Capital Group: Eyeing long growth runways in an uncertain environment

It’s clearly been a tough environment for emerging market equities. China’s economic slowdown, the dollar’s rally and tightening U.S. monetary policy have all shaken confidence.

20.12.2018 | 10:18 Uhr

It’s clearly been a tough environment for emerging market equities. China’s economic slowdown, the dollar’s rally and tightening U.S. monetary policy have all shaken confidence.

Many probably wonder if emerging markets will ever catch a break. It’s true that the near-term picture looks a bit daunting given the unpredictability of U.S.-China trade talks, China’s slowing economy, rising U.S. interest rates and a strong dollar. For those willing to take a longer view, the picture isn’t all that grim.

For one, there’s a strong dose of pessimism already baked into many stock prices, offering potential upside for companies with large addressable markets that have been sold off.

And despite current challenges, investors shouldn’t lose sight of promising areas within emerging markets. Some things haven’t changed: Innovation is accelerating in areas of technology and health care and demand continues to grow for internet-based mobile services that emerging market consumers use every day.

“I still believe that there are companies delivering important services to underserved markets that have long-term secular growth runways,” says portfolio manager Carl Kawaja. “Emerging markets remains an area of opportunity despite current trade concerns and political uncertainty in some countries. It’s possible that some of these political clouds around the trade war will lift at some point and, if so, we might see a sharp snapback in developing countries where valuations in many cases look attractive.”

China conundrum

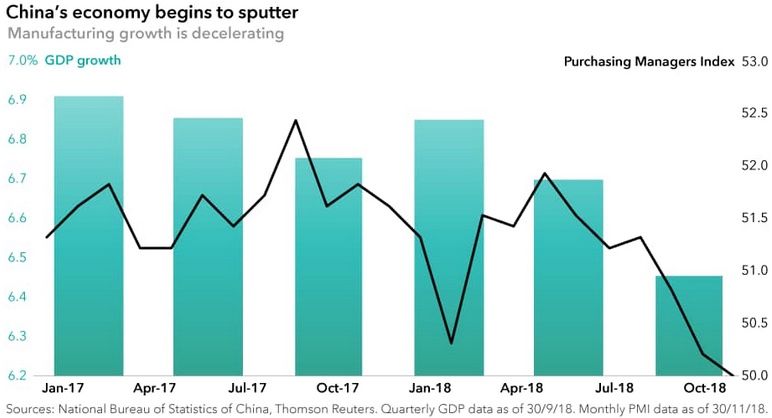

There’s no doubt China’s slowing economic growth could weigh on market sentiment. Moreover, the trade dispute is complicating Beijing’s multiyear plan that’s been focused on quality of growth, reducing debt and curbing risks in parts of its economy. China’s economy is still growing at 6.5% (annualised), according to the most recent government figures.

Many economists estimate the rate of growth to be lower than the government’s published figures and say the deceleration is having a dampening effect on areas of the global economy such as Europe.

Credit growth is slowing, the housing market is softening after several years of robust growth and the manufacturing sector is decelerating. Consumer confidence also is off its highs, reflecting some nervousness within China over how Beijing will respond to the U.S. over trade.

“It’s clear that China’s economy is continuing to decelerate, especially as there appears to be some confusion around which policies are most appropriate to implement, given global trade tensions,” says Stephen Green, Capital Group’s China economist. “I would not expect to see a strong policy response from Beijing in terms of a bigger pro-stimulus push until mid-2019, when we may see further signs of the economic slowdown.”

Green says mixed policy signals emanating from Beijing are delaying infrastructure projects. Local government officials are apparently reluctant to loosen their purse strings because they are unsure which projects fit the bill of top party officials. Private businesses also have become more cautious.

Promising growth runways

Despite China’s slowdown and the likelihood for more

volatility in emerging markets, we believe longer term trends in

developing countries look sustainable. These include:

Growth of mobile e-commerce and services

An expansion of Asia’s consumer class

Soaring demand for air travel in Asia

Semiconductors used in artificial intelligence, cloud computing and industrial automation

Ageing population in China that seeks better health care products and services

We see investible opportunities in both developing and developed markets that could benefit from these trends.

For instance, Indian conglomerate Reliance Industries runs the Jio mobile-phone business, which has rapidly become India’s largest by subscribers since launching in 2016. French airplane maker Airbus has a huge order backlog that could result in healthy cash flows in the years ahead. Hong Kong-listed AIA Group has seen strong demand for its insurance products from Chinese consumers. Taiwan Semiconductor remains one of the world’s leading makers of advanced computer-processing chips.

“In this environment, I’m focusing on companies with stronger balance sheets and cash generative businesses that still have decent growth prospects and pricing power despite slowing global growth and trade tensions,” says portfolio manager Chris Thomsen. “I’ve also shifted to companies undergoing fundamental changes that can potentially drive future revenue and earnings growth regardless of macro uncertainty.”

Along those lines, Thomsen points to Brazilian mining giant Vale. The company is aggressively cutting costs, reducing debt, selling non-core assets and seeing healthy demand for its higher-quality iron ore from Chinese steel makers because of China’s stricter environmental policies. Vale also plans to pay dividends and repurchase its stock.

Sifting through the wreckage

Despite some of the sell-off in emerging markets, corporate fundamentals don’t look bad.

According to consensus estimates compiled by data aggregator FactSet, aggregate profits for companies in the MSCI Emerging Markets Index are projected to rise 11% in 2019 on a year-over-year basis. In addition, cash flows are improving and debt levels are decreasing.

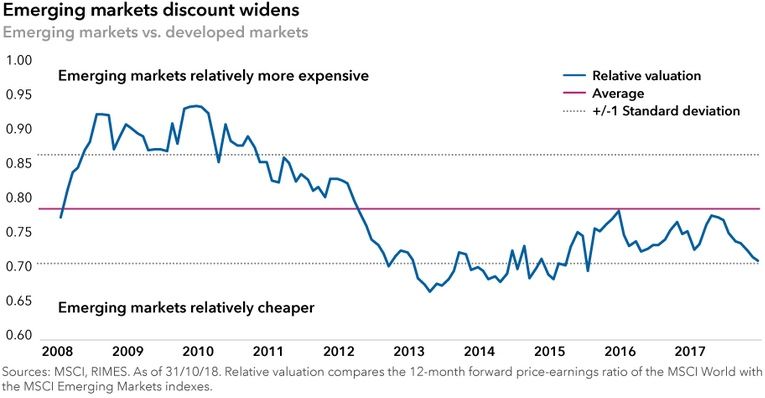

The valuation gap for emerging markets stocks also has widened compared with developed markets, and this could provide ample opportunities to invest on a selective basis.

There are attractive opportunities in the market where stocks have sold off and valuations have come down, Thomsen says. Chinese technology giants Alibaba and Tencent are still very profitable, high growth companies with incredibly dominant market share positions and both are relatively insulated from foreign competition and trade tariffs. Casino-operators in Macau — a large gambling and entertainment hub located off mainland China — are trading at depressed valuations and attractive dividend yields. But gaming revenue is still growing and new rail infrastructure and bridges into Macau may help drive more visitors from China to the gaming enclave.

Maintaining a focus on fundamentals

To be sure, emerging markets are likely to remain choppy.

China-U.S. trade talks may hit a logjam. India is heading into an election year, and new leaders in Brazil and Mexico may disappoint investors with their economic reforms. These and other factors could take a toll on emerging markets stocks at different times throughout the year.

As emerging markets have matured, with growth in the technology and consumer-oriented sectors, company fundamentals have become key drivers of returns, making stock selection more relevant.

“We’ve been in an environment for the past 18 months where geopolitics and country-specific risks have overwhelmed company fundamentals in emerging markets,” says portfolio manager Nick Grace. “Ultimately, it is my belief that fundamentals will win out at some point, and this recent volatility is creating some compelling opportunities for us to invest with our long-term view.”

Diesen Beitrag teilen: