Janus Henderson Investors: Chinese money trends weak before virus hit

Chinese money and credit numbers for January were probably little affected by the coronavirus shock, which had limited economic impact until this month.

25.02.2020 | 07:30 Uhr

Money trends softened with broad credit growth stable. The results are viewed here as confirming that Chinese economic prospects were weak before the shock.

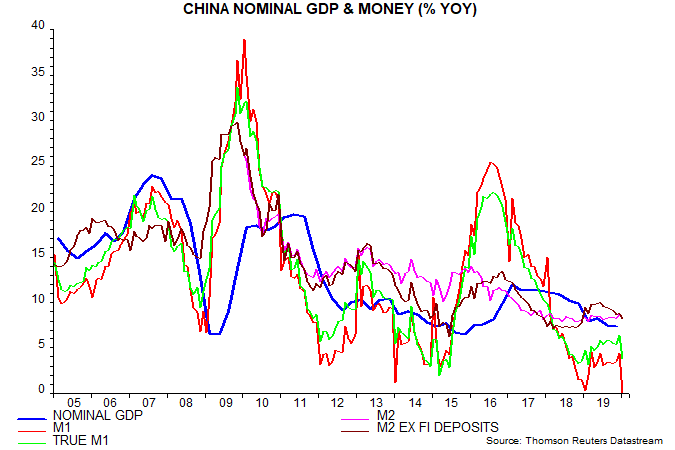

The first chart shows annual growth rates of the headline money aggregates and alternative preferred measures. Bears have focused on a slump in M1 growth from 4.5% in December to zero but this partly reflected the lunar new year holiday falling in January this year versus February in 2019. The same timing difference last occurred in 2017 – M1 growth fell from 21.4% in December 2016 to 14.5% in January 2017, returning to 21.4% in February.

The distortion arises from China’s definition of M1 as the sum of currency in circulation and demand deposits of enterprises and government organisations, omitting household deposits. Firms pay workers ahead of the holiday, resulting in a fall in their demand deposits and a corresponding rise in those of households. M1 captures only the former. The effect reverses as holiday spending transfers money back from consumers to firms.

The preferred narrow money measure here is “true M1”, which adds household demand deposits to the headline series. The PBoC has yet to release a January number for such deposits but a reasonable assumption is that they matched a 7.8% month-on-month increase in January 2017. On this basis, annual true M1 growth is estimated to have fallen from 6.3% in December to 3.8% in January. (True M1 may also have been affected by the holiday timing difference, though to a much lesser extent. Growth fell from 18.9% in December 2016 to 16.4% in January 2017, rebounding to 18.1% in February.)

Growth of the broader M2 aggregate fell from 8.7% in December to 8.4% in January but remains within its narrow 2018-19 range. The relationship between M2 and economic activity has been distorted in recent years by large swings in deposits of non-bank financial institutions. The preferred measure here excludes such deposits: annual growth is estimated to have fallen to a 13-month low of 8.2%, supporting the downbeat message from narrow money.

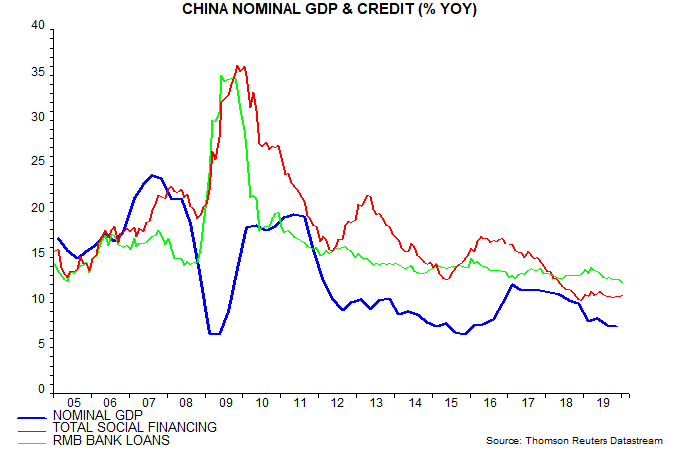

Broad credit growth was stable in January: the monthly flow of total social financing exceeded the consensus forecast but the annual change in the stock remained at 10.7% – second chart.

Diesen Beitrag teilen: