BNP Paribas AM: Four good reasons to anticipate a return of volatility

Quantitative easing has contributed to lower volatility, but high levels of debt potentially exacerbate vulnerability to a turn in the cycle. Meanwhile the search for yield has led investors into new territory.

18.01.2018 | 12:24 Uhr

From a simple statistical indicator used mostly by risk management teams, volatility has become a key variable in financial markets over the last few years, scrutinised by a large number of investors and analysts.

The increasing popularity of implied volatility indices such as the VIX (the Chicago Board Options Exchange Volatility index), but also the rise of management processes based on risk budgeting, have contributed to media coverage of the concept. What had been the subject of expert discussions has now become a matter of coffee-time conversation, at least within financial circles. Recently, the debate seems to be focused on one question: why is volatility so low and how long can it remain so?

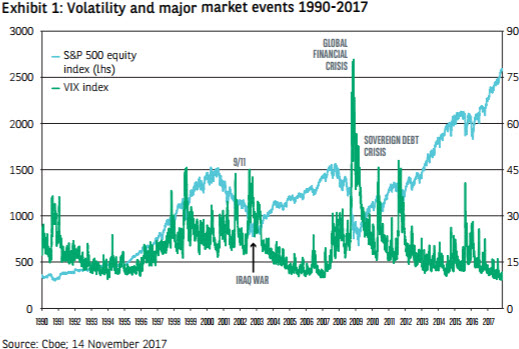

The fact is that market volatility is now exceptionally low. The VIX hit an historic trough in September 2017 at 9.51 (see Exhibit 1). Rather than looking at the implicit volatility measure based on options prices, one could also look at realised volatility. Here too, what we see is clear: at the end of September 2017, the historical volatility of the S&P 500 stock index over a rolling one-year period was 7.7. To put this figure into perspective, such volatility is not so far from that of long-maturity government bonds. This concerns data for the US market, but the same low-volatility phenomenon applies to both other equity indices – for the European market, the VStoxx index also recently hit an historic low – and to asset classes such as bonds and currencies. We are faced with a global trend: volatility is simultaneously low across a broad spectrum of regions and assets.

This issue is all the more sensitive because this rare situation has consequences for portfolio management. How does one calibrate asset allocation in this context? Must one adapt to a low- volatility regime on a long-term basis?

In our view, most of the main factors behind the decline in volatility are unlikely to continue forever. We could even see a turning point in the coming quarters.

Quantitative easing has contributed to lower volatility

Firstly, what the major central banks have done with their unconventional monetary stimulus, through quantitative easing, has had a significant effect, not only through their direct purchasing of securities, but equally because of the implicit assurance that central banks would step in to prop up valuations of financial assets if this was judged necessary. The notion of ‘forward guidance’ – i.e. central banks providing greater clarity on the future path of monetary policy – has also affected volatility. As a result, implied volatility on interest rates, which reflects the level of market uncertainty about policy, is close to all-time lows.

These same central banks are now embarking on a gradual unwinding of their unconventional policy measures, as is the case with the US Federal Reserve, or are planning to do so. Normalisation of policy is underway. Initially, rather than outright increases in key policy interest rates, tangible reductions in central bank balance sheets await us. This should have a significant impact on the volatility cycle and looks set to be one of the key themes in 2018.

High levels of dept potentially exacerate vulnerability to a turn in the cycle

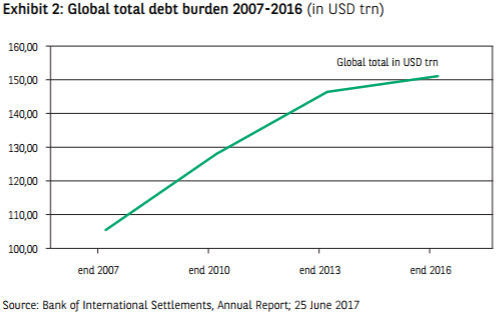

At the same time, maintaining interest rates at accommodative levels over a relatively long period has led many companies to increase their debt loads, taking advantage of the favourable terms for financing. This is particularly apparent in the US, where many listed companies have entered into extensive share buyback programmes, but also in China, where the ratio of corporate private debt to GDP increased from 99.8% in 2008 to 158.6% at the end of 2016. This widespread increase in debt (see Exhibit 2) goes hand in hand with a deterioration in the quality of company balance sheets. For us, this is the second factor that could contribute to a rise in volatility. The price of risk must be linked to the greater or lesser vulnerability of private sector companies to a fall in revenues or increase in interest rates. On this point, we recall the work of Nobel laureate Robert Merton, among others, on the link between corporate debt and the volatility of equities.

The search for yield has led investors into new territory

Another source of uncertainty is to be found in the behavioural nature of financial markets themselves. Several years of calm markets, low interest rates and credit spread compression have driven investors to new areas in their search for yield. Some bond investors have sought out defensive stocks paying attractive dividends in place of clipping the coupons from debt instruments.

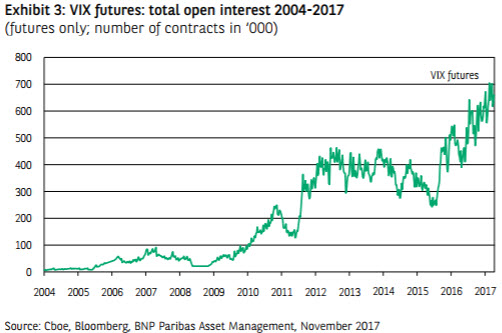

Over the same period, financial engineers have developed a range of derivative products linked to VIX futures that allow investors to take positions anticipating a rise or fall in the VIX. Financial products that structurally sell implied volatility indices have seen significant inflows in the wake of the strong performance of equity marketsin recent years (see Exhibit 3). As the VIX fell, this paid off handsomely. Such products and other forays into new territory in the search for yield are nevertheless vulnerable to reversals of the trend. Assuming that the cycle begins to turn, one can expect pro-cyclical behaviour by some market participants, mechanically accelerating the pace of sales.

Political risk: a known unknown

Lastly, there is the issue of political risk, whose influence has been on the rise since the Brexit vote and the surprise election of Donald Trump as US president. While the emergence of this potential source of volatility is widely debated, it has not yet translated into a change of approach in financial markets. It is as if market participants, being unable to precisely define future threats, would prefer to stick to more of a wait-and-see approach to this risk. Despite everything – growing inequality, the middle classes feeling vulnerable in the face of globalisation and the rise of geopolitical tensions in Asia and the Middle East – all this combines to reinforce the feeling of uncertainty.

Although we have identified four good reasons for anticipating a return of volatility, it is difficult to link these to a specific date or timeframe. Calm in financial markets could well persist, especially if economic fundamentals continue to show positive momentum . The course of action we are taking is to prepare for a rise in volatility by paying particular attention to the flexibility of investment processes. As a result, in recent years, we have increased the responsiveness of our risk re-allocation thresholds and extended the period taken into consideration by our volatility measure with regard to past crises. It is also possible to turn to options strategies to mitigate the impact of an eventual turnaround. After all, if we believe that the level of volatility is artificially low, the cost of options as a hedge looks all the more attractive.

Let us conclude by pointing out that a return to a more volatile market would not have only adverse effects. Without involving a Nietzschean-style bout of pain and suffering, greater volatility could reduce what may look like complacency and put a limit on the leverage of the economic and financial system. A more differentiated environment should also provide opportunities for active asset managers, with a premium for those who are flexible in their approach.

To read BNPP AM’s full 2018 investment outlook, click here

Diesen Beitrag teilen: