Janus Henderson: Is business investment good as it is

Optimists expect strong growth of business investment. The view here, by contrast, is that investment strength may be peaking ahead of weakness in 2019-20.

23.08.2018 | 09:41 Uhr

Optimists expect strong growth of business investment to relieve capacity strains and allow the global economic upswing to continue for several more years. The view here, by contrast, is that investment strength may be peaking ahead of weakness in 2019-20.

Economists in the first half of the twentieth century were familiar with a 7-11 year cycle in business investment (the Juglar cycle, after nineteenth-century French economist Clément Juglar), along with shorter- and longer-term cycles in inventories and housing construction respectively. The long post-WW2 economic expansion contributed to the idea of distinct cycles in different parts of the economy falling out of fashion in favour of a vaguer concept of an irregular business cycle that could be tamed by wise policy-makers.

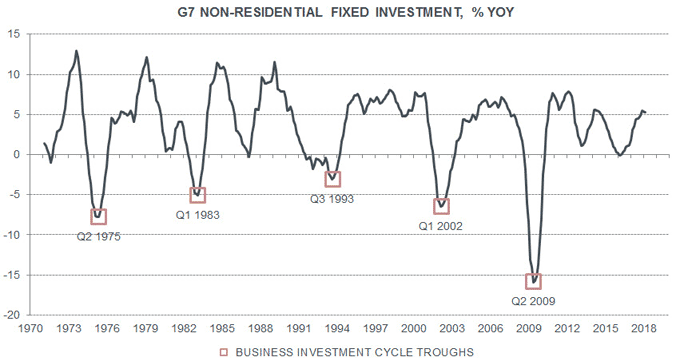

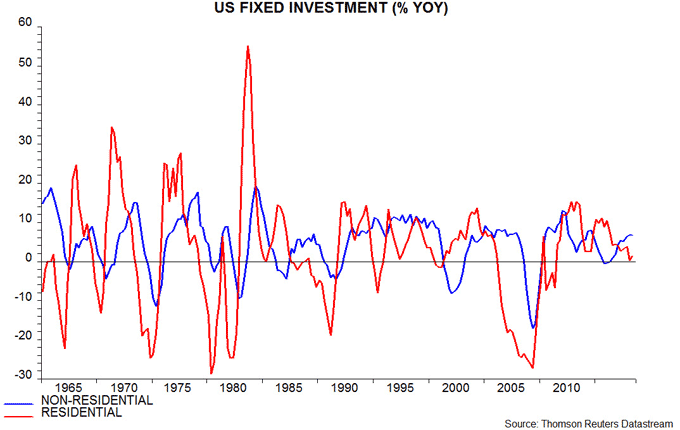

A 7-11 year fluctuation in business investment, however, is clearly visible in post-war US / G7 data, with troughs in the cycle plausibly occurring in 1949, 1958, 1968, 1975, 1983, 1993, 2002 and 2009 – see first chart. Another trough, therefore, is scheduled by 2020 at the latest, implying that the cycle will be in a downswing in 2019.

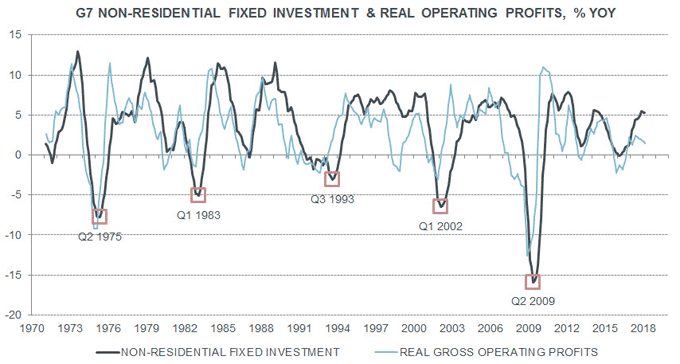

The investment cycle is closely related to the profits cycle, with the latter usually leading by several quarters – second chart. The profits measure in the chart is a national-accounts version of EBITDA and usually moves ahead of cash flow numbers associated with stock market indices such as MSCI World – these numbers are usually presented as four-quarter moving totals. Nominal profits were converted to real terms using the GDP deflator. G7 real profits growth is running below investment growth and eased into the first quarter, despite a rise in the US. Second-quarter figures will be important for assessing whether the investment cycle is already peaking.

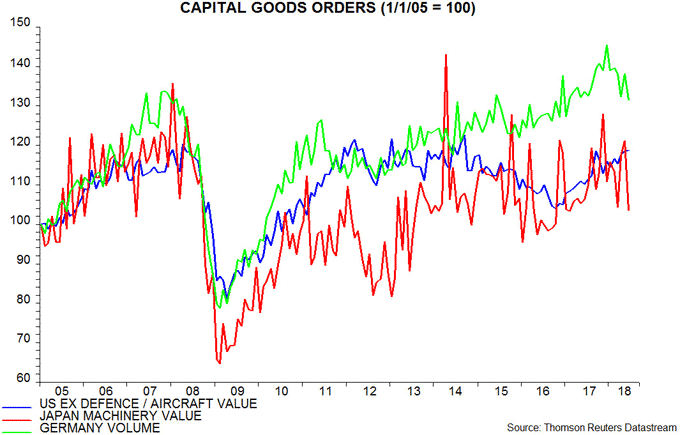

The relative weakness of profits trends in Japan and Europe suggests that an investment slowdown should begin there. Japanese and German capital goods orders, indeed, have been surprisingly weak recently, contrasting with a continued rise in US core orders – third chart.

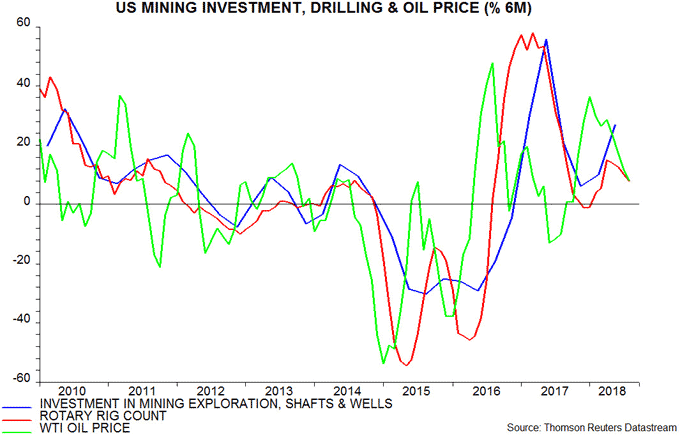

As well as a stronger profits trend, US business investment has been boosted by the boom in oil and gas exploration – mining investment contributed one-quarter of non-residential fixed investment growth of 9.4% annualised between the fourth quarter of 2017 and second quarter of 2018. A recent stalling of the rig count and oil prices, however, suggests that this segment will lose momentum – fourth chart.

A further reason for expecting US business investment strength to cool is the lagged relationship with residential investment, which has slowed sharply in recent quarters – fifth chart. This empirical regularity may reflect housing responding more quickly than business investment to changes in monetary conditions; an alternative explanation is that housing swings affect general economic activity, resulting in an accelerator effect on business investment. For whatever reason, the leading relationship has been surprisingly reliable historically.

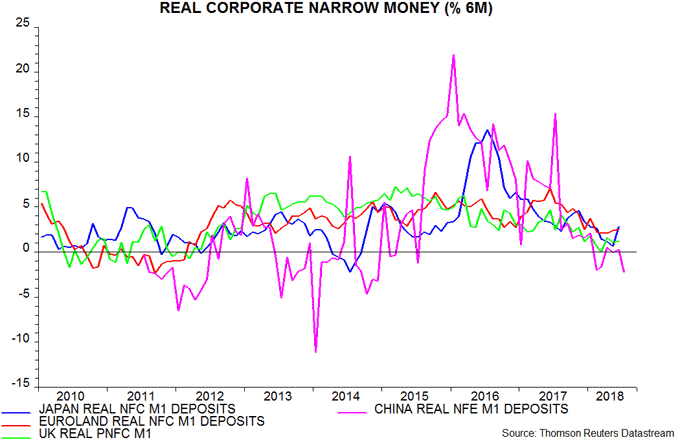

Softening prospects for business investment would be expected to be associated with weaker corporate narrow money trends. No monthly sectoral breakdown of US monetary data is available but the six-month rate of change of real corporate narrow money is lower than a year ago in Japan, Euroland, the UK and China, although there are hints of a bottoming out recently – sixth chart*.

*NFC = non-financial corporation; PNFC = private NFC; NFE = non-financial enterprise.

Diesen Beitrag teilen: