Janus Henderson: Euroland money trends subdued before Italian crisis

Italian political turmoil threatens to trigger capital flight and a general rise in risk aversion, resulting in additional monetary deterioration.

01.06.2018 | 13:35 Uhr

Euroland monetary trends are signalling a further loss of economic momentum but – based on April data – do not suggest outright weakness. Italian political turmoil, of course, threatens to trigger capital flight and a general rise in risk aversion, resulting in additional monetary deterioration.

Softer economic expansion since the start of the year was predicted by a significant fall in six-month growth of real narrow and broad money during the second half of 2017. Last week’s flash purchasing managers’ surveys for May were again weaker than the consensus expected, providing further evidence that slower economic growth represents a change of trend rather than a temporary blip due one-off factors such as disruptive weather.

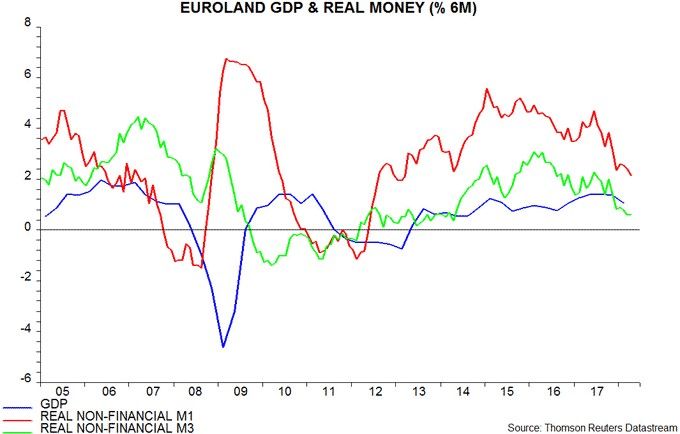

Six-month growth of real narrow money, as measured by non-financial M1 deflated by consumer prices, eased further in April, reaching its lowest level since 2013. Growth of the broader non-financial M3 measure was unchanged from its March level, which was the lowest since 2014 – see first chart.

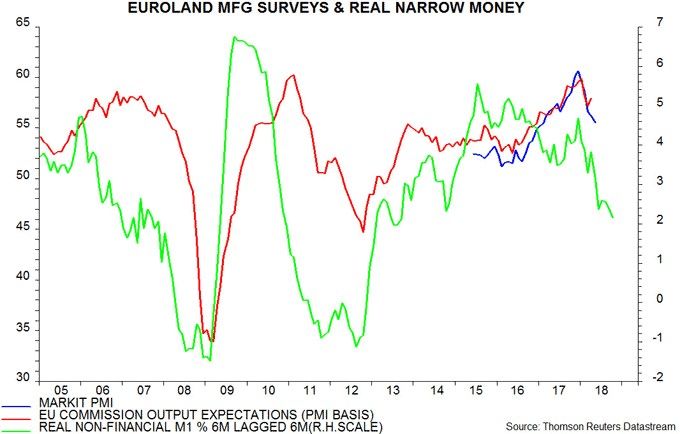

Optimists point out that the purchasing managers’ indices remain at a level historically consistent with solid economic growth. The lagged relationship with real money growth, however, suggests that the surveys will weaken further – second chart.

Current monetary trends are still consistent with economic expansion. Six-month real non-financial M1 growth of 2.2% in April, or 4.4% annualised, is only modestly below its average over 2005-17, of 2.7% or 5.4% annualised. Real narrow money contracted before the 2008-09 and 2011-12 recessions – first chart.

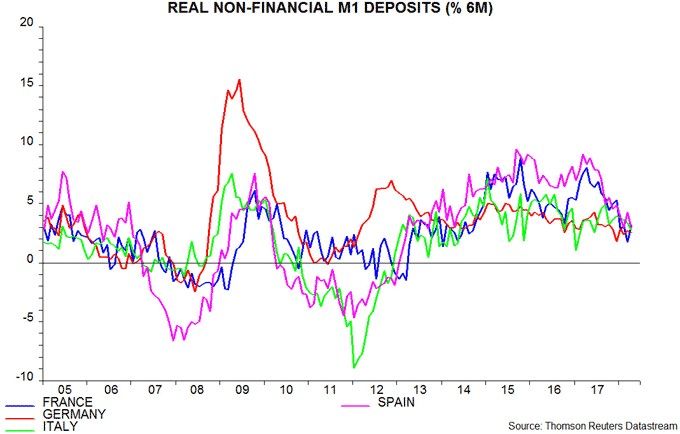

Those recessions were also preceded by a divergence of monetary trends across countries. Six-month growth of real non-financial M1 deposits is currently similar in the “big four” economies – third chart. Growth in France and Spain, however, has fallen significantly since mid-2017 – the risk of negative data surprises may be greater in those two economies.

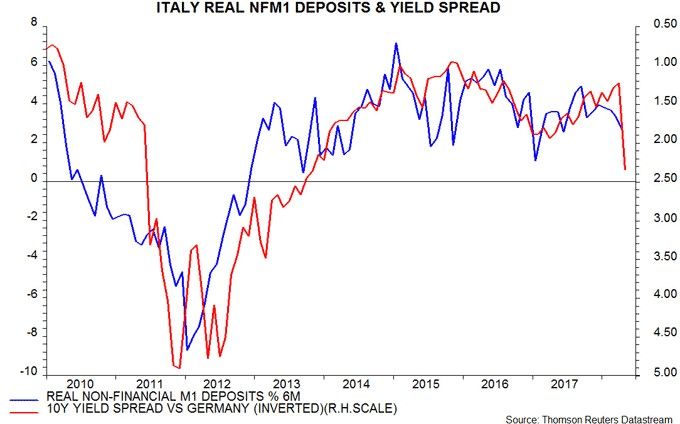

Italian real narrow money trends through April suggest that the economy was on course for continued moderate economic growth before the current political crisis. Recent developments may be contrasted with 2010-11, when monetary / economic weakness drove the rise in Italian government yield spreads, which contributed to a further deterioration in monetary trends – fourth chart. The source of the pressure is now political rather than monetary / economic, although negative feedback is again likely.

Diesen Beitrag teilen: