BNP Paribas: Investment Outlook 2021 - Legacy of the Lockdowns - Part 3

The global economy faced a crisis of unprecedented magnitude following the coronavirus pandemic lockdowns. Part 3: EUROPE FACES CHALLENGES TO A QUICK RECOVERY.

13.01.2021 | 07:40 Uhr

Europe faces a more daunting task to rebound from the collapse in GDP during 2020. While the US is expected to return to its pre-pandemic level of GDP by the end of 2021, a full recovery is not forecast for the eurozone until the end of 2022. Europe’s labour markets have so far suffered far less from the lockdowns than those in the US thanks to more generous unemployment benefits, lengthier furlough schemes and extended bans on firings. The EU unemployment rate has risen to just 7.5% from a pre-pandemic low of 6.5%, while the US rate had reached 14.7% already in April, but has since dropped below 7%.

This resilience comes at the cost of flexibility, however. It is not simply a matter of tiding workers over till a vaccine is widely available, the pandemic has passed and everyone returns to their old ways. Many industries will need fewer workers (hospitality, retail), while others will need more (technology, warehousing). The comparatively low rankings of some of the larger European countries in the World Bank’s Ease of Doing Business survey (Spain 30, France 32 and Italy 58) reflects this inflexibility.

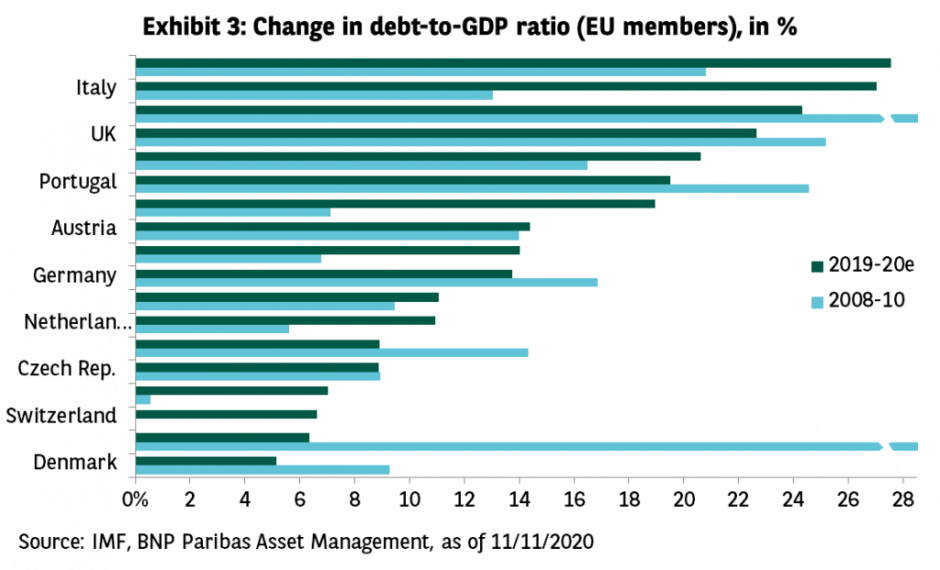

Many eurozone governments have responded to the economic damage from the lockdowns with massive fiscal aid, either direct from the state or through the new Next Generation EU programme. Debt-to-GDP levels have consequently soared, increasing for many countries by more than they did in the years following the Global Financial Crisis (see Exhibit 3).

In the short term, the resulting fall in creditworthiness should not lead to higher interest rates or drag on growth since the ECB is buying the bulk of the debt. Interest expense is low (at just 3.6% of GDP for the EU in 2019), again thanks to the ECB. Part of the debt is even ‘interest free’ since the interest that governments do pay on debt purchased by the ECB via the respective national central banks is paid back to the country’s Treasury.

The risk in the medium to long term is that interest rates rise or the ECB begins to run down its balance sheet, but for now governments are able to borrow enough to cushion the blow of the lockdowns, but not necessarily enough to restore growth to pre-pandemic levels quickly.

Another reason for the slower recovery in the eurozone is the limited scope for the ECB to ‘do more’ in a way that has a meaningful impact on growth or inflation. In 2021, the central bank is expected to adopt a new inflation target closer to the US Federal Reserve’s symmetric 2% target, recalibrate its quantitative easing programmes, adjust its longer-term refinancing operations to possibly allow banks to borrow more at an even cheaper rate for longer, and perhaps make a small cut in the deposit rate.

While such moves should be helpful, we note that interest rates are already near historic lows in many markets, banks are reluctant to lend and businesses are loath to borrow. It is only once a vaccine is widely available and governments lift restrictions that the region’s economies can hope to return to trend-rates of growth.

Investment Outlook 2021 - Legacy of the Lockdowns - Part 2

Diesen Beitrag teilen: