Kames Capital: Correlations and multi-asset investing

The dictionary defines correlation as the “mutual relationship or connection between two or more things.” This applies to a range of potential assets, such as bonds, equities, property and alternative investments. Why multi-asset investors pay such close attention to the correlations between asset classes.

29.06.2017 | 12:20 Uhr

Vincent McEntegart, manager of Kames Capital’s diversified income strategy, explains why multi-asset investors pay such close attention to the correlations between asset classes.The dictionary defines correlation as the “mutual relationship or connection between two or more things.” This applies to a range of potential assets, such as bonds, equities, property and alternative investments.

Our multi-asset funds aim to provide a total return similar to long-term equity markets, but with between half to two-thirds of equity market risk. We believe asset allocation is the primary driver of investment returns, so the best way to reduce risk (while maintaining return) is by diversifying across lowly-correlated investments.Historically, many investors have reduced risk by holding a portfolio of around 60% equities and 40% government bonds, relying on the assumption that equities and government bonds are negatively correlated. But as the past decade has shown, this is not always the case. Traditional relationships and correlations between equities and bonds can and do break downTo achieve their return and risk objectives, multi-asset portfolios have become more global and are making use of a broader range of assets, including infrastructure, renewable energy and asset leasing. This demands that we have a detailed understanding of the inter-relationships between a larger and more diverse universe of potential investments.

How do major asset classes correlate with each other?

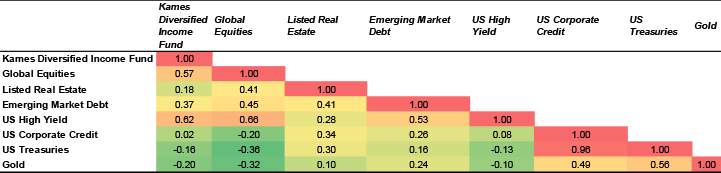

The ‘heat map’ in Table 1 below shows the correlations between major asset classes within our UK-domiciled multi-asset income fund. The lowest correlations are in green and yellow, with more highly correlated assets in red and amberTable 1: Sample cross-asset correlations since launch of Kames Diversified Income Strategy Source: Kames Capital. As at 30 April 2017, reflecting daily price movements from fund inception on 25 February 2014.This understanding of how different asset classes relate to one another enables us to blend them together in the most efficient way to meet our objectives. A good example is gold, which currently has a correlation of -0.32 with global equities and +0.56 with US Treasury bonds. This means that gold can potentially be used in multi-asset portfolios to help protect against a potential equity market sell-off.

Recognising the negative correlation between gold and equities, it is possible that some investors may have chosen to structurally allocate to gold rather than US Treasuries in recent years. This may have been justified on the premise that US Treasures would deliver a negative return if yields rose (as was widely expected). However, our experience since launching our multi-asset income fund in 2014 has been a negative return from gold (-1.7% per annum) and a positive return from US Treasuries (+2.3% per annum)

This illustrates the importance of not basing asset allocation decisions solely on correlations. An analysis of expected returns, driven by valuations and fundamentals, is also important. This explains why we have not held gold, which provides no income and has a very volatile price, so it is difficult to assess its fair value. It is also why we have seldom made significant allocations to US Treasuries.

Instead, we have sought to manage risk by diversifying into other alternative assets, such as real estate investment trusts. Although not negatively correlated with equities, they still offer diversification benefits as the correlation with equities is relatively low. Furthermore, relative to US Treasuries they also offer attractive income and return prospects, allowing us to manage risk at the same time as achieving our return objectives.

Can correlations change?

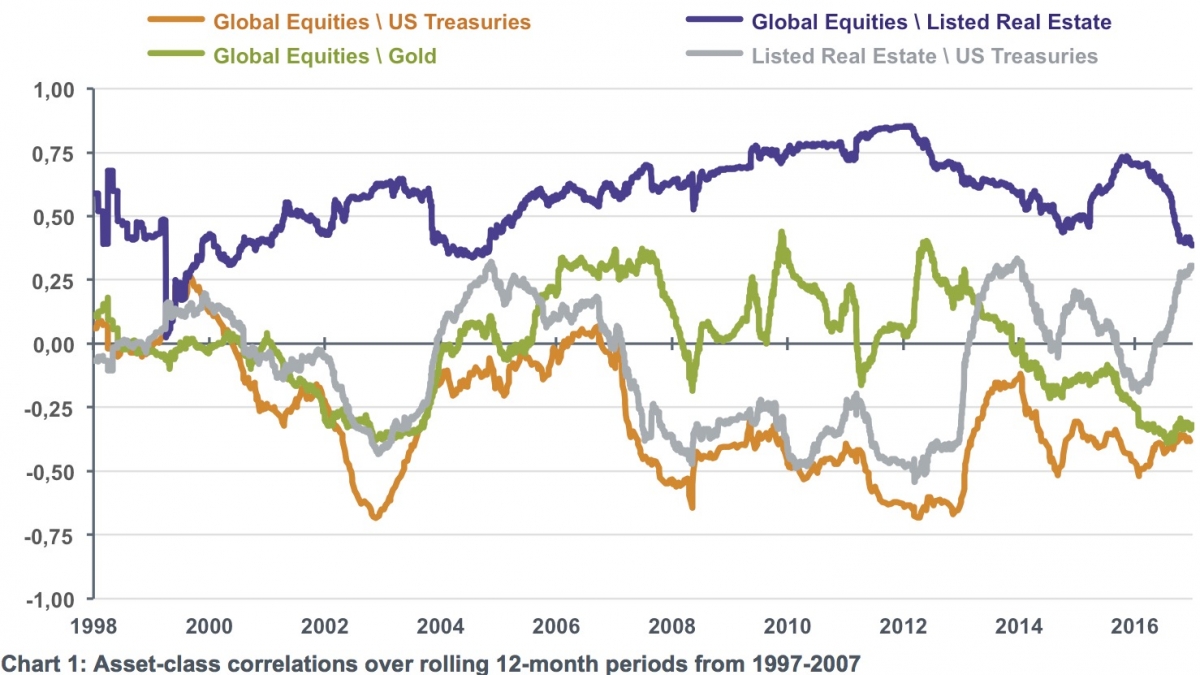

Yes. An alternative dictionary definition for the word correlation is “the process of establishing a relationship or connection between two or more things.” This definition is perhaps more representative of asset-class correlations, because despite the persistence of some traditional relationships (such as that between gold and theUS dollar), these are constantly changing. This can be seen in Chart 1 below, where we illustrate historic rolling 12-month correlations between various asset classes over the past 20 years.

As multi-asset managers we invest on a forward-looking basis, taking account of the past and anticipating how these correlations might change in the future. So, while we may use bonds in future to dampen volatility, our global, multi-asset remit means that we are not reliant on them

How are we positioning for the future?

We continue to use a range of alternatives and cash to diversify equity and credit risks. For our income-focused fund, the merit of a significant cash position is limited in the current low rate environment. ‘Alternative’ assets cover a wide and growing opportunity set with significant appeal, including real estate investment trusts, real-asset leasing, infrastructure and renewable energy. The importance of these ‘diversifiers’ is two-fold: Their ability to reduce the net risk of the portfolio through their low correlations, along with a positive potential total return contribution in their own right. Listed investments in infrastructure and renewable energy provide the latter through their contractually-backed income streams, long time horizons and degree of inflation protection. However, their effectiveness as a diversifier (and their future role within our portfolios) will depend on their correlations with other asset classesIf we are to continue delivering attractive risk-adjusted returns for our clients it will be necessary to understand both expected future returns and potential changes in correlations across asset classes.

Diesen Beitrag teilen: