Morgan Stanley IM: Beyond Diversification - The Case for Active Multi-Asset Funds

There are two keys to managing a multi-asset portfolio successfully. The Global Balanced Risk Control team discusses.

23.07.2021 | 10:50 Uhr

Here you can find the complete article.

Hiking enthusiasts understand the importance of wearing the right footwear given the terrain. Comfortable sneakers work just fine on the flats wending through the forest or around a lake.

Hiking boots generally afford a sturdier tread for tougher terrain, and high-tops improve ankle support. Waterproof boots are available for river crossings and crampons can be attached for added traction on the most challenging hikes. But treadless sneakers in the downhill steeps on scree? The potential for a disastrous fall.

Investors too are faced with continually changing market conditions. In our years of active fund management, our team has invested during economic recessions and recoveries, momentum markets and bubbles, rising interest rate and inflationary environments. Not to mention those “black swan” events that can take even the most astute investors by surprise.

Diversification is good but not sufficient

Given the vicissitudes of the market, holding certain investments in certain markets could be potentially disastrous. Research shows that, in distressed markets, equities across the globe start to move together in lockstep. Equity-only managers have no recourse other than to reallocate between their equity holdings and cash. We have previously referred to this quandary as “rearranging the deck chairs on the Titanic.”

Fixed income is often viewed as a safer investment in volatile markets. But we have seen bond funds lose money, and they have historically delivered lower long-term performance than equity.

Diversification is often the pat answer to managing volatility. It entails building a portfolio with both equity and fixed income assets in some fixed proportion based on an investment horizon and risk profile. And it’s a good idea.

Until it isn’t.

In our minds, a passively-managed portfolio, no matter how diversified, fails to protect capital during significant market drawdowns. Imagine an investor holding a 70% equity/30% fixed portfolio: If the equity allocation is down -30% and fixed income is unchanged, simple maths indicates the total portfolio is still down -21%, i.e., bear territory.

In contrast, a multi-asset manager allocates across multiple asset classes that can be rearranged to manage risk. But in our view, there are two keys to managing a multi-asset portfolio successfully: One, that the manager is a truly active manager, and two, that they manage to a volatility target, not a benchmark.

Active management is forward looking

Simply defined, multi-asset managers manage equity, fixed income and cash in the same portfolio. In our case (and others), we manage commodity-linked notes as well. Multi-asset funds are not “target date” funds, where allocations between equity and fixed income change at prescribed intervals over the life of the fund, based on the age and risk profile of the investor. While target date funds are a good fit for certain investors, they generally do not make tactical adjustments based on market conditions over the life of the fund.

As we see it, diversification is only effective if a portfolio is actively managed. In our case, active management is a forward-looking exercise, and anticipating volatility events is the hallmark of our investment approach. Yes, that means we are, in fact, trying to forecast the future. But not with tarot cards. Our dedicated team of 171 investment professionals continually surveys macroeconomic and geopolitical conditions across the globe to identify potential sources of risk that could arise. Our stated goal is to adjust portfolio exposures before volatility strikes.

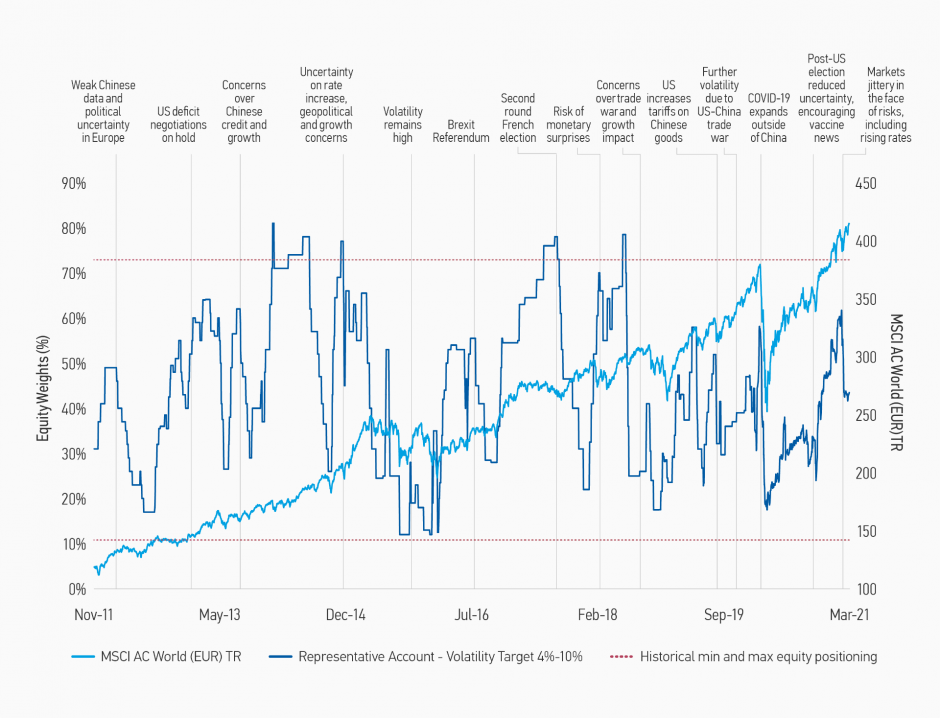

In our portfolios the equity allocation is the primary lever for adjusting our risk exposure. When we expect some event—such as political instability, exacerbated trade tensions or a significant change in monetary policy— to cause a spike in market volatility, we typically—actively—reduce exposure to equities. Our goal is to get ahead of the “bad” news, as opposed to a post-volatility correction. In the same way, when we expect a reduction in the volatility level, we actively increase exposure to equities, to take advantage of the upside potential. Display 1 shows how we have adjusted equity exposure in anticipation of various global events over the past two years.

Display 1: Dynamic equity exposure is key in our multi-asset portfolios

Source: Morgan Stanley Investment Management, DataStream, 31 March 2021. Subject to daily changes, for illustrative purposes only. Not intended as a recommendation to buy or sell a specific security. Past performance is not a reliable indicator of future performance.

As you can see from Display 1, we make significant changes to our asset mix based on what we see as upcoming risk events. Our equity allocation was near 80% in mid 2018, but when US-China trade tensions were exacerbated globally by political factors, we shifted that allocation to close to 25% by the summer of that year. In early 2020, to help manage volatility during the COVID-19 pandemic and unprecedented shutdown of the global economy, we reduced the equity allocation of our flagship portfolio from around 55% to 20%, a position we maintained as volatility remained elevated.

Multi-asset managers have to manage volatility

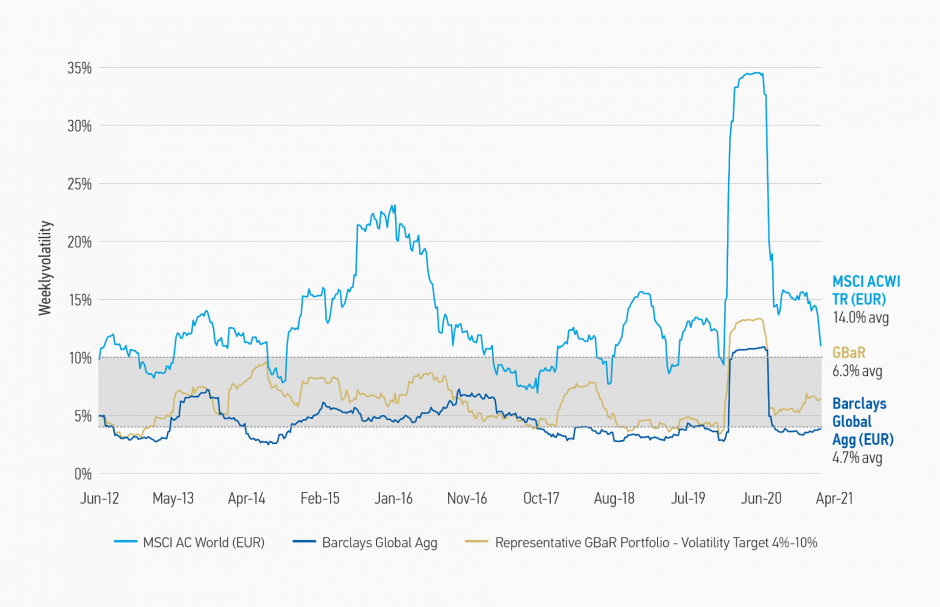

On one level we are managing a multi-asset portfolio, but in truth,

what we are really managing is volatility. In our case, we manage our

multi-asset fund to a pre-defined risk budget, also defined as a

volatility target range. In the MS INVF Global Balanced Risk Control

Fund, launched in November 2011, we target volatility in the range of

4%-10% (see Display 2). Typically, we expect volatility to be

towards the middle of this range, but in extreme conditions we may make

fuller use of the range, for example to protect the portfolio from

volatile down markets. Our goal is to deliver competitive returns and

minimize downside market participation within these volatility

parameters.

Display 2: A track record of stable volatility

Source: Bloomberg, 6-months volatility, 4 May 2012 to 30 April 2020. Subject to change daily. Past performance is not a reliable indicator of future performance. Provided for informational purposes only and should not be deemed as a recommendation to buy or sell securities in the asset class shown above. Each portfolio may differ due to specific investment restrictions and guidelines. Accordingly, individual results may vary.

This is quite a different approach from most investment managers, who designate a benchmark to evaluate their fund’s performance. But evaluating any investment relative to a benchmark is tricky: If the broader market is down -35% and a portfolio only -30%, the manager has in fact beaten their benchmark, which is great for the manager. The client, however, has still lost close to a third of their investment.

We benchmark our portfolios based on volatility and our investment process begins with risk. As discussed, we specify a target range of volatility, e.g., 4%-10%, within which we aim to maintain the strategy’s volatility. Typically, we expect this to be towards the middle of the range i.e., 6%-7%. As stated, our multi-asset portfolios hold a mix of equities, fixed income, commodity-linked notes and cash, and this flexibility to diversify across asset classes is critical in managing risk.

In the industry vernacular, we are often referred to as, not surprisingly, a “volatility manager.” A paper from the Yale School of Management, “Volatility Managed Portfolios,”2 indicates that volatility management is an investment approach that can produce superior investment results.

From the paper’s abstract:

- “Managed portfolios that take less risk when volatility is high produce large, positive alphas and increase factor Sharpe ratios by substantial amounts.”

Furthermore from the research:

- “We construct portfolios that scale monthly returns by the inverse of their expected variance, decreasing risk exposure when the returns variance is expected to be high, and vice versa. We call these volatility-managed portfolios. We document that this simple trading strategy earns large alphas across a wide range of asset-pricing factors, suggesting that investors can benefit from volatility timing.”

The Global Balanced Risk Control team’s multi-asset portfolios: 2020

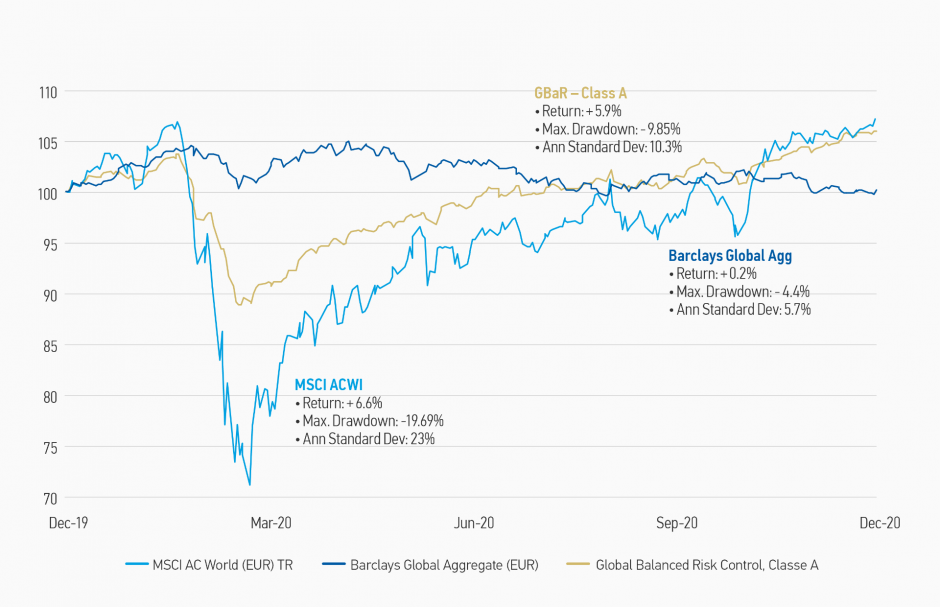

2020 is a good example of what we believe are the advantages of an actively managed multi-asset portfolio benchmarked to a volatility target.

As can be seen in Display 3, our multi-asset portfolio, the MS INVF Global Balanced Risk Control (GBaR) Fund of Funds—Class A in euro terms— captured nearly 90% of the MSCI All Country World Index’s (ACWI) (EUR) positive return over the course of 2020. Yet, its maximum drawdown during the year was only half that of the index—approximately ~10% vs. ~20% for the MSCI ACWI, achieved with less than half the volatility—approximately 10% versus 23% for the MSCI ACWI. In our view, delivering competitive performance without extreme volatility is particularly appealing for the vast majority of clients.

Display 3: An active multi-asset approach anticipates risk, avoids extremes

Source: Datastream. Data shown from 01 January 2020 until 31 December 2020. Subject to change daily. Provided for informational purposes only and should not be deemed as a recommendation to buy or sell securities in the asset class shown above. Each portfolio may differ due to specific investment restrictions and guidelines. Accordingly, individual results may vary. Past performance is no guarantee of future results.

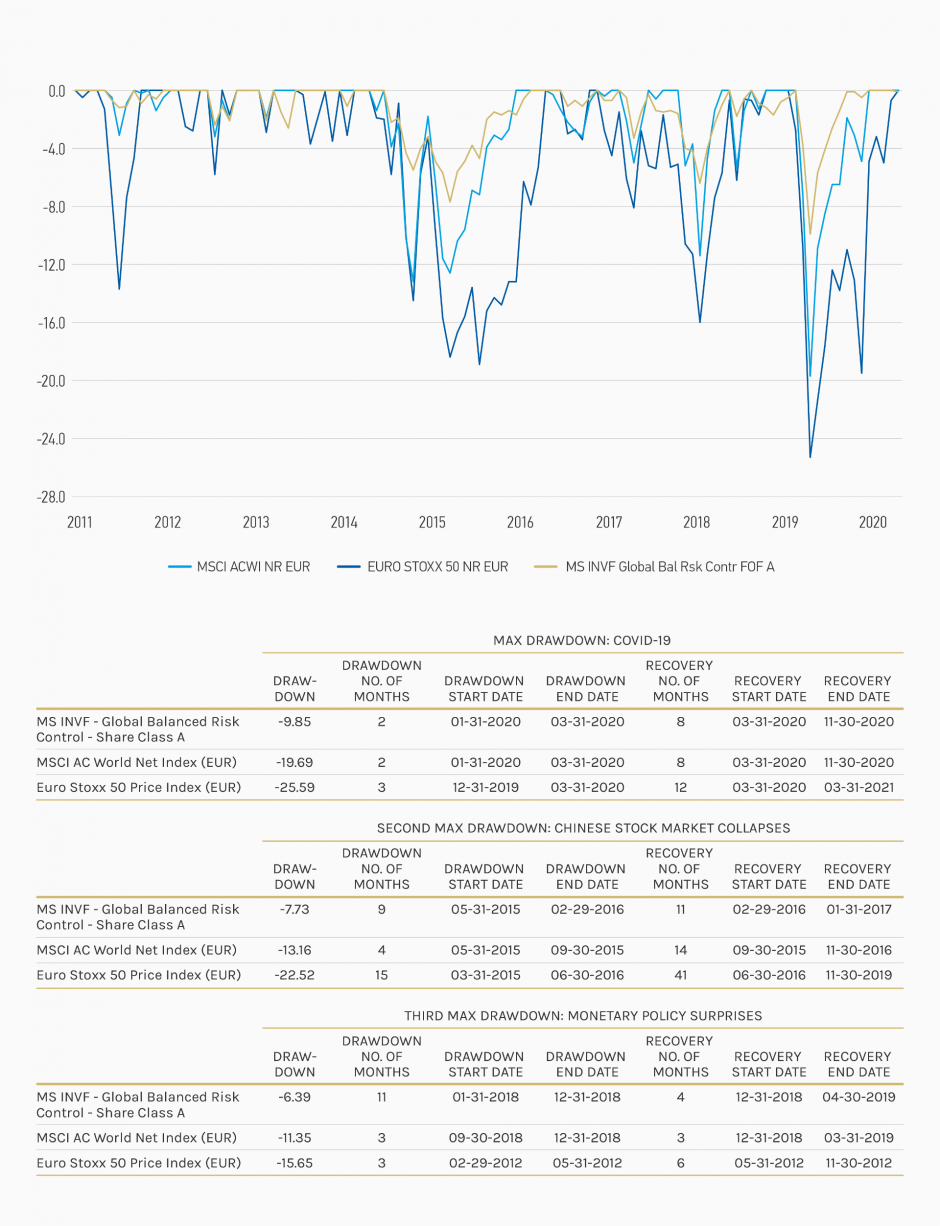

In fact, we find that our approach to multi-asset investing often meets the needs of both high-net-worth (HNW) investors and smaller clients. In particular, as a core portfolio allocation for the former and as a holistic strategy for the latter. Over the years, we have come to understand that investors are often more concerned with keeping their money than with growing it aggressively. Having said that, we see that both HWN and smaller investors do want to grow their money, but with less volatility and most importantly, with no surprises. These investors (and others) realize that massive drawdowns have the potential to cause even the most sophisticated investors to sell at the bottom—often the biggest disaster of all. Our ability to protect portfolios on a relative basis during the most volatile periods is shown in Display 4, demonstrating the manager’s true active management and flexibility within a volatility target/risk control framework. The speed of execution and available tools (futures and options, among others) in order to achieve these results are also factors to consider when an investor delegates part of their portfolio to a multi-asset manager with a risk control framework.

Display 4: Drawdowns since inception of MS INVF Global Balanced Risk Control in comparison with MSCI ACWI TR (EUR) and Euro STOXX 50

* Past performance is no guarantee of future results. This is for information purposes only and should not be construed as a recommendation to buy or sell the funds mentioned.

Source: Morningstar Direct

The increased demand for multi-asset products

There has been an uptick in the popularity of multi-asset funds in Europe. According to a recent Lipper Alpha Insight, “Multi-Asset Is Dead – Long Live Multi-Asset!”3

- “Given the fact that a number of investors are not willing, or allowed, to invest directly in the stock markets and/ or demand returns that are considerably higher than the returns from the bond markets, one doesn’t need to be a market wizard to predict that the assets in multi-asset funds will increase, as multi-asset funds are the product type of choice for these investors.”

The paper goes on to say that “the increasing demand from regulators in Europe regarding financial advice could lead to more demand for multi-asset products, as these might be the most appropriate product type for retail investors According to data from EFAMA (European Fund and Asset Management Association), demand for multi-asset funds, despite a reduction in demand for 2020, compared to 2019, is gaining further traction in 2021, with net inflows of EUR 10 billion recorded in February 2021, up from EUR 4 billion in January 2021.4

Looking ahead

As of the writing of this article, let us try to answer some concerns of our clients that revolve around inflation, a rising-rate environment and the dreaded stagflation (the dreaded mix of stagnant economic growth coupled with high inflation).

RISING-RATE ENVIRONMENT – A rising interest rate environment often heralds a strong economy and an uptick in inflation, which should benefit cyclical sectors including, for example, financials, energy and industrials. We view this type of environment as rich with opportunities for an active multi-asset manager, as opposed to passive buy and hold strategies.

INFLATION/STAGFLATION – We have clients concerned about a scenario pairing hyperinflation and a depressed economy. In our view, runaway inflation would be the result of undisciplined monetary policy or a major supply shock. While we have witnessed sizable increase in debt levels in many major economies such as the U.S., fiscal spending going forward is likely to be more funded and hence less inflationary. The near term supply constraints are likely to push up costs such as raw material prices, but we foresee the bottleneck to be transitory. That being said, we do see some of the structurally deflationary factors such as globalization start to weaken and expect inflation to return in the coming decade.

In any of these scenarios, an active multi-asset portfolio is likely the best place to be. Our anticipatory approach to risk guides us as to where we should be – and in a higher inflation scenario we would consider investments like gold, broad commodities, energy stocks, short duration assets and select emerging market equities, amongst others. Our list of choices continually evolves and we believe gives us an edge over passive equity and fixed income vehicles.

An approach that adapts – so that you don’t have to

Serious hikers and enthusiasts choose footwear that can deliver comfort and traction on a wide variety of terrain. We believe that multi-asset portfolios can do similarly by employing an approach that actively manages allocation decisions, while managing the entire portfolio to a volatility target. This is an approach that adapts the asset mix so that you don’t have to.

The goal is similar: Competitive performance with minimized participation in distressed markets.

Time to hit the trails!

Diesen Beitrag teilen: