GBP | LU0987091344 | 7,46% | 12,89% | 10,80% | 21,80% | 9,55% | |

| U ASSET ALLOCATION - Dynamic USD AC USD | LU2262127876 | 7,44% | 20,29% | 17,12% | 8,94% | ||

| Ganador - CC Multi-Asset Spezial - I | LU0294838767 | 7,41% | 15,78% | 11,57% | 22,82% | 39,51% | 7,44% |

| Nordlux Pro Horizont Fonds CF (A) | LU0438890013 | 7,39% | 11,25% | 7,96% | 9,18% | 7,82% | 7,07% |

| Barbarossa: Wachstum | LU0332978740 | 7,39% | 17,78% | 13,59% | 33,72% | 45,99% | 7,31% |

| Allianz Dynamic Multi Asset Strategy SRI 50 - A - EUR | LU1019989323 | 7,34% | 17,72% | 12,77% | 30,65% | 55,85% | 8,76% |

| BNY Mellon Multi-Asset Diversified Return Fund Sterling Income Shares | GB00B1GJ9L14 | 7,34% | 13,80% | 9,54% | 27,10% | 42,80% | 9,66% |

| WertpapierStrategiePortfolio ausgewogen | DE000DK0LJ61 | 7,33% | 16,26% | 12,58% | 24,62% | 7,05% | |

| Mauselus | DE000A0DPZF6 | 7,32% | 11,79% | 8,20% | 28,29% | 67,10% | 8,34% |

| DWS Strategic ESG Allocation Balance LC | LU1740984924 | 7,30% | 16,41% | 12,87% | 28,38% | 8,53% | |

| GAM Star Growth C USD Acc | IE00B8FMPT07 | 7,30% | 19,45% | 18,33% | 34,23% | 87,24% | 8,82% |

| Raiffeisen-ESG-Income (R) (A) | AT0000A1JU25 | 7,26% | 13,89% | 7,71% | 17,86% | 8,81% | |

| Absolute Return Multi Premium Fonds R | DE000A2AGM26 | 7,26% | 9,40% | 6,90% | -21,88% | 9,19% | |

| Bright Future Fund | DE000A2AR3V2 | 7,25% | 16,20% | 11,62% | 25,82% | 7,37% | |

| Metzler Multi Asset Dynamic Sustainability A | DE000A1J16Y5 | 7,25% | 22,06% | 18,17% | 28,11% | 35,65% | 8,32% |

| Amundi Ethik Plus - A (C) | DE0009792002 | 7,23% | 16,93% | 11,85% | 23,52% | 26,09% | 8,85% |

| Multiflex SICAV - Lansdowne Endowment Fund A-EUR | LU1946059513 | 7,18% | 12,55% | 9,02% | 7,12% | ||

| HanseMerkur Strategie ausgewogen | DE000A1JGB21 | 7,13% | 12,00% | 7,96% | 23,75% | 49,69% | 8,15% |

| Luxembourg Placement Fund - Bolle A | LU0187653737 | 7,11% | 14,65% | 11,18% | 28,39% | 46,30% | 8,43% |

| KANON Strategiekonzept Defensiv | DE000A2H68V4 | 7,11% | 1,45% | 0,64% | 17,05% | 8,68% | |

| MEAG VermögensAnlage Return A | DE000A1JJJR3 | 7,06% | 13,61% | 10,20% | 22,66% | 39,70% | 8,22% |

| Ethna-DYNAMISCH (A) | LU0455734433 | 7,02% | 17,98% | 12,55% | 22,62% | 37,86% | 7,40% |

| Aramea Strategie I | DE000A0NEKF1 | 7,00% | 12,06% | 8,37% | 24,63% | 41,07% | 7,17% |

| Castell Global Growth Opportunities R | DE000A2QK6A8 | 7,00% | 18,33% | 14,82% | 9,61% | ||

| DB ESG Balanced SAA (EUR) Plus DPMC | LU2132879664 | 6,98% | 15,35% | 11,84% | 7,97% | ||

| Siemens Balanced | DE000A0KEXM6 | 6,97% | 14,05% | 9,73% | 20,82% | 49,06% | 8,57% |

| Schelhammer Capital - Ertragsoptimiertes Portfolio (T) | AT0000A188X7 | 6,96% | 17,46% | 13,93% | 31,82% | 9,12% | |

| PrivatFonds: Kontrolliert pro | DE000A0RPAN3 | 6,90% | 19,33% | 14,79% | 30,32% | 45,86% | 8,22% |

| State Street Flexible Asset Allocation Plus Fund P | LU1112178071 | 6,89% | 15,24% | 10,85% | 23,71% | 7,98% | |

| Adelca Invest - VI Multi Asset Fund | LU0328114854 | 6,87% | 15,02% | 12,07% | 27,34% | 93,51% | 7,96% |

| JPMorgan Investment Funds - Global Income A (div) - EUR | LU0395794307 | 6,83% | 16,04% | 10,64% | 19,16% | 33,39% | 9,60% |

| Amundi Ethik Fonds Evolution (A) | AT0000774484 | 6,82% | 16,49% | 11,81% | 41,53% | 77,41% | 8,64% |

| Hypo-Global Balanced (A) | AT0000713474 | 6,80% | 14,48% | 11,34% | 27,41% | 35,68% | 7,44% |

| Ethik Mix Ausgewogen A | AT000ETHIKA8 | 6,78% | 19,07% | 14,31% | 16,80% | 8,34% | |

| Portfolio Management Ethik Mix Ausgewogen T | AT0000A26ZA7 | 6,77% | 19,07% | 14,30% | 16,81% | 8,34% | |

| DB ESG Growth | LU0240541440 | 6,77% | 15,54% | 12,32% | 27,72% | 55,81% | 9,55% |

| Mix-Fonds: Aktiv Wachstum | LU0571517225 | 6,75% | 17,14% | 12,87% | 15,85% | 26,70% | 8,58% |

| Sparinvest SICAV Balance EUR R | LU0650088072 | 6,68% | 14,94% | 10,73% | 18,69% | 40,24% | 8,65% |

| Swisscanto (CH) Portfolio Fund I - Select AA CHF | CH0002379268 | 6,60% | 13,84% | 7,53% | 20,44% | 39,76% | 7,12% |

| Bethmann Vermögensverwaltung Ausgewogen | LU0328069454 | 6,59% | 14,25% | 9,85% | 22,23% | 45,50% | 8,45% |

| Swisscanto (LU) Portfolio Fund Responsible Balance (CHF) AA | LU0112803316 | 6,57% | 14,33% | 8,22% | 22,38% | 49,26% | 7,63% |

| Portfolio Management AUSGEWOGEN (A) | AT0000707542 | 6,57% | 17,38% | 12,73% | 17,95% | 42,94% | 8,93% |

| Phaidros Funds - Conservative B | LU0504448647 | 6,54% | 13,56% | 9,89% | 24,43% | 50,04% | 8,17% |

| AGIF - Allianz Global Dynamic Multi Asset Strategy 50 - A - EUR | LU1311291493 | 6,46% | 19,55% | 16,07% | 11,20% | 8,62% | |

| VanEck Multi-Asset Balanced Allocation UCITS ETF | NL0009272772 | 6,46% | 17,16% | 11,10% | 22,15% | 56,03% | 9,43% |

| Swiss Life Funds (Lux) - Portfolio Global Growth (CHF) R Cap | LU0094705737 | 6,39% | 15,53% | 9,20% | 25,40% | 61,04% | 8,82% |

| CT (Lux) Diversified Growth A Inc EUR | LU0308885531 | 6,30% | 14,08% | 9,86% | 16,20% | 17,28% | 7,36% |

| Rothschild & Co WM - Strategie P EURO dist | LU1685839406 | 6,26% | 15,78% | 12,60% | 25,40% | 7,87% | |

| VermögensManagement Wachstum - A - EUR | LU0321021312 | 6,26% | 20,30% | 15,70% | 23,88% | 45,83% | 7,88% |

| Amundi Öko Sozial Mix dynamisch - A EUR | AT0000A1KTU5 | 6,26% | 19,11% | 14,79% | 20,20% | 8,92% | |

| apano Global Systematik R | DE000A14UWW2 | 6,17% | 18,73% | 13,12% | 34,92% | 8,29% | |

| GAAM - Premium Selection Balanced Fund | LU1675731423 | 6,15% | 10,80% | 8,69% | 20,10% | 9,69% | |

| Fonds für Stiftungen Invesco | DE0008023565 | 6,10% | 15,42% | 10,43% | 17,10% | 21,45% | 7,75% |

| DWS Multi Asset PIR Fund FC | LU1631464952 | 6,08% | 13,42% | 8,93% | 25,81% | 9,16% | |

| Baloise Fund Invest (Lux) - BFI Progress (EUR) R EUR | LU0127031556 | 6,07% | 14,57% | 9,92% | 17,74% | 46,25% | 8,12% |

| Primus Inter Pares Strategie Wachstum R | DE000A0M2H96 | 6,05% | 5,91% | 3,11% | 19,01% | 29,17% | 7,57% |

| Konzept: Ertrag Dynamisch T (C) | AT0000811369 | 6,03% | 18,90% | 14,33% | 28,69% | 61,07% | 9,04% |

| Swisscanto (CH) Pension Portfolio Fund Responsible Protection DT CHF | CH0134142725 | 6,02% | 14,64% | 6,95% | 41,32% | 7,95% | |

| W&W SachInvest | DE000A1J19U7 | 6,02% | 17,63% | 11,43% | 26,86% | 40,30% | 8,45% |

| HSBC Mix Dynamique A | FR0007006671 | 5,97% | 14,61% | 11,38% | 22,59% | 59,47% | 9,24% |

| DB ESG Balanced SAA (EUR) DPMC | LU2132880167 | 5,95% | 13,76% | 10,42% | 7,66% | ||

| PrivatDepot 4 (A) | DE000A0DNG24 | 5,77% | 16,92% | 12,59% | 23,54% | 36,15% | 8,45% |

| Castell Global Opportunities I | DE000A12GDC7 | 5,73% | 15,12% | 11,90% | 26,00% | 7,62% | |

| Bantleon Select Sicav - Bantleon Changing World PT | LU1808872888 | 5,73% | 18,20% | 11,77% | 31,08% | 9,02% | |

| Weberbank Premium 50 | DE0005319818 | 5,70% | 14,87% | 13,00% | 15,89% | 32,17% | 8,38% |

| Tri Style Fund (T) | AT0000701164 | 5,69% | 16,39% | 14,35% | 20,61% | 44,57% | 8,98% |

| HSBC Strategie Dynamik AC | DE000A0NA4G7 | 5,67% | 15,13% | 11,76% | 23,72% | 55,82% | 9,73% |

| MBS Invest 3 | DE000A2DJVP3 | 5,66% | 15,38% | 10,98% | 20,80% | 8,91% | |

| Barmenia Nachhaltigkeit Balanced | DE000A141WN9 | 5,65% | 16,00% | 12,40% | 18,78% | 8,54% | |

| Swiss Life Funds (LUX) Multi Asset Growth (EUR) R Cap | LU0367334975 | 5,65% | 14,65% | 11,06% | 22,30% | 41,96% | 9,58% |

| Stadtsparkasse Düsseldorf Top-Return | DE000A0NBG18 | 5,64% | 15,23% | 10,82% | 9,72% | 20,07% | 7,74% |

| Deka-ESG Sigma Plus Ausgewogen | DE000DK0V6D3 | 5,61% | 15,14% | 9,88% | 7,16% | ||

| Schoellerbank PREMIUM Global Portfolio Thesaurierer | AT0000A0VL88 | 5,57% | 19,60% | 14,67% | 28,25% | 73,04% | 9,81% |

| Schoellerbank Ethik Vorsorge (T) | AT0000820477 | 5,53% | 12,65% | 8,43% | 20,52% | 61,78% | 7,56% |

| Maneris Select UI | DE000A2DMT10 | 5,52% | 13,56% | 10,77% | 25,25% | 8,56% | |

| Fidelity Funds - Global Multi Asset Growth & Income Fund A-Euro | LU0267387503 | 5,47% | 15,06% | 11,85% | 6,12% | 20,97% | 7,09% |

| SPDR Morningstar Multi-Asset Global Infrastructure UCITS ETF | IE00BQWJFQ70 | 5,40% | 15,78% | 10,54% | 19,05% | 8,83% | |

| WARBURG-MULTI-ASSET-SELECT-FONDS R | DE0009765305 | 5,37% | 17,82% | 13,78% | 17,98% | 35,16% | 7,39% |

| Deka-Nachhaltigkeit Multi Asset CF | DE000DK0V5F0 | 5,34% | 16,83% | 11,77% | 9,07% | ||

| Warburg Zukunftsmanagement R | DE000A1W2BL8 | 5,32% | 13,99% | 9,72% | 17,40% | 38,02% | 9,00% |

| Challenge Funds - Challenge Provident 2 Fund P | IE00B1P83R33 | 5,29% | 14,71% | 10,99% | 20,94% | 44,97% | 7,94% |

| Böhke & Compagnie Vermögensverwaltungsfonds R | DE000A2ATCX2 | 5,26% | 15,08% | 11,14% | 17,29% | 9,26% | |

| VR Premium Fonds - Progressio | LU0392136643 | 5,24% | 16,10% | 11,60% | 31,70% | 69,29% | 9,98% |

| Deka-PortfolioSelect ausgewogen | DE000A2N44B5 | 5,22% | 16,08% | 12,05% | 18,28% | 8,92% | |

| AKS Global | LU0203345250 | 5,21% | 13,99% | 11,55% | 23,28% | 37,84% | 8,15% |

| Franklin Diversified Balanced Fund A (Ydis) EUR | LU1147469677 | 5,21% | 14,69% | 9,10% | 25,59% | 25,65% | 8,21% |

| Siemens Absolute Return | DE000A2N66L7 | 5,19% | 13,04% | 8,93% | 15,89% | 7,47% | |

| GFS Strategic IV P(a) | DE000A0NGJ10 | 5,17% | 16,55% | 12,58% | 4,97% | 7,87% | 9,25% |

| W&W Nachhaltige Strategie | DE000A2P0RJ0 | 5,14% | 18,39% | 13,52% | 9,89% | ||

| GENERALI Multi INDEX 20 | CH0109560166 | 5,12% | 10,44% | 3,03% | 10,32% | 27,33% | 8,45% |

| Allianz Global Dynamic Multi Asset Income - I USD | LU1366196324 | 5,09% | 15,94% | 11,42% | 6,81% | 7,08% | |

| VermögensManagement RenditeStars - A - EUR | LU1312033811 | 5,07% | 15,39% | 11,33% | 18,95% | 7,29% | |

| Global Focus Growth | LU0405297564 | 5,07% | 8,25% | 5,19% | 16,72% | 32,97% | 9,49% |

| UniInstitutional Multi Asset | DE000A1C74J0 | 5,05% | 15,15% | 11,50% | 25,28% | 35,73% | 7,81% |

| UBS (Lux) IndexSelection Fund Income CHF B | LU0439734368 | 5,03% | 10,44% | 3,73% | 18,68% | 35,92% | 7,69% |

| Flossbach von Storch - Multiple Opportunities R | LU0323578657 | 4,98% | 12,69% | 9,59% | 23,55% | 73,56% | 8,15% |

| ERGO Vermögensmanagement Flexibel | DE000A2ARYP6 | 4,98% | 15,04% | 10,67% | 22,82% | 9,07% | |

| Aktiv Strategie II | DE000A1WY1X8 | 4,97% | 14,24% | 10,36% | 15,48% | 41,78% | 8,02% |

| Canada Life Fidelity Chance IR II | IE00B3ZNL231 | 4,91% | 13,32% | 9,04% | 17,04% | 51,26% | 9,69% |

| Naspa-Fonds Ausschüttung Plus | DE0008480807 | 4,90% | 10,06% | 5,65% | 9,95% | 18,73% | 8,42% |

| PVI Global Wealth R | DE000A3C5J54 | 4,82% | 16,55% | 14,24% | 9,70% | ||

| NinetyOne GSF - Global Strategic Managed Fund A Acc gross USD | LU0345768153 | 4,75% | 17,79% | 11,43% | 27,85% | 68,95% | 9,26% |

| Lienhardt & Partner Core Strategy Fund - A-CHF | CH0002789847 | 4,71% | 12,20% | 5,87% | 24,23% | 41,61% | 8,71% |

| Deka-BasisStrategie Flexibel CF | DE000DK2EAR4 | 4,70% | 21,98% | 17,19% | 19,77% | 38,06% | 9,69% |

| PIMCO GIS Strategic Income Fund E EUR Hedged Income | IE00BG800X66 | 4,69% | 11,38% | 7,07% | 11,31% | 20,28% | 8,28% |

| Werte Fonds Münsterland Nachhaltig | DE000A2PPKC5 | 4,68% | 20,02% | 15,60% | 9,57% | ||

| RLC Connor B | LU0804306552 | 4,66% | 24,99% | 22,17% | 42,43% | 58,89% | 8,33% |

| UniMultiAsset: Exklusiv | DE000A2H9A01 | 4,60% | 14,86% | 11,24% | 23,79% | 7,80% | |

| Tailormade Sustainable Fund Balanced VT1 | AT0000A2D929 | 4,51% | 14,95% | 10,89% | 8,30% | ||

| Swisscanto (LU) Portfolio Fund Responsible Balance (EUR) AA | LU0112804983 | 4,51% | 15,29% | 10,95% | 20,12% | 42,92% | 8,65% |

| R-co Conviction Club C EUR | FR0010541557 | 4,40% | 9,09% | 5,69% | 15,72% | 35,16% | 9,35% |

| Postbank Wachstum 70 ESG T EUR | LU1682639452 | 4,33% | 16,57% | 12,62% | 25,28% | 9,93% | |

| Fidelity Funds - Multi Asset Dynamic Inflation Fund A-EUR | LU0056886558 | 4,31% | 15,53% | 12,99% | 0,58% | 12,12% | 7,26% |

| Alpen Privatbank Vermögensfonds - Ausgewogen - R | LU0327378542 | 4,31% | 14,77% | 10,71% | 13,11% | 31,73% | 7,46% |

| HanseMerkur Strategie ausgewogen Nachhaltigkeit | DE000A2P0U90 | 4,31% | 12,11% | 8,28% | 9,25% | ||

| Dynamic Global Balance | DE000A0EAWB2 | 4,26% | 13,81% | 9,93% | 11,65% | 25,12% | 7,15% |

| UniInstitutional Stiftungsfonds Nachhaltig | DE000A2DMVH4 | 4,19% | 14,99% | 10,95% | 17,37% | 8,08% | |

| Portfolio Selektion ZKB Oe (R) (T) | AT0000A0M7H0 | 4,18% | 14,37% | 9,77% | 20,69% | 46,29% | 9,11% |

| Invesco Pan European High Income Fund A (quarterly distribution) EUR | LU0243957312 | 4,17% | 8,80% | 4,95% | 11,80% | 34,04% | 7,73% |

| LF - MMT Premium Protect Value Fonds R | LU2265009527 | 4,13% | 9,23% | 6,18% | 7,24% | ||

| Swisscanto (LU) Portfolio Fund Sustainable Balanced (CHF) AA | LU0136171393 | 4,12% | 13,76% | 7,52% | 32,98% | 67,29% | 8,29% |

| MainSky Macro Allocation Fund C | LU0835750265 | 4,12% | 16,76% | 12,01% | 23,55% | 9,07% | |

| framas-Treuhand - Family Office Fund I | LU0950053065 | 4,08% | 12,11% | 9,04% | 21,51% | 40,11% | 7,67% |

| HSBC Select Flexible A | FR0007036926 | 4,06% | 11,98% | 8,22% | 18,72% | 31,08% | 7,18% |

| UBS (Lux) Key Selection SICAV - Global Multi Income (USD) P-acc | LU1224425600 | 4,04% | 18,11% | 13,97% | 11,65% | 7,18% | |

| DB ESG Balanced | LU0240541366 | 3,98% | 12,87% | 9,65% | 17,42% | 35,85% | 7,91% |

| HAL Systematic Multi Asset Balanced RT | DE000A0MVZT6 | 3,97% | 18,06% | 13,57% | 18,20% | 27,42% | 9,09% |

| UniMultiAsset Chance III Nachhaltig | DE000A2PPKB7 | 3,95% | 16,87% | 10,10% | 9,63% | ||

| ODDO BHF Polaris Flexible DRW-EUR | LU0319572730 | 3,91% | 11,81% | 8,29% | 30,33% | 58,82% | 8,50% |

| Eurizon Fund - Active Allocation Z EUR acc | LU0735549858 | 3,90% | 14,78% | 9,68% | 20,34% | 8,31% | |

| BRW Balanced Return Direct | DE000A2H7N99 | 3,90% | 9,71% | 6,07% | 21,15% | 8,52% | |

| Aktiv Strategie IV | DE000A0NAU78 | 3,88% | 17,85% | 14,07% | 11,84% | 23,81% | 9,60% |

| Gutmann Vorsorge Fonds | AT0000856828 | 3,87% | 14,13% | 9,70% | 10,27% | 21,40% | 7,61% |

| Globalance Sokrates Fund B | LU0585393332 | 3,80% | 13,73% | 7,17% | 20,91% | 30,40% | 8,76% |

| Epsilon Fund - Q-Flexible - R EUR acc | LU0365359032 | 3,76% | 10,52% | 5,94% | 22,03% | 8,57% | |

| Amundi Ethik Fonds ausgewogen (T) | AT0000A2GGM5 | 3,69% | 14,88% | 10,15% | 8,06% | ||

| PARIUM Relaxed Fund P | LU0425671327 | 3,62% | 10,94% | 6,81% | 18,48% | 39,05% | 7,62% |

| Generali Investments SICAV - Global Multi Asset Income AY dis | LU1357656278 | 3,62% | 7,83% | 3,02% | 5,34% | 8,49% | |

| UniInstitutional Multi Asset FK | DE000A2H8729 | 3,50% | 14,58% | 10,99% | 22,01% | 7,81% | |

| Westfalicafonds Aktien Renten | DE000A1XDYE4 | 3,44% | 9,85% | 5,99% | 19,60% | 42,81% | 7,70% |

| Vanguard LifeStrategy® 40% Equity UCITS ETF EUR Dist | IE00BMVB5N38 | 3,44% | 15,41% | 10,65% | 8,56% | ||

| ERGO Vermögensmanagement Ausgewogen | DE000A2ARYT8 | 3,42% | 14,45% | 10,34% | 16,40% | 8,17% | |

| Alpen Privatbank Vermögensfonds - Offensiv - R | LU0327378625 | 3,40% | 17,56% | 12,56% | 13,88% | 38,55% | 9,97% |

| Deka-Multi Asset Income CF (A) | DE000DK2J662 | 3,39% | 9,57% | 5,47% | 8,49% | 8,78% | |

| Flossbach von Storch - Multiple Opportunities II - R | LU0952573482 | 3,37% | 12,00% | 8,95% | 21,36% | 68,08% | 8,20% |

| Hypo-Invest | AT0000857511 | 3,36% | 7,52% | 4,72% | 11,84% | 21,75% | 7,84% |

| BNY Mellon Real Return Fund Sterling Income Shares | GB0006780323 | 3,32% | 15,58% | 12,18% | 20,41% | 24,65% | 7,55% |

| Primus | AT0000A054R3 | 3,32% | 13,44% | 9,77% | 19,52% | 39,10% | 8,71% |

| SQUAD - VALUE A | LU0199057307 | 3,29% | 7,93% | 4,73% | 29,91% | 105,81% | 9,70% |

| Eurizon Fund - Azioni Strategia Flessibile - R EUR acc | LU0497415702 | 3,28% | 10,36% | 6,62% | 14,73% | 8,96% | |

| BlackPoint Evolution Fund D | LU2369268854 | 3,27% | 15,47% | 11,95% | 8,88% | ||

| Hypo Vorarlberg Ausgewogen Global A | AT0000814975 | 3,24% | 14,32% | 10,37% | 20,08% | 32,70% | 7,95% |

| Vermögensmandat Strategie Wachstum | DE000A1110F2 | 3,22% | 13,18% | 8,62% | 9,74% | 18,48% | 9,26% |

| Veermaster Flexible Navigation Fund UI P | DE000A2DWUS2 | 3,22% | 10,23% | 5,56% | 18,95% | 9,53% | |

| Schroder ISF Global Multi-Asset Balanced EUR A Acc | LU0776414087 | 3,19% | 12,95% | 7,51% | 19,18% | 19,38% | 8,59% |

| Champions Select Balance LC | DE000DWS2W22 | 3,19% | 16,13% | 11,32% | 22,99% | 9,38% | |

| W&W Vermögensverwaltende Strategie | DE000A1W1PT3 | 3,14% | 15,00% | 10,46% | 24,21% | 22,36% | 9,53% |

| Alpen Privatbank Ausgewogene Strategie (T) | AT0000828553 | 3,09% | 14,10% | 10,71% | 18,18% | 34,43% | 7,35% |

| AVBV 2020 | DE000A0JEPH4 | 3,04% | 10,79% | 6,76% | 12,74% | 11,55% | 8,40% |

| TOP-Investors Global | DE000A0M2JC3 | 3,04% | 12,75% | 9,36% | 15,27% | 37,00% | 9,03% |

| Haspa PB Strategie Wachstum | LU0324035731 | 3,03% | 11,86% | 7,78% | 14,55% | 19,34% | 7,13% |

| Franklin Global Multi-Asset Income Fund A (Acc) EUR | LU0909060385 | 3,00% | 11,66% | 6,60% | 19,09% | 19,87% | 8,22% |

| Eurizon Fund - Active Allocation X EUR acc | LU1769712073 | 2,95% | 14,50% | 9,44% | 20,99% | 8,33% | |

| BRW Balanced Return V | DE000A1T75N3 | 2,93% | 9,06% | 5,48% | 17,48% | 37,87% | 8,46% |

| BW Portfolio 40 | DE000DK094H2 | 2,91% | 12,76% | 8,92% | 22,06% | 34,48% | 7,80% |

| Russell Investment Company plc - Multi-Asset Growth Strategy Euro I A RollUp | IE00B8C33B48 | 2,88% | 15,33% | 10,58% | 17,69% | 34,39% | 9,72% |

| Morgan Stanley Global Balanced Risk Control A | LU0694238501 | 2,82% | 19,18% | 14,83% | 14,38% | 28,00% | 7,56% |

| UBS (CH) Strategy Fund - Balanced (CHF) P | CH0002792122 | 2,82% | 12,33% | 4,57% | 19,18% | 44,05% | 9,53% |

| UBS (Lux) Strategy Fund - Balanced Sustainable (CHF) P-dist | LU0049785107 | 2,76% | 12,06% | 4,37% | 18,41% | 41,62% | 9,52% |

| MARS-5 MultiAsset-INVEST | DE0009774836 | 2,75% | 15,51% | 11,41% | 9,60% | 13,55% | 8,96% |

| HANSApost TriSelect | DE0009770370 | 2,67% | 5,84% | 4,25% | 6,84% | 17,25% | 7,43% |

| Vermögensportfolio Ulm ESG | LU0233541282 | 2,66% | 11,94% | 7,93% | 10,74% | 28,97% | 7,04% |

| DWS Invest ESG Multi Asset Income LD | LU1054320970 | 2,65% | 10,98% | 6,17% | 15,19% | 30,70% | 8,33% |

| Vermögenspooling Fonds Nr. 3 | DE000A14N9D3 | 2,62% | 10,07% | 6,11% | 15,70% | 7,42% | |

| Exklusiv Portfolio SICAV - Chance R | LU0329749708 | 2,60% | 12,42% | 9,06% | 20,45% | 42,88% | 8,87% |

| KIRIX Substitution Plus | DE000A12BSV6 | 2,58% | 9,00% | 5,76% | 18,92% | 8,29% | |

| Ethna SICAV - DYNAMISCH A | LU1546162501 | 2,56% | 15,83% | 10,51% | 16,67% | 7,50% | |

| di exclusive Linus global | DE000A2DKRQ7 | 2,52% | 12,18% | 11,40% | 28,58% | 9,59% | |

| UBS (Lux) Strategy Xtra Sicav - Balanced (CHF) P-acc | LU0186860077 | 2,51% | 10,40% | 3,83% | 18,00% | 35,10% | 7,53% |

| Baumann and Partners - GANESHA A | LU0802954999 | 2,46% | 4,06% | 2,80% | 16,37% | 20,41% | 7,66% |

| Allianz Strategy 50 - CT - EUR | LU0352312184 | 2,44% | 15,19% | 9,64% | 13,52% | 47,10% | 8,90% |

| Private Banking exklusiv EUR R01 | AT0000A0T6K9 | 2,38% | 15,18% | 9,94% | 17,11% | 34,51% | 8,73% |

| Nachhaltigkeitsfonds - ausgewogen B | DE000A2DHTD7 | 2,37% | 9,85% | 6,38% | 11,29% | 7,78% | |

| U ASSET ALLOCATION - Dynamic GBP AC GBP | LU2262128841 | 2,37% | 18,26% | 14,76% | 9,90% | ||

| VAB Strategie Basis | DE000A0M6MQ8 | 2,34% | 20,30% | 12,72% | 1,51% | 0,39% | 8,19% |

| LLB Strategie Rendite ESG+ (CHF) | LI0595164133 | 2,31% | 10,48% | 3,56% | 7,53% | ||

| Raiffeisen-Nachhaltigkeit-Mix R (A) | AT0000859517 | 2,30% | 15,96% | 11,07% | 18,32% | 56,15% | 8,96% |

| LUX-PORTFOLIO BALANCED | LU0091958230 | 2,28% | 14,73% | 10,62% | 11,53% | 31,88% | 7,18% |

| Candriam L Multi-Asset Income & Growth - C Part (C) | LU1207305258 | 2,28% | 11,74% | 7,84% | 22,55% | 7,54% | |

| SK Rhein Neckar Nord Nachhaltigkeit Invest | DE000DK0V6R3 | 2,28% | 15,76% | 11,28% | 8,98% | ||

| Deutsche Postbank Europafonds Plus | DE0009797712 | 2,26% | 11,99% | 8,27% | 12,25% | 27,73% | 8,12% |

| Allianz Strategy Select 50 - WT2 - EUR | LU1462180164 | 2,23% | 14,65% | 9,50% | 19,42% | 9,45% | |

| Oddo ProActif Europe CR | FR0010109165 | 2,22% | 3,22% | 0,58% | 1,48% | 15,79% | 7,57% |

| PrivatFonds: Flexibel pro | DE000A0RPAL7 | 2,21% | 15,55% | 11,44% | 21,86% | 23,79% | 7,46% |

| BlackRock ESG Multi-Asset Moderate Portfolio UCITS ETF EUR (Acc) | IE00BLLZQS08 | 2,19% | 15,56% | 10,76% | 9,67% | ||

| Kathrein Fund - NDR Active Allocation (TTH) IT | AT0000A1DJX5 | 2,18% | 18,28% | 13,56% | 19,15% | 8,90% | |

| UBS (Lux) Strategy Xtra Sicav - Yield (CHF) P-acc | LU0186859905 | 2,11% | 9,73% | 2,98% | 13,83% | 24,38% | 7,00% |

| Morgan Stanley Global Balanced Sustainable Fund A | LU2135297146 | 1,98% | 15,41% | 10,85% | 7,25% | ||

| PB Wels Portfolio Management SOLIDE T | AT0000PBRBW5 | 1,94% | 13,29% | 8,79% | 8,64% | 7,74% | |

| UniMultiAsset: Chance II | DE000A2N7VZ5 | 1,91% | 15,17% | 10,08% | 23,50% | 8,32% | |

| PTAM Defensiv Portfolio P | LU0260464168 | 1,87% | 14,94% | 11,62% | 20,11% | 40,45% | 8,21% |

| BSF - Global Balance B | LU0338100323 | 1,83% | 10,62% | 7,74% | 18,79% | 32,02% | 8,12% |

| Baloise-International DWS | DE0008474297 | 1,83% | 15,72% | 11,49% | 18,25% | 39,88% | 8,92% |

| U ASSET ALLOCATION - Dynamic Asian Biased USD AD USD | LU2262129906 | 1,82% | 17,99% | 15,30% | 8,01% | ||

| UBS (Lux) Key Selection Sicav - European Growth and Income (EUR) P-8%-mdist | LU1038902414 | 1,80% | 10,13% | 7,25% | 15,92% | 37,21% | 8,21% |

| Mediolanum Best Brands - Mediolanum Invesco Balanced Risk Coupon Selection L - A | IE00B91SH939 | 1,75% | 14,37% | 9,52% | 10,76% | 18,41% | 9,03% |

| LBBW Multi Global Plus Nachhaltigkeit R | DE000A2DHTQ9 | 1,73% | 12,50% | 8,35% | 15,53% | 9,51% | |

| AXA World Funds - Global Income Generation A qDis fl EUR | LU0960400322 | 1,65% | 13,74% | 8,95% | 9,18% | 7,09% | |

| KiRac Stiftungsfonds Omega | DE000A2QCXW2 | 1,63% | 13,34% | 9,45% | 7,45% | ||

| Hartz Regehr Substanz-Fonds A | DE000A0NEBQ7 | 1,63% | 12,05% | 9,21% | 19,35% | 57,19% | 9,89% |

| FutureFolio 55 P € dist | DE000A2N67J9 | 1,59% | 14,02% | 9,51% | 16,99% | 8,11% | |

| SOLVECON Global Opportunities Fund A | LU1751487106 | 1,58% | 35,78% | 8,60% | |||

| LIGA Portfolio Concept A | LU1172417856 | 1,56% | 14,62% | 10,64% | 3,09% | 7,89% | |

| Stiftungsfonds ESG Global S | DE000DK0LJZ7 | 1,56% | 13,17% | 10,16% | 8,18% | ||

| UBS (D) Euro Aktiv - Balance | DE000A0M6TT7 | 1,56% | 10,03% | 6,07% | 38,15% | 9,14% | |

| SIP Balanced | LU0346416414 | 1,47% | 13,72% | 9,74% | 8,53% | 17,27% | 8,46% |

| DEGEF-Bayer-Mitarbeiter-Fonds | DE0008492596 | 1,46% | 8,22% | 4,15% | 18,92% | 45,60% | 9,05% |

| Bethmann Vermögensverwaltung Defensiv Ausgewogen Dis | LU1431858262 | 1,43% | 11,65% | 7,33% | 11,08% | 7,24% | |

| antea Strategie II | DE000ANTE026 | 1,39% | 9,97% | 8,39% | 13,26% | 53,48% | 8,32% |

| VanEck Multi-Asset Conservative Allocation UCITS ETF | NL0009272764 | 1,36% | 12,52% | 7,12% | 11,94% | 35,84% | 8,11% |

| U ASSET ALLOCATION - Balanced GBP AC GBP | LU2262125821 | 1,35% | 16,30% | 12,82% | 8,51% | ||

| Invest Evolution | LU1608590672 | 1,34% | 10,16% | 6,57% | 9,79% | 7,19% | |

| VV-Strategie - Ausgewogen ESG T1 | LU0336101570 | 1,30% | 10,87% | 7,52% | 13,60% | 22,50% | 7,06% |

| DPAM B Balanced Strategy A EUR | BE6227493937 | 1,29% | 15,87% | 11,08% | 23,49% | 57,18% | 9,05% |

| PrivatFonds: Nachhaltig | LU1900195949 | 1,28% | 15,18% | 9,81% | 11,07% | 7,30% | |

| ODDO BHF Flexibles Individual Portfolio FT | LU0325203320 | 1,26% | 10,52% | 6,87% | 25,99% | 56,30% | 8,61% |

| ARBOR INVEST - VERMÖGENSVERWALTUNGSFONDS P | LU0324372738 | 1,20% | 14,71% | 11,18% | 26,88% | 41,81% | 8,66% |

| Frankfurter Sparkasse Nachhaltigkeit Invest Flexibel CF (A) | DE000DK0LNA2 | 1,19% | 14,62% | 9,69% | 15,43% | 9,01% | |

| Schelhammer Capital - Ausgewogenes Portfolio T EUR | AT0000A188W9 | 1,18% | 12,41% | 8,71% | 13,40% | 7,14% | |

| Canada Life Fidelity Balance IR | IE00B3K7VR57 | 1,17% | 12,03% | 7,60% | 10,90% | 37,99% | 9,18% |

| Amundi Total Return A EUR (ND) | LU0209095446 | 1,13% | 11,09% | 6,76% | 12,09% | 13,72% | 7,21% |

| DZPB Vario - Rendite Plus 16 | LU0085086071 | 1,01% | 6,70% | 2,60% | 6,42% | 17,59% | 7,76% |

| UniZukunft Klima A | DE000A2QFXR5 | 0,97% | 15,78% | 10,93% | 8,90% | ||

| C-QUADRAT ARTS Total Return ESG (T) | AT0000618137 | 0,96% | 33,86% | 29,42% | 34,67% | 21,87% | 9,90% |

| Mandarine Funds - Mandarine Multi-Assets R EUR | LU0982863069 | 0,95% | 5,83% | 2,05% | 9,21% | ||

| SMS Ars multiplex | DE000A1CXUY2 | 0,90% | 11,41% | 7,41% | 16,19% | 35,36% | 7,81% |

| Swisscanto (LU) Portfolio Fund Sustainable Balanced (EUR) AA | LU0208341965 | 0,90% | 15,19% | 10,94% | 25,90% | 52,10% | 9,38% |

| UniMultiAsset Exklusiv Nachhaltig | DE000A2PPJ80 | 0,88% | 14,19% | 10,02% | 8,31% | ||

| UniInvest Nachhaltig 2 | LU2368864844 | 0,86% | 15,85% | 10,47% | 8,84% | ||

| Echiquier Arty SRI A | FR0010611293 | 0,85% | 7,28% | 3,45% | 11,86% | 24,35% | 7,04% |

| SUPERIOR 2 - Ethik Mix A | AT0000855614 | 0,85% | 15,50% | 11,07% | 11,81% | 28,46% | 8,83% |

| HSBC Mix Equilibre A | FR0007003868 | 0,83% | 11,54% | 8,22% | 11,21% | 32,71% | 7,35% |

| VR Premium Fonds - Ambitio | LU0392135595 | 0,82% | 12,33% | 8,32% | 15,89% | 34,81% | 7,23% |

| U ASSET ALLOCATION - Balanced CHF AC CHF | LU2262125318 | 0,82% | 13,27% | 7,27% | 7,49% | ||

| apo TopSelect Balance A | DE000A1W9AD2 | 0,77% | 14,24% | 9,48% | 9,98% | 8,41% | |

| UBS (CH) Strategy Fund - Yield (CHF) P | CH0002792114 | 0,73% | 10,25% | 2,63% | 12,90% | 30,50% | 8,65% |

| HanseMerkur Strategie sicherheitsbewusst | DE000A1JGB13 | 0,72% | 10,47% | 6,23% | 9,76% | 18,18% | 7,12% |

| UBS (Lux) Key Selection Sicav - Global Allocation (USD) Pacc | LU0197216392 | 0,71% | 19,42% | 15,44% | 15,35% | 42,16% | 7,97% |

| MEAG FlexConcept - Wachstum | LU0887262516 | 0,67% | 11,42% | 6,02% | 2,52% | 27,28% | 8,97% |

| Deka-PortfolioSelect moderat | DE000A2N44C3 | 0,56% | 10,59% | 6,85% | 5,63% | 7,11% | |

| HSBC Strategie Balanced AC | DE000A0NA4H5 | 0,53% | 11,97% | 8,37% | 10,79% | 29,43% | 8,14% |

| U ASSET ALLOCATION - Open Sea USD AC USD | LU2262132280 | 0,47% | 17,30% | 12,50% | 9,74% | ||

| Swiss Life Funds (LUX) Multi Asset Balanced (EUR) - R Cap | LU0367332680 | 0,45% | 11,21% | 7,53% | 11,85% | 28,38% | 8,48% |

| UniMultiAsset Chance II Nachhaltig | DE000A2PPKA9 | 0,40% | 13,30% | 6,87% | 8,93% | ||

| DPAM B Balanced Low Strategy A EUR | BE6264045764 | 0,32% | 13,46% | 8,74% | 35,29% | 7,92% | |

| Amundi GF Vorsorge Aktiv A (D) | AT0000812698 | 0,29% | 12,70% | 7,93% | 12,63% | 34,11% | 7,00% |

| DWS Fixed Maturity ESG Multi Asset Defensive 2026 | LU2079058876 | 0,28% | 13,21% | 9,41% | 7,25% | ||

| Amundi Öko Sozial Mix ausgewogen - A EUR | AT0000818885 | 0,28% | 15,94% | 11,64% | 14,06% | 31,22% | 8,20% |

| db PrivatMandat Comfort - Balance ESG | LU0193173159 | 0,21% | 11,10% | 6,01% | 20,08% | 33,35% | 8,98% |

| UBS (Lux) Strategy Fund - Yield Sustainable (CHF) P-dist | LU0033035352 | 0,19% | 10,03% | 2,49% | 11,84% | 28,29% | 8,75% |

| Multipartner SICAV Allround QUADInvest Fund C | LU0871827035 | 0,17% | 2,84% | -0,96% | 14,28% | 36,00% | 9,96% |

| Private Banking Vermögensportfolio Nachhaltig 70 Klasse 1 EUR thesaurierend | DE000A0M03Y9 | 0,15% | 12,42% | 8,63% | 13,92% | 30,52% | 7,49% |

| Smart & Fair-Fonds | DE000A2H7NX5 | 0,14% | 9,31% | 5,39% | 7,10% | 7,28% | |

| BL - Emerging Markets B | LU0309192036 | 0,13% | 10,07% | 8,06% | 1,79% | 16,35% | 9,69% |

| Eurizon Fund - Active Allocation - R EUR acc | LU1092477741 | -0,02% | 13,34% | 8,44% | 13,52% | 8,30% | |

| Bethmann Nachhaltigkeit Ausgewogen A | DE000DWS08X0 | -0,02% | 14,31% | 11,01% | 25,12% | 58,65% | 9,11% |

| LGT Alpha Indexing Fund (CHF) B | LI0101102999 | -0,04% | 11,60% | 3,98% | 15,92% | 46,10% | 8,83% |

| RB LuxTopic - Systematic Return A | LU1181278976 | -0,14% | 1,10% | -2,71% | 30,07% | 7,71% | |

| KCD-Union Nachhaltig MIX | DE0009750000 | -0,18% | 11,24% | 7,02% | 3,30% | 19,04% | 8,20% |

| Mediolanum Best Brands - New Opportunities Collection L - A | IE00B6SBTN25 | -0,21% | 14,03% | 9,47% | 16,81% | 32,01% | 8,61% |

| Hartz Regehr Vermögens-Fonds A | DE000A0MYEJ6 | -0,21% | 10,92% | 7,92% | 12,99% | 40,92% | 8,89% |

| VermögensManagement Einkommen Europa -A- EUR | LU0322926154 | -0,22% | 11,37% | 6,60% | 4,78% | 9,02% | 8,09% |

| Multi Asset Global Vision | DE000A1CXUU0 | -0,28% | 16,16% | 11,05% | 16,42% | 31,12% | 8,78% |

| Swisscanto (LU) Portfolio Fund Sustainable Protection AT | LU0562145853 | -0,29% | 12,07% | 4,48% | 7,18% | 13,36% | 8,58% |

| DWS ESG Balance Portfolio E | DE0008471301 | -0,32% | 13,90% | 9,70% | 11,70% | 27,39% | 8,18% |

| PineBridge Global Dynamic Asset Allocation Fund A USD Acc | IE0034235295 | -0,35% | 17,65% | 13,44% | 20,60% | 37,81% | 7,10% |

| Schroder ISF Sustainable Multi-Asset Income A Dist EUR | LU2097343540 | -0,39% | 11,06% | 6,60% | 7,09% | ||

| Triodos Impact Mixed Fund Neutral R-dis | LU0504302604 | -0,39% | 12,83% | 8,51% | 8,90% | 33,34% | 9,45% |

| A&F Strategiedepot Moderat Multi Manager Ökologisch-Ethisch A | LU1951933719 | -0,42% | 14,74% | 10,43% | 13,32% | 8,38% | |

| KEPLER Mix Solide (A) | AT0000825468 | -0,46% | 11,55% | 6,91% | 4,10% | 16,11% | 7,40% |

| DWS Vermögensmandat-Balance LD | LU0309483435 | -0,49% | 13,86% | 9,76% | 13,93% | 25,67% | 7,60% |

| Mediolanum Best Brands - Coupon Strategy Collection L - A | IE00B3WM4L37 | -0,49% | 13,57% | 9,14% | 10,22% | 20,31% | 8,64% |

| RB LuxTopic - Flex A | LU0191701282 | -0,50% | 7,44% | 5,40% | 69,30% | 117,74% | 9,25% |

| GIR Portfolio 50 - Chance | IE00BWZMZM17 | -0,50% | 15,94% | 11,30% | 13,85% | 9,92% | |

| Convictions Premium Anteil A | FR0010687038 | -0,53% | 10,51% | 6,93% | 8,05% | 13,75% | 7,38% |

| S4A Systematic Absolute Return R | DE000A2QCYE8 | -0,54% | 7,97% | 6,31% | 8,19% | ||

| DEVK Anlagekonzept Rendite | DE000A2JN5D0 | -0,56% | 10,70% | 6,87% | 8,55% | 7,62% | |

| Lux-Portfolio Global Flexible cap | LU1283290481 | -0,63% | 15,05% | 9,31% | 16,65% | 8,61% | |

| Nordlux Pro Fondsmanagement - StiftungsPartner A Cap | LU1297767904 | -0,75% | 12,21% | 8,08% | 5,26% | 8,05% | |

| Top Strategie Zukunft EUR R01 T | AT0000A0T6F9 | -0,76% | 13,31% | 9,18% | 14,87% | 30,46% | 7,74% |

| I-AM AllStars Multi Asset T EUR | AT0000618731 | -0,82% | 16,12% | 13,57% | 9,28% | 22,79% | 9,87% |

| smart-invest - Helios AR A | LU0227003679 | -0,83% | 15,11% | 12,20% | 15,11% | 18,02% | 7,34% |

| M&G (Lux) Income Allocation Fund EUR A Dist | LU1582984909 | -0,84% | 9,74% | 4,94% | 6,11% | 18,92% | 8,08% |

| Starmix Konservativ A | AT0000636485 | -0,85% | 10,85% | 6,37% | 4,98% | 20,38% | 7,38% |

| Guliver Demografie Sicherheit | LU0299704329 | -0,88% | 14,60% | 8,93% | 5,56% | 23,74% | 9,09% |

| IP White T | LU1144474043 | -0,89% | 15,27% | 14,45% | 17,14% | 9,03% | |

| Rivertree Fd - Strategic Balanced F EUR Acc | LU1105481094 | -1,01% | 14,19% | 10,10% | 18,80% | 34,74% | 9,25% |

| Swisscanto (LU) Portfolio Fund Responsible Select (EUR) AA | LU0112799290 | -1,03% | 11,20% | 7,01% | 8,10% | 21,04% | 7,25% |

| Archimedes Invest Plus Fund - CHF | LI0023457893 | -1,07% | 10,39% | 1,94% | 10,02% | 16,14% | 9,13% |

| PRIME VALUES Growth (EUR) A | AT0000803689 | -1,12% | 12,54% | 8,26% | 13,09% | 28,57% | 7,91% |

| U ASSET ALLOCATION - Balanced EUR MC | LU0860987923 | -1,15% | 12,08% | 8,81% | 16,45% | 28,02% | 7,39% |

| Argentum Stabilitäts-Portfolio | DE000A1C6992 | -1,19% | 11,00% | 6,84% | 11,12% | 21,15% | 8,58% |

| Vermögensmandat Strategie Ertrag | DE000A1110D7 | -1,21% | 10,62% | 6,17% | 2,67% | 10,02% | 8,00% |

| FOS Strategie-Fonds Nr. 1 | DE000DWS0TS9 | -1,25% | 14,68% | 10,28% | 23,76% | 49,83% | 8,97% |

| AMUNDI FUNDS GLOBAL MULTI-ASSET - A EUR (C) | LU1883327816 | -1,26% | 12,89% | 8,37% | 19,00% | 43,42% | 9,84% |

| WorldConcept (VT-Ausland) | AT0000A2CN87 | -1,29% | 17,01% | 13,96% | 9,36% | ||

| SK Invest - Flexibel A | LU0328547376 | -1,33% | 10,72% | 7,57% | 22,59% | 57,04% | 8,29% |

| WSTV ESPA Traditionell T | AT0000647599 | -1,39% | 10,19% | 6,20% | 13,02% | 30,75% | 7,19% |

| UniInvest Nachhaltig 1 | LU2357623821 | -1,40% | 12,72% | 7,74% | 7,48% | ||

| Fidelity Funds - European Multi Asset Income Fund A-Euro | LU0052588471 | -1,42% | 8,63% | 4,44% | 6,23% | 25,17% | 7,67% |

| LöwenPlus Rendite | LU1856121394 | -1,47% | 10,25% | 6,03% | 4,84% | 7,27% | |

| Kompass Strategie Fokus Moderat R | DE000A2P3XA1 | -1,47% | 12,85% | 8,40% | 7,42% | ||

| Waverton Multi-Asset Income Fund B GBP Income | IE00BQ1KPP02 | -1,47% | 13,26% | 10,30% | 16,22% | 31,94% | 8,57% |

| Berenberg Variato R | LU1878856043 | -1,58% | 15,12% | 10,95% | 26,14% | 8,57% | |

| Mediolanum Best Brands - European Coupon Strategy Collection L Class A Units | IE00BYVXS238 | -1,60% | 10,28% | 5,78% | 7,18% | 8,99% | |

| FOS Rendite und Nachhaltigkeit A | DE000DWS0XF8 | -1,68% | 10,10% | 6,34% | 12,09% | 25,25% | 7,06% |

| PRO change AMI I (a) | DE000A1WZ0P5 | -1,80% | 12,67% | 8,86% | 9,28% | 25,99% | 7,45% |

| 4 Jahreszeiten P | DE000A2N68F5 | -1,81% | 17,13% | 11,36% | 15,69% | 8,15% | |

| StarCapital Multi Income A | LU0256567925 | -1,82% | 12,71% | 9,38% | -1,04% | 11,01% | 7,53% |

| AMUNDI FUNDS MULTI-ASSET SUSTAINABLE FUTURE A EUR Acc | LU1941681956 | -1,91% | 11,18% | 6,88% | 5,72% | 7,32% | |

| HSBC Responsible Investment Funds - SRI Balanced AC | FR0013443181 | -1,91% | 10,38% | 5,90% | 12,25% | 9,58% | |

| Monetalis Global Selection | LI0364853700 | -1,92% | 21,79% | 15,86% | 24,52% | 9,43% | |

| ICP Fonds - Global Star Select - A | LU0313749870 | -1,94% | 22,36% | 18,02% | 15,86% | 9,18% | 9,43% |

| DPAM L Balanced Conservative Sustainable A | LU1499202692 | -1,98% | 11,35% | 6,57% | 14,34% | 8,57% | |

| DB Strategic Income Allocation EUR (SIA) Balanced Plus LBD | LU2330518965 | -2,01% | 11,45% | 8,52% | 7,48% | ||

| AXA World Funds - Global Convertibles A Cap USD (Hedged) pf | LU0545090499 | -2,01% | 16,05% | 13,12% | 16,66% | 56,29% | 8,01% |

| BL - Global Flexible € A | LU0211339816 | -2,05% | 13,02% | 8,02% | 12,54% | 52,26% | 9,07% |

| U ASSET ALLOCATION - Dynamic CHF AC CHF | LU2262128338 | -2,06% | 13,93% | 8,41% | 9,03% | ||

| SICAV BCEE LUX-PENSION 50% | LU0151357943 | -2,07% | 6,84% | 3,29% | 2,44% | 22,54% | 8,54% |

| PTAM Balanced Portfolio A | LU0084489227 | -2,08% | 12,59% | 8,69% | 18,69% | 35,95% | 7,53% |

| DPAM B Balanced Flexible B EUR | BE0940785794 | -2,09% | 13,11% | 7,71% | 35,73% | 9,82% | |

| M&G (Lux) Optimal Income Fund - EUR A Dist | LU1670724456 | -2,10% | 6,16% | 0,64% | 0,86% | 8,63% | |

| JPMorgan IF - Global Balanced Fund A (acc) - EUR | LU0070212591 | -2,10% | 15,38% | 10,07% | 17,56% | 37,46% | 8,93% |

| RT OPTIMUM §14 Fonds (A) | AT0000858923 | -2,17% | 9,68% | 5,56% | 9,19% | 27,84% | 8,15% |

| HAL Nachhaltigkeitsfonds Stiftungen IA | DE000A0JELN1 | -2,20% | 7,60% | 4,04% | 4,39% | 10,58% | 7,31% |

| Millennium Global Opportunities P | LU0140354944 | -2,29% | 21,39% | 14,42% | 18,03% | 39,40% | 9,56% |

| Bethmann Nachhaltigkeit Defensiv Ausgewogen A | DE000DWS2GK9 | -2,32% | 12,31% | 8,70% | 14,00% | 7,61% | |

| HANSApost Balanced | DE0008006263 | -2,39% | 7,89% | 4,51% | 0,32% | -1,00% | 7,21% |

| CSR Ertrag Plus | DE000A2P37P4 | -2,41% | 8,48% | 5,05% | 1,03% | 7,04% | 7,29% |

| Warburg Portfolio Konservativ | DE000A12BTP6 | -2,45% | 11,14% | 6,88% | 8,58% | 7,01% | |

| Canada Life Fidelity Balance IR II | IE00B67LMM38 | -2,51% | 10,41% | 5,83% | 4,28% | 27,65% | 8,68% |

| Multi Manager Access II - US Multi Credit I-Ukdist (GBP hedged) | LU1003004865 | -2,55% | 12,59% | 8,66% | -1,19% | -12,65% | 8,77% |

| Merck Finck Stiftungsfonds Balanced UI | DE000A1C5D88 | -2,68% | 14,29% | 10,09% | 15,81% | 27,17% | 9,94% |

| SPKED Invest | DE000A2N6709 | -2,71% | 7,21% | 3,23% | 5,24% | 7,52% | |

| AXA World Funds - Global Optimal Income A Capitalisation EUR | LU0465917044 | -2,80% | 18,64% | 13,01% | 8,94% | 40,76% | 9,27% |

| AMUNDI FUNDS GLOBAL MULTI-ASSET CONSERVATIVE - A EUR (C) | LU1883329432 | -2,82% | 9,44% | 5,00% | 7,98% | 25,84% | 7,49% |

| Pax Nachhaltig Global Fonds I | DE000A12BTY8 | -2,85% | 11,60% | 6,66% | 3,84% | 7,93% | |

| UBS (Lux) Strategy Xtra Sicav - Balanced (EUR) P-acc | LU0186859491 | -2,86% | 9,40% | 5,98% | 10,21% | 20,10% | 7,38% |

| RM Vermögensstrategie Nachhaltigkeit | DE000A2PND54 | -2,86% | 10,40% | 6,50% | 8,31% | ||

| Substanz & Nachhaltigkeit Global A Euro ausschüttend | DE000A2P1RD1 | -2,86% | 11,56% | 7,10% | 8,97% | ||

| BlackRock Global Funds - ESG Multi-Asset Fund A2 EUR | LU0093503497 | -2,93% | 12,27% | 7,41% | 23,12% | 44,16% | 8,94% |

| Amundi Patrimoine (C) | FR0011199371 | -2,97% | 13,20% | 8,24% | 10,37% | 13,78% | 9,31% |

| Candriam Sustainable Medium C | BE0159411405 | -3,06% | 12,61% | 8,07% | 15,29% | 33,21% | 8,31% |

| Multi Asset Value Invest | DE000A0M7WM4 | -3,06% | 10,23% | 6,05% | 9,48% | 21,39% | 8,37% |

| FIVV-MIC-Mandat-Offensiv | DE0009790865 | -3,07% | 15,08% | 11,26% | 10,97% | 64,26% | 9,43% |

| Warburg Portfolio Flexibel T | DE000A0NAUV5 | -3,10% | 11,73% | 7,57% | 8,80% | 25,97% | 7,49% |

| Allianz Better World Defensive AT (EUR) | LU2364420716 | -3,15% | 15,32% | 10,83% | 8,72% | ||

| DBC Basic Return | DE000A0M6MR6 | -3,17% | 8,32% | 5,03% | 6,34% | 25,90% | 7,47% |

| FBG Balanced Sustainable PA | DE000A0M2QS4 | -3,25% | 8,84% | 4,83% | 9,06% | 15,45% | 9,65% |

| KSK Tübingen Invest Nachhaltigkeit | DE000A2P0RC5 | -3,28% | 9,01% | 5,15% | 7,73% | ||

| UniInstitutional Kommunalfonds Nachhaltig | DE000A2H9AZ3 | -3,33% | 8,12% | 4,20% | 0,36% | 7,97% | |

| U ASSET ALLOCATION - Dynamic EUR AC EUR | LU2262129492 | -3,34% | 13,74% | 10,42% | 9,86% | ||

| avant-garde capital Opportunities Fund S | DE000A2N82D1 | -3,49% | 21,71% | 18,86% | 10,25% | 9,75% | |

| Sustainable Alpha Fund - (R) (T) | AT0000A1XCH1 | -3,56% | 7,01% | 3,27% | 19,01% | 8,24% | |

| Jyske Invest Stable Strategy CL Euro thes | DK0016262058 | -3,63% | 10,48% | 6,13% | 1,84% | 13,12% | 8,04% |

| HAL Systematic Multi Asset Conservative RT | DE000A0MVZV2 | -3,66% | 11,59% | 7,38% | 1,84% | 2,30% | 7,53% |

| Schoellerbank Global Balanced Plus A | AT0000A23SX1 | -3,70% | 11,04% | 6,68% | 4,08% | 7,98% | |

| LBBW Multi Global R | DE0009766881 | -3,72% | 8,81% | 4,72% | 5,59% | 15,00% | 9,32% |

| Eurizon Fund - Bond Flexible - Z EUR acc | LU1090960326 | -3,75% | 7,38% | 1,98% | -0,77% | 7,53% | |

| BGF ESG Global Conservative Income Fund A2 EUR | LU1845136925 | -3,77% | 9,06% | 4,18% | 3,68% | 7,21% | |

| UBS (Lux) Strategy Fund - Balanced Sustainable (EUR) P-dist | LU0049785362 | -3,88% | 11,13% | 7,05% | 8,69% | 23,28% | 9,63% |

| Swiss Life Funds (LUX) Multi Asset Moderate (EUR) R - Cap | LU0367327417 | -3,94% | 8,54% | 4,58% | 1,53% | 14,78% | 7,67% |

| Vermögensmandat Strategie Stabil | DE000A1110E5 | -3,95% | 8,78% | 4,45% | -2,85% | 3,42% | 7,12% |

| UBS (CH) Strategy Fund - Balanced (EUR) P | CH0000474541 | -4,00% | 11,11% | 7,08% | 8,62% | 24,39% | 9,70% |

| AXA World Funds - ACT Multi Asset Optimal Impact A Cap EUR | LU2080768091 | -4,10% | 14,75% | 8,69% | 9,31% | ||

| Klassik Nachhaltigkeit Mix R A | AT0000961081 | -4,13% | 14,20% | 9,32% | 8,83% | 33,48% | 9,60% |

| Vanguard LifeStrategy® 20% Equity UCITS ETF EUR Dist | IE00BMVB5L14 | -4,16% | 10,71% | 6,02% | 7,74% | ||

| Multi Flex+ | DE000A2JQH06 | -4,18% | 15,46% | 11,99% | 12,33% | 7,23% | |

| RM Select Invest Global | DE000A0MP243 | -4,21% | 12,64% | 9,68% | 9,32% | 44,89% | 7,30% |

| UniMultiAsset Chance I Nachhaltig | DE000A2PPJ98 | -4,22% | 10,23% | 4,01% | 8,15% | ||

| Bethmann Stiftungsfonds 2 I | DE000A2QCYH1 | -4,24% | 9,22% | 5,65% | 7,21% | ||

| Sparkasse Passau Drei-Flüsse Invest | DE000A2P0RD3 | -4,24% | 7,90% | 4,74% | 8,66% | ||

| Dynamik Ertrag | AT0000A10C72 | -4,42% | 10,15% | 5,52% | -3,36% | 5,98% | 7,65% |

| Migros Bank (Lux) Fonds 40 (EUR) A | LU0261662844 | -4,43% | 8,07% | 3,93% | 1,23% | 17,26% | 9,05% |

| Eurizon Fund - Bond Flexible - X EUR acc | LU1769712313 | -4,48% | 7,10% | 1,75% | -1,67% | 7,53% | |

| M&G (Lux) Investment Funds 1 - M&G (Lux) Sustainable Allocation Fund A EUR Acc | LU1900799617 | -4,59% | 8,01% | 3,23% | 6,16% | 9,17% | |

| UniRak Nachhaltig Konservativ A | LU1572731245 | -4,62% | 13,45% | 9,41% | 5,58% | 8,34% | |

| Julius Baer Germany - Focus Fund Income I | DE000A2JF7X4 | -4,67% | 11,62% | 8,06% | 3,46% | 9,43% | |

| Rivertree Fd - Strategic Defensive F EUR Acc | LU1105480286 | -4,86% | 9,77% | 6,10% | 3,96% | 13,50% | 7,36% |

| 3 Banken Mensch & Umwelt Mischfonds R | AT0000A23YG4 | -4,87% | 12,02% | 6,84% | 11,42% | 9,37% | |

| Schön & Co Nachhaltigkeitsfonds | DE000A12BU09 | -4,89% | 4,97% | 0,82% | 9,86% | ||

| Volksbank Kraichgau Fonds - Nachhaltigkeit - R | LU1530784245 | -4,91% | 8,83% | 5,57% | 14,57% | 8,19% | |

| UniRak Konservativ A | DE000A1C81C0 | -4,93% | 13,87% | 9,96% | 3,89% | 21,46% | 8,52% |

| AXA World Funds - Optimal Income A Dis gr EUR pf | LU0179866354 | -4,93% | 6,92% | 1,77% | 6,66% | 27,02% | 8,91% |

| apo TopSelect Stabilität A | DE000A1W9AC4 | -4,94% | 11,30% | 6,51% | 0,23% | 7,51% | |

| JSS Sustainable Multi Asset - Thematic Balanced (EUR) P EUR dist | LU0058893917 | -4,94% | 15,62% | 11,31% | 7,72% | 30,64% | 9,73% |

| VermögensManagement Wachstumsländer Balance - P - EUR | LU1717021353 | -5,03% | 14,38% | 11,87% | 5,51% | 8,25% | |

| SVA-Strategiefonds | LI0028487382 | -5,08% | 13,52% | 9,23% | 48,64% | 94,58% | 8,32% |

| 3ik-Strategiefonds I Class I | DE000A1H44G8 | -5,15% | 10,12% | 6,29% | 3,61% | -2,84% | 7,33% |

| HSBC Responsible Investment Funds - SRI Moderate AC | FR0013443132 | -5,19% | 8,67% | 4,31% | 3,42% | 7,95% | |

| Pegasos - SFC Global Markets B | LU0355736231 | -5,21% | 13,64% | 8,04% | 5,10% | 21,20% | 7,76% |

| Berenberg Multi Asset Balanced R A | DE000A0MWKF5 | -5,27% | 12,20% | 8,41% | 22,83% | 36,80% | 9,27% |

| BayernInvest ESG Multi Asset Defensive AL | LU0828716919 | -5,33% | 9,95% | 4,98% | 3,08% | 15,03% | 8,04% |

| Canada Life Fidelity Defensiv IR | IE00B3K7VS64 | -5,36% | 9,42% | 4,76% | -0,95% | 16,82% | 8,30% |

| MontLake Crabel Gemini UCITS Fund EUR Retail | IE00BKPFDH72 | -5,52% | 1,88% | -1,13% | 7,41% | ||

| UBS (Lux) Strategy Fund - Yield Sustainable (EUR) P-dist | LU0033040600 | -5,57% | 9,05% | 5,19% | 3,08% | 12,20% | 8,20% |

| LGT Sustainable Strategy 4 Years (EUR) B | LI0008232220 | -5,69% | 8,50% | 3,97% | 7,16% | 23,86% | 8,82% |

| Zindstein Vermögens-Mandat P | DE000A2PR0K4 | -5,75% | 5,64% | 6,21% | 9,61% | ||

| YOU INVEST GREEN active A | AT0000A11F78 | -5,76% | 9,24% | 5,05% | 4,05% | 12,20% | 7,73% |

| Fundsolution Deutsche Aktien System - A | LU1687254851 | -5,76% | 8,54% | 6,88% | -6,35% | 9,82% | |

| Bantleon Select Sicav - Bantleon Global Multi Asset PA EUR | LU0634998545 | -5,82% | 12,37% | 7,73% | 2,72% | 6,32% | 7,71% |

| Sarasin-FairInvest-Universal-Fonds A | DE000A0MQR01 | -5,85% | 7,93% | 3,31% | -2,44% | 7,02% | 7,98% |

| BNP Paribas Sustainable Multi-Asset Stability - EUR Classic Acc | LU1956159773 | -5,89% | 10,63% | 5,51% | 8,53% | ||

| LI Multi Leaders Fund | DE000A0MUW08 | -6,05% | 16,10% | 12,34% | 2,82% | 21,26% | 9,18% |

| Steyler Fair Invest - Balanced R | DE000A111ZH7 | -6,10% | 7,63% | 2,74% | 0,91% | 9,01% | |

| Eurizon Fund - Bond Flexible - R EUR acc | LU1090960086 | -6,23% | 6,44% | 1,18% | -4,83% | 7,52% | |

| Ampega Real Estate Plus | DE0009847483 | -6,33% | 9,19% | 4,16% | -4,97% | -1,18% | 8,76% |

| MFC Base A | AT0000A1Q5S6 | -6,46% | 11,41% | 6,64% | 2,80% | 9,19% | |

| LUX-PENSION 25% | LU0151357604 | -6,50% | 6,39% | 2,59% | -4,51% | 6,74% | 7,01% |

| LF Global Multi Asset Sustainable R | DE000A1WZ2J4 | -6,54% | 8,19% | 2,30% | 21,30% | 77,66% | 9,96% |

| Kapital Plus - A - EUR | DE0008476250 | -6,57% | 6,26% | 1,02% | 6,26% | 25,75% | 9,29% |

| Allianz Capital Plus - AT - EUR | LU1254136416 | -6,57% | 6,30% | 1,02% | 6,21% | 9,33% | |

| Merck Finck Stiftungsfonds UI | DE0008483983 | -6,67% | 10,07% | 6,46% | 3,75% | 10,73% | 7,75% |

| Canada Life EURO Sicherheitsorientiert II | IE00B0YVMD51 | -6,73% | 10,13% | 4,89% | 0,51% | 21,11% | 9,01% |

| CLE Portfolio Balance IR | IE00B98X6H26 | -6,87% | 12,74% | 7,89% | 1,96% | 28,03% | 9,77% |

| FISCH Convex Multi Asset Fund AE2 EUR | LU0997985303 | -6,92% | 9,44% | 4,37% | 4,18% | 10,01% | 7,00% |

| ERSTE D-A-CH Fonds (A) (EUR) | AT0000A0RMH4 | -6,92% | 6,40% | 1,95% | 0,13% | 12,04% | 7,25% |

| Oddo BHF WerteFonds | DE0007045148 | -6,92% | 8,42% | 4,21% | -2,57% | 5,45% | 8,27% |

| db Advisory Multibrands - JPMorgan Emerging Markets Active Allocation PFC | LU1181275956 | -6,92% | 11,78% | 8,18% | 4,81% | 9,88% | |

| GUH Vermögen I | DE000A1H44J2 | -7,06% | 9,88% | 4,92% | 11,10% | 10,92% | 8,89% |

| GENERALI SMART FUNDS - JP Morgan Global Income Conservative Dx Acc EUR | LU1401872913 | -7,51% | 8,53% | 3,55% | -2,78% | 8,01% | |

| Mediolanum Best Brands - Equilibrium L - A | IE00BVL88F07 | -7,52% | 8,70% | 5,42% | -2,62% | 8,14% | |

| Renten Global Opportunities | DE000A0M7WL6 | -7,61% | 7,44% | 3,30% | -7,81% | -5,49% | 7,44% |

| SQUAD Aguja Opportunities - R | DE000A2AR9B1 | -7,69% | 12,35% | 10,71% | 34,40% | 9,15% | |

| Canada Life EURO Sicherheitsorientiert | IE0007791621 | -7,98% | 9,60% | 4,45% | -1,74% | 15,75% | 9,00% |

| Bantleon Select Sicav - Bantleon Opportunities L PA | LU0337414485 | -8,04% | 6,64% | 2,55% | -1,43% | -3,21% | 7,46% |

| Franklin Diversified Conservative Fund A (Ydis) EUR | LU1147470253 | -8,14% | 7,61% | 2,38% | -3,81% | -5,91% | 7,01% |

| GS&P Fonds - Deutsche Aktien Total Return I | LU0216092006 | -8,15% | 1,12% | -1,86% | 15,26% | 65,20% | 8,56% |

| Alpen Privatbank German Select R | LU0181454132 | -8,22% | 7,66% | 4,56% | -6,71% | 4,63% | 8,04% |

| Geneon Vermögensverwaltungsfonds | DE000A0Q8HF3 | -8,40% | 9,42% | 5,78% | 3,27% | 2,90% | 7,26% |

| JPM Global Income Conservative A (inc) - EUR | LU1458463152 | -8,41% | 5,72% | 0,95% | -2,84% | 7,97% | |

| Value Opportunity Fund P | LU0406025261 | -8,42% | 10,96% | 7,68% | 15,59% | 60,94% | 7,65% |

| LVM ProBasis-Fonds | IE00B13XV652 | -8,51% | 6,15% | 1,44% | -3,09% | 6,80% | 8,59% |

| BNP Paribas Target Risk Balanced Classic Cap | LU0089291651 | -8,69% | 9,21% | 5,51% | -4,05% | 15,25% | 8,14% |

| Selection Rendite Plus I | DE0002605037 | -9,10% | 8,22% | 3,91% | 4,14% | 23,03% | 7,95% |

| Canada Life Fidelity Defensiv IR II | IE00B623RT60 | -9,20% | 7,69% | 2,93% | -6,79% | 8,83% | 8,01% |

| apo Medical Balance R | DE000A117YJ3 | -9,23% | 7,75% | 3,86% | 4,35% | 8,88% | |

| GIR Portfolio 30 - Ausgewogen | IE00BWZMZL00 | -9,55% | 11,81% | 6,87% | -2,99% | 9,80% | |

| VPV Ertrag Plus EUR A acc | FR0013474053 | -10,09% | 1,45% | 1,26% | 7,12% | ||

| Mediolanum Best Brands - Mediolanum Fidelity Asian Coupon Selection L Class A | IE00BYVXRV56 | -10,10% | 12,21% | 11,12% | -4,46% | 9,81% | |

| Amundi Funds Multi-Strategy Growth - A EUR | LU1883335165 | -10,17% | 15,49% | 7,12% | 5,18% | 14,87% | 8,03% |

| GLS Bank Klimafonds A | DE000A2DTNA1 | -10,22% | 6,80% | 1,37% | 0,80% | 8,65% | |

| Value Investment Fonds Klassik (A) | AT0000654652 | -10,29% | 7,51% | 6,20% | -6,37% | 3,28% | 8,72% |

| Deka-Europa Balance Dynamisch CF | DE000DK2CGD5 | -10,68% | 7,43% | 3,23% | 5,16% | 3,33% | 8,85% |

| GENERALI SMART FUNDS - JP Morgan Global Macro Opportunity Dx | LU1401869372 | -11,65% | 4,96% | 6,59% | 2,51% | 8,30% | |

| VM - Manufakturfonds 1 | LU0328779821 | -11,83% | -1,93% | -4,42% | 7,18% | 30,38% | 9,67% |

| S700 (T) | AT0000727383 | -11,91% | 6,87% | 1,49% | -12,71% | -2,51% | 7,62% |

| DuoPlus R | DE000A0RK8R9 | -13,06% | 7,71% | 4,30% | -15,29% | -15,79% | 9,35% |

| Wealth Generation Fund T | AT0000606397 | -13,14% | 5,49% | 3,13% | -7,65% | 0,24% | 7,95% |

| PIMCO GIS Dynamic Multi-Asset Fund E Retail EUR acc | IE00BZ6SF527 | -13,36% | 9,65% | 4,65% | 3,52% | 8,24% | |

| CT (Lux) Sustainable Multi-Asset Income A Inc EUR | LU2051394786 | -13,43% | 7,95% | 4,72% | -1,48% | 8,54% | |

| GIR Portfolio 20 - Defensiv | IE00BWZMZK92 | -13,46% | 9,52% | 4,44% | -9,76% | 9,82% | |

| CLE Portfolio Defensiv IR | IE00B98XRQ87 | -13,61% | 9,40% | 4,36% | -10,25% | 7,61% | 9,81% |

| Tinzenhorn Fonds T | DE000A0YEQT6 | -14,07% | 5,66% | 1,98% | -7,09% | 7,19% | 8,39% |

| db Advisory Multibrands - Invesco Asia Megatrends LC | LU0848427703 | -14,11% | 10,44% | 7,69% | -7,80% | 3,26% | 9,55% |

| Invesco Balanced-Risk Allocation 12% A acc EUR | LU1233164364 | -14,12% | 7,66% | 3,17% | -8,53% | 7,36% | |

| ÖKOBASIS One World Protect R | DE000A2DJU46 | -16,37% | 11,51% | 8,29% | 6,51% | 9,27% | |

| Stand: 26.11.2024, Perf. 10 Jahre, per 31.10.24. Volatilitätszahlen werden auf Monatsbasis berechnet. |

Quelle: FVBS professional

Diesen Beitrag teilen: