Morgan Stanley IM: Traversing Peaks

Much of the discussion in financial markets in recent months has been about peaks: peaks in economic growth rates, Covid infection rates and (more recently) inflation rates.

28.09.2021 | 07:20 Uhr

Here you can find the complete article.

This makes lots of sense. Growth, Covid and inflation are key factors for the global economy and financial markets, and markets are forward-looking. The focus, therefore, is normally on what will happen in the future — are things getting better or worse? Are they getting better or worse faster or more slowly? — rather than what is happening right now.

However, sometimes focusing on the third (or even fourth) derivative of a variable is not always useful. For example, many of the business and economic sentiment indicators peaked in the second quarter and have been declining since then, even if they are still at elevated levels versus history. We believe these series are the most timely indicators of the economic growth outlook, and hence their decline is a source of concern: Growth is slowing, so government bonds should rally and risky assets should sell off! Yet, markets have not really moved in synch with the data this year, which is most likely because of the extraordinary economic circumstances we have been in: sentiment indices rose to record levels earlier this year, as economies were expected to recover very rapidly from lockdowns. Indeed they did, and now growth has started to moderate as things get closer to normal. Nethertheless, this moderation doesn’t necessarily mean the economic expansion is now over, and falling sentiment indices most likely don’t reflect growing recession risks, as they have often in the past. In short, focusing too much on the changes in the growth rate distracts from the fact that the growth rate remains at a healthy level. And the very unusual state of the global economy means sentiment indices are not likely to have their usual power in predicting when the economic cycle is starting to come to an end. The key point sometimes missed is that, in most developed economies, economic growth has been strong and the outlook remains robust. We believe this provides a supportive environment for risky assets and means central banks can start moving towards tapering the emergency support they provided in response to the epidemic.

Similarly, Covid infection rate curves have been a focus of many investors (and a growing army of armchair epidemiological statisticians). Rising infections have been a source of concern for investors (and mankind). However, the economic impact of rising infections has been changed by rising vaccination rates, which has altered the link between infections and hospitalisations and deaths. In addition to the fact that infection waves have been very different across countries, the economic impact of those waves is also becoming different. This means trying to develop an investment thesis based on Covid infection rates is getting harder!

The other peak which investors are looking for is the one in inflation. In spite of the very high prints we have already experienced, it’s not clear if we are at the peak yet, as the inflation data continue to surprise on the upside. And even if we have seen the highest figures already, many economists now expect the year-on-year prints to stay at current levels for another 9 to 12 months. Rather than forecasting a sharp peak, the consensus is now more for a high plateau from which we will decline only in the second half of 2022. The issue for inflation is not so much if we have seen the peak yet, but for how long will inflation remain elevated, and will this push inflation expectations higher and force central banks to act?

The point is that in these unusual times, trying to pick the turning point in different trends might not be a useful exercise. It’s probably better to focus on things we can know with more certainty: the economic outlook remains positive; Covid continues to pose downside risks; higher inflation looks like it is transitory. but investors should stay vigilant to central banks starting to worry if it stays high for too long.

In terms of our market views, we remain long risky assets (corporate

credit, higher yielding non-agency residential mortgage-backed

securities (RMBS), emerging markets) because of the positive economic

outlook and strong fundamentals, and in spite of credit spreads being

tight relative to history. We think government bond yields will move

higher as central banks look to taper, but we do not expect a disorderly

sell-off.

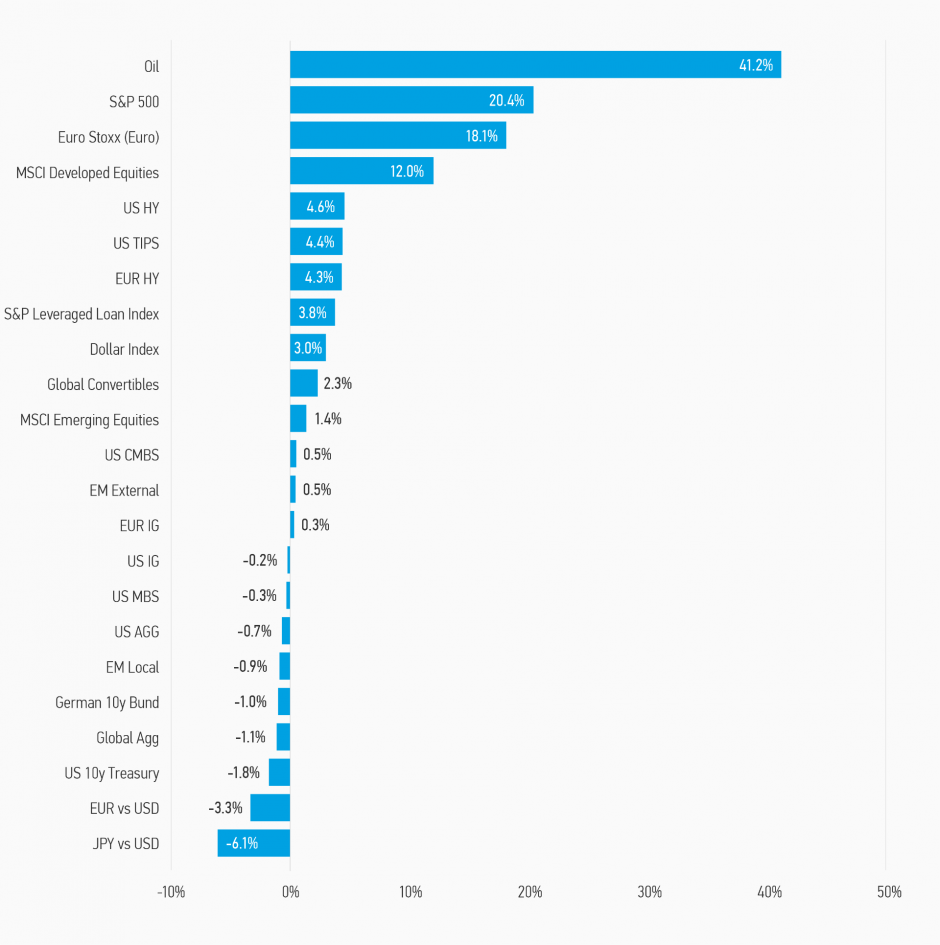

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of August 31, 2021. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See disclosures section below for index definitions.

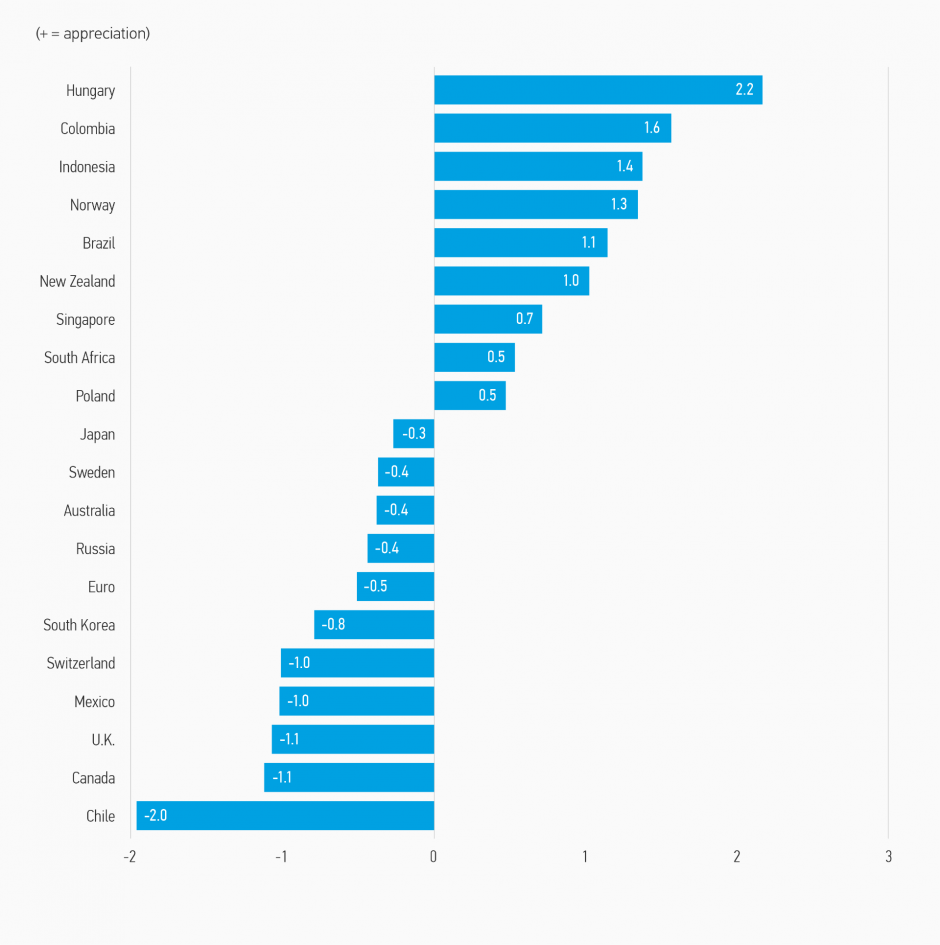

Display 2: Currency Monthly Changes Versus U.S. Dollar

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of August 31, 2021.

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of August 31, 2021.

Fixed Income Outlook

For once August was a relatively quiet month for markets, as it is supposed to be. Equities continued to grind higher, credit spreads were largely unchanged and developed market government bond yields were modestly higher. The sanguine attitude was in spite of some important central bank meetings, in particular the U.S. Federal Reserve’s annual offsite at Jackson Hole, economic data which was either mixed or deteriorating, and inflation numbers which continue to surprise substantially to the upside. Why were the markets so calm?

In our view, the main reason is that, while the economic data has been moderating rapidly, it is still consistent with strong levels of economic growth. In particular, it is the forward-looking economic surveys which have moderated sharply. However, they are still at levels that are consistent with healthy economic expansion, and some moderation was always to be expected given they were previously at record highs. The very rapid pace of recovery from economic lockdown couldn’t be sustained forever, and to some extent the current slower growth rates just reflect the extent to which economies have been able to bounce back already.

The same positive growth picture can be seen in equity markets, where Q2 earnings generally beat expectations, hence providing a fundamental justification for the strong equity performance seen to date. Credit markets have been supported by a collapse in bankruptcies and in most cases corporate and household balance sheets are in the best condition they have been in in years (thanks to the largesse shown by governments in response to the crisis). In addition, central banks remain committed to keeping liquidity conditions easy.

Of course, the story isn’t rosy everywhere, with the Covid delta variant leading to surging infection levels even in developed economies with high vaccination rates. This appears to be more of a problem in the U.S., where patchy vaccine take-up and limited social distancing measures mean higher infections are causing another wave of hospitalizations and deaths; the same is not happening in Europe, where vaccine take-up is now surpassing the U.S. The market consequence has been for the Fed to moderate its hawkishness, but it’s not the only central bank to have eased off due to Covid: for example, the Reserve Bank of New Zealand (RBNZ) chose not to raise rates due to a Covid breakout leading to a lockdown in the country.

In general, though, central banks are eyeing how and when to unwind the extraordinary policy measures they introduced in response to Covid. The U.S. Federal Reserve discussed this at their August meeting, the European Central Bank (ECB) will do so at their September meeting, and there basically isn’t a central bank anywhere which hasn’t started tapering or talking about how it will taper. Asides from some very modest yield rises over the last month (and some widening of euro sovereign spreads), this has not really caused markets concern. Why? Well, from the perspective of risky assets (equities, credit, etc.), higher yields are a response to improving macro-fundamentals; while not helpful by themselves, the boost from the better macro picture matters more. Second, markets have already anticipated central banks normalizing policy, so to the extent they are moving no quicker than investors have already priced in, it shouldn’t push yields higher. Third, as mentioned above, it seems clear that central banks will ease off tightening if they see any risks to the economy, from Covid or other sources.

What could threaten this benign outlook? One obvious risk is inflation, given large upside inflation surprises everywhere this year, which could pose a threat to central banks’ price stability mandates. So far central banks have been very sanguine about the numbers, seeing them as resulting from transitory shocks and bottlenecks in the global economy. These should pass relatively quickly and, in our view, are not a good reason to tighten monetary policy. However, if some of the inflation increase becomes more permanent, leading to higher inflation expectations, then there might be reason to act. This is even more the case where rising prices can be linked to low interest rates from monetary policy, e.g., the housing market and housing costs.

Where does this leave our views on markets? On government bonds, we expect yields to rise over time, but not sharply as long as any tapering is done gently. We expect U.S. treasuries to remain range-bound in the next few months with a bias towards higher rates from current levels. We are modestly overweight investment grade credit: spreads are tight, but fundamentals are good, and it’s better to earn some additional carry than not.1 We have a larger overweight to high yield, although still a medium sized position, favoring Bs vs. BBs; once again, spreads are tight vs history but fundamentals are attractive and higher commodity prices should also help. We see non-agency RMBS as particularly attractive from a risk-adjusted return perspective, but are underweight Agency mortgage backed securities (MBS) due to demanding valuations and the expected tapering of Fed purchases. We are overweight emerging markets due to being long an idiosyncratic collection of names rather than owning the asset class broadly.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

Developed markets were quieter as the summer came to an end. However, infections from the Covid delta variant continued to pick up momentum, which, coupled with continued concerns around inflation and growth prospects, created uncertainty in markets. Yields were generally higher across the developed markets.

Outlook

The second half of 2021 marks the next phase of the pandemic-driven-economic-cycle that is past the initial peak in growth, inflation and monetary and fiscal policy support. Policy is still expected to be a dominant driver of asset performance, but the recovery in the economy to date means it make sense that policymakers are eyeing how they will dial back emergency support measures without threatening the economic recovery.

While we do not expect a dramatic sell-off in government bond markets, we think the risk is skewed to yields rising, as markets price in the path to monetary policy normalization. We expect inflation to remain high for some time, but that the surge is mainly transitory, although there is a risk that higher inflation proves to be more sustained.

We judge G10 currencies to be close to their medium-term fair values. The USD no longer benefits from notably better than expected economic data than other G10 economies, and the Fed is probably in the middle of the pack in terms of its dovishness, except for the ECB and Bank of Japan, who are more dovish.

Emerging Market (EM) Rate/FX

Monthly Review

EM debt returns were positive in August. Hard currency sovereigns delivered positive returns, predominantly driven by tighter spreads. EM Corporates were also positive, with high yield outperforming investment grade corporates. Local currency bonds posted positive returns due to stronger EM currencies versus the U.S. dollar.2 From a sectoral perspective, companies in the Real Estate, Metals & Mining, Transport led the market, while those in the Diversified, Consumer and Industrial sectors underperformed.

Outlook

A less hawkish-than-expected Jackson Hole Fed summit last month may provide support to Emerging Markets in the weeks ahead, in addition to pre-existing factors such as the relatively attractive valuations across EM assets, high commodity prices, and continued improvement in vaccine rollouts in EM. Medium-term risks to our benign view for EM assets, besides setbacks in the Covid pandemic, include a delayed transition to fiscal consolidation which could drive EM risk premia higher, as well as rising geopolitical risks that could weigh on market sentiment.

Credit

Monthly Review

Credit spreads were slightly wider in Europe and the U.S. over the month. Equity market strength and lower volatility supported credit markets broadly.3

Outlook

We remain fundamentally constructive on credit, and although valuations are demanding, we expect spreads to consolidate at these levels. Financial conditions will likely remain easy, which will support the continuation of the rebound in economic activity, and low corporate default rates. We expect corporates to maintain profitability with conservative balance sheet strategies as overall macro uncertainty remains high. Finally, there is likely continued demand for credit in general as risk-free assets offer negative real and absolute yields, and excess liquidity looks to be invested.

Securitized Products

Monthly Review

August was a quiet month overall, with new issuance slowing from its Q2 and early summer pace, and very minimal secondary trading activity.4 Interest rate volatility declined during the month, and rates remained largely range-bound, although the curve steepened. Agency MBS spreads widened in August, bank buying of agency MBS has slowed, and talk of potential Fed tapering of its MBS purchases continued to weigh on the market. U.S. Non-agency RMBS spreads were essentially unchanged. U.S. asset-backed securities (ABS) spreads were slightly tighter again and U.S. commercial mortgage-backed securities (CMBS) spreads were largely unchanged. European RMBS, CMBS and ABS activity was very light as both new issuance and secondary trading volumes remain very low. European securitized spreads were largely unchanged during the month.

Outlook

We believe the securitized market offers a unique combination of low duration, attractive yields, and solid credit fundamentals. We remain constructive on securitized credit and have a modest credit overweight across our portfolios. We remain cautious on interest rate risk, and we continue to manage the portfolios with relatively short duration.

RISK CONSIDERATIONS

Diversification neither assures a profit nor guarantees against loss in a declining market.

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, and correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: