Morgan Stanley: Volatility and Uncertainty Continue

Why have government bonds and other fixed income assets prevailed in the current market environment while other sectors and asset classes have struggled?

14.10.2019 | 10:52 Uhr

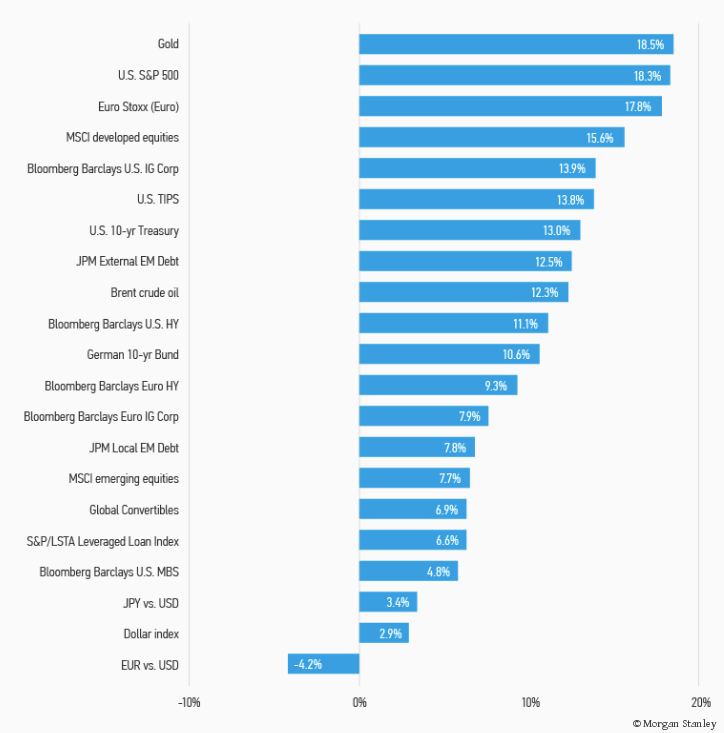

Government bonds and the U.S. dollar continued their exceptional performance in August while other sectors and asset classes struggled. The reason: rising anxiety about the global economic outlook and policy responses. The causes: the U.S./China trade dispute escalated, economic data weakened (or did not improve as anticipated) and there was uncertainty about future central bank actions. Importantly, despite these issues, high-yield bonds and equities have weathered the storm well, preserving strong year-to-date returns. In fact, most fixed income assets, including credit, delivered positive returns in August. The problem: much of these returns are due to the dramatic fall in bond yields, which is unlikely to be repeated.

Display 1: Asset Performance Year-To-Date

Note: USD-based performance. Source: Thomson Reuters Datastream. Data as of August 30, 2019. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

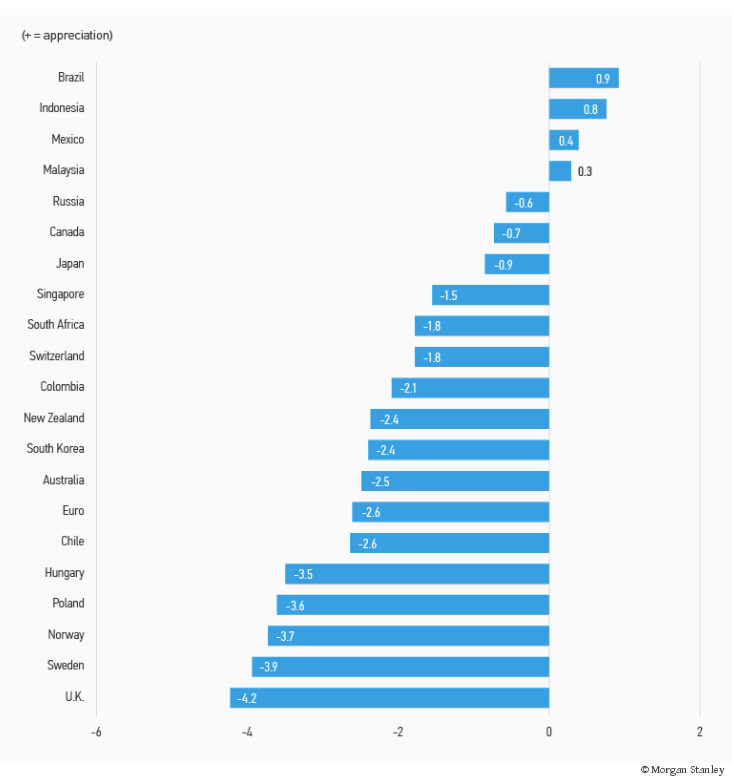

Display 2: Currency Monthly Changes Versus USD

Source: Bloomberg. Data, as of August 30, 2019. Note: Positive change means appreciation of the currency against the USD.

Here you can find the complete article.

Diesen Beitrag teilen: