Morgan Stanley IM: The REIT Opportunity Today

The MSIM Global Listed Real Assets Team explores why real estate values in the public markets have suffered year to date and why the value of REITs should be more stable and create significant opportunities in the coming year.

14.12.2022 | 07:00 Uhr

Here you can find the complete article

Real estate values in the public markets have suffered year to date as a result of rising interest rates, moderating growth and tightening credit markets

Despite the inflation protection typically associated with the real estate sector, REITs underperformed the broader equities market and have overcorrected compared to private real estate, creating significant opportunities for the coming year

The earnings growth (and values) of REITs should be more stable and hold up better than broader equities over the next year.

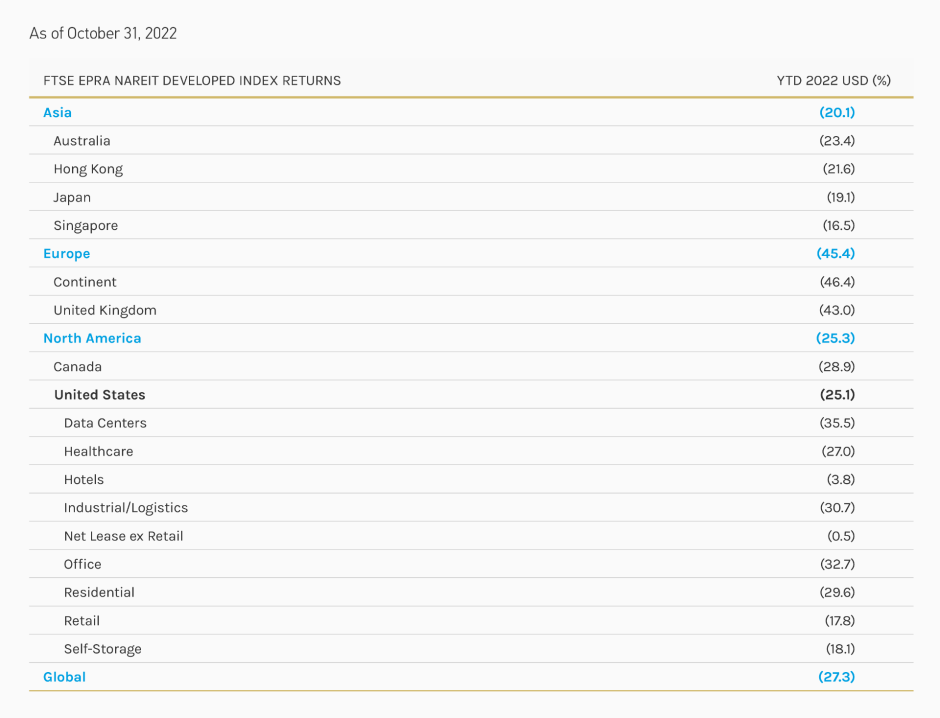

DISPLAY 1

Year-to-Date (YTD) 2022 REITs Performance1

Source: FTSE EPRA Nareit, Morgan Stanley Investment Management.

2022 started with great optimism for stocks and real estate, yet quickly turned into a year of disappointment. Record inflation led the Fed and other central banks to raise rates more aggressively than anticipated.

These aggressive hikes, coupled with stubborn inflation, declining consumer confidence, the depletion of real income growth and deteriorating savings rates, led to declines in the broader equities market. Importantly, this also led to increasing credit market concerns—both for the availability and cost of debt—which spelled bad news for listed real estate.

Ultimately, real estate values are a function of supply, demand and credit. With demand moderating due to slowing growth and credit markets tightening with increasing interest rates, real estate values in the public markets suffered. Despite the inflation protection typically associated with the listed real estate sector, REITs underperformed the broader equities market.

Simultaneously, as is often the case, values within the private real estate markets are taking longer to adjust. The appraisal-based nature of private real estate typically lags public valuations by approximately 12 months, while the daily pricing and volatility of listed real estate typically results in overcorrections in the public markets. Though painful on a coincident basis, this has now created an interesting arbitrage opportunity as we are faced with some potential contraction in private real estate and potentially meaningful appreciation in public real estate.

1Past performance should not be construed as a guarantee of

future performance. Index returns are gross of withholding tax. It is not

possible to invest in an index. Groupings are based on how the investment team

views the real estate securities universe and do not necessarily reflect

official groupings. Provided for illustrative purposes only. The views,

opinions and forecasts expressed herein are those of the investment team as of

October 31, 2022, are not necessarily indicative of those of Morgan Stanley,

are subject to change based on market, economic and other conditions, and may

not necessarily come to pass.

RISK WARNING

There are special risk considerations associated with investing in the real estate industry securities such as Real Estate Investment Trusts (REITs) and the securities of companies principally engaged in the real estate industry. These risks include: the cyclical nature of real estate values, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses, demographic trends and variations in rental income, changes in zoning laws, casualty or condemnation losses, environmental risks, regulatory limitations on rents, changes in neighborhood values, related party risks, changes in the appeal of properties to tenants, increases in interest rates and other real estate capital market influences. Generally, increases in interest rates will increase the costs of obtaining financing, which could directly and indirectly decrease the value of a strategy investing in the Real Estate Industry.

Diesen Beitrag teilen: