Morgan Stanley IM: Why REITs? And Why Now?

Real Estate Investment Trusts (REITs) are liquid, publicly-traded companies that offer investors access to high-quality commercial real estate assets with strong growth potential and the unique benefits that come with investing in real assets.

07.07.2022 | 09:54 Uhr

Here you can find the complete article.

REITs own, operate, and develop traditional commercial properties like shopping centers, office buildings and apartment complexes, but also more specialty properties, such as cell towers, self-storage facilities and healthcare clinics.

The listed real estate market evolves and grows with the broader needs of society and the economy—and sits at the epicenter of how people live, work, shop and communicate.

We believe there are several compelling reasons for investors to consider an allocation to REITs.

- REITs typically generate superior yields relative to other investments

- REITs have a history of producing attractive returns

- REITs provide diversification benefits in a portfolio of traditional equities and bonds

REITs’ inflation-hedging characteristics also make them a particularly attractive investment opportunity today. And for those investors focused on sustainability, certain REITs invest in real estate properties that are helping to achieve carbon neutrality by 2050.

What is a REIT?

U.S. REITs are a tax structure that was formed through Congress in the

1960s as a means of making investing in high-quality commercial real

estate accessible to all investors. Broadly, REITs are companies that

own commercial real estate, collect rents on that real estate, and then

pay that collected rent out in the form of dividends to shareholders. In

the U.S., REITs are required to pay out at least 90% of their taxable

income—many pay out 100%.

Listed real estate companies invest in familiar commercial properties including shopping centers and apartment complexes, as well as properties that are not necessarily top-of-mind, like storage facilities, data centers and cell phone towers. The modern REIT market is continuously evolving to meet the needs of the public and the necessity-based nature of these properties— facilitating commerce, providing shelter, and building the infrastructure of tomorrow—providing insulation to earnings in a way that more discretionary investments cannot.

Many other countries, including France, the U.K., Japan, Australia and Canada have also adopted REIT like structures, offering investors access to non U.S. real estate markets as well.

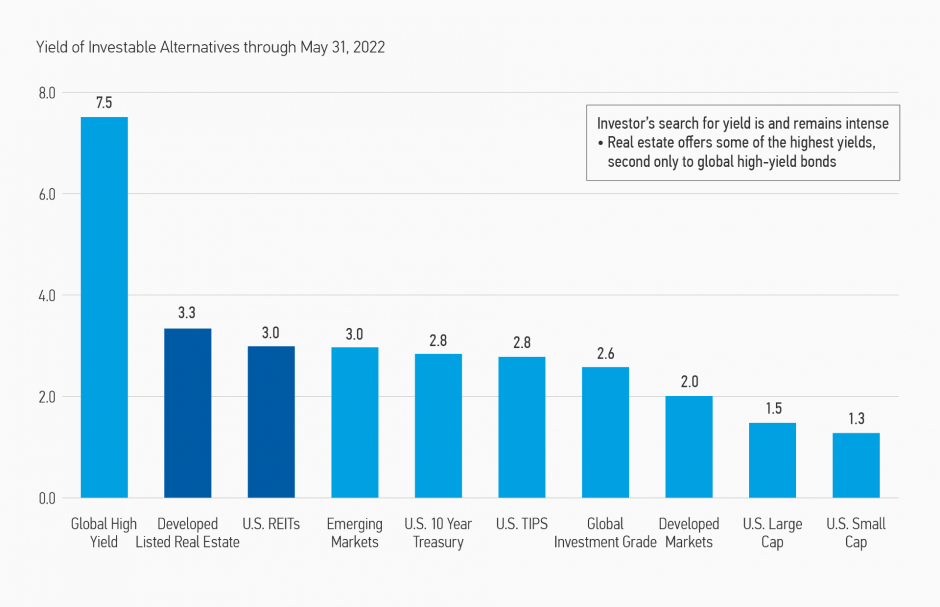

DISPLAY 1: Real Estate Offers Some of the Highest Yields

Source: FactSet for Equity Index Dividend Yield; BlackRock Aladdin for Fixed Income Index Nominal Yield; Bloomberg for 10 Year U.S. Treasury Yield. Data as of May 31, 2022. Asset classes represented by the following indexes: U.S. Large Cap: S&P 500 Index; U.S. Small Cap: Russell 2000 Index; Developed Markets: MSCI World Index; Global Investment Grade: Bloomberg Barclays Global Aggregate Bond Index; Global High Yield: Bloomberg Barclays Global High Yield Index; Emerging Markets: MSCI Emerging Markets Index; Developed Listed Real Estate: FTSE EPRA Nareit Developed Extended Index; U.S. REITs: FTSE Nareit All Equity REITs Index; U.S. TIPS: Bloomberg Barclays TIPS Index.

Past performance should not be construed as a guarantee of future performance. is not possible to invest in an index. Provided for illustrative purposes only.

The Case for REITs

We believe there are several good reasons to invest in REITs:

YIELD: Low absolute interest rates continue to add fuel to investors’ search for yield. U.S. and global real estate pay a high yield relative to investable alternatives. In fact, real estate offers some of the highest yields, second only to global high-yield bonds.

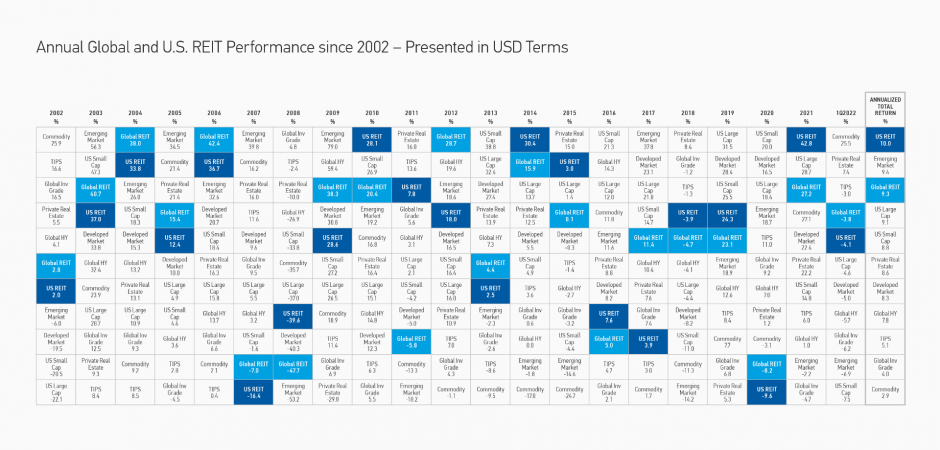

TOTAL RETURN: Beyond yield, REITs can provide an attractive source of total return. In fact, Display 2 shows that U.S. REITs and Global REITs provide very competitive total returns from 2002 – 1Q 2022 relative to investable alternatives.

DISPLAY 2: REITs are Worth Considering Adding to a Portfolio

Source: Morgan Stanley Investment Management.

Data provided in USD. Asset classes are represented by the following indexes: U.S. Large Cap: S&P 500 Index; U.S. Small Cap: Russell 2000 Index; Developed Market: MSCI World Index; Global Investment Grade: Barclays Global Aggregate Bond Index; Global High Yield: Bloomberg Barclays Global High Yield Total Return Index; Emerging Market: MSCI Emerging Markets Index; Commodity: Bloomberg Commodity Index; Global REIT: FTSE EPRA Nareit Developed Index; U.S. REIT: FTSE EPRA Nareit U.S. Index; TIPS: Bloomberg Barclays TIPS Index; Private Real Estate: NCREIF NFI-ODCE Index.

Past performance should not be construed as a guarantee of future performance. Index returns are gross of withholding tax. It is not possible to invest in an index. Provided for illustrative purposes only. Average annualized returns provided for the period from December 31, 2001 through March 31, 2022.

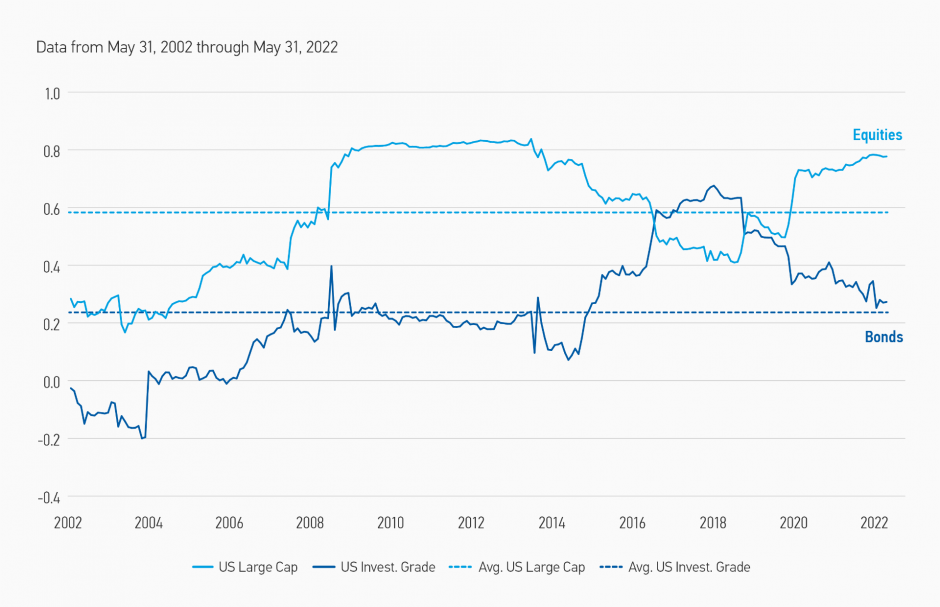

DIVERSIFICATION: REITs can help investors diversify traditional equity and bond portfolios. REITs do not perform in lockstep with traditional equity and fixed income investments. This low correlation, shown in Display 3, is a positive for strategic portfolio allocations.

DISPLAY 3: REITs Historically Low Correlation to U.S. Equities and Bonds

Source: Bloomberg

Correlation data based on the monthly total returns for the FTSE NAREIT All Equity REITS Index, the S&P 500 Index and the Bloomberg U.S. Aggregate Bond Index. The series shows the rolling 60-month correlation between the FTSE Nareit All Equity REITs Index and benchmark indices, as well as the average 60-month correlation over the last 20 years for each. Past performance should not be construed as a guarantee of future performance.

Why Consider REITs Now?

INFLATION HEDGE: REITS HAVE HISTORICALLY PERFORMED WELL IN INFLATIONARY ENVIRONMENTS – Inflation is in the headlines and has become a discernable part of everyday life, with price increases evident at the gas station, grocery store and travel related industries, amongst others. Many businesses—and their stock prices—continue to suffer from increases in the cost of raw materials and wages, especially those businesses where it is difficult to pass on price increases to end consumers.

REITs, on the other hand, have some real advantages in inflationary environments. As prices rise, property values tend to appreciate, while cash flow streams also generally benefit. For example, properties with short-term leases, such as hotels, self-storage facilities and apartments, are reset frequently. Landlords then have the ability to adjust rents quickly in reaction to inflationary pressures. Additionally, for those property types with longer-duration leases, such as retail, office and logistics, the investment can often offer inflation protection that is specifically built into the lease (e.g. explicit inflation linked increases).

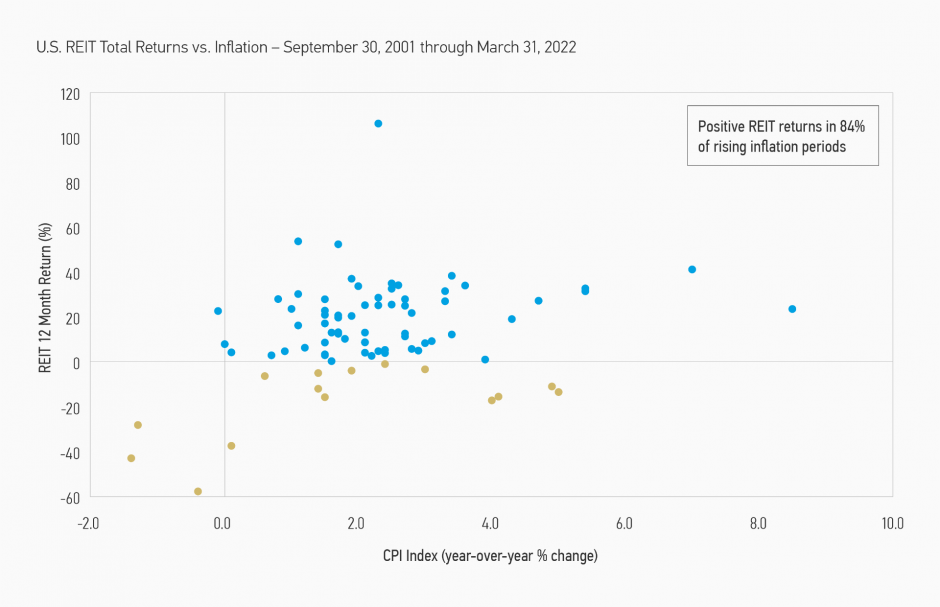

Display 4 shows that REITs have historically posted positive returns in most inflationary environments, to the point where many investors consider real estate a compelling hedge against inflation.

DISPLAY 4: REITs Have Historically Done Well in Inflationary Environments

Source: Sources: Bloomberg Economic Data, Morgan Stanley Investment Management. Analysis of FTSE Nareit All Equity REITs Index one-year total return and year-over-year change in Consumer Price Index on a quarterly basis for 20 years ending March 31, 2022. Inflation data based on CPI YoY Index, measure of prices paid by consumers for a market basket of consumer goods & services; collected by the U.S. Bureau of Labor Statistics.

Past performance is not indicative of future results. Data as of March 31, 2022. Indexes do not include any expenses, fees or sales charges, which would lower performance. Indexes are unmanaged and should not be considered an investment. It is not possible to invest directly in an index.

Real Estate and “Work-From-Home” –

Some Interesting Opportunities

The Covid-19 pandemic has accelerated and introduced new market dynamics, creating significant and, in many cases, surprising dispersions—and opportunities—for active managers within listed real estate investing. One of the most disruptive impacts the Covid-19 pandemic has had on commercial real estate has been to the office sector. Over the course of the pandemic, work-from-home and hybrid work became the norm, and while the number of Covid cases has dropped globally, a return to office hasn’t increased correspondingly.

However, the impact of the return to office has varied significantly city-by-city and country-by-country. Additionally, an increased focus on health, wellness and safety is reversing densification trends witnessed over the past decades and serving as a partial offset to the demand impairment stemming from hybrid work.

We are increasingly more constructive on office over the short to intermediate term in light of return to office trends. While the office industry is facing headwinds from lingering secular and cyclical forces, we expect certain secular challenges—specifically, densification trends from shrinking square foot per employee, to reverse; while other challenges—high sustaining capex—will persist.

Real Estate and e-Commerce – “Bricks and Mortar” Is Not Dead

In the retail real estate world, the explosive growth in e-commerce had shifted demand away from “bricks and mortar” storefronts to warehouses, data centers and logistics. However, coming out of the pandemic, there is now a renewed appreciation for the storefront as retailers rethink the role of the physical store in distribution and, in some cases, brand development. There will likely continue to be square footage rationalization as e-commerce grows, but brick-and-mortar retail will not disappear. The pandemic has underscored the importance of a physical location in a true omnichannel distribution environment and retailers are reinvesting in their stores and looking to sign leases in premium retail centers globally.

Sustainability – How REITs Can Make a Difference

Businesses, governments and investors are committing to achieving carbon neutrality by 2050. This has significant implications for global real estate. According to the United Nations Environment Program, building operations and construction represent 39% of global greenhouse gas emissions. It estimates that direct building carbon emissions will need to be cut in half by 2030 to get on track for 2050, having major implications for real estate landlords, developers and property values.

As an investor focused on responsible investing, understanding the key risks and opportunities faced by commercial real estate landlords looking to cut global emissions is top of our mind and fully integrated into our research and investment process.

In Summary

We believe there are several compelling reasons to invest in listed real estate over a market cycle, and more importantly, now. These include:

- Attractive yield potential relative to other investments

- Ability to generate a compelling total return

- Portfolio diversification

- Proven potential to perform well in inflationary environments

- Enhanced environmental, social and governance investment opportunities

RISK WARNING

There are special risk considerations associated with investing in the real estate industry securities such as Real Estate Investment Trusts (REITs) and the securities of companies principally engaged in the real estate industry. These risks include: the cyclical nature of real estate values, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses, demographic trends and variations in rental income, changes in zoning laws, casualty or condemnation losses, environmental risks, regulatory limitations on rents, changes in neighborhood values, related party risks, changes in the appeal of properties to tenants, increases in interest rates and other real estate capital market influences. Generally, increases in interest rates will increase the costs of obtaining financing, which could directly and indirectly decrease the value of a strategy investing in the Real Estate Industry.

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this portfolio may be subject to certain additional risks.

Diesen Beitrag teilen: