BNP Paribas: Investment Outlook 2021 - Legacy of the Lockdowns - Part 1

The global economy faced a crisis of unprecedented magnitude following the coronavirus pandemic lockdowns. A sharp global contraction in early 2020, and possible renewed dip in Europe in the fourth quarter, should nonetheless be followed by a rebound in growth in 2021.

07.01.2021 | 08:21 Uhr

Takeaways

- Several vaccines for COVID-19 should become widely available in 2021, but until then countries will increasingly need to ‘live with’ the virus as repeated lockdowns will not be a sustainable coping strategy.

- In 2020, advanced economies loosened the monetary and fiscal reins most spectacularly. Debt-to-GDP ratios soared, rising for many countries by more than they did in the years after the Global Financial Crisis (GFC). Major central banks have largely financed the increase in budget deficits, monetising an expanding national debt, much as Japan has done.

- How will all this debt be paid for? The appropriate historical parallel is the post-World War II period, when central banks capped bond yields at levels well below the trend GDP growth rate to gradually reduce the national debt as a proportion of GDP. The prospect of sustained low yields argues for a structural long duration position, or at least a strategy to buy duration on any meaningful back-ups.

- Global growth may well be lower after the pandemic is over. Inadequate fiscal stimulus would leave marginal sections of the economy vulnerable to collapse. Such an outcome would test the Goldilocks paradigm of modest growth, low inflation and supportive central banks that has supported asset prices since the 2008 GFC.

- Today we face three interconnected crises – health, economic and climate. The instability provoked by the pandemic presents a window of opportunity to pivot in a new direction. Long-term environmental viability, equality and inclusive growth are essential pre-conditions to a sustainable economy. By taking a holistic, systemic, long-term view, we are less likely to be surprised by crises and better able to manage them.

Marcroeconomics

Global Economy

The coronavirus pandemic is one of the most significant in history. This is not because of the number of deaths, however, which have been low relative to previous pandemics, but because of the dramatic changes in geopolitics, economic activity, consumer behaviour, and indebtedness that have followed the imposition of nationwide lockdowns in many countries.

So far, with over 1.2 million deaths globally, about 0.016% of the world’s population has died due to coronavirus. This is half the rate of the Hong Kong flu of the 1970s and one-fifth of the toll of the Asian flu of the 1950s. The Spanish flu at the end of World War I was estimated to have killed up to 50 million people when the global population was one-quarter of today’s level.

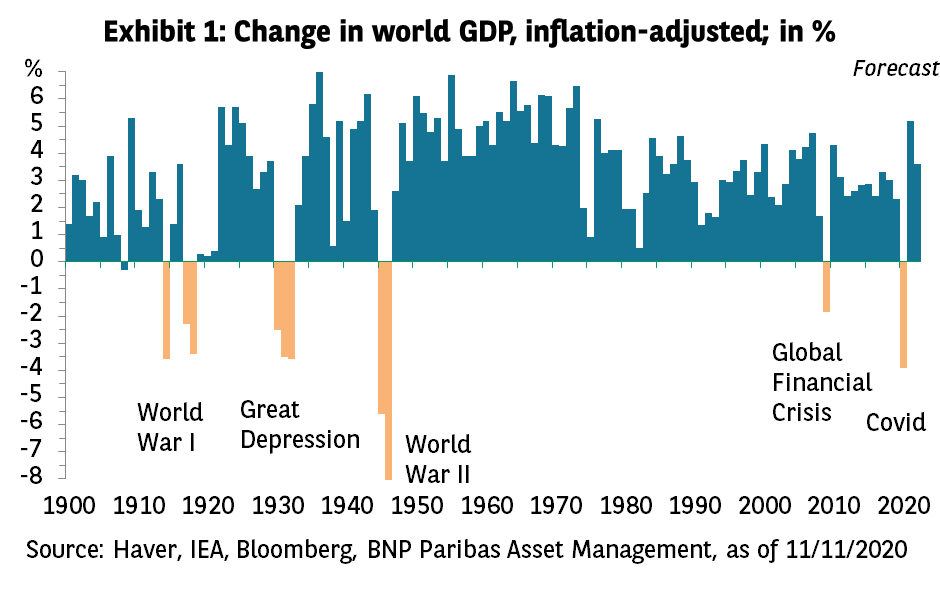

The coronavirus pandemic has been much less lethal because governments responded to the threat in an unprecedented fashion. Previous pandemics saw limited containment measures and consequently had a relatively modest economic impact. The response to coronavirus by contrast has led to the biggest decline in global GDP growth since World War II (see Exhibit 1). The permeation of technology in modern economies in part explains the difference in response. The internet has enabled a significant share of the population to work from home, a situation that was impossible 40 years ago.

Economies will nonetheless recover; growth is forecast to rebound to 5.2% in 2021 (Bloomberg consensus estimate). But even as aggregate demand rises, particularly after the arrival of a vaccine, the world will be a profoundly altered place. We will travel differently, shop differently, work differently and be entertained differently. Geopolitics will be different as China’s economy advances relative to other countries that managed the pandemic less well. Growth rates across countries will diverge as more flexible economies re-allocate labour and capital more easily to future growth areas.

Some of the changes will stem from changes in mentality, for example, the realisation that one does not need to fly thousands of (polluting) kilometres for a face-to-face meeting when a video call will suffice. Or to travel to the office every day.

Some of the differences will result from the dramatic increases in country indebtedness as governments financed businesses and households through the lockdowns. The end of the austerity mentality will also make it easier to finance the large investments needed to combat climate change.

Some of the changes will come because businesses fail to survive lengthy or repetitive closures. These are some of the legacies of the lockdowns.

Diesen Beitrag teilen: