Morgan Stanley: Can It, Will It, Continue?

Asset markets performed well in June. Equities rallied, spreads tightened; and the USD weakened. However, for the first time in months, news on the virus front was not all positive.

28.07.2020 | 10:05 Uhr

Rising infection rates in the U.S. (and globally) detracted from the uniformly good news on the economic data front, where the data beat expectations across the board. Once again, government bond yields remained exceptionally well-anchored, hardly moving over the month and quarter. Indeed, 10-year U.S. Treasury yields ended the quarter basically unchanged (though returns are up 11% year to date)1 .

While this does not necessarily sound positive, government bond yields simply remaining unchanged when economic data surpassed the most bullish forecasts, and high-yield and equities posted double-digit returns, is an achievement. Indeed, anchoring government bond yields and intervening in credit markets (both corporate and mortgage) is the central bank playbook. So far, it has been a winning strategy. Whether or not they win the war will require progress on the health front, for an economy cannot be normal if people cannot work or feel safe spending money.

June did not see any new policy initiatives, but previously announced programs had a significant impact on the market. The Federal Reserve’s (Fed) Term Asset-Backed Loan Facility (TALF) program (previously announced) was launched, but given the compression in AAA-rated Asset Backed Securities (ABS) spreads in the second quarter, it is not clear that the Fed will actually do much lending (the Fed achieved its goals without spending/lending a penny)! That’s credibility. Even if TALF funds do not end up investing much money, the existence of the program was the key factor in driving spreads lower. In Europe, there was a large EUR 1.35tn take-up of the European Central Bank’s (ECB) TLTRO III facility, which enables banks to borrow money from the ECB TLTRO for as little as -1%.2 While the ECB has been running TLTRO funding schemes since 2012; what is significant about the latest scheme is not only how cheap the borrowing cost is – banks are literally being paid 1% p.a. to borrow! – but also in just how much banks found they could borrow given the conditions attached to the program. The high take-up and cheap cost is a boost to European bank profitability, the economy and the financial assets banks might buy. Looking forward, central banks have earned credibility such that it seems they only need to threaten to do more to get markets to move in the desired direction. Markets, no doubt, believe in the “do whatever it takes” aura currently surrounding central banks. Policy dominance remains.

Fiscal actions have also been key in supporting the nascent economic recovery. Transfer payments have bolstered incomes, fostering spending as households come out of lockdowns. While there are questions about some of the U.S. income support programs ending at the end of July, we are confident the U.S. Congress will renew or initiate new programs to keep incomes flowing to those who are not currently working. In Europe, there is continued wrangling about the EU Recovery Fund, with not all countries happy with loosening the purse strings too much, but the direction is very clearly moving toward allowing individual governments to spend more if they choose and greater fiscal support on the EU level. We expect monetary policy will continue to be highly stimulative, helping to allay any investor concerns about governments’ increased borrowing needs.

While June and the second quarter generated stellar returns, risks abound. An alarming rise in infection rates in several large U.S. states and outbreaks in countries exiting lockdowns risk backsliding in the economy. The U.S. presidential election and U.S./Chinese relations represent another set of issues independent of the pandemic. But, on the positive side, progress on vaccines and/or therapeutics could generate upside economic and financial surprises. There is lots to think about. We remain optimistic that, despite rising infection rates, large-scale lockdowns will not be reimposed.

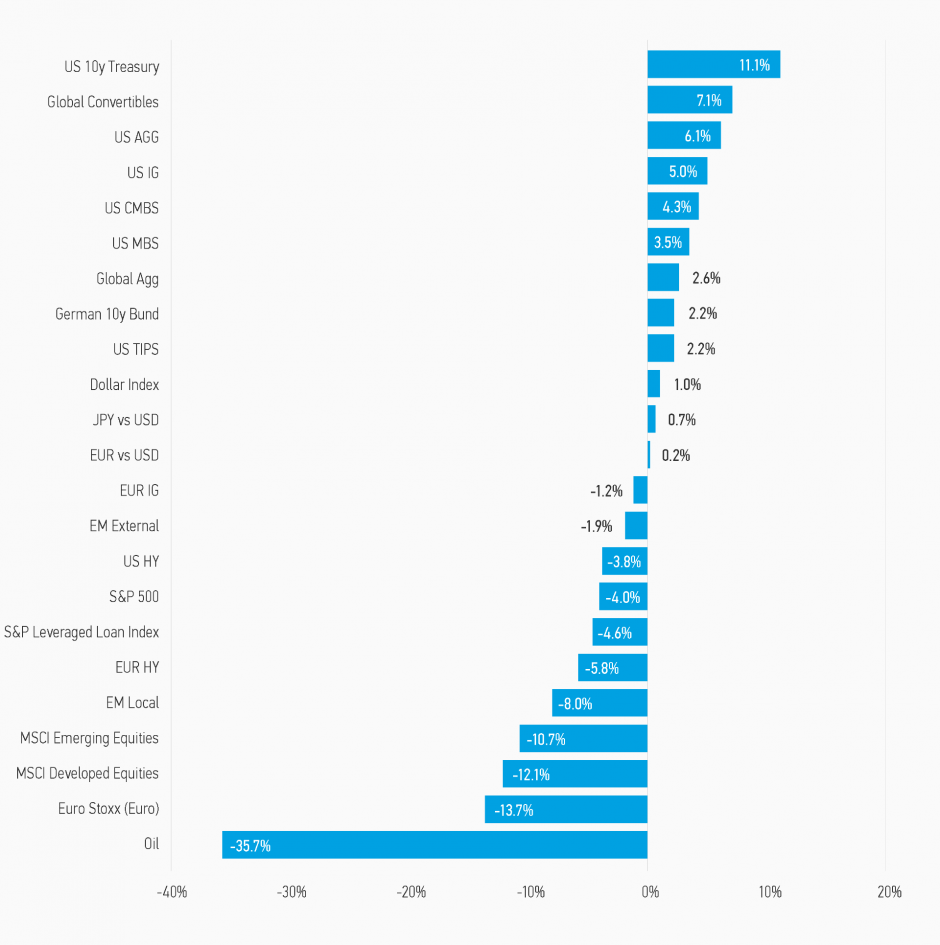

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of June 30, 2020. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

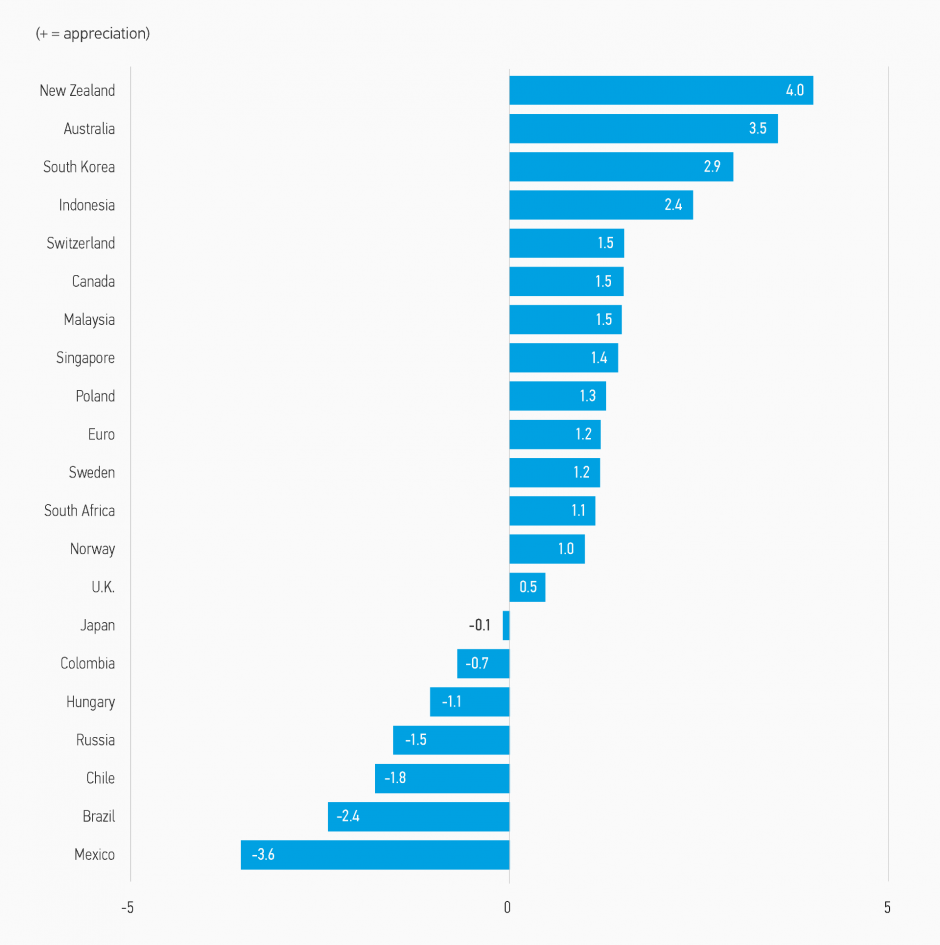

Display 2: Currency Monthly Changes Versus USD

Source: Bloomberg. Data as of June 30, 2020. Note: Positive change means appreciation of the currency against the USD.

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JP Morgan. Data as of June 30, 2020.

Fixed Income Outlook

Our outlook on fixed income continues to range from constructive to moderately bullish. But there are some headwinds. The V-shaped economic bounce happened, but it is likely to flatten out. A bounce is not a trend. Economic data is not likely to be as surprisingly good going forward (it might be, but we should not count on it). Valuations are more challenging than last month. We are also likely to see smaller improvements in employment and output relative to now improved expectations. Moreover, even with improvements on many fronts, several important industries remain shuttered or operating well below potential (travel, leisure, and entertainment). This will slow aggregate gains. On the positive side of the ledger, people have money and want to spend it; companies want to hire and increase/restore production. Lastly, we notice potential risks in the form of a bungled reopening of economies amid a worse-than-expected second wave of infections, as well as heightened U.S./China tensions (Hong Kong and trade issues) and geopolitical noise in other regions (Russia/India versus China) weighing on risk sentiment.

Markets did exceptionally well in June and in the second quarter. The reason was part better data, part market positioning, part policy and part hope on the pandemic front. Can it, will it, continue? We believe it can, but at a slower pace. Most importantly, policy support remains robust and is poised to do more if necessary. There is no doubt that policy is in a “do whatever it takes” mode. Do not underestimate the capabilities and willingness of central banks to provide effectively unlimited support in the months ahead.

As such, government bond yields should and need to remain low and stable. Volatility has steadily fallen on the back of better economic data, fiscal transfer payments, improved virus control (at least outside the U.S. and Brazil), and quantitative easing. Any rise in longer-term yields will likely result from a much improved economic and pandemic outlook. But, even then, with inflation well below target, and the Fed, for example, likely embarking on an outcome-based policy framework, meaning no tightening of policy until policy objectives are achieved, suggesting repression of risk premia and rate expectations for years to come. The risk to this view is a scientific breakthrough that ends the pandemic.

We remain cautiously constructive on emerging market (EM) debt. Large-scale policy actions in developed countries provide a strong backdrop for EM debt. EM countries have also provided unprecedented monetary and fiscal support to their nations, helping cushion the blow from the pandemic. Unusually for EM, investors have not punished countries for these expansionary policy measures (say, through weakening the currency or pulling out funds), even where the underlying macro fundamentals are weak. It seems there is a broad consensus that the correct policy response at present is to be accommodative. Valuations are now less compelling given the second quarter rally, but returns have lagged those in developed markets, particularly in those sectors under the developed market policy umbrella. Reopening momentum is strong in Asia and eastern Europe. Latin America faces more challenges due to slow policy response to the virus in terms of health care policy. The very strong recovery in China is also supportive of EM. The biggest moves in EM rates are most likely behind us, but we still see value in selective external debt and currencies.

Credit markets also continue to perform well. Policy support should continue (e.g., Fed and ECB buying), economic data is on an upswing, and supply should diminish relative to the record pace of the first half of the year. Most of the economic losses should prove transitory, and as such will not be meaningfully negative for corporate valuations. Indeed, businesses continue to implement risk-reduction strategies through asset sales, dividend cuts and reduced capex. As economies improve, we expect corporate performance to improve meaningfully, with short-term corporate losses and higher leverage being less important, though important nonetheless for differentiating outperforming businesses. Barring any jarring negative economic and pandemic news, spreads on both investment grade and high yield bonds should grind tighter over the remainder of the year. After the recent rally, some consolidation while waiting for additional insight into the U.S. outbreaks would not be surprising.

Recent trends in securitized fixed income continued in June with strong, steady performance. Given the tightening in AAA spreads, there appears to be a limited upside. However, lower-rated classes, particularly BBBs and BBs, still have significant room to tighten further, in our opinion. While we’ve seen some spread recovery over the past two months, lower-rated securitized spreads remain much wider than February levels and have lagged the recoveries experienced by the corporate credit sectors. Fundamental data remains critical, but so far the performance deterioration has been very mild for most sectors and far better than expectations. Agency MBS performance will likely remain muted, and we continue to underweight this sector.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

June marked the end of a historic quarter and first half of the year across asset classes and regions, as many countries within the developed markets continued on the path of economic reopening. Generally, economic data was better than expected, with survey data in particular surprising to the upside. While some areas saw an uptick in coronavirus cases, other areas in the developed economies continued to see a decline. A key exception is the higher infection rate in some large U.S. states, although even here there was some good news in that the mortality rate is a lot lower than in previous breakouts (possibly because it has mainly been a younger demographic which has been infected).

Outlook

We continue to expect monetary policy to remain accommodative and risk assets to be well-supported across developed markets in the coming months in order to support the continued stabilization of the global economy and financial markets. Having eased aggressively in prior months, most central banks are now closely monitoring incoming economic data to determine if further measures are necessary. Additionally, incoming data has generally been better than expected, but with inflationary pressures very weak and economies hit by a severe exogenous shock, there is every reason to believe central banks will be ready to ease further, most likely through unconventional policy measures.

Emerging Market (EM) Rate/FX

Monthly Review

The rally in emerging market (EM) assets extended into June, leading to one of the strongest quarters on record. Investors were encouraged by ongoing monetary and fiscal easing across EM and developed market economies, as well as the International Monetary Fund (IMF)’s revamped programs to assist developing nations in their COVID-19 response.3 EM dollar-denominated sovereigns once again led performance, driven by the high-yield segment, as well as energy-exporting countries, as energy prices rose on higher consumption and growth expectations. Dollar-denominated corporates followed sovereigns, with local currency debt lagging as EM currencies weakened versus the U.S. dollar.4

Outlook

We remain cautiously constructive on EM debt in the near term, as positive news from reopenings are partially offset by less-compelling valuations than a few months ago and setbacks on fighting the pandemic in certain countries. We still think there is value in EM debt, mainly in high-yield hard currency and FX. Nevertheless, we notice potential risks in the form of a bungled reopening of economies amid a worse-than-expected second wave of infections, as well as heightened U.S./China tensions (Hong Kong and trade issues) and geopolitical noise in other regions (Russia/India verus China) weighing on risk sentiment.

Credit

Monthly Review

Investment-grade credit spreads were tighter in June both in the U.S. and in Europe. The key driver was an initial rally at the start of the month as developed economies began exiting from COVID-19 lockdowns and better-than-expected economic activity data. But a weakening in the second half of the month followed as increased infection rates in the U.S., coupled with political headlines on U.S./China relations, turned sentiment negative. Corporate news was limited ahead of Q2 results starting in July. BBB-rated names outperformed higher-rated securities. In terms of excess returns versus government bonds, the Bloomberg Barclays U.S. Investment Grade (IG) index generated a positive excess return of 1.89%. European IG, as measured by the Bloomberg Barclays Euro-Aggregate Corporate Index, underperformed the U.S. market in June, closing 21 bps tighter at 148 bps.5

Outlook

Corporates have responded to the coronavirus by focusing on raising cash, a rational response given the economic uncertainty. This has resulted in a combination of strategies including equity raises, corporate debt issuance, dividend reductions and lower capex. The response has varied across sectors, with the more cyclical sectors looking to raise more cash. Looking forward, there is a question about the optimal financing structure for firms in a potentially low growth, low inflation, and low cost of debt backdrop.

Securitized

Monthly Review

The securitized credit markets continued to recover during June with consumer credit, office-backed commercial real estate, and housing-related sectors all experiencing spread-tightening. However, U.S. economic conditions remain weak, with more than 30 million people continuing to claim unemployment benefits, although there are signs improvement with parts of the economy reopening in various stages across the country.

Outlook

As AAA spreads have now retraced 80-90% of the COVID-19 spread widening, we believe they seem unlikely to tighten materially further given current credit conditions. On the other hand, they are also unlikely to widen materially given the lower issuance volumes and $100 billion of TALF money poised to take advantage of any spread-widening. However, lower-rated classes, particularly BBBs and BBs still have significant room to tighten further. While we’ve seen some spread recovery over the past two months, lower-rated securitized spreads remain much wider than February levels and have lagged the recoveries experienced by the corporate credit sectors. Fundamental data remains critical and the markets are closely watching for signs of material credit deterioration resulting from the spike in joblessness, but so far the performance deterioration has been mild for most sectors and far better than expected, and the economy is slowly showing signs of coming back to life.

1 Source: Bloomberg, as of 6/30/2020

2 Source: The European Central Bank, as of 6/30/2020

3 Source: Bloomberg, as of 6/30/2020

4 Source: JP Morgan, as of 6/30/2020

5 Source: Bloomberg Barclays, as of 6/30/2020

Here you can find the complete article.

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: