Janus Henderson: Natural Resources - the silver lining of a downturn

David Whitten, Head of Global Natural Resources, explains how discipline through the downturn in commodities has left natural resource companies leaner, more efficient and ultimately more profitable.

27.12.2018 | 09:45 Uhr

What are the key themes likely to shape markets in 2019?

The silver lining of the weaker commodity prices between 2011 and 2016 was that many companies within the natural resources sector were forced to become much more disciplined in their operations and expenditure. This shift ultimately left companies in far better shape to capitalise on opportunities, while ensuring more stability and resilience to better weather any downturns.

During the downturn, a number of companies experienced capital project cancellations, operating cost reductions and worked to optimise future project returns. This has led to the unusual situation where the leading companies in global integrated energy and global mining are now trading with low financial leverage, good growth prospects, high dividend yields and share buy backs.

Where do you see the most important opportunities and risks within your asset class?

We invest globally in the three natural resource sub-sectors of mining, energy and agriculture. While Australia boasts two of the global heavyweights in BHP and Rio Tinto, the global investment opportunity is many times that of the domestic resources opportunity. In fact, the global investment universe is around 23 times larger than the Australian resources market and five times the market cap of the total Australian stock market, giving us a wide range of investment opportunities.

Mining – China’s shift to quality raw materials is likely to continue

Strong cash generation and capital discipline are providing a positive outlook for strong capital returns. The supply/demand outlook for many commodities appears favourable and shareholders are being rewarded with increasing dividends and buybacks. We value gold as a diversifier that should perform strongly in a weak market.

The outlook for electric vehicle (EV) metals is strong. Beyond lithium, demand for other metals such as cobalt, aluminium and copper will also benefit from this theme. Copper has seen years of under-investment, mine depletion and cost inflation, a background which makes for a very favourable long-term outlook. Battery demand for residential, utility and industrial applications will likely be more significant than EV-driven demand for battery raw materials.

Selected companies are also benefitting from China’s anti-pollution initiatives, which have seen raw material imports focused on high grade materials in order to reduce additional processing, energy use and air pollution in China. Both BHP and Rio Tinto are among the beneficiaries of this shift.

Energy – an increasingly important role for liquefied natural gas (LNG)

Similar to the mining sector, strong cash generation and capital discipline is a key theme in the energy sector.

We have seen oil companies pivoting somewhat away from oil production growth and into domestic/pipeline gas, LNG, chemicals and plastics, and mobility (reconfiguring petrol service stations). Oil may remain quite cyclical for many years to come, and we believe that we may possibly be two years into a five to six year positive cycle, where supply will lag due to underinvestment between 2015 to 2018.

Companies exposed to LNG are benefitting from the transition from coal-fired power generation, in some markets, as the focus on reducing pollution and greenhouse gas emissions increases.

Agriculture – opportunities despite major consolidation as trends to clean and green accelerate

Consolidation, globalisation and technological innovation to increase crop yields have been the ongoing themes within the agriculture sector for the past few years. Among the major agricultural seed technology companies there have been two takeovers and a merger, with the six historic leaders reduced to four. Bayer acquired Monsanto, ChinaChem acquired Syngenta, and Dow Chemical and DuPont merged with well-advanced plans to spin-off a new company called Corteva in 2019. BASF, the other major agriculture player in the market has remained independent.

In fertiliser and agricultural trading and services, Agrium acquired Potash Corp and is now very well positioned for a market recovery. Glencore has joined the traditional Archer Daniels Midland, Bunge, Cargill and Louis Dreyfus companies with a long-term view to further consolidate this industry.

This sector has also benefitted from China’s insatiable demand for safe, high quality food. This provides good opportunities for investors to partake in the gradual move of the Chinese economy from being driven by fixed asset investment to services.

How have your experiences in 2018 shifted your approach or outlook for 2019?

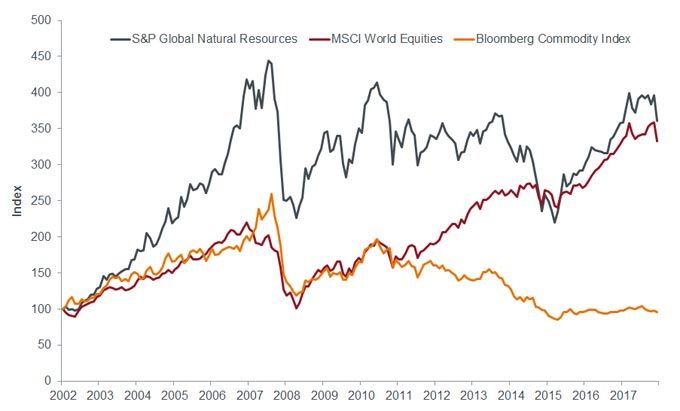

As the chart below shows, the global natural resources sector has lagged the MSCI world equity index since the peak of the super-cycle in 2008. This protracted underperformance came to an abrupt end during late 2015 (in US dollar terms) and resources have generally been outperforming world equities since this time.

Chart 1: Global natural resources have outperformed global equities in recent years (USD)

Source: Bloomberg, Janus Henderson Investors, as at 15 November 2018. Rebased to 100 on December 2002, is US dollar terms.

We view the current sell-off as a mid-cycle pause, with investors still unable to fully accept that the giants of world mining and energy can deliver sustainable cash flow and returns to investors. We believe that they can deliver and that the sector leaders will be re-rated when other investments with higher valuations and less robust earnings disappoint in an environment of modest growth and interest rate rises.

In our view, while a number of companies are undervalued due to volatility in commodity prices, a stronger US dollar, the threat of trade disruptions and the risk of a slowdown in China, the outlook for quality natural resources equity remains positive.

Diesen Beitrag teilen: