Morgan Stanley IM: Oh no, it’s too hot, no wait, it’s too cold, no, it’s actually too hot!

After a horrendous June, bond and credit markets reversed course dramatically in July, generating exceptionally strong performance while also being the first positive return month of the year! The Fixed Income team shares its thoughts.

29.08.2022 | 10:11 Uhr

Here you can find the complete article

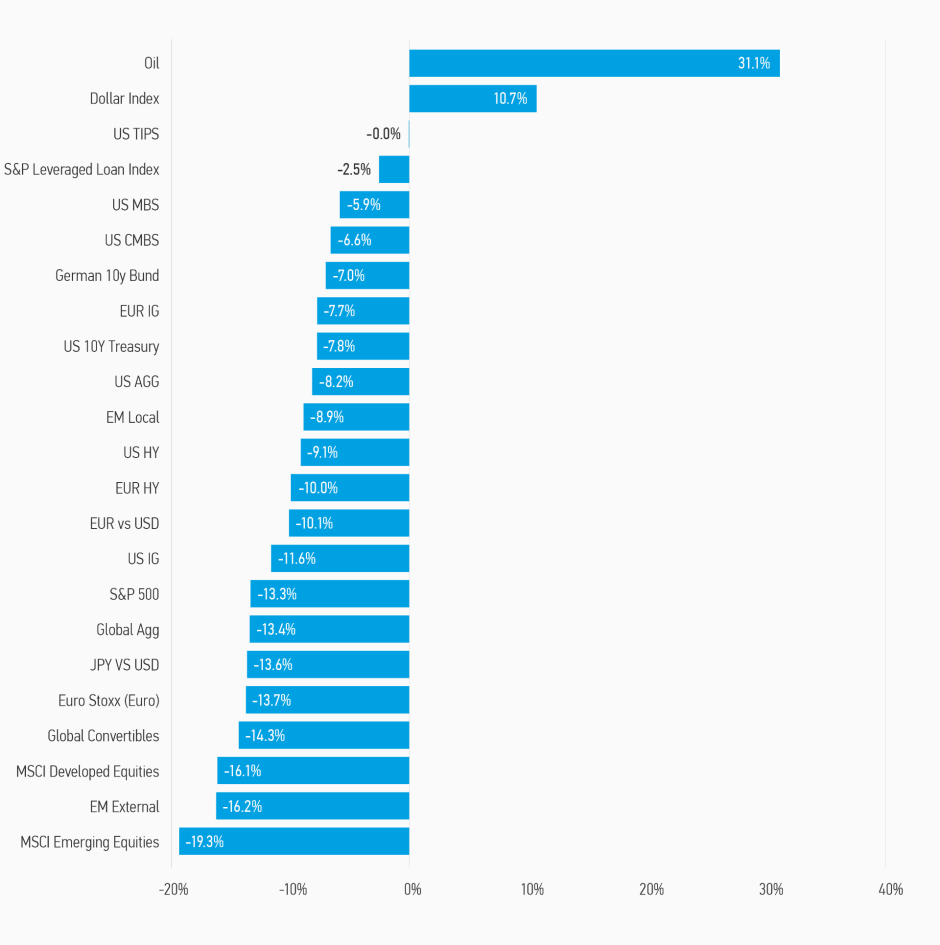

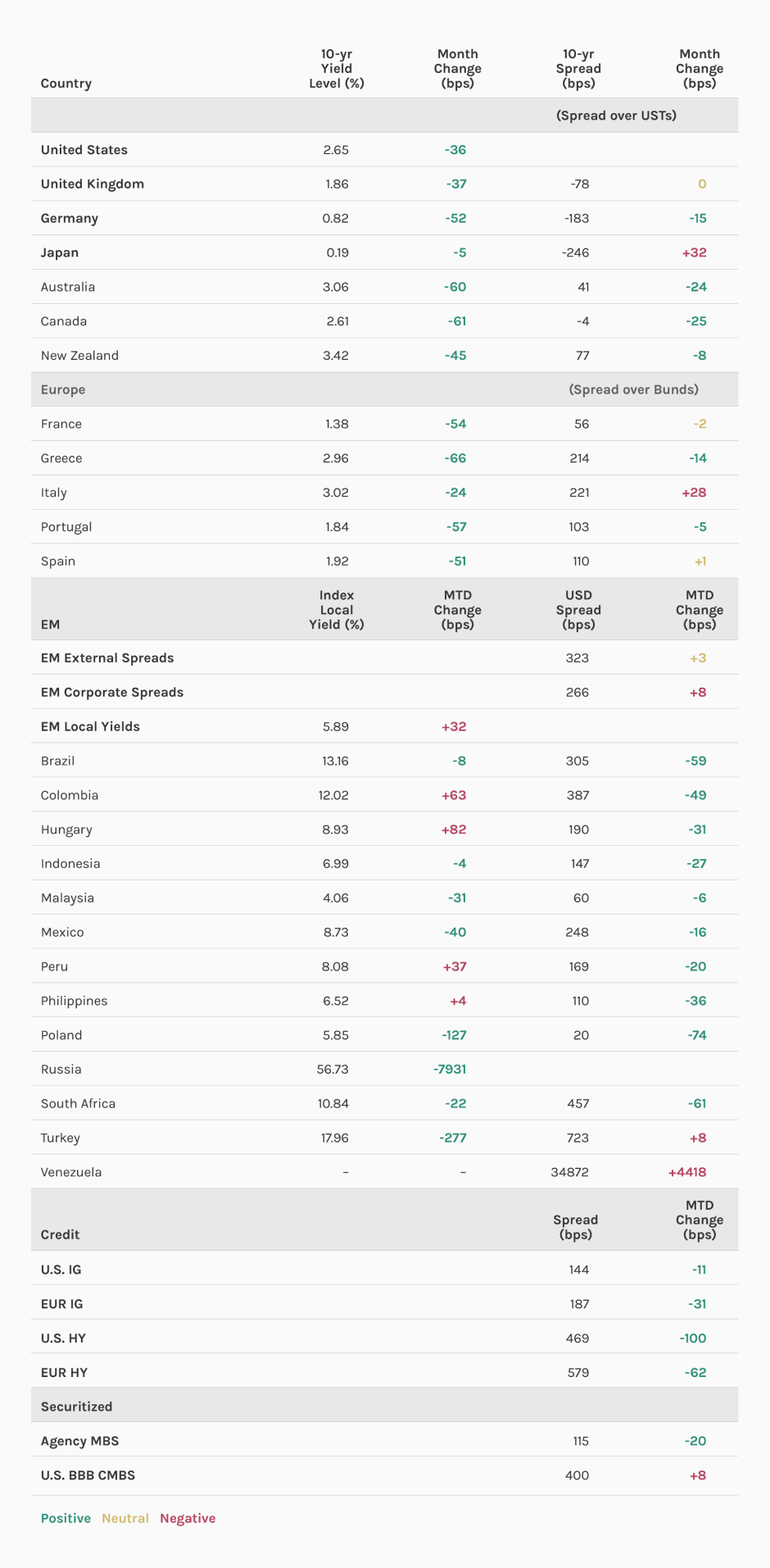

Given the situation the US and global economy finds itself in, this was unexpected to say the least. Indeed, financial market performance has not been this volatile in a long, long time. The narrative of a hawkish US Federal Reserve (Fed) and high and stubborn inflation (a too hot economy) was the story until mid-June. By the end of June, recession fears (economy too cold) took hold, driving yields and, somewhat surprisingly, credit spreads lower. US Treasury 10-year yields fell 36 basis points (bps) on the month, and a whopping 85 bps from their peak on June 14th. Inflation expectations fell sharply as did real interest rates as markets priced in Fed success of achieving their long-term inflation objective of 2%. European and other bond markets had equivalent, if not larger, rallies. Indeed, on top of the fall in government bond yields, credit spreads tightened meaningfully from their June levels, generating even higher returns.

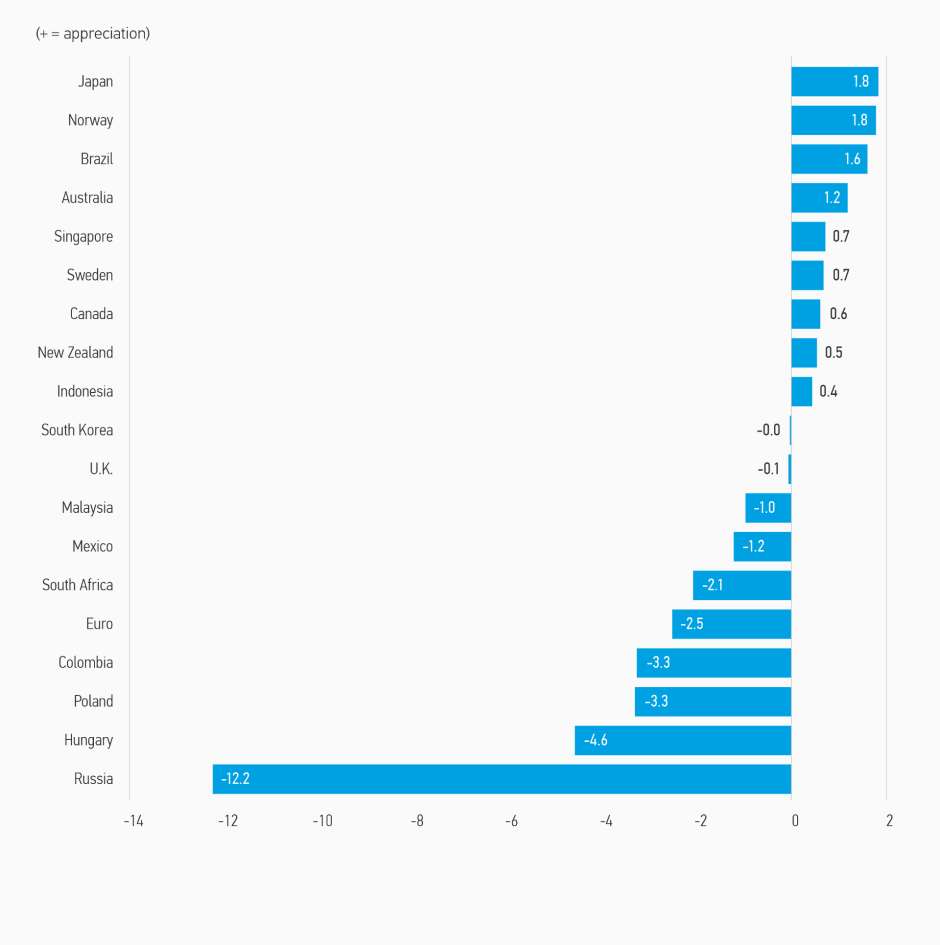

For example, the US high yield index tightened 100 bps (with yields falling 132 bps, generating a return over 6%) while Euro HY spreads tightened 62 bps. Emerging markets also had spots of robust performance, but external markets generally underperformed developed market governments and corporates. Just as all things sold off in June, essentially everything rallied in July. Even the US dollar, while not exactly weak in July, did sell off against a variety of currencies, after being somewhat impregnable previously.1

What caused such a turnaround? Bad news. Economic data, particularly on the goods/industrial production side of the economy, was weak while also surprising to the downside. Whether it was survey data (business confidence PMIs,) or GDP data (US GDP contracted in the first half of the year), economic indicators increasingly pointed to a looming recession in most economies outside of Asia. While not a certainty, probabilities moved well past 50%. Although one might think this would be bad for equities and credit, markets took it positively for two reasons. The first is the expected path of short-term rates as set by central banks was adjusted meaningfully lower, e.g., less rate hikes were expected. In the Eurozone this adjustment reached 100 bps of rate hikes priced out of the bond market. While economic data was weak, the expectation (hope?) that central banks would “pivot” to a more dovish policy stance buoyed the market. To see how dramatic this was, German 2-year government bond yields fell. Secondly, the velocity of the sell-off in rates and spreads was extreme in the relatively short period it occurred in the run up to the Fed June rate hike. US and European high yield spreads (as well as Euro investment grade spreads) moved into recession territory. Although not priced for an extreme recession like 2008 or 2020, high yield spreads did move to levels associated with economic downturns. The combination of these two factors was the primary driver responsible for the dramatic turnaround in asset prices in July. Falling commodity prices also helped.2

DISPLAY 1: Asset Performance Year-to-Date

Unfortunately, volatility is not likely to abate soon. US labor market data remains very strong. Witness July payrolls released August 5: it was gangbusters showing further tightening of the labor market rather than loosening, and further increases in wage growth rather than amelioration. The unemployment rate is now at its lowest level since the 1960s! Commodity prices are coming down (except for Europeans), particularly energy and food. Unfortunately, for Europeans, inflation also remains under threat of further increases given its vulnerability to disruption in energy supplies.3 Whether or not this is the last gasp of US labor market strength, or the last gasp of inflation, markets should be prepared for more gyrations as all market forecasts this year have proven to be wide of the mark. Hot to cold to hot again?

DISPLAY 2: Currency Monthly Changes Versus U.S. Dollar

Fixed Income Outlook

The pandemic and its repercussions both in terms of policy response and behavior have been unprecedented. Therefore, historical playbooks are of limited use. For example, the US economy is in a recession as measured by two negative quarterly GDP results. Additionally, household and business confidence are near historical lows on several measures. But, at the same time, the unemployment rate continues to fall as jobs are created at a pace normally associated with a booming economy.

So, what is the truth? There is no doubt economic growth has decelerated, particularly goods production. The slowdown was almost preordained given how above trend growth got to in 2021 AND the residual supply chain disruptions which continue to bedevil the global economy. Core inflation in almost all countries remains unacceptably high and shows no signs of significant deceleration, although it might have peaked. The truth is imbalances in labor markets and goods markets continue. There appears to be excess employment in some industries (e.g., tech), underemployment in services (travel & leisure), and potentially goods markets struggling with supply chains. This creates a very muddled picture. In the US for example, initial jobless claims released on August 4th hit its highest level in six months, suggesting a cooling of the labor market, but the employment report on August 5th was strong across the board. The job openings to unemployed ratio is also coming down, but still shows in absolute terms excess demand for labor. The employment report and strong wage growth trumps jobless claims, suggesting stubborn inflation unless the Fed sticks to its tightening plans. The US economy exhibits somewhat schizophrenic behavior: some sectors are struggling while others are recovering (and growing nicely). Continue to expect conflicting signals. Growth should be better in the second half of the year but will not be strong. It is too soon to be confident that the economy will cool enough, and unemployment will rise enough to bring inflation down to acceptable levels in the time frame the market expects.

What this suggests is that it is premature to signal the all clear on the bond bear market, although we are skeptical, we will achieve new highs in long-term yields. In particular, the recent rally in US Treasury 10-year yields to almost 2.5% looks too aggressive and may constitute the floor for yields in the months ahead. In other words, yields should continue to back up. Yield curves should continue to flatten and could become meaningfully inverted if inflation remains stubborn.

The good news is we do not see the start of a new leg of an extended bond bear market. The contours of US Treasury yields appear to be set: the peak in 10-year yields was likely hit in mid- June when the Fed surprised with a 75-bps hike and the lows set prior to July’s employment report released in August constitute the bottom of the range: 2.5% - 3.25%. Similar calculations apply to most other developed market bond markets, with for example, German 10-year government yields likely to be in a 0.75% to 1.25% range near term. Some countries faced with more downside economic risk like the UK, New Zealand and Australia are likely to see less aggressive yield rises.

While near term volatility is likely to persist as the too cold vs too hot debate continues, corporate bond markets are likely to stay in a range. Uncertainty over the macro backdrop and corporate performance supports a bias to sell credit into rallies and move up in credit quality (hedging the risk central banks WILL cause a recession to bring down inflation). Spreads are generally above their long-run averages, suggesting a somewhat undervalued market with lower risk of a recession this year but higher next year, at least in the US. Euro investment grade (IG) looks somewhat more attractive than US IG given wide swap spreads and an FX hedging advantage. On the other hand, much higher probability of recession in Europe makes European high yield corporates and securitized credit less attractive. Securitized credit did not benefit nearly as much from the July rally as did corporate credit.

Emerging Markets did selectively benefit from the July rally but remain undervalued (in general) and cheaper than developed market corporate credit. Many EM high yield issuers continue to trade at high yields and wide spreads. However, fears of US inflation (bad) and/or US recession (also bad) is inhibiting flows into the asset class. With yields so much higher on DM government bonds and credit in general, investors do not need to allocate as much to EM to generate attractive yields. That said, inflationary pressures remain and corresponding central bank reactions for both emerging and developed markets will be important factors. Commodity prices will continue to have a large impact on the asset class as food and energy prices remain elevated, even if they are beginning to fall. Differentiation among countries and credits will be pivotal for uncovering value.

Portfolio positioning remains cautious. Valuations are selectively attractive, opportunistic buying prevails, but risks remain, mostly on the inflation front and central bank reactions to it.

Developed Market Rate/ Foreign Currency

MONTHLY REVIEW

Developed market rates moved lower during July, as rates broadly rallied as recession concerns remained in focus. For the most part, economic data and indicators continue to point to a likely slowdown; however, the severity and timetable remains unclear. Central bank decisions were again the focus for the month, with central banks predominately adopting a front-loading approach to tightening monetary policy.4

OUTLOOK

We believe that central banks will struggle to effectively lower inflation using their current tools and strategy. As a result, we still see risks that short term rates will go higher as the Fed will be forced to do more to combat inflation. The situation in Europe is especially difficult given the issues with food and energy prices. We see developed market rates remaining volatile given the uncertainty. As the Bank of Japan (BoJ) remains stubbornly accommodative, we still believe that Japanese rates could rise as the BoJ will have to similarly normalize policy. Regarding foreign exchange, the US dollar is likely to remain a beneficiary of tighter Fed policy and growing global growth concerns. Other than that, we do not have any significant conviction regarding FX positions.

Emerging Market Rate/ Foreign Currency

MONTHLY REVIEW

Emerging markets debt (EMD) performance turned positive following a sell-off that lasted for most of the first half of 2022. After a further sell-off in early July, rates, currencies, and credit all strongly rallied during the second half of the month. The macroeconomic environment continues to be challenging but following particularly poor performance in May and June performance rebounded in July. The three major EMD indices were all positive for the month.5

OUTLOOK

Valuations for local rates and the credit segments of emerging markets debt appear to be attractive. The macroeconomic environment continues to be challenging. Signs that the technical pressure on EMD from large outflows may be easing is an additional reason for optimism looking forward. That said, inflationary pressures remain and corresponding central bank reactions for both emerging and developed markets will be important factors. Commodity prices will continue to have a large impact on the asset class as food and energy prices remain elevated. Differentiation among countries and credits will be pivotal for uncovering value.

Corporate Credit

MONTHLY REVIEW

IG corporate spreads rallied in July. Euro IG corporate spreads tightened as the market rebounded from the June credit spread wides. US credit underperformed Euro but tightened as well. One notable feature of the rally in credit spreads in July was the lack of compression with both A and BBB tighter on the month in contrast to the widening of June.6

The high yield market posted is strongest one-month return since 2009, nearly offsetting the June sell-off. Softening rhetoric from the US Fed and a batch of earnings which exceeded conservative expectations prompted demand for high yield credit amidst starting average spreads that appeared attractive from a longer-term perspective. The top performing sectors for the month were other financial, communications and consumer cyclical.7

Global convertibles had the first monthly gain of the year in July as investors began to bet that inflation and recession fears are already priced into markets.8

The senior corporate loan market rebounded sharply in July, paring the losses experienced in May and June.9

OUTLOOK

Looking forward the outlook is little changed. We see spreads offering attractive valuations that look inconsistent with the fundamentals we are seeing at the corporate level. Potential catalysts for a rally include second quarter reporting that confirms issuer performance is stronger than market pricing suggests or a change in macro sentiment where central banks pivot to a more balanced policy targeting both inflation and growth. In addition, a change to the technical would be impactful with market liquidity low at these elevated spread levels relative to history.

We remain cautious on the US high yield market as there is little to suggest the supportive backdrop experienced in July is sustainable and we expect volatility to increase over the balance of the third quarter. We have a bias toward conservatism. We are inclined to reduce exposure to cyclicals and segments exhibiting asymmetric risk/return characteristics and to add exposure to higher-conviction ideas that have experienced excessive technical pressure.

We remain constructive on the prospects for the loan market and believe this asset class is well positioned heading into the second half of the year. Despite our ongoing conviction, the outlook is certainly clouded by a growing number of question marks compared with just a quarter or two ago.

Securitized Products

MONTHLY REVIEW

Securitized spread movement was mixed as agency MBS spreads tightened materially, while most credit spreads widened during the month.

OUTLOOK

Our fundamental credit outlook remains positive, and we believe credit spreads now offer attractive risk premiums for risk. Credit spreads for many securitized sectors have returned to levels last seen at the depths of the pandemic, but credit conditions are materially better today.

Diesen Beitrag teilen: