Morgan Stanley IM: A Low Carbon Tilt to Global Multi-Asset Investing

The recently-launched Global Balanced Sustainable Fund was the main topic during an internal call with Christian Goldsmith, lead portfolio specialist of the Global Balanced Risk Control (GBaR) team. Here we share some excerpts from that discussion.

08.02.2021 | 12:14 Uhr

Here you can find the complete article

The GBaR team is best known for risk-controlled multi-asset portfolios. What compelled you to launch a new sustainable fund?

It’s true that we’ve built a strong reputation for managing risk. We’ve been running volatility-targeted portfolios since 2009, and all of our portfolios benefit from GBaR’s trademark risk-controlled approach. Sustainable investing, though, is not new to us. We launched our first ESG1 funds in 2016.

Our team’s experience with ESG has convinced us of the increasing materiality of sustainability factors in investment decisions. It’s this conviction, combined with growing demand from clients for innovative approaches to sustainable investing, which inspired us to launch the Global Balanced Sustainable Fund.

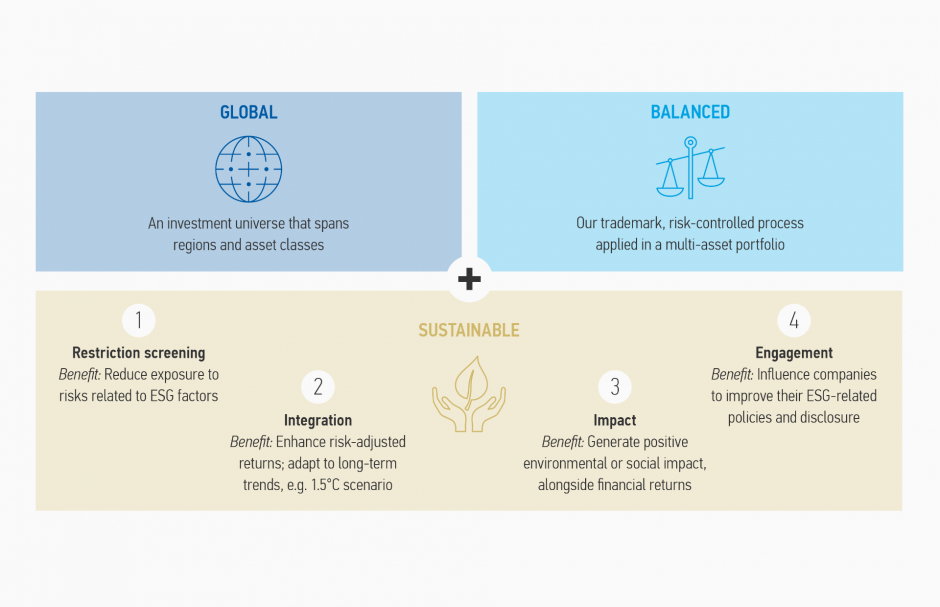

Investors are seeking higher-conviction approaches—managers who genuinely strive to contribute solutions to the world’s environmental and social challenges, whilst also providing attractive risk-adjusted returns. Like our existing funds, the Global Balanced Sustainable Fund integrates ESG factors into the investment process and incorporates restriction screening. But it goes further in both of these areas than we have previously gone, plus it has the additional element of impact investing. On top of all of this is our commitment to align our direct equity exposure with the Paris Agreement’s objective of limiting global warming to 1.5° Celsius.

Having spent over a decade researching risks to the global economy and global markets, ESG factors such as climate change clearly fall into our definition of potential “risk events.” We therefore view the fund as a natural extension of our philosophy around risk control.

Tell us more about what makes this fund distinctive. Why should I include it in my portfolio?

Simply put, what makes this portfolio unique is its four-part approach to sustainability. It employs a combination of restriction screening, ESG integration, impact investing and engagement—all in the context of a global portfolio that balances risk and reward across asset classes. A key attribute is that our core equity allocation is aligned with the Paris Agreement’s objective of limiting the increase in global warming to 1.5° Celsius (Display 1). Not many other multi-asset funds can say that.

Source: Morgan Stanley Investment Management.

Download the PDF to read other excerpts from our discussion and learn more about the Global Balanced Sustainable Fund.

Diesen Beitrag teilen: