Morgan Stanley IM: What's Going On?

Looking at the performance of U.S. Treasuries (and other developed government bond markets) in both nominal and real terms, one could be forgiven if one believed the economy was sinking, the Fed was easing, and/or inflation was falling.

01.09.2021 | 09:20 Uhr

Here you can find the complete article.

Nothing could be farther from the truth! Other financial asset prices are sending a different message. Indeed, the U.S. and global economy are doing just fine, even if growth is not turning out to be quite as strong as expected a few months ago. But, even most of that can be explained by supply side/production problems. Aggregate demand remains robust; economic reopening (as measured by performance of the ISM services index) is improving and employment growth is robust (especially given the recent July report released August 6th). Other asset prices are sending the signal that all is well on the economic front as equities continue to rally and credit spreads remain relatively firm. What gives?

In fact, this phenomenon began earlier in Q2; it’s just that July’s rally has taken yields much lower than almost anyone had expected (circa 1.2% on the U.S. Treasury 10-year note). To put things in perspective, real yields made new lows in July, meaning they are now lower than they were at the peak of the pandemic or at the low in nominal yields in September of last year. During this period, as we all know, inflation continued to surprise to the upside, on all measures, even taking into account supply disruptions and Covid-induced anomalies. Not surprisingly this has elicited worrisome comments from several Fed officials and market participants.

Market analysts have put forward a whole host of reasons for the surprisingly strong performance of government bonds. Technicals, not fundamentals, is what we hear most. This explanation encompasses a whole host of explanatory factors including expectation adjustments, market positioning (less likely in July although news of some large losses at a hedge fund does suggest a market imbalance remained), Delta variant fears, relatively high U.S. yields compared to other countries, excess reserves in banking sector, Treasury funding and its balances at the Fed, and hawkishness of some Fed officials. The explanation is probably all of the above but, most importantly, the largest contributor is excess liquidity/savings in the world. In a world awash with cash and cash yields zero almost everywhere, money has to go somewhere.

Where does that leave us? Government bond yields everywhere are unlikely to go lower even with the Delta variant complicating return to work and reduced social distancing. Central banks want easy policy but nowhere have they said they want easier policy! With real yields plummeting in the U.S. and elsewhere, this constitutes material easing of financial conditions. With economies growing strongly; inflation rising; inflation expectations more importantly no longer low or falling, central banks should not want to increase accommodation further. Indeed, Canada, New Zealand, Australia and Norway have already taken measures to reduce accommodation (not embark on tightening, mind you, just reducing accommodations no longer needed). However, to send bond yields back up, markets need a catalyst and we believe that catalyst is likely to be time: Time for labor markets to continue to heal; time for central banks to be confident economies will not falter; time for higher inflation expectations to stabilize. This could easily begin in the fourth quarter.

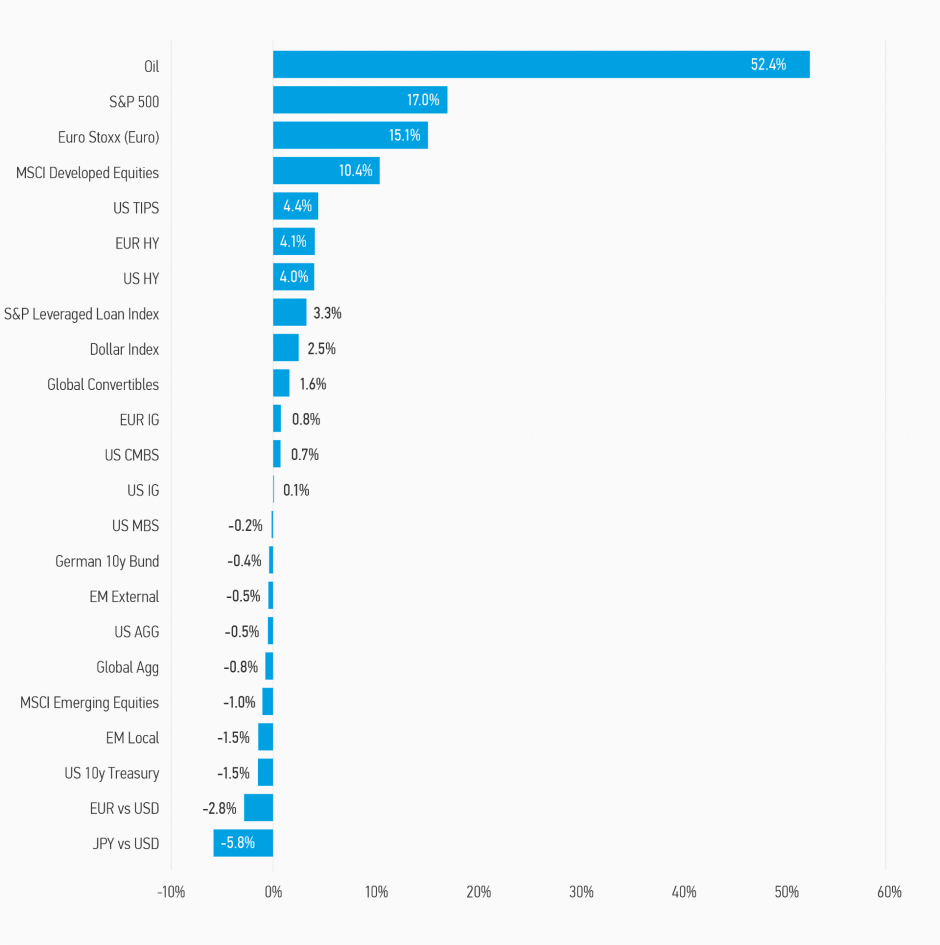

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of July 31, 2021. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See index definitions below.

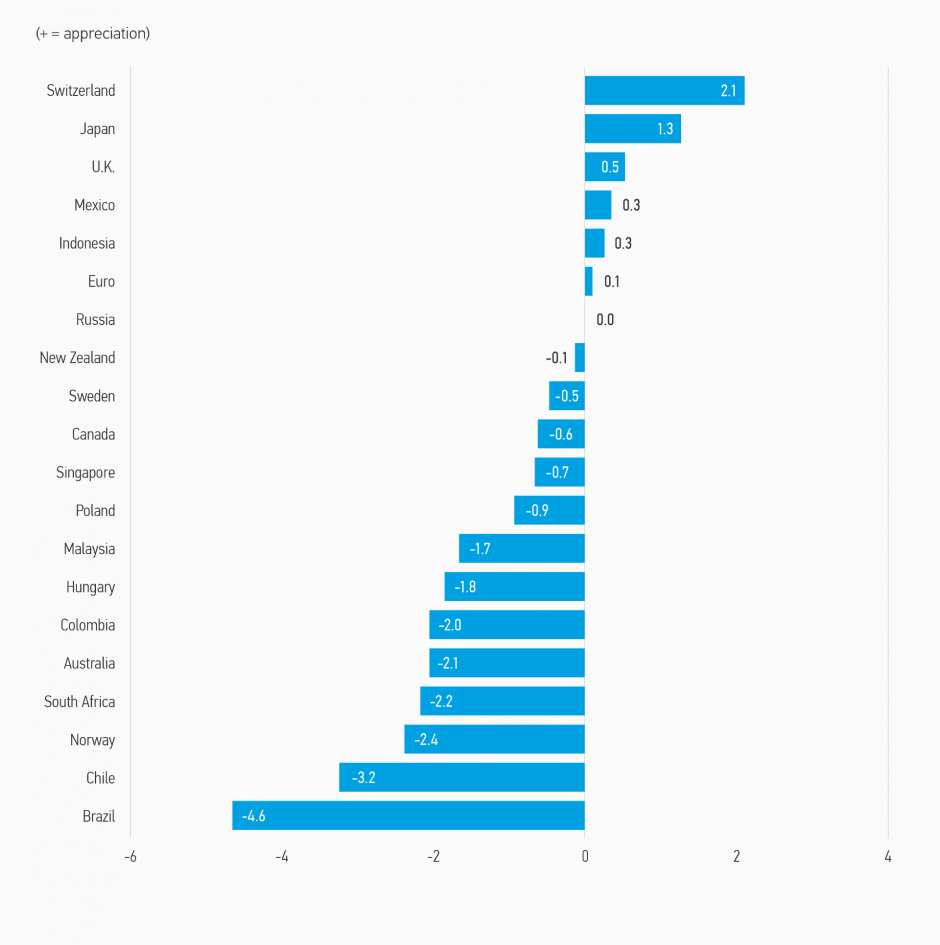

Display 2: Currency Monthly Changes Versus U.S. Dollar

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of July 31, 2021.

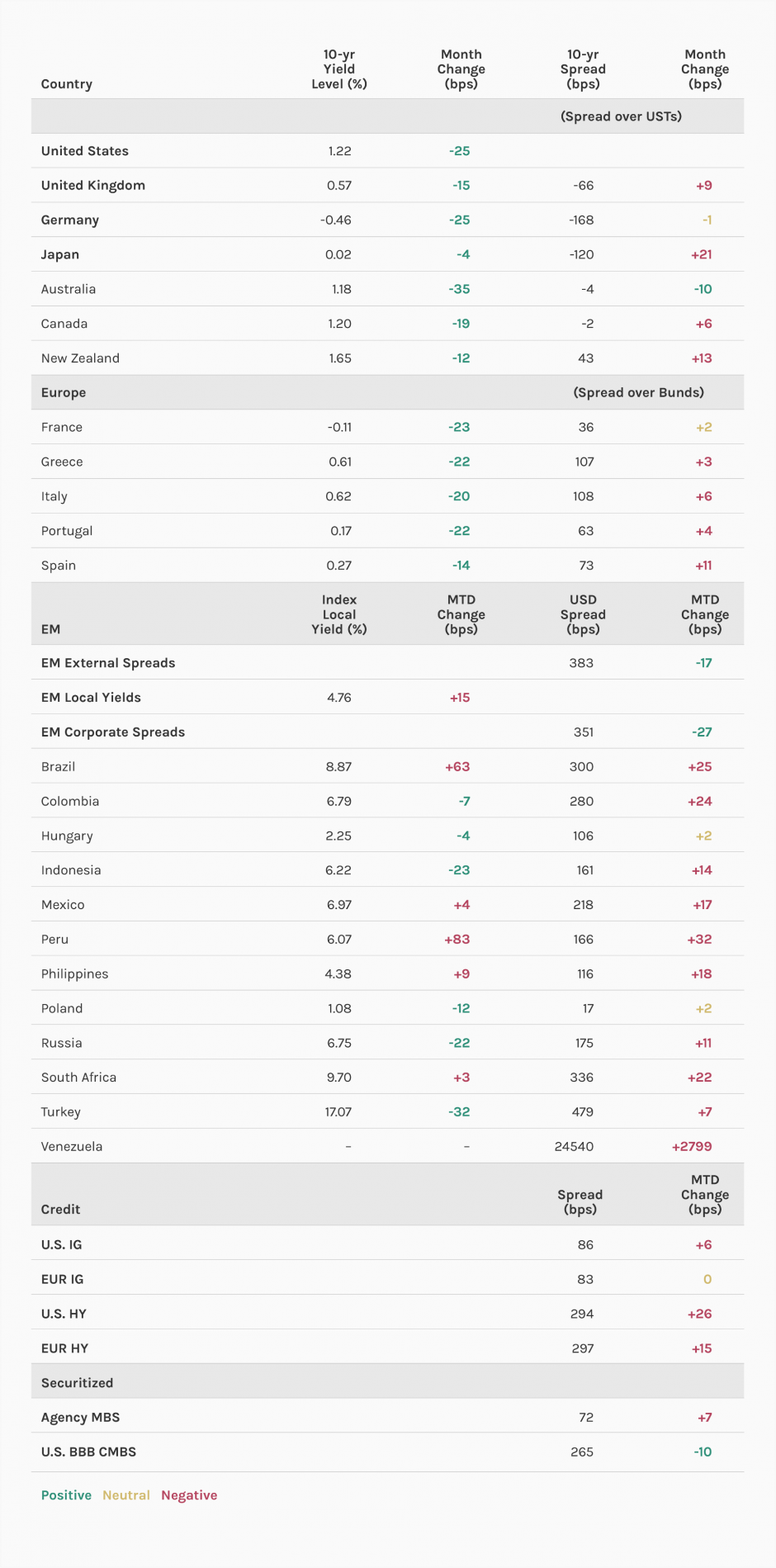

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of July 31, 2021.

Fixed Income Outlook

Aside from the sharp rally in government bonds, not a whole lot has changed over the last month. Equities grind higher (albeit with a lot of dispersion), credit spreads—both high yield and investment grade—remain well supported, if not a little soft on the back of elevated supply. From this perspective asset allocation views have not changed. The rally in government bonds came to a halt on August 6th with the strong U.S. employment report, but that may not be the last we’ve heard from that sector. While the data confirmed the Fed’s expectations that good progress is being made on the economic and particularly employment front, “substantial” progress is likely still a bit away. A few more months of data, particularly those encompassing the back to school and back to work and ending of Federal supplemental unemployment benefits will be necessary to cement in confidence that the economy no longer needs emergency like accommodative monetary conditions. Then and only then will the Fed and probably other central banks be confident that there will be no back sliding. Certainly, the surge in Covid cases due to the spread of the Delta variant has not made the decision easier. That said, there have been no signals that central banks view the Delta variant as completely derailing the recovery.

Consensus that the Fed will give guidance on tapering in September looks reasonable with actual tapering most likely starting early 2022. The next big issue for the Fed and the market will be what this means for the path of rate hikes. This issue remains to be hashed out and will be a source of market volatility in the months ahead. Another major source of volatility will be the discrepancy between current market forecasts of the terminal Fed funds rate of 1.5% and the Fed’s forecast of it being 2.5%. Who is right will determine the extent to which yields can rise above previous highs of approximately 1.75% on the U.S. Treasury 10-year note. We believe a terminal rate of around 2% is reasonable which pushes fair value of 10-year U.S. Treasuries to around 1.75%, near previous high earlier this year. Whether this happens this year or next will be highly data dependent and how economic data and inflation expectations evolve over the next few months.

Economic data released in July showed a very strong U.S. and global economy, even if a little softer than earlier envisaged. Nonetheless, the U.S. economy grew in real terms at more than a 6.5% annualized rate in Q2 and at more than a 16% annualized rate in nominal terms. Even if the economy slows next year to 4%, that is still strong enough to reduce unemployment back to pre-Covid levels in 2022, a pre-condition for the Fed to raise rates. That said, risks still abound with respect to the Delta variant as all of this strong data, including the July employment report, occurred before the Delta induced Covid surge, at least in the U.S. Optimism is the right attitude, dosed with a small amount of concern. Data watching will be in strong vogue in the weeks ahead.

As mentioned earlier, nothing significantly changed in the fundamental outlook to cause changes in asset allocation. Credit market valuations remain high but deservedly so given macro fundamentals and the liquidity the corporate sector has been able to acquire. Defaults and downgrades are at rock bottom levels and deservedly so. Outside of specific idiosyncratic risks to particular industries, like energy, or certain companies involved in reopening/disruption risks, the corporate outlook has never been better as seen by continued record earnings results. We continue to overweight HY, securitized credit and more cyclical IG sectors to reflect these sound fundamentals even though bargains do not exist. If U.S. Treasury yields (or European government bond yields) move higher we could see spreads tighten anew. In the interim, owning these sectors for their carry makes excellent sense.

Emerging markets (EM) as they are wont to do represent a mixed bag. There are a lot of idiosyncratic risks, from politics to monetary and fiscal policies. Several EM central banks including Mexico, Brazil, Chile, and Hungary have seen it necessary to raise rates to rein in inflation expectations despite still in early Covid recovery period. Political noise in countries like Peru have also surfaced as have regulatory clampdowns in China. We remain opportunistic in EM looking at each country on an individual basis and not making broad asset class decisions at the current time. The bottom line is that an investment strategy focused on a continuation of low but gently rising nominal (and in particular real) yields, strong growth (in output and incomes), rising vaccination rates, and stable policy remains intact.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

In July, concerns around the spread of the Delta variant and its threat on the economic recovery consumed markets. The prospect of high inflation seemingly took a back seat in investors’ minds, as the sustainability of the economic rebound caused a new wave of concern. Yields fell sharply over the month across the developed markets, with the 10-year Treasury yield ending the month at 1.22%. The U.S. Dollar traded sideways to slightly weaker over the month.

Outlook

Recent data and information flow continue to imply 2021 and 2022 economic activity will be very strong, even if recent data is coming out weaker than expected (except for inflation which is still surprising to the upside). Rising case counts as a result of the Delta variant now present a potential headwind to the U.S. and global economy getting back to trend growth. Even though some economies have recovered quicker from the COVID-19 economic shock than anticipated, they are still operating significantly below their estimated capacity, especially in the services sector.

We expect the current high elevated inflation to continue, with year-over-year rates only declining in 2H22. While inflation has continued to surprise to the upside, it is still our view that the surge is mainly transitory, due to base effects, higher commodity prices, temporary bottlenecks in the economy and statistical issues. In the coming months, we also expect central banks to begin to slow or to announce their intention to begin slowing asset purchases. We judge G10 currencies to be close to their medium term fair values. The USD no longer benefits from notably better than expected economic data than other G10 economies, and the Fed is probably in the middle of the pack in terms of its dovishness.

Emerging Market (EM) Rate/FX

Monthly Review

EM debt returns were positive overall in July. Hard currency, as represented by the JPM EMBI Global Diversified, returned, 0.4%, predominantly driven by lower U.S. Treasury yields. EM Corporates were also positive for the month according to the JPM CEMBI Broad Diversified Index, with high yield underperforming investment grade corporates. Local currency bonds posted negative returns, due to weaker EM currencies versus the U.S. dollar. From a sectoral perspective, companies in the Pulp & Paper, TMT and Industrial sectors led the market, while those in the Real Estate, Metals & Mining and Utilities sectors underperformed.

Outlook

Despite ample monetary policy support in the developed world and attractive valuations of EM assets, we notice a marginal deterioration in market sentiment as of late. We remain cautious on EM Fixed Income assets in the weeks ahead on the back of disappointing data on the spreading Delta variant and plateauing vaccination.

Credit

Monthly Review

Credit spreads over the month were flat in Europe and widened in the U.S. Risk-free yields moved lower globally, as curves flattened with long- dated paper outperforming. News on increased cases of the Delta variant were a key driver of sentiment although vaccinations continued to roll- out and economies like the UK saw restrictions lifted as the summer holidays started. In addition, volatility was seen in Chinese credits which led to negative ripple effects outwards, following concerns that government intervention was increasing in housing, health and education.

Market Outlook

We remain fundamentally constructive on credit, although valuations look fully priced. We expect financial conditions to remain easy, which will support the continuation of the rebound in economic activity, and low corporate default rates. We expect corporates to maintain conservative strategies as overall macro uncertainty remains high. Finally, there is likely continued demand for credit in general, as risk-free assets offer negative real and nominal yields.

Securitized Products

Monthly Review

July was another active month of new issuance and relatively quiet month of secondary trading activity. Interest rate volatility increased, with the market testing lower rate levels, as concerns over a slowing economic recovery and renewed threats from the COVID Delta-variant weighed on the market. Agency mortgage backed securities (MBS) spreads widened in July as volatility increased, bank buying of agency MBS slowed, and talks of potential Fed tapering continued to weigh on the market. U.S. Non-agency residential mortgage- backed securities (RMBS) spreads and commercial mortgage-backed securities (CMBS) spreads were essentially unchanged in July. U.S. asset-backed securities (ABS) spreads were slightly tighter again in July. European RMBS spreads tightened again in July as both new issuance and secondary trading volumes remained very low.

Outlook

We believe the securitized market offers a unique combination of low duration, attractive yields, and solid credit fundamentals. We expect the new securitized issuance to slow in August which should be a positive technical factor for credit spreads overall. We remain constructive on securitized credit and have a modest credit overweight across our portfolios. We remain cautious on interest rate risk, and we continue to manage the portfolios with relatively short duration.

RISK CONSIDERATIONS

Diversification neither assures a profit nor guarantees against loss in a declining market.

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, and correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: