NN IP: Fired up

On the fundamental side of the equation, macroeconomic surprises and earnings momentum improved marginally in the past week. Probably because of the benign fundamental picture, markets remain resilient in the face of geopolitical and US policy risks.

31.08.2017 | 14:00 Uhr

From a fundamental point of view not much has changed over the past week. If anything, we witnessed a marginal improvement in the macro surprise data (the US Q2 GDP number was revised up to 3%, which was above expectations) and earnings momentum data, with European momentum also benefitting from the improvement in the global growth outlook. On the monetary policy front the Jackson Hole gathering did not bring any surprise or hint. Both Yellen and Draghi steered away from monetary policy comments.

There was nevertheless some fireworks, or some sort of. North Korea fired a missile that crossed Japan, which briefly impacted risk appetite. The biggest moves were on the currency front, where the US dollar briefly dipped below the 1.20 mark against the euro, which hurt global equities. Treasury yields declined, with US yields touching this year’s lows and the JGB yield falling back below zero. Overall, markets remain resilient thus far as they partly recovered Tuesday’s losses.

The upcoming weeks could become eventful on the US political front. Congress has little time to address the debt limit and to avoid a government shutdown (12 joint working days after the summer recess). In the past, the equity market impact was fairly limited, with the exception of 2011 but this was in a different macro environment as US growth momentum slowed. This time, given the clumsy functioning of Congress, the impact may be bigger as these discussions may draw attention away from the plan to reduce taxes.

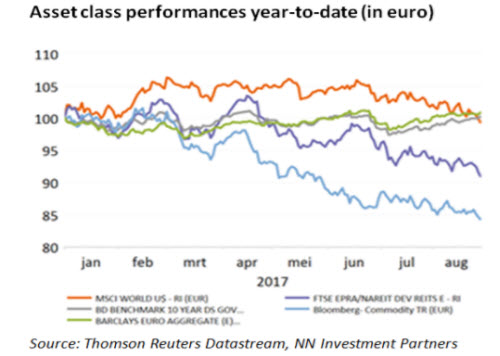

We did not make any changes in our allocation this week. Treasuries are a medium underweight whereas real estate, commodities and spreads are a small overweight. Equities are neutral.

Diesen Beitrag teilen: