Schroders: The company earnings at risk from rising carbon prices

A new model developed by Schroders provides investors with a more accurate measure of how carbon costs will affect companies.

05.09.2017 | 12:50 Uhr

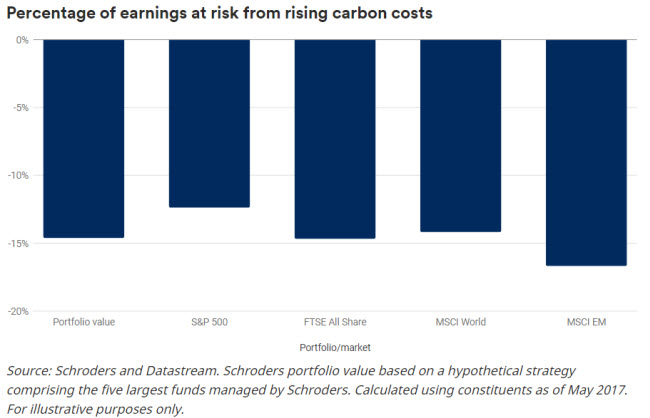

The extent to which company profits and investor returns could be at risk from tougher climate policies and higher carbon prices has been set out by a new model developed by Schroders.

The “Carbon Value at Risk” (Carbon VaR) framework, developed by the Sustainable investment team, highlights the inadequacies of traditional measures of climate risk and the problems investors face evaluating the impact of climate change on company profits.

Carbon VaR shows almost half of listed global companies would face a rise or fall of more than 20% in earnings if carbon prices rose to $100 a tonne.

A carbon price is a cost applied to pollution to encourage companies and other organisations to reduce the amount of greenhouse gases they emit.

Unlike usual carbon footprint measures, Carbon VaR focuses on companies’ business models and profit drivers rather than purely environmental measures.

The analysis shows carbon prices will have to be far higher than recent levels, reaching over $100 if the internationally agreed target of 2°C for global warming limit is to be met. (Visit our Climate Progress Dashboard to find out our latest prediction of where we stand on likely future warming.)

The effects on industries, companies and financial markets would be significant and widespread. Measuring and managing those risks is critical and requires the sort of innovative thinking Schroders is introducing today.

Source: Schroders and Datastream. Schroders portfolio value based on a hypothetical strategy comprising the five largest funds managed by Schroders. Calculated using constituents as of May 2017. For illustrative purposes only.

What is Carbon Value at Risk?

Carbon VaR measures the impact of rising carbon costs on a company’s profitability more accurately than those provided by carbon footprint analyses.

The effects of rising carbon prices on companies will be both dynamic and complex:

Companies’ costs will rise in proportion to the total emissions generated by themselves and their suppliers.

Selling prices are likely to rise to offset cost increases at an industry level.Demand should fall reflecting the sensitivity of customers to prices in each market affected, shrinking companies’ sales and costs.

Carbon VaR takes these linkages into account to gauge the impact on industry profits, using an estimating process to capture the three key variables of emissions, price and changing demand.

It’s also important to include all greenhouse gas emissions required to produce and sell a product, which conventional measures of carbon exposure do not.

The analysis also underlines the inadequacies of traditional measures of climate risk.

The problem with carbon footprints

Carbon footprints have become one of the most familiar ways for investors to gauge the impact of their investments on the environment.

A carbon footprint is a measure of the impact our activities have on the environment measured in units of carbon dioxide. So, if you drive a car to get to work or take a plane to go on holiday you leave a carbon footprint.

Businesses are the same. Everyday their operations create carbon emissions. A company’s carbon footprint typically relates the emissions it generates to its revenue or market capitalisation.

Such measures of “carbon intensity”, even if they are consistent, are often poor indicators of the effects of climate change on profitability or value. As a result, they provide little clue to the effect of carbon emissions on company earnings.

The curious case of Apple and Samsung

The example of Apple and Samsung is worth considering.

The two rivals sell fundamentally similar consumer electronics. Yet Samsung’s carbon footprint is significantly higher than Apple’s, because Apple outsources most of its manufacturing whereas Samsung manufactures more products itself.

In climate terms, this is an irrelevance: the emissions created by producing and selling both sets of products are in reality much the same.

To get an accurate picture, an investor clearly needs to get a handle not just on the company’s own emissions, but also those emanating from its suppliers. Carbon footprints, as currently conceived, don’t incorporate that information.

It follows that investors who rely on carbon footprints to guide their portfolios may face risks that they and their managers are not addressing.

Without innovative tools to help navigate a new environment of carbon reduction, investors will find it hard to reach their investment destinations, which is why the Carbon VaR model was created.

Die hierin geäußerten Ansichten und Meinungen stellen nicht notwendigerweise die in anderen Mitteilungen, Strategien oder Fonds von Schroders oder anderen Marktteilnehmern ausgedrückten oder aufgeführten Ansichten dar.

Der Beitrag wurde am 04.09.17 auch auf schroders.com veröffentlicht.

Diesen Beitrag teilen: