BNP Paribas: Investment Outlook 2021 - Legacy of the Lockdowns - Part 4

The global economy faced a crisis of unprecedented magnitude following the coronavirus pandemic lockdowns. Part 4: EMERGING MARKETS SHOULD BENEFIT FROM CHINA, US STRENGTH.

19.01.2021 | 08:38 Uhr

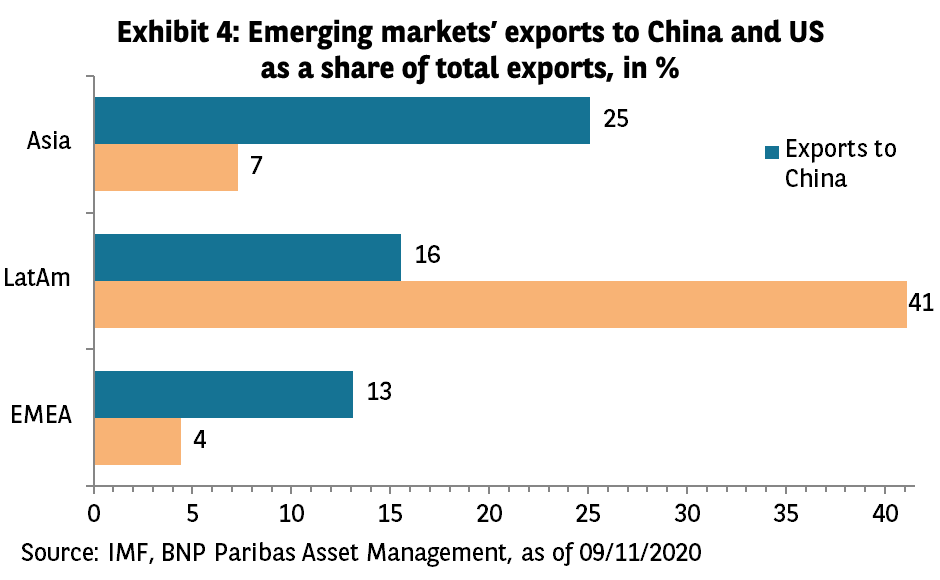

Emerging markets suffered similar declines in GDP as developed markets following the lockdowns despite deploying far less fiscal or monetary stimulus, meaning they face fewer risks from higher debt burdens than the US or Europe. The recovery into 2021 should be aided by what we expect to be robust growth in both the US and China. Domestic demand-orientated fiscal stimulus in the US should pull in exports from many emerging markets. China’s recovery, while perhaps less commodity-intensive than in the past, should still support activity in the wider Asian region. Emerging Europe, the Middle East and Africa may benefit less since their exports are oriented more towards a slower-growing Europe (see Exhibit 4).

In the same way that the COVID lockdowns have led to a divergence in the outlook for the US and Europe, China is distancing itself from developed economies. Thanks to the country’s effective management of the pandemic, GDP has already regained the losses from the lockdown, and this without the resorting to quantitative easing, negative interest rates, or a big increase in government debt.

One potential concern over the medium term is the acceleration by the pandemic of the de-globalisation trend begun by US President Donald Trump. There is broad consensus in Washington for a more distant relationship with China. Even with a new administration, trade relations are unlikely to change much (the Democrats have traditionally been more sceptical towards trade agreements).

COVID has encouraged governments and companies to bring manufacturing production closer to home. However, China is not the same economy it was when it joined the World Trade Organisation in 2001. The manufacturing sector then was nearly 10% larger than the services sector, whereas today services is nearly twice the size of manufacturing. Net exports contributed to China’s growth in the years leading up to the GFC, but over the last five years, growth has come much more from consumption, while the contribution from net exports is near zero.

China’s recent 5th Plenum highlighted domestic demand growth, import substitution and technological self-sufficiency as the main growth drivers. ‘Greening’ the economy by reducing carbon emissions and improving environmental protection will also be a priority. We believe China will aim for, and likely achieve, 5% to 6% annual growth in the next several years.

Diesen Beitrag teilen: