NN IP: Expectations create their own economic reality

US policy has made expectations resilient but volatile; still no end in sight for the Brexit saga

01.03.2019 | 12:17 Uhr

When it comes to medium-term prospects for economic growth, in the absence of shocks (including policy shocks), the economy will eventually tend to settle around its potential growth path. However, this growth path is not set in stone. For instance, persistently strong demand growth and targeted structural policies can increase labour supply growth and productivity growth. Still, at any point in time there will be some potential growth and a concomitant stable feedback loop between income and spending that keeps the economy on track.

In reality, this feedback loop is never stable for long. There will always be actors in the economy who change their spending plans, setting in motion changes in prices, wages, financial conditions and other elements that force other sectors to adjust. John Maynard Keynes’ essential point is that these changes may not be sufficient to guide the economy back to its potential growth path. If there is widespread private-sector pessimism, these expectations will continue to validate themselves. In that case, the economy needs a policy-induced kick-start to emerge from its depression.

Alternatively, agents might remain optimistic after a negative shock to growth because they expect it to be temporary. In that case, their expectations will be stabilising – i.e., they will be willing to smooth spending over time by allowing the negative income shock to cause a temporary decrease in their savings ratio. The crucial question policymakers must ask themselves is in which regime private expectations are situated. In other words, is the private sector still optimistic enough to resume spending once the political uncertainty headwinds abate?

The answer to this may differ between regions, but we should probably worry least about the US in this respect. Even though it is the epicentre of trade risks, its economy is much more closed than that of Europe or Japan. What’s more, the US recovery over the past 10 years has clearly outperformed its developed market peers, which has probably made US private confidence structurally more resilient to shocks than Europe and Japan. Europe faced a double-dip recession, prolonged stagnation in the periphery and continued weak inflation performance, while Japan has been in the grip of a deflationary psychology for more than two decades.

Still, there are compelling observations to be made about the US economy in general and private confidence in particular. Before Trump, the economy seemed to be on a natural gliding path towards its potential output level. The Fed was gradually tightening policy, and in the absence of active fiscal policies, the automatic stabilisers should apply a mild fiscal brake. Additionally, there were no major imbalances in the economic environment, which made for decent odds that the expansion would continue for a few years. Then along came Trump with his fiscal easing/protectionist policy mix, which complicated life for the Fed, torn as it was between domestic overheating risks and external/global financial risks.

It was not exactly easy for the private sector either. Fiscal easing and the stock market boom helped fuel positive animal spirits in the business and consumer sectors, which were mostly frontloaded in 2018. On the other side of the ledger were trade risks and the tightening of global financial conditions, which stemmed from the combination of these risks and Fed tightening/uncertainty about how the Fed would respond to the aforementioned trade-off. These factors started to exert a negative effect on these animal spirits towards the end of 2018. For consumers, this effect was exacerbated by the longest government shutdown in history.

Viewed from this angle, the Fed’s decision not to add any further waves was probably a sensible one. After all, the most important drivers of US economic momentum in the next few quarters will be the fiscal pulse and the pulse exerted by financial conditions. Fed dovishness has certainly helped to loosen the latter substantially following the severe tightening seen in Q4.

Meanwhile, the fiscal pulse will recede gradually during 2019, but we should not write it off too soon. US growth likely decelerated to around 1.5% last quarter and may well remain below 2% this quarter. The shutdown and other political risks have thus affected US domestic momentum, mostly via the channels of confidence and financial conditions. The extent of the damage remains uncertain, however. The ISM New Orders Index, which is a good indicator of capex momentum, dropped sharply in December but rebounded handsomely in January. Capex intentions in regional Fed surveys have declined over the past few months but remain historically robust.

On the other hand, the NFIB Small Business Optimism Index has declined to its lowest level during the Trump presidency on the back of an increase in economic uncertainty. On the consumer side, the preliminary reading of the Michigan Consumer Sentiment Index rebounded after the December decline, which is a sign that the shutdown and the stock market sell-off were important drivers of the slump. Reassuringly, income growth expectations remain solid, suggesting that a strong feedback loop between consumer labour income growth and spending is likely to remain in place.

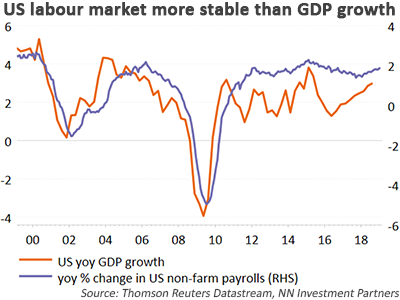

Ever since the Great Recession, the crucial mechanism that has allowed the US economy to recover from various soft patches has been the continued strength of employment growth, which gave vital support to consumer spending and service-sector activity. The strange thing is that US employment growth is extremely responsive to a downturn in GDP growth during recessions but has hardly responded to soft patches seen over the past nine years. Given the relatively low cost of hiring and firing in the US, one would expect employment growth to be relatively responsive to swings in GDP growth all the time. Over the same period, EMU employment growth has been more responsive to swings in GDP growth, even though hiring and firing costs in Europe are higher.

It is not easy to explain this conundrum. We can think of two factors that are essentially related to the resilience of confidence to shocks. First, US profit margins are higher than in the Eurozone. This is a long-standing trend, as the labour share of GDP has fallen more in the US since the early 1970s than in Germany and France. This means that US corporates have a larger buffer of excess profits than their European counterparts and may feel less need to adjust to small shocks. Second, corporate longer-term income growth expectations have likely been firmer in the US than in the Eurozone. The US monetary policy response was fast and furious, which probably did a lot to maintain corporate faith in the return to some kind of normal situation. By contrast, the double-dip recession in the Eurozone was probably followed by a large degree of uncertainty surrounding longer-run economic growth rates. If income expectations are more stable and solid, the inclination to respond to relatively small shocks to profitability will also be smaller, especially in the vicinity of full employment. After all, once a firm fires workers, it may be difficult to rehire them.

The past behaviour of US firms gives reason to expect labour market resilience, but it is worth considering to what extent this behaviour is likely to change now that the unemployment rate is below 4%. At some point, real wage growth should rise as workers gain bargaining power and increase their attempts to obtain a bigger share of the economic pie. The corporate reaction to this is uncertain. If corporate profits are higher than warranted by the normal return to equity because of a certain degree of market power, then the reaction of corporates could be rather muted. Conversely, if firms do not earn excess profits, the pressure on profitability will induce them to take action, which could take several forms. The increase in real wages could give firms an incentive to invest in labour-saving technologies, which would raise supply-side growth and thus allow continued expansion. Alternatively, firms could try to protect their profit margins by raising output prices in response to a rise in wage costs. To some extent this would even be welcomed by the Fed, which increasingly recognises the desirability of entering the next recession with inflation somewhat above target.

No end in sight for the Brexit saga

Prime Minister Theresa May has postponed the meaningful vote on the (revised) deal with the EU. Originally this vote was scheduled for this week, but May has now stated that she will bring a vote to Parliament by the 12th of March. It remains unclear what revisions will be made to the deal.

The focus is on the softening of the Irish backstop, as many Conservative MPs have refused to accept a backstop that is not time-limited and that the UK cannot exit unilaterally. Even if May succeeds in changing the backstop, we are not certain whether that will be enough to yield a majority in Parliament. In the last vote, 432 MPs voted against and 202 voted for the deal, which is still a huge gap to bridge. Assuming the new version of the deal fails to gain Parliamentary approval, May has promised to offer MPs two further votes. The first would be on a no-deal Brexit and would take place on 13 March; should that vote also fail, May would put forward a further vote on extending Article 50, which would take place on 14 March.

The focus this week is on the amendments that were voted on last night. The main one was the Cooper amendment, which proposes that if no deal is approved by mid-March, Parliament can call for an Article 50 extension to avoid a no-deal Brexit. This amendment passed with a majority of 502 votes to 20, having secured the backing of both the Conservatives and Labour. The Labour Party also put forward a separate amendment on an alternative Brexit plan on a customs union. This amendment failed to secure the necessary votes; as a result, Labour will back a second referendum, which would include a Remain option.

In the meantime we see more instability in the government, Conservative Party and Labour Party. Although Parliament will be able to vote on extending Article 50 if May’s deal fails a second time, there is no clarity on how long the potential extension would last. Moreover, it remains unclear whether any of the coming votes can garner the Parliamentary support to pass, though given the overwhelming support for the Cooper amendment, it looks like an extension has become more likely. In the coming days, the focus will be on whether the intergovernmental struggles continue and whether more Labour and Conservative MPs leave their respective parties. The key focus will be on the week of the 12th.

Diesen Beitrag teilen: