Morgan Stanley IM: Is the Fed losing patience?

With bond yields near 5%, US GDP coming in at 4.9% in 3Q and volatility increasing, we have reduced both risk and our duration underweight. We believe that the Fed may be losing patience and the risk of another hike is higher than reflected in current valuations.

15.11.2023 | 07:37 Uhr

Here you can find the complete article

During October, global equity markets remained under pressure for the third consecutive month as the S&P 500 Index returned -2.1%1 (USD), the MSCI Europe (EUR) Index fell 3.6%1 and the MSCI Japan Index (JPY) returned -3.1%1. Emerging markets also remained in negative territory with the MSCI EM (USD) Index down 3.9%1. Sector performance was broadly negative with only the MSCI ACWI Utilities (USD) Index posting a marginally positive return. The yield on the 10-year U.S. Treasury note touched 5% in intraday trading during October, its highest since July 2007. This move was most likely driven by a confluence of positioning, technicals, and investors’ acceptance of a higher-for-longer rates. The US 10-Year Treasury yield ended the month at 4.91%2, over 30bps higher than September end. Equity volatility as measured by the VIX increased sharply as the US 10-Year Treasury yield went up but fell to 18.12 by the end of the month.

Unsurprisingly, the Federal Open Market Committee (FOMC) left rates unchanged in its 1 November meeting. That said, we believe the market is still underpricing the risk of another rate hike in December. Pricing reflects a scenario where the Fed holds rates until mid-2024 and then cuts. However, markets have got it wrong before and if, as we suspect, there is a hike in December, valuations will need to adjust.

Why do we believe we are in store for one more rate hike? The issue is in the stronger than expected data in recent weeks - and the Fed may be losing patience. The Fed indicated back in September that they would be patient, allowing time for prior rate hikes to filter into the economy.

However, the US economy grew faster-than-expected, with GDP coming in at 4.9%3 in the third quarter (versus an expected 4.5%), driven by robust consumer spending. This is despite rising interest rates, persistent inflationary pressures, geopolitical tensions and a host of other domestic and international headwinds. The GDP increase marked the biggest gain since the fourth quarter of 2021. The US labour market remains strong, with September’s nonfarm payroll vastly outstripping expectations and the US Consumer Price Index (CPI) for September was also higher than expected. With all this in mind, we believe that the chances of another rate hike in December should be higher, perhaps closer to 50/50, as the current situation stands, higher than reflected in current valuations.

Investment Implications

We reduced risk across portfolios, given increased volatility, to

ensure portfolios remain aligned to their volatility targets. As 10-Year

US Treasury bond yields move close to 5%, we think this is a good

opportunity to reduce the duration underweight for the first time this

year. The bear steepening of the yield curve pressured risk asset

valuations, resulting in a sell-off in equities. Higher quality

companies performed relatively better. Despite higher yields, the US

dollar was not able to benefit from this rise to the same extent that it

did in September. Short-term rate differentials between the US and

other developed markets held stable and long positioning in the

greenback had become fairly stretched. Given this backdrop, we made the

following tactical changes in October:

US Small Cap Equities

We reduced our US small caps underweight, reallocating to US

equities. High leverage and low profitability has been weighing on small

cap performance and the asset class is now more sensitive to rates.

Until there is clarity that 1) rates have peaked and/or 2) it is very

clear a recession has been averted and not only pushed out, we believe

that the asset class may continue to underperform.

European Energy Equities

We moved further overweight on European energy equities given their

attractive fundamentals and the potential for the asset class to act as

a hedge for geopolitical risk.

Duration

As bond yields move close to 5% for the US 10-year Treasury, we

think this is a good opportunity to reduce the duration underweight. We

did this by moving from neutral to overweight US Treasuries. We also

removed the underweight to German Bunds and French OATs.

US 10-year Treasury bond

We moved from neutral to overweight US Treasuries, as after the

recent rise in term premium and after investors have priced out much of

the Fed rate cuts for 2024 and 2025, expectations are now more aligned

with our view of higher-for-longer Fed rates. This means US-Treasuries

should act as a better hedge against risk assets in future. This also

helped reduce our underweight duration.

European Core Government Bonds

We moved from underweight to neutral EU Core Government Bonds, as

EU disinflation trends are set to accelerate in the coming quarters with

the potential to surprise to the downside.

UK Gilts

We moved from underweight to neutral on UK Gilt bonds, as growth

and inflation risks are two-sided, leaving a slightly asymmetric risk

profile for the rates outlook, which does not warrant an underweight

signal anymore.

Emerging Markets Local Currency Sovereign Debt

We moved from overweight to neutral Emerging Markets Local Currency

Sovereign Debt, given differentials in Developed Market (DM) vs

Emerging Market (EM) policy movements. EM 10-Year rates have come down

sharply relative to DM and the “spread” between EM and DM is very tight

by historical standards.

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See Disclosure section for index definitions.

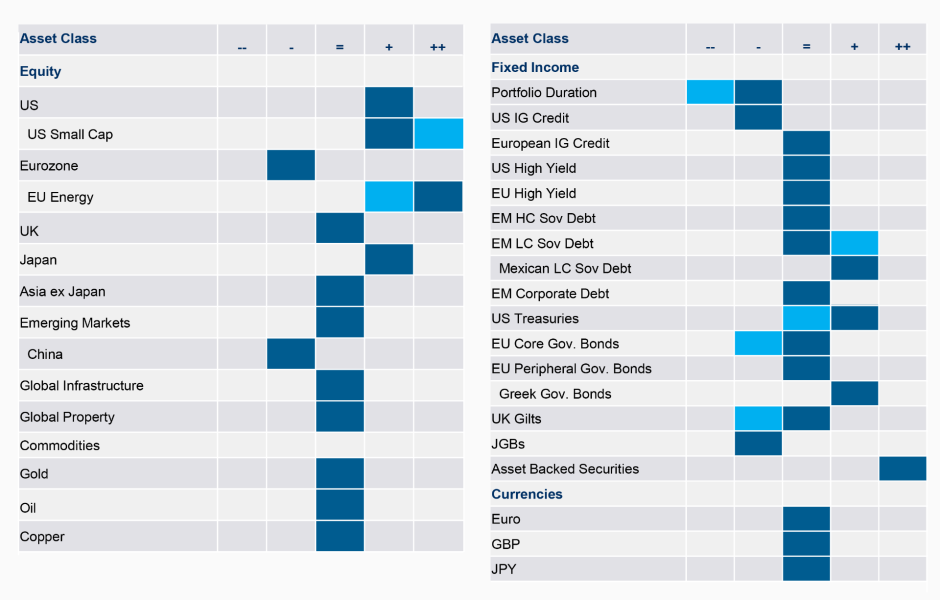

Tactical Positioning

We have provided our tactical views below:

Diesen Beitrag teilen: