Schroders: Does low volatility mean a shock lies in store for investors?

Despite the many economic and geopolitical risks in the world today, volatility in asset markets has been remarkably subdued. The Vix index, the market’s so-called fear gauge, has recently fallen to a reading of around 10. This is exceptionally low compared to long-term norms. and only just above the all-time low of 9 that it fell to in 1993. Since 1990, it has averaged 20.

14.06.2017 | 11:22 Uhr

The Vix reflects the amount of volatility traders expect for America’s S&P 500 during the next 30 days.

The recent calm in the markets has raised alarm bells among investors amid concerns of over-complacency.

However, when we look back over time, investors would have been unwise to sell equities purely on the basis of a low Vix reading.

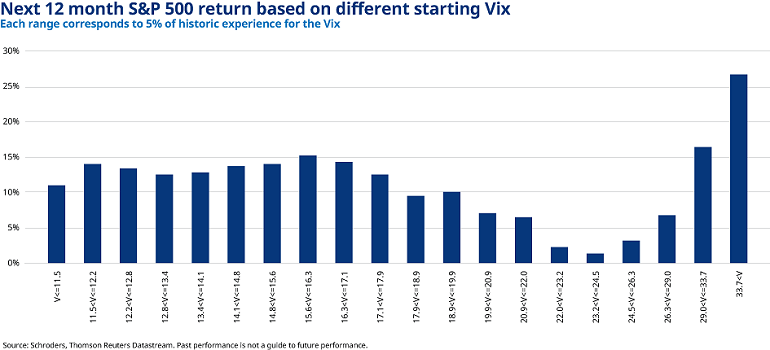

The chart below shows how the S&P 500 has performed when the Vix has been in different percentiles of its history. For example, 5% of the time the Vix has been below 11.6 and 5% of the time it has been between 11.6 and 12.2, and so on. This breakdown allows us to derive the most meaningful data.

When the Vix has been in its lowest 5% of readings (at a level of 11.6 or less), the S&P 500 has historically generated an average return of 11% over the subsequent 12 months, according to Schroders analysis.

Rather than a foreteller of doom, a low Vix has in fact been associated with quite healthy returns. Not as healthy as when the Vix has been slightly higher but good nonetheless.

Conversely, the worst time to buy has actually been when the Vix has been relatively high. Typically, the Vix spikes when markets are falling. When the Vix has been in the 20s, the knife has still been falling and investors who bought then have cut themselves.

It is only when investors turn hysterical – when the Vix has been around 30 or higher – that the best returns have been earned by the brave hearted. The old adage that investors should be greedy when others are fearful shines through clearly here.

As with all investment, the past is not necessarily a guide to the future but history suggests that investors would be unwise to make their investing decisions purely on the basis of subdued levels of volatility.

Diesen Beitrag teilen: