BNP Paribas: A pause that refreshes, but for how long?

Tighter financial conditions and a weakening global backdrop have led the Fed to signal a pause in the hiking cycle. Signs of progress in the US-China trade dispute, supports our cautious optimism.

21.01.2019 | 11:04 Uhr

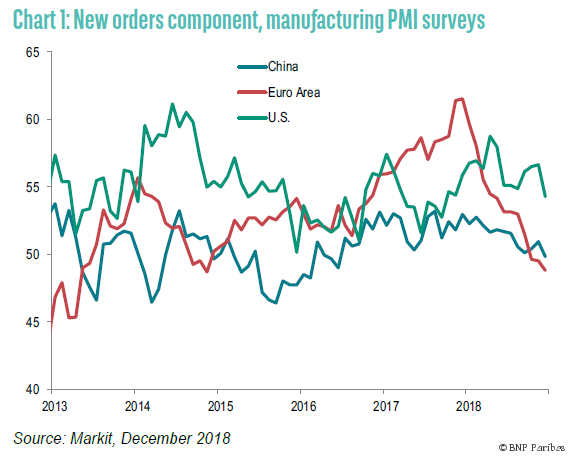

Federal Reserve Chairman Jerome Powell has garnered his fair share of criticism for what has been viewed as a number of communications missteps last quarter. We have indulged in some of these criticisms ourselves, but dwelling on Federal Reserve (Fed) communications masks some larger points about the global economy and markets. There are a number of signs pointing to a downshift in global growth, sparking concerns about the willingness of developed market central banks to pivot quickly from their plans for policy normalization. Investor concerns about the reaction of policymakers to weakness in the data are not limited to developed markets. China remains a significant point of focus, given what many perceive to be an insufficient policy response to signs of slowing growth. The wall of worry confronting markets also extends into the political arena as well, and includes the ongoing US-China trade dispute, increasing disfunction in US politics, and the final stages of the Brexit process, to name a few.

All of these issues have contributed to tighter financial conditions in many economies, and in the case of the US, elevated concerns about the durability of the expansion.

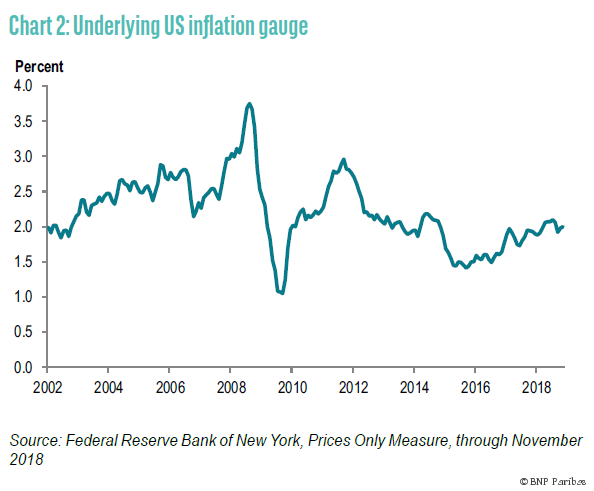

We share many of these concerns, but at least for the time being, we see reasons for optimism that a weaker growth environment will not spiral into recession. First, the global policy backdrop will remain somewhat accommodative for the foreseeable future. Federal Reserve policymakers have already pivoted to signal a pause in the policy normalization process in response to tighter financial conditions, a weaker global backdrop, and some deterioration in forward-looking survey indicators. Monetary policy looks set to remain on hold at least until the middle of the year, and if anything, the risks are skewed towards this pause being extended into the second half of the year. This is because a relatively benign inflation environment provides policymakers significant flexibility.

Recent comments from policymakers also suggest a degree of confidence about the supply side of the US economy, and this confidence should translate into additional policy patience given the disinflationary implications of rising trend growth.

Despite this perceived pause in US policy tightening, we cannot ignore the tightening effects of continued balance sheet runoff. The Federal Reserve is in a difficult position because it continues to downplay the significance of runoff for the economy, even as investors express concern with the policy being on auto-pilot. Still, the notion of a policy pause could extend to other developed market central banks. In the euro-area, the end of quantitative easing and a compromise on Italy’s budget suggest greater scope for policy flexibility than was the case last year. The European Central Bank (ECB) has signaled that an initial rate increase could occur in the fourth quarter, but with inflation risks skewed to the downside, the start of interest rate normalization could be delayed until 2020. Similarly, we do not expect any further steps by the Bank of Japan to widen the yield band for the 10-year government bond absent an improvement in the inflation data, which does not appear in the offing. The forthcoming consumption tax increase will also limit the Bank of Japan’s appetite to take any measures that could be perceived as a withdrawal of policy accommodation.

We also remain cautiously optimistic that China will continue to provide sufficient stimulus to the economy to prevent anything more than a gradual deceleration in growth, to around 6.2 percent this year. The People’s Bank of China has already announced a 100 basis point cut in reserve requirements, and we expect an additional 200 basis points of cuts over the remainder of the year. This and other liquidity injections from the central bank will complement fiscal expansion through infrastructure spending and tax cuts. Investors may continue to be disappointed by the targeted nature of Chinese stimulus, as policymakers are keen to prevent a releveraging of the economy. But this does not change the fact that policymakers have both the intention and the tools to prevent a sharp growth deceleration.

The outlook for the trade dispute between the US and China has also improved on the margins. For both countries, a loss of momentum in economic activity provides a powerful incentive to reach a deal. In the case of the US, we suspect that stock market weakness provides a similar incentive for President Trump. Progress in recent negotiations suggests some scope for compromise, increasing the odds that the December agreement to halt any additional tariffs will be extended beyond March. While a comprehensive agreement remains far off, incremental news that the two countries will refrain from further escalation and continue to engage in dialogue should be a market positive.

While the monetary policy backdrop and recent signals on US-China trade negotiations are reasons for cautious optimism, we remain cognizant that many of the top-of-mind risks for investors are in the political sphere. The US government shutdown is just a taste of how volatile the political environment will be this year, with Democrats taking control of the House of Representatives and set to challenge President Trump on a host of issues. We also suspect that populist impulses in the euro area are not set to subside any time soon, and the Brexit process is coming to a head. Forecasting the eventual outcome is far from straightforward but if we eliminate the increasingly improbable then whatever is left can at least be considered reasonable probable outcomes. It looks less likely that there will be an election to resolve the problem: the Prime Minister has pledged not to call one and it looks unlikely that the opposition will have quite enough votes to topple the government.

Nor does it seem likely that parliamentarians will coalesce around an alternative option and impose that upon the Prime Minister: on closer inspection the “Norway+” option does not have much to recommend it. Nor does it seem likely that Parliament or for that matter the Prime Minister will countenance leaving with no deal. Putting Brexit on pause for the foreseeable future without any public mandate is not a long-term solution. So the two most likely outcomes are the Prime Minister’s deal passes on the second or third time of asking or the decision is put back to the people.

Remain looks the likely winner in a second referendum, but this is also the most plausible route to a Hard (no deal) Brexit. In the event that the Prime Minister’s deal passes we would expect to see sterling rally and the market price back in rate hikes, with a more aggressive move in the same direction in the event of Remain. No deal on the other hand would tip the U.K. into an economic and potentially political crisis, with the currency taking the strain.

Um den kompletten Marktkommentar mit den Implikationen für passende Investments zu lesen, klicken Sie hier.

Diesen Beitrag teilen: